Individuals wishing to receive a tax deduction cannot do without issuing a document such as form 3-NDFL.

[sc:docObr id=»https://grazhdaninu.com/wp-content/uploads/2017/07/3-NDFL-2019-obrazec-zapolneniya.pdf» mytext=»filling out the 3-NDFL form «]

In this regard, we suggest that you understand general issues regarding the rules for filling out the declaration form, as well as consider several illustrative examples.

- Sample declaration forms for 2021 are available here.

- We recommend downloading the declaration preparation program here.

- Link to empty form 3-NDFL.

Appearance and structure

To give a specific completed example of Sheet E1 from 3-NDFL, you need to understand the form in which this declaration is submitted.

So, for 2021, individuals who want to return personal income tax on their own (for example, it is not possible to do this through a tax agent, since the person no longer works for him), do this on the 3-NDFL declaration form, approved by order of the Tax Service of Russia dated December 24 2014 No. ММВ-7-11/671.

Also see “Download the 3-NDFL declaration for 2021 to fill out.”

The E1 Sheet in question looks like this:

This form was last updated on October 10, 2021. At the same time, they affected Sheet E1 of the 3-NDFL declaration for 2021. Thus, in field 030, the income limit giving the right to a “children’s” deduction has increased since 2016 to 350,000 rubles (Federal Law No. 317-FZ dated November 23, 2015).

Also see “3-NDFL in 2021: what has changed.”

As you can see, any example of filling out Sheet E1 of the 3-NDFL declaration always takes one standard A4 sheet of this form.

In its structure, any example of Sheet E1 of the 3-NDFL declaration includes 4 points:

- Calculation of standard deductions.

- Calculation of social deductions for which there is no limit of 120,000 rubles.

- Calculation of social deductions, for which there is a limit of 120,000 rubles.

- Their total amount.

You will immediately notice when filling out 3-NDFL that in the sample Sheet E1 almost every line is a separate deduction. That is, any complex calculations or comparisons are not initially provided.

When entering indicators into Sheet E1, it is difficult to imagine that all its lines will be filled in. Therefore, dashes must be placed in unused places. This will be clearly demonstrated by our example of filling out Sheet E1 of the 3-NDFL declaration in 2021 (see below).

In addition, unlike income tax amounts, deductions in 3-NDFL are given with kopecks or zeros in their place.

What is the standard child tax credit?

Deductions for children are provided to certain categories of individuals. Their size for each category of citizens is clearly fixed: 3000 rubles, 1400 rubles (based on clauses 1–4 of Article 218 of the Tax Code of the Russian Federation). Standard tax deductions are primarily provided at work (by employers). This group of deductions includes the so-called “children’s deductions”.

To receive this type of tax deduction, an employee must contact his employer with an application for a deduction. Documents confirming the right to a child deduction must be attached to the application.

If a citizen combines several jobs (works simultaneously for several employers), the standard deduction is provided to him by choice.

There are cases in which one parent of a child is entitled to receive a double deduction. For example, if the child is the only parent. How to correctly fill out the 3-NDFL declaration in this case? Let's look at an example.

The procedure for filling out the 3-NDFL declaration for children's deduction:

1) Step one: fill out your personal information. It is necessary to fill out all the fields in which you must carefully and without errors indicate all your data. If you know your TIN, then it is not necessary to enter your passport data - these fields will be filled in automatically.

- After filling out all the fields, click the “save and continue” button.

- 2) Step two: proceed to filling out the address.

- After filling out the address, there are lines in which you should fill in the codes according to OKTMO and the Federal Tax Service.

3) Step three: we moved on to the “Income” section. Our main source of income in this case will be work. This must be indicated in the appropriate field.

4) Step four: proceed to filling out information about the employer. This data just needs to be carefully copied from the 2-NDFL certificate, which must be taken from the employer.

5) Step five: In the “Deductions” section, you need to select the standard deduction.

6) Step six: here you need to be very careful. This is the most basic section. You must first select the desired standard deduction code at the top.

And it doesn’t matter that such a deduction is not in the 2-NDFL certificate, you need to receive it and you must mark it. Moreover, in order to activate this deduction, you need to indicate in the fields (they appear below in tabular form) the amount of accrued salary by month. This data is also found in the 2-NDFL certificate.

Next, there are two lines in which you need to enter the total amount of the standard deduction that was not provided to you at work.

After everything is filled out, all you have to do is click “Save and Continue” again. Your declaration is ready. You can download it and prepare a package of documents for personal income tax return.

At each stage of preparing the 3-NDFL declaration, you can ask a tax consultant who will help you fill out the declaration correctly.

Source: https://ndflka.ru/question/232/primer_zapolneniya_deklaratsii_3_ndfl_dlya_polucheniya_detskogo_vyicheta

Our sample of Sheet E1 of the 3-NDFL declaration

As a general rule, the right to a standard and/or social deduction depends on the current life situation. Therefore, it is impossible to give an example of filling out Sheet E1 3-NDFL for 2021, covering all bases under the Tax Code of the Russian Federation.

We proceeded from the most common situation: when a mother has a child under 24 years of age and pays for his full-time education at a university at her own expense.

Also see “Who must submit 3-NDFL for 2021: list and new rules.”

EXAMPLE

Let us agree that E.A. Shirokova paid for her son’s university studies in 2021. The total amount was 100,000 rubles. According to a certificate from the educational institution, her son is in full-time education.

Shirokova’s labor and other income, taxed at a rate of 13%, amounted to 600,000 rubles in 2016. In 2021, she decided to return personal income tax in connection with her son’s education.

The maximum social deduction for tuition fees that can be declared in 3-NDFL is 50,000 rubles (page 100 of Sheet E1) based on clause. 2 p. 1 art. 219 of the Tax Code of the Russian Federation.

Shirokova’s son is not yet 24 years old, and he is studying full-time. Therefore, while she was working, every month in 2021 she received a standard deduction for it (1,400 rubles each). Namely: for 7 months, until her income approached the mark of 350,000 rubles (subclause 4, clause 1, article 218 of the Tax Code of the Russian Federation).

The indicator for lines 040 and 080 is obtained as follows:

1400 rub. × 7 months = 9800 rub.

Below is a sample of filling out Sheet E1 from 3-NDFL for 2021, which E.A. Shirokova submitted on March 2, 2021 to the Federal Tax Service No. 18 of Moscow:

As you can see, in Sheet E1, based on the results of calculations, they show the total amount of deductions: standard + social. Even if the “children’s” deductions were provided by the employer.

Now let’s find out what amount of personal income tax Shirokova will ultimately return from the treasury if she fills out Sheet E1 of the 3-NDFL declaration for 2016.

We reduce the total income by all the deductions required by Shirokova:

600,000 rub. – 59,800 rub. = 540,200 rub.

RUB 540,200 ×13% = 70,226 rub. (calculated personal income tax taking into account deductions for training).

However, the employer provided Shirokova only with a “children’s” deduction. That is, the withheld tax was greater:

(RUR 600,000 – RUR 9,800) × 13% = RUR 76,726

As a result, in 2021, according to the 3-NDFL declaration, Shirokova will be able to return:

RUR 76,726 – 70,226 rub. = 6500 rub.

Also see “Sheet E1 of the 3-NDFL declaration for 2021: filling out.”

Read also

03.03.2017

What deductions are provided as a measure of social support?

With the help of this category of deductions, several socially significant goals are realized at once:

- Support for those taxpayer citizens who transfer funds to charity, and also donate funds for the development of such socially significant areas as mass sports, culture, and science.

IMPORTANT! There is a maximum limit of 25% of the donor's income for such deductions.

- Support for citizens paying for their own education, children, as well as brothers and sisters under the age group of 24 years.

IMPORTANT! There are several restrictions on these deductions. For example: children’s education must be full-time; the amount that can be compensated by deduction cannot exceed 50,000 rubles per child.

See here for more details.

- Support for people who have required expensive treatment. Deductions for an individual's expenses for medical services are possible if they are documented, provided by licensed medical institutions and comply with the list of types of treatment approved by the government of the Russian Federation. In addition, the specified person must pay for the treatment independently, from his own funds.

- Support for citizens of the Russian Federation who participate in long-term (at least 5 years) voluntary life insurance, pension insurance and pension contracts.

For each category of individuals - residents of the Russian Federation listed above, it is possible to reduce the tax base, as well as refund the income tax of individuals on amounts involved in the specified areas (subject to restrictions).

Filling out Section No. 1

In general, as a rule, this section is filled out last, because in line 040 you must indicate the amount of tax contributions to the budget.

So, we fill out the header of this document sheet as standard:

- TIN

- Page number

- Last name and initials of the payer.

Then we indicate the budget classification code and the OKTMO code. If you do not know either one or the other, you can look on the Internet, where such information will certainly be available.

Then we indicate the amount of budget payments calculated earlier.

In line 050, indicate 0 if the amount of tax payment has been calculated.

Each page must be signed and dated at the bottom.

Filling out sheet A

The procedure for filling out sheet A of the tax return:

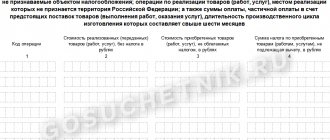

Line No. 010 reflects the tax rate in %, in this case it is 13%.- Line No. 020 is used to encode the type of income. In our situation, code 06 is used - it denotes income that was received under the terms of the employment contract. The personal income tax accrued on it was withheld by the employer. You can find out more about other codes in Appendix No. 4.

- Lines No. 030-060 are intended to indicate information about the source of income received. In this situation, it’s about the employer. They include: name, tax identification number, OKTMO coding, checkpoint.

- Line No. 070 reflects the total income of an individual.

- Line No. 080 serves to reflect the total tax base.

- In line No. 090 indicate the accrued amount of personal income tax.

- Line No. 100 reflects the total amount of tax withheld by the employer.

Which sheets should be filled out and when?

The tax return type KND 1151020 has nineteen sheets, and the Federal Tax Service website provides detailed instructions for filling out each one. We present the statements most commonly used by taxpayers:

This is an article from the site vseofinansah dot ru. If you are posting this article on another site, then it has been stolen.

Sheet A – allows you to indicate information about the sold apartment or car.

- Sheet E1 - to indicate the social deduction for personal income tax for the treatment and education of the child. You will also need information from sheet A here.

- Sheet D1 - is filled out for property deduction; if the apartment is sold, you also need to fill out sheet D3 and two sections Nos. 1-2.

We invite you to familiarize yourself with the Claim to a private dental clinic: sample form, structure, necessary documents

Section 1:

Section 2:

- Sheet D2 - filled out when selling an apartment that has been owned for less than 3 years and to obtain a tax deduction for this housing.

Sheet D2:

Online magazine for accountants

Important

Code, in the amount of additional insurance contributions for the funded part of the labor pension, paid in accordance with Federal Law of April 30, 2008 N 56-FZ. To calculate the value of the line 160 indicator, fill out subparagraphs 1.1 and 1.2 and paragraphs 2-4 of Sheet E2.

The value of the indicator in paragraph 4 of Sheet E2 is transferred to subparagraph 3.4 of Sheet E1. Subclause 3.5 indicates the total amount of social tax deductions under clause 3 of Sheet E1.

The value of the indicator is calculated as the sum of the values of the indicators specified in subclauses 3.1, 3.2, 3.3, 3.4 of Sheet E1 (this sum of values should not exceed 120,000 rubles). The total amount of social tax deductions is indicated in subparagraph 3.6 of Sheet E1 and is determined by adding the values of the indicators of subparagraphs 2.4 and 3.5 of Sheet E1.

12.8.

The total amount of standardized expenses does not exceed 120,000 rubles, so Sidorova will add the entire amount of expenses - 54,500 rubles - to the total for Section 3. 4. Sidorova sums up both types of claimed deductions and records the result - a deduction for reducing the tax base for personal income tax - in section 4 of sheet E1.

Filling out the title page

The title page displays the full details of the personal income tax payer. It must be completely filled out, except for the fields marked for completion by tax officials.

To be filled out:

- Correction number. When initially supplied, zero is indicated. When resubmitting after corrections - from 1 onwards.

- Submission to the tax authority. The code of the tax service to which the declaration is submitted is indicated.

- Taxpayer category code. Filled out according to the code book. In this situation, we set 760, which means an individual who declares income to receive deductions.

- Document type code. Indicated according to the reference book. When presenting a passport, encoding 21 is indicated.

- Region. Indicated according to the regional directory.

- Tax payer status. For a resident of Russia, code 1 is indicated.

- Personal data. Filled out based on documents. It is necessary to indicate your full name, date of birth, place of birth, passport details, as well as residential and/or registration address and contact telephone number.

- The final point is to number the pages and indicate the number of sheets, pages, and copies of documents.

At the bottom of the title page you must indicate the code of the person directly submitting the documents to the tax service. The number 1 means that documents are submitted in person, 2 means that they are submitted by a representative.

When submitting a declaration, a representative must indicate his full personal data as the person who completed the declaration.