How to submit the SZV-M report?

Among the many types of reporting to the Pension Fund, there is a report that recently appeared - form SZV-M (information about insured persons).

This form was needed by government agencies in connection with the suspension of indexation of pensions for working pensioners, who now need to be “tracked.” The form must be filled out by individual entrepreneurs and organizations that have at least one employee working under an employment or civil contract. Form SZV-M is submitted monthly before the 15th day of the month following the reporting month. This information can be submitted on paper by employers with fewer than 25 employees, while other employers are required to submit SZV-M only in electronic form.

The fine for late submission of the form or incorrect completion is 500 rubles for each employee. And if you submit a paper document instead of a mandatory electronic document, the fine for such a case will be 1000 rubles.

Composition of the form and rules for filling it out

The form includes 4 sections:

- details of the policyholder;

- reporting period;

- form type (code);

- information about insured citizens.

There are no separate rules on how to fill out the SZV-M, but it is intuitively clear what to do. In the first section, indicate the name of the organization, TIN, KPP and registration number with the Pension Fund.

In the “Reporting period” section, indicate the month for which the report is provided.

In the third, the type of form to be filled out is noted. If the form is filled out for the first time for the reporting period, it is marked as the original one. If you are filing a supplementary report, select the “supplemental” type. If the previously sent report contained inaccuracies, submit a document with the “cancelling” type.

The fourth section is a table in which opposite the full name. citizens who have contracts indicate their TIN (optional) and SNILS.

Sample completed form

Pension Fund programs

They can be found in the “free programs for employers” section. Several programs are suitable for preparing SZV-M: “PU 6 Documents”, “Spu_orb”, “PD SPU”, “PsvRSV”. However, in order to understand the difference between them and correctly install the selected program, you will need the advice of a specialist who understands these issues.

To create a personal account on the Pension Fund website, you will have to go through a difficult registration procedure. This can only be done without leaving the office using an electronic digital signature. Or you need to contact the Pension Fund in person and receive a registration card to enter the office.

Do I need to reflect the renaming of the employer?

According to clause 2.4 of Article No. 27-FZ, only four personnel events are recorded in the SZV-TD form: hiring, dismissal, transfer or filing an application to choose the form of the work book.

However, PFR Resolution No. 730p provides an expanded list of activities that must be indicated in the report on labor activity. It includes, among other things, the item “renaming the employer” (for more details, see the article “How to correctly fill out and submit the SZV-TD form”).

The question arises. If the last entry in the work book is a change in the name of the employing company, is it necessary to indicate this information in the SZV-TD as of the beginning of 2021? Or should the previous entry be reflected instead?

A similar situation is discussed on the website of one of the regional branches of the Pension Fund of Russia in the section “You asked us: electronic work record book” (point 3). The fund's specialists did not give a direct answer. But they emphasized that the renaming of the organization does not constitute information about the work activity of the insured person as of January 1, 2020. From this we can conclude: there is no need to record a change of company name in SZV-TD.

Example

Engineer Petrov is listed as an engineer at Trade LLC. There is not a single entry in Petrov’s work book dated 2020.

The latest entries are:

October 24, 2021 - Vympel LLC was renamed Trade LLC from October 24, 2019;

April 8, 2021 - hired as an engineer (at Vympel LLC).

The accountant provided information about Petrov’s labor activity as of January 1, 2021. The table in SZV-TD is filled out as follows:

Clicking will open the table in a larger size.

Maintain personnel records in the web service, fill out and submit SZV-TD via the Internet

Professional accounting programs

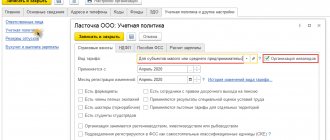

If you don't want to bother with pension fund programs or register in your personal account, you can use professional accounting software.

The most famous and popular is, of course, 1SBuhgalteriya. But there are other programs for accounting and filing tax reports. Among the domestic ones, these are “Galaktika” and “Parus”, both have been on the market for more than 20 years. Among the foreign ones, SAP is the most famous.

But often a company does not need the range of functions that these programs offer. Accounting programs with sophisticated functionality are affordable only for large companies. But there are more modern and “lighter” programs for accounting and tax accounting, aimed mainly at small ones, “My Business”, “Kontur.Extern” and some others.

What period to indicate in the report

The SZV-TD form has a field in which you should enter the reporting period: month and year. What period does the information on labor activity as of January 1, 2021 refer to?

Opinions vary. Some experts argue that it is necessary to indicate January 2021. This is explained by the fact that the form in question must be submitted no later than February 15, 2021. And this is the last date for submitting SZV-TD in relation to some personnel events that took place in January.

Others believe that since the information refers to the first day of 2020, the reporting period is December 2021.

There have been no official explanations from the Pension Fund on this issue yet. But there is information that reports indicating “December 2020” were successfully verified. This option is probably valid.

Online services on an ongoing basis

Another option to fill out the SZV-M without any problems is to use online services.

There are several portals that allow you to fill out the SZV-M report online: “My Business”, “Contour”, “Sky”.

For clarity, here is a table of these services:

| Service name | Who is it aimed at? | Advantages | Price |

| My business | Individual entrepreneur on the simplified tax system and UTII | Specializes in the most popular tax regimes for small businesses. | From 3990 per year. |

| Contour.Extern | Small businesses using the simplified tax system and UTII, medium-sized businesses (including in the field of alcoholic beverages) and budgetary enterprises located in St. Petersburg and the Leningrad region. | The ability to generate reports to all government agencies, including RPN and RAR, the ability to work from different computers, free access to the promotion for 3 months. | From 2900 per year |

| Sky | Companies wishing to submit reports electronically. It is possible to draw up declarations of the simplified tax system, UTII, EUND, VAT. | There is a free tariff “Reporting only” | 100–170 rubles for one document when sending the document at the same time in the presence of the Sky ES. |

Now let's see how to fill out the SZV-M in these programs.

Checking SZV-M

Before sending a document to the Pension Fund, it must be checked. This can be done in two ways:

- verification in Pension Fund programs;

- checking SZV-M online for free in online accounting services.

1. Pension Fund programs that allow you to fill out the SZV-M also allow you to test it. The CheckXML and CheckPFR programs are especially popular. To check the form, you must first install it on your computer.

2. It is almost impossible to check SZV-M online without registering in online services, but the registration procedure will not take much time.

What to indicate in the SZV-TD if the employee is “remote”

The previous version of Article 312.2 of the Labor Code of the Russian Federation (valid until December 2020 inclusive) stated that by agreement of the parties, information about remote work need not be included in the work book.

It turns out that the “remote worker” who took advantage of this norm does not have any records in his work book about personnel events for which the form must be submitted no later than February 15, 2021. On the basis of what documents must an employer fill out the SZV-TD as of the beginning of 2021? Based on orders for employment, transfer and other personnel documents. This directly follows from paragraph 1.2 of the Procedure for filling out information on labor activity (approved by Resolution No. 730n).

When working remotely, it is necessary to exchange electronic documents with employees Start exchange

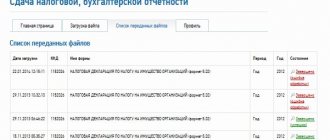

Dispatch SZV-M

After you have checked the SZV-M report online or with the Pension Fund of Russia program, you need to make sure that the file is generated in the required format. The file must be converted to the required format. The Federal Tax Service accepts documents in xml format. If your document is in excel format, you need to tinker to convert the file to xml. You will have to understand the non-ordinary functions of Excel.

If the form is generated in pdf format, you can use an online file converter from pdf to excel. Then we save the excel file in xml format using the “save as” function.

But to avoid mistakes when saving a file in the required format, it is better to initially fill it out in a program or online service specially designed for this.

Who is exempt from reporting?

There are exceptions for certain categories of business entities and employees. Thus, the SZV-M report is not provided by:

- peasant farms where there are no hired workers;

- individual entrepreneurs, arbitration managers, privately practicing lawyers and notaries who pay fixed insurance premiums only for themselves;

- employers in relation to foreign citizens and stateless persons who are temporarily staying in Russia or working remotely, who are not covered by compulsory pension insurance;

- employers in relation to military personnel, employees of the Ministry of Internal Affairs and the Federal Security Service (with the exception of civilian employees), since compulsory pension insurance does not apply to them, and the state provides other guarantees for them.

Sending SZV-M in electronic format

The Pension Fund does not provide employers with the opportunity to send a report from their personal account on the Pension Fund website, so you can send the form electronically through an electronic document management (EDF) operator.

EDF operators are specialized companies that provide services not only for generating reports, but also for sending them to tax authorities via secure communication channels using an electronic digital signature.

To do this, you will need to enter into an agreement with the EDF operator in order to connect to its service and receive an electronic digital signature, and notify the Pension Fund of the Russian Federation about the submission of documents electronically.

Sending SZV-M on paper or in person

To send a document by mail, you need to print it out, put a stamp (if there is one), fill out two copies of the list of attachments and fill out an envelope (PFR address and sender's address). Take the unsealed envelope with the report and two copies of the inventory to the post office. The branch employee will stamp and sign the second copy of the inventory and issue a payment receipt, which will indicate the shipment ID. Keep these documents in case the Pension Fund loses your report.

Submitting SZV-M in person

To personally submit the SZV-M form to the Pension Fund of the Russian Federation, print it out in two copies (with signature and seal, if any), take a passport and/or power of attorney from the organization to submit reports. Give both copies of the report to the Pension Fund employee. The inspector will keep one copy for himself, and on the second (yours) he will put an acceptance mark.

Information on external part-time workers

If a company (or individual entrepreneur) employs external part-time workers hired before 2021, you need to consider the following.

Firstly, they must submit information about their employment as of the beginning of 2021 - the same as for full-time employees. If there were no personnel events last year and the report was not submitted, it should be submitted no later than February 15, 2021.

Secondly, the personnel event “choosing the form of a work book” does not need to be recorded in SZV-TD. This must be done by the employer at the main place of work. For more information about the peculiarities of employing part-time workers, see “Part-time work: how to properly formalize the hiring of an employee.”

On how to compile individual fields of the SZV-TD for a part-time worker, see “The Pension Fund explained how to fill out the SZV-TD for a part-time worker.”