All payments to pregnant and postpartum women this year will be paid in accordance with the law and in order to ensure decent material conditions for the young mother. There are not many such payments, and their size is set both at the federal and regional budget levels. Each region can additionally pay special allowances and benefits to young women giving birth in the amount it deems necessary. But all residents of the Russian Federation must receive no less than the established federal minimum. And then we’ll talk about what types of benefits and payments are due to pregnant women and women in labor.

What is maternity benefit

Payment for pregnant and postpartum women is one of the options for providing citizens with compulsory social insurance. This assistance is intended for young mothers who are registered while pregnant and have already given birth.

Maternity benefit is a type of insurance coverage

Who can apply for maternity benefits

Only a new mother can apply for such a payment, unlike child care benefits . Apply for benefits if you belong to the following categories of women:

- working;

- unemployed;

- undergoing contract military service;

- undergoing full-time training;

- who have adopted a child and fall into the above categories.

You can learn more about the law on state support for families with children dated May 9, 1995 No. 81-FZ here. You may also find the order of the Ministry of Health and Social Development dated December 23, 2009 N 1012n useful.

In order to receive benefits, the following conditions must be met:

For those who work, study full-time on a free or paid basis, or are on military service, benefits are paid at the place of work, service and training .

This is also important to know:

What benefits are available to labor veterans in 2021?

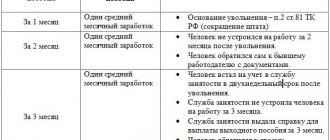

Those who were forced to resign due to:

- The onset of an illness that makes it difficult to carry out work or makes it impossible to stay in a certain area (due to unsuitable climatic and other conditions, about which there is a document drawn up in full form at a medical institution);

- Illness of a family member who requires care, or the presence of a disability of the 1st group (in both cases, a document issued by a medical institution is required);

- The need to move outside one’s locality to the spouse’s place of residence or new job.

Payment of benefits is made at the last place of work if the onset of maternity leave falls within a month after dismissal.

Those who were fired for the following reasons:

- The company or enterprise where the woman worked was liquidated;

- Suspension of work as an individual entrepreneur;

- Suspension of the work of lawyers, private notaries and those who, due to their occupation, are required to undergo the state registration procedure.

Payment of benefits is carried out by regional employment services at the place of residence if the woman received official unemployed status no later than one year after the occurrence of the above circumstances.

When can you go on maternity leave?

Official leave is granted at the onset of the thirtieth week of pregnancy. The minimum duration of maternity leave is 140 days. Working mothers receive compensation payments equivalent to their monthly earnings. However, by law the maximum possible amount of such payments in 2021 is limited to 322,191 rubles.

In a situation in which, at the onset of the thirtieth week of pregnancy, the expectant mother expressed a desire to continue working, benefits are not accrued. According to the law, it is impossible to simultaneously receive compensation payments and wages. The decision to continue working will be fully justified if the monthly income is higher than the benefit amount.

Documents for receiving maternity benefits

The list of required documents is given in the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.” You will need:

- application for granting benefits (drawn up in free form)

- sick leave

- certificate of earnings for calculating benefits

Documents for receiving maternity benefits in 2019 can be sent electronically or by mail - in the latter case, not originals, but certified copies are provided

All payments to pregnant and postpartum women assigned in 2021

In 2021, every pregnant or postpartum woman can apply for the following benefit options:

- for pregnancy and childbirth;

- at the birth of a child;

- for registration at the antenatal clinic in the early stages of pregnancy, up to 12 weeks:

- for caring for a baby up to one and a half and up to three years;

- maternal capital.

The expectant mother has the right to benefits for pregnancy and childbirth, for the birth of a child, for registration with an antenatal clinic in the early stages of pregnancy, etc.

Table: what payments are due to pregnant or postpartum women in 2021

| Type of benefit | Amounts of maternity payments in 2019 | |

| From January 1, 2021 | From February 1, 2021 | |

| 1. Maternity benefit | Maximum size: Free legal consultation We will answer your question in 5 minutes! Ask a Question Free legal consultation We will answer your question in 5 minutes! Ask a Question

Minimum size:

| |

| 2. Allowance for registration in the early stages of pregnancy | RUB 613.14 | RUR 628.46(613.14 x 1.025) |

| 3. One-time benefit for the birth of a child | RUB 16,350.33 | RUR 16,759.09 (16,350.33 × 1.025) |

| 4. Monthly allowance for child care up to one and a half years old | Minimum size: for the first child - 3065.69 rubles. (taking into account the minimum wage - 3120 (7800 x 40%) for the second and subsequent children - 6131.37 rubles. | Minimum size: - for the first child - 3142.33 rubles. (3065.69 x 1.025) for the second and subsequent children - 6284.65 rubles. (6131.37 x 1.025) |

| 5. Monthly allowance for child care up to 3 years old | Varies by region | |

| 6. Maternity capital | RUB 453,026 | |

This is also important to know:

Dismissal due to staff reduction: payments and compensation

Table: schedule for processing benefits for the expectant mother and child

| Term | Pay |

| 28 or 30 weeks of pregnancy | When registering in the early stages of pregnancy; for pregnancy and childbirth |

| From 0 to 6 months baby | One-time benefit |

| From 0 to 1.5 years old child | Caring for a child up to 1.5 years old; at the birth of the third and subsequent children |

| From 1.5 to 3 years old child | Compensation up to 3 years |

| From 0 to 3 years | Compensation (50 rub.) |

| From 0 to 18 years of age child | Maternal capital |

Most of the payments noted in the table have been indexed since February 1, 2021.

One-time payment upon registration

Not all pregnant women who have learned about this joyful event are in a hurry to make an appointment with a doctor and undergo all the necessary examination. But in vain. It is the first trimester of pregnancy that is the most dangerous and can end disastrously for a young mother. That is why, in order to somehow stimulate the fair sex to be more attentive to their situation and take care of the baby’s health in advance, payment for early registration was introduced into practice.

I would like to note in advance that the amount of this payment is not so large, and it is unlikely to be able to somehow help the woman in the future, since its amount is not enough even for the most necessary tests. But let's just say this is a nice little bonus for the lady's responsibility. That's all.

The amount of such benefit in 2021 is only 628.46 rubles . In the regions, such a one-time payment may be higher, since the regions have the right to pay a certain amount in addition to this amount, which they happily do. If we compare Moscow and the Moscow region, then in this district a woman will be paid an additional 600 rubles for an early appointment with a doctor.

True, it is necessary to take into account this point: the regional surcharge is paid not to those who register in Moscow and the region, but only to those who have a residence permit in a given city. And you need to know this.

The question arises, who is eligible to receive such a small bonus? According to the law, all pregnant women who previously officially worked under an employment contract. Yes, unfortunately, those who do not work officially will not be able to receive this money. If the expectant mother does not work, but is at the employment center and officially receives benefits, then she will also receive 628.46 rubles.

Amount of maternity benefit

The amount of maternity payments depends on the status of the recipient:

- Working women receive benefits in the amount of 100% of average earnings

- Those dismissed due to the liquidation of the organization - in the amount of 300 rubles

- Female students - in the amount of the scholarship

- Contract servicemen - in the amount of monetary allowance

If an insured woman’s work experience is less than six months, she can count on benefits in an amount not higher than the minimum wage (from May 1, 2019 - 11,163 rubles)

EXAMPLE

A woman who went on maternity leave in 2017 earned 670 thousand rubles during 2021, and 590 thousand rubles during 2015. Over the course of two years, she spent a total of 19 days on sick leave; there were no other periods not included in the calculation.

Total earnings for two years amounted to 1,260,000 rubles. It must be divided by the number of calendar days of these years (730) with the exception of those that are not taken into account in the calculation (19):

1,260,000 / (730 - 19) = 1,752.4 rubles.

This amount does not exceed the maximum amount (1901.4 rubles), so it can be used in further calculations. Finally, we determine the final benefit amount. Let’s assume that the pregnancy was singleton and the birth took place without complications - the woman will be given leave of 70 days before and 70 days after childbirth (140 days in total). Taking this into account, the benefit amount will be:

This is also important to know:

Rules and procedure for obtaining the title “Veteran of Labor”

1752.4 rub. x 100% x 140 = 245,336 rubles.

Who is eligible to receive benefits?

Unemployed pregnant women do not receive benefits from the state. But there are several conditions under which an unemployed pregnant Russian woman will be able to receive financial assistance from the budget:

- Women who were fired due to the cessation of the company's activities or the complete liquidation of the employer's company can count on maternity payments;

- benefits are paid to girls who are studying full-time in secondary specialized, vocational or higher educational institutions.

In all other cases, unemployed women are not paid benefits.

The amount of payments to an unemployed pregnant woman depends on individual conditions and the income she currently receives:

| Conditions | Payment amount |

| Upon dismissal due to termination of the enterprise, as well as former notaries and lawyers | 300 rubles per month |

| When studying full-time | In the amount of the scholarship |

This procedure and types of payments are approved in Articles 6 and 8 of Federal Law No. 81.

Who pays - the employer or the Social Insurance Fund?

maternity sick leave and an application for payment (usually combined with an application for maternity leave to the personnel department at the place of work . Then, upon payment, an offset occurs between the employer and the Social Insurance Fund - as a rule, against the insurance premiums payable. That is, in fact, it turns out that the money is ultimately paid from the Social Insurance Fund.

If a woman went on labor and employment leave within a month after her dismissal, she should apply to her last place of work. This also applies to the following cases:

- moving to another area to join your husband;

- transfer of husband for work;

- illness that prevents you from working or living in the area;

- the need to care for a sick family member or a disabled person of group I.

However, even a woman with a current job may have difficulty obtaining benefits from her employer. This happens if:

- the organization is preparing for bankruptcy or for some other reason it does not have money in its account;

- company accounts are frozen;

- the employer cannot actually be found;

- the company was closed at the time of applying for payment.

In this case, you have to go to court and prove the impossibility of receiving money at your place of work. It can be inconvenient and resource-intensive for a pregnant woman or a woman who has given birth, so this can be done within 6 months after the end of maternity leave.

Only after the court decision comes into force will the child’s mother be able to receive money directly through the Social Insurance Fund (SIF). It is easier to arrange a payment without litigation through the Social Insurance Fund in regions where the pilot project “Direct Payments” operates.

If a woman works for two or more employers (insurers) at the same time and has worked for them for the last two years, she can receive full payments from each of them separately. If over the past two years the expectant mother has worked in other places, the benefit is issued for one of the current jobs (at the applicant’s choice).

One-time benefit for the birth of a baby

Birth benefits for working and non-working mothers are paid in the same amount. However, here you should pay attention to possible regional surcharges that are relevant for certain regions of the country.

The right to receive such compensation payments is granted to both parents of the baby, who are recorded in his birth certificate. A mandatory condition for receiving funds is participation in the social insurance system. That is why, if a mother is raising a child, then the father must apply for a one-time benefit. If a single mother applies for benefits or the father also does not have an official place of work, then compensation is paid to the mother at the social protection authorities at the place of registration. A non-working student mother must apply for payments to her educational institution.

You can find out more information about the lump sum benefit for the birth of a child from the following articles:

How to get a? Who should? Who pays?

Amount of cash payments

The size of the one-time benefit for the birth of a child as of this moment remains at the level of 18,004.12 rubles + regional coefficient. You can receive one-time financial assistance at your place of work or service.

How to apply for maternity benefits?

Deadline for paying maternity benefits

Maternity benefits are paid for the entire period of maternity leave: 140 calendar days (70 before childbirth and 70 after). In the case of multiple pregnancies and the birth of two or more children - 84 and 110. In the case of complicated births - 70 and 86 (Part 1 of Article 10 of Law No. 255-FZ).

This is also important to know:

What payments and compensations are due to a victim who receives a work injury?

The benefit is paid in advance for the entire period of incapacity indicated on the certificate of incapacity for work. Current legislation does not provide for partial payment of benefits or payment first for the prenatal and then for the postpartum period.

Advanced training courses for accountants and chief accountants on OSNO and USN. All requirements of the professional standard “Accountant” are taken into account.

Payment of sick leave during pregnancy and application period

Having received from a woman an application for the assignment and payment of benefits and a certificate of incapacity for work due to pregnancy, the employer is obliged to pay the benefit within 10 calendar days.

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

Ask a Question

From the first calendar day, benefits are paid from the budget of the Social Insurance Fund of the Russian Federation. The employer does not bear the cost of paying benefits. Application deadline: no later than 6 months from the end of maternity leave.

If maternity leave is not formalized, there are no grounds for payment of benefits. The benefit is paid at 100%, regardless of length of service.

How to calculate maternity benefits

All the features of calculating benefits for temporary disability and in connection with maternity are reflected in the Regulations approved by Decree of the Government of the Russian Federation dated June 15, 2007 No. 375 “On the specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth...”.

We will calculate maternity benefits based on average earnings.

Payments that should be included in the calculation

When calculating benefits for temporary disability, pregnancy and childbirth, and child care for children up to one and a half years old in 2019, the calculation of average earnings can include maximum payments for 2021 in the amount of 755,000 rubles, and for 2021 - in the amount of 718,000 rubles . (according to paragraph 2 of Article 14 of Law No. 255-FZ).

Billing period

The calculation period for calculating temporary disability benefits, maternity benefits, and childcare benefits for children up to one and a half years old will be the two years preceding the occurrence of the insured event. For example, if an employee got sick or went on maternity leave in 2021, then the billing period will be from January 1, 2021 to December 31, 2021.

Replacing periods

If in two calendar years immediately preceding the year of occurrence of the specified insured events, or in one of the specified years, the insured person was on maternity leave and (or) child care leave, then the corresponding calendar years (calendar year) upon application the insured person may be replaced for the purpose of calculating average earnings by previous calendar years (calendar year), provided that this will result in an increase in benefits.

Please note that you can replace years or year with any previous years.

Regional payments

Each federal subject has its own regional benefits. In some regions, the government has established maternity capital for 2 and 3 children born after January 1, 2011. In the Moscow region, for example, the amount of this payment is 100 thousand rubles.

The authorities in Nizhny Novgorod also pay regional capital. It is received by families in which the second child was born after September 1, 2011. But the amount of this monetary compensation is less than in Moscow. It is 25 thousand rubles. And for the third and subsequent children, maternity capital increases to 100 thousand rubles. The procedure for receiving regional payments is established separately for each constituent entity of Russia.

Regional payments are assigned simultaneously with federal ones. Therefore, residents of the regions receive double subsidies from the state. However, not everywhere regional authorities decide on additional incentives for families.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

New benefit amounts for BIR from May 1, 2019

If maternity leave begins on May 1, 2021 or later, then the minimum average daily earnings for calculating maternity benefits should be taken equal to 367.00273. If actual earnings are below the minimum, then benefits had to be calculated from this value. Here are the minimum amounts of maternity benefits from May 1, 2021:

- RUB 51,380.38 (367.00273 × 140 days) – in the general case;

- RUB 71,198.53 (367.00273 x 194 days) – in case of multiple pregnancy;

- RUB 57,252.43 (367.00273 x 156 days) – for complicated childbirth.

What were the sizes before May 1?

From January 1, 2021, the federal minimum wage was 9,489 rubles. And the minimum average daily earnings was 311.967123 rubles per day (9489 rubles x 24 / 730 days). Therefore, if maternity leave began from January 1 to April 30, 2021, then the minimum maternity benefits would be:

- RUR 43,675.80 (311.967123 × 140 days) – in the general case;

- RUB 60,521.62 (311.967123 x 194 days) – in case of multiple pregnancy;

- RUR 48,666.87 (311.967123 x 156 days) – for complicated childbirth.

This is also important to know:

Sample characteristics for an award: when required, writing structure, types

Sources:

- https://www.mos.ru/otvet-semya-i-deti/kak-poluchit-pomosch-dlya-beremennyh/

- https://detskie-posobiya.molodaja-semja.ru/posobiya-po-beremennosti/

- https://www.consultant.ru/law/ref/poleznye-sovety/detskie-posobija/posobie-po-beremennosti-i-rodam/

- https://mamaprofi.com/bolnichnyj-dekret-posobiya/posobie-po-beremennosti-i-rodam.html

- https://posobie-expert.ru/po-beremennosti/posobie-po-rodam/

- https://school.kontur.ru/publications/368

- https://www.garant.ru/actual/posobiya/posob_deti/1020048/

- https://buhguru.com/posobia/posobie-po-berem-i-rodam-s-maya-2018.html

Subscribe to the latest news