Employer reporting

Olga Yakushina

Tax expert-journalist

Current as of January 29, 2019

ERSV for the 4th quarter of 2021 - we will look at a sample of filling out this report in this article. Absolutely all employers are required to take it. How to fill out a report correctly and which lines will inspectors pay close attention to? What is the deadline for reporting? Let us consider in detail the algorithm for processing and transferring the calculation to the Federal Tax Service.

In 2021 - a new form of payment

Officials from the Federal Tax Service have developed a new form for calculating insurance premiums. The new form has been published on the Unified Portal for posting draft legal acts. But to be more precise, the project intends to approve a new edition of the form for calculating insurance premiums, and not a new form.

As for the changes, for example, in the updated form there is no annex that includes information about the application of the reduced tariff established for the period until 2021. In Appendix 2 “Calculation of the amount of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity” new fields have appeared.

The changes also affected, for example, section 3, which is required for personalized information of individuals. It has a new attribute “Adjustment type”. Accountants, as in SZV-M, will put a mark in it indicating which form they are submitting: original, correcting or canceling. In the order of filling out, it was indicated that the calculation should not contain numbers with minuses. And in Appendix 2 to Section 1, the field “Payer’s tariff code” was added. The changes also affected other calculation applications.

However, the draft provides that the new order will come into force on January 1, 2021 and will be applied starting with the submission of calculations for insurance premiums for the first quarter of 2021.

Section 3

For each employee, the accountant prepared a separate section 3. In each, he displayed:

- billing period code, which corresponds to a similar code indicated in the title page: “34”;

- reporting year;

- date of settlement;

- employee information:

- TIN;

- SNILS;

- FULL NAME;

- date of birth;

- passport information.

You should be very careful when filling out the personal information of employees: if there is an error in the last name, first name or patronymic, as well as in the TIN or SNILS, the tax authorities will not accept the calculation (letter of the Federal Tax Service of Russia dated January 19, 2017 No. BS-4-11 / [email protected] ).

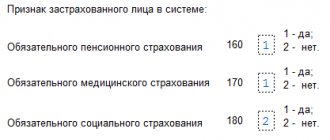

In the fields “Identification of an insured person in the system,” the accountant recorded code 1, which means that the employee is insured in the system of compulsory pension, medical and social insurance.

In section 3.2.1, the accountant indicated the month of accrual of earnings: 10 (October), 11 (November) and 12 (December). In the line “Category code of the insured person” - code “НР”, which means that the employee is an employee.

A complete list of codes is given in Appendix No. 8 to the procedure for filling out the calculation. You can download it here.

In lines 210, 220, 230, 240, the accountant recorded the amount of income accrued for each month and the amount of contributions to pension insurance.

Deadlines for submitting calculations for insurance premiums in 2018: table

Submit your invoice no later than the 30th day of the month following the reporting (billing) period. If the due date falls on a weekend, the payment can be submitted on the next working day.

Such rules are established by paragraph 7 of Article 431, paragraph 7 of Article 6.1 of the Tax Code of the Russian Federation.

The reporting period for calculating insurance premiums is the first quarter, half a year, nine months. The billing period is a calendar year. This is provided for in Article 423 of the Tax Code of the Russian Federation.

Below we provide a table with the deadlines for submitting calculations of insurance premiums to the Federal Tax Service in 2021. The table shows the deadlines no later than which the calculation must be submitted:

| Reporting period | Deadline |

| Calculation for 2021 | January 30, 2021 |

| Calculation for the 1st quarter of 2021 | May 3, 2021 |

| Calculation for the first half of 2021 | July 30, 2021 |

| Calculation for 9 months of 2021 | October 30, 2021 |

Heads of peasant (farm) households without hired workers submit payments once a year before January 30 of the calendar year that follows the expired billing period. Therefore, no later than January 30, 2021, they submit the calculation for 2021.

Title page

Example

Sfera LLC has 3 employees. At the end of 2021, the accountant filled out the calculation of insurance premiums.

First of all, the accountant prepared a cover sheet, which contains basic information about the policyholder:

- TIN and KPP (separate divisions in the KPP field indicate their code for the territorial location of the branch, individual entrepreneurs do not fill in this field);

- number of the Federal Tax Service with which the company is registered;

- full name;

- OKVED code (the company is engaged in the wholesale sale of vegetables and fruits);

- contact number;

- the number of sheets on which the calculation is filled out.

If you miss deadlines

What happens if the deadlines for submitting insurance premium payments are missed in 2021? For late submission of calculations, the tax office may fine an organization or entrepreneur. The amount of the fine is 5 percent of the contributions that must be paid (additional payment) based on this calculation. When calculating the fine, inspectors will subtract from this amount the contributions that you transferred to the budget on time.

A 5 percent fine will be charged for each month of delay, including the day the calculation is submitted. They will count it as a full month, even if the due date was on the 2nd of the month, and you submitted the calculation on the 15th.

The total amount of the fine cannot be more than 30 percent of the amount of contributions and less than 1000 rubles. For example, if the organization paid the settlement fees in full within the deadline set for submitting the settlement, then the fine for being late will be 1,000 rubles. There will be such a fine even if you violated the deadline for paying contributions, approved by paragraph 3 of Article 430 of the Tax Code of the Russian Federation. That is, based on the results of the months of the reporting period, contributions were transferred later than the 15th of the next month. This violation does not affect the penalty for late payment.

If you don’t have time to submit your contribution report in 2021, it’s better to pay off the arrears. Then the tax authorities will issue a minimal fine for late reporting.

For example, you submit a calculation for insurance premiums for 2021 no later than January 30, 2021. If you are late by even one day, officials will fine you 5 percent of the premiums for 2021 that you did not manage to pay by January 30, for each full and incomplete month delays. And if you have no debt on contributions, the tax authorities will charge a minimum fine of 1,000 rubles. (Clause 1 of Article 119 of the Tax Code).

Example: The organization had not paid insurance premiums for December by January 15, 2021. The debt amounted to 100,000 rubles. On January 29, the accountant realized that he would not be able to submit the contribution report for 2021 on time. If by January 30 the company repays the debt on contributions, the fine for failure to submit a report will be 1,000 rubles. If the arrears are outstanding, the tax authorities will fine you 5,000 rubles. (RUB 100,000 × 5%).

Read also

06.04.2018

Appendices No. 3, No. 2 and No. 1 to section 1

Since in 2021 one employee was on sick leave for 5 days, the accountant proceeded to fill out Appendix No. 3 to Section 1. The amount of sick leave was 8,000 rubles. The employee was sick for 5 days. The accountant recorded this information in line 010 of Appendix No. 3 to Section 1.

Next, the accountant proceeded to draw up Appendix No. 1 to Section 1, which consists of 4 subsections. Only the first 2 are required to be filled out. Subsections No. 1.3 and No. 1.4 are filled out only if insurance premiums have been accrued according to additional tariffs.

Calculation of contributions for compulsory health insurance and compulsory health insurance – subsections 1.1 – 1.2 of Appendix 1 to section. 1

Basic tariff codes (line 001):

- 01 – organization on a general regime, charging contributions according to basic tariffs;

- 02 – organization on the simplified tax system with basic tariffs;

- 08 – organization on the simplified tax system with reduced tariffs, conducting preferential activities;

- 03 – UTII payer with basic tariffs.

The number of insured persons (line 010) – all employees registered in your organization, as well as those who work under the GPA. Line 010 may be larger than line 020. After all, line 010 will take into account workers on maternity leave who do not have payments subject to contributions.

The data on payments and contributions in subsection 1.1 must correspond to the data in section. 3 for all employees (clause 7 of Article 431 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated December 13, 2017 # GD-4-11/25417).

The organization in the general mode charges contributions at the basic tariffs. It employs 10 people, one of whom is on maternity leave. The amounts of payments and contributions for 2021 are shown in the table.

| Index | 9 months | October | november | December | year |

| Payments | 1 153 000 | 303 837 | 304 018,45 | 328 696 | 2 089 551,45 |

| Non-taxable payments | 18 300 | 7 179 | 11 781,90 | 7 179 | 44 439,90 |

| Contribution base | 1 134 700 | 296 658 | 292 236,55 | 321 517 | 2 045 111,55 |

| Contributions: – to OPS | 249 634 | 65 264,76 | 64 292,04 | 70 733,74 | 449 924,54 |

| – on compulsory medical insurance | 57 869,70 | 15 129,56 | 14 904,06 | 16 397,37 | 104 300,69 |

Reporting on insurance premiums to the Social Insurance Fund

According to Order of the Federal Social Insurance Fund of the Russian Federation dated September 26, 2016 No. 381, it is necessary to submit an updated 4-FSS reporting format to the fund. It excludes information on insurance in case of illness or maternity, but the following information must be provided:

- calculated base for contributions “for injuries”;

- information on the accrual, payment, offset (or non-offset) of insurance premiums;

- expenses associated with accidents and occupational diseases, as well as information about the affected persons;

- data from a special assessment of working conditions.

The 4-FSS must be submitted within a time frame that depends on the method of generating and submitting the report:

- if in electronic form with more than 25 employees, then no later than the 25th day of the month following the reporting quarter;

- if in paper form and the number of employees is 25 people or less, then the period becomes shorter by 5 days.

If companies fail to submit 4-FSS on time, a fine of 5% of the amount of insurance premiums for each full and incomplete calendar month is provided. The minimum fine is 1 thousand rubles, and the maximum is 30% of the amount of insurance premiums.

Questions related to filling out the form

Let's consider what questions the policyholder may have when filling out the form:

- What tariff code should be reflected in the document? When calculating insurance premiums for 2021, the tariff code depends on which tax regime the policyholder applies: 01 – OSNO, 52 – USN, 53 – UTII.

- How to fill out the payment attribute column? In the calculation of insurance premiums for 2021, the payment indicator suggests two possible options: 1 – direct payments, 2 – offset payments. Direct payments mean that benefits will be paid to the employee directly from the extra-budgetary fund, bypassing the employer. However, in practice, direct payments relate to a pilot project of the Federal Tax Service and are not relevant for all regions. The offset system assumes that the payment of benefits is entrusted to companies, which will later be reimbursed by the fund for the expenses incurred.

Calculation of insurance premiums in 2021 - the premium calculator is presented in various Internet resources - is one of the most important tax reports in the system for calculating and paying insurance premiums.

Similar articles

- Calculation of insurance premiums 2021 form

- Checking the calculation of insurance premiums 2018

- Sample zero calculation for insurance premiums (2018)

- Calculation of insurance premiums 2021 zero example

- Procedure for filling out calculations for insurance premiums 2018

Amount of insurance premiums

The maximum amount of earnings that employers need to focus on when calculating insurance premiums for 2018 is set at the following amount:

- for contributions transferred within the compulsory pension insurance system, the base limit is fixed at 1,021,000 rubles;

- for social insurance payments related to temporary disability and maternity, the taxable limit is 815,000 rubles;

- For health insurance, there are no limits on taxable income for accruals.

Read more about limits here.

This might also be useful:

- KBC for insurance premiums for 2021

- How to reduce the simplified tax system for insurance premiums?

- Individual entrepreneur insurance premiums for employees in 2021

- Insurance premiums for injuries in 2021

- Details for paying insurance premiums in 2021

- Insurance premiums for individual entrepreneurs “for themselves” in 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Section 1

In section 1, the accountant transferred all amounts of contributions for the year, for the 4th quarter and broken down for October, November, December 2021. I also indicated the current BCC for each type of contribution.

We recommend checking the budget classification codes before sending the report to the Federal Tax Service, as the program may pick up incorrect codes. If this happens, then the accrued and paid contributions will end up on different cards, and an arrears will form on the front card with the incorrect BCC, on which the tax authorities will charge penalties. To correct the error, you will have to submit a clarification.

Sample RSV 2018

How to check the ERSV for the 4th quarter of 2018

Before sending to the Federal Tax Service, check the RSV with form 6-NDFL. Tax officials will do the same during a desk audit. And if the values do not agree, they will ask for explanations about the reasons for the discrepancies.

For self-control, check the amount of income, excluding dividends, in 6-NDFL with the indicators on page 050 of subsection 1.1 to section 1 of the DAM form. According to the explanations of the tax authorities, the base subject to personal income tax must exceed or be equal to the base subject to insurance contributions. The formula that tax authorities rely on is given in the control ratios (CR) approved. by letter of the Federal Tax Service dated December 29, 2017 No. GD-4-11/27043.

If the COPs do not agree, tax authorities may decide that the base in 6-NDFL is underestimated and the tax has not been paid in full.

But there are situations when income tax and contributions are recognized in different reporting periods, for example, if the payment is carryover.

Let's explain with an example.

The employee was paid vacation pay on Monday, October 1, and accrued on Friday, September 28. The amount of vacation pay should be included in page 050 of subsection 1.1 of section 1 of the DAM form for 9 months of 2018 (clause 1 of article 424 of the Tax Code of the Russian Federation).

In turn, the date of receipt of income in the form of vacation pay for the purpose of calculating personal income tax is the day of payment (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Since the tax was withheld already in the 4th quarter, the amount of vacation pay will fall into the annual 6-personal income tax for 2021.

If you have a similar situation and the tax authorities ask for clarification, write a letter that there is no error, since the payment for contributions was recognized in the 3rd quarter, and for personal income tax - in the 4th.

A similar situation arises with the payment of holiday, annual and quarterly bonuses. Contributions are calculated on the day the premium is calculated, and the date of payment does not matter (letter of the Ministry of Finance dated June 20, 2017 No. 03-15-06/38515).

But for personal income tax, the date of withholding tax on bonuses (except for monthly ones) is the day of payment to the employee (letter of the Federal Tax Service dated October 6, 2017 No. GD-4-11/20217). Therefore, if a bonus is assigned in the 3rd quarter and paid in the 4th, then it will appear in the reports in different periods.

The situation is different with the monthly bonus. It is recognized as income for personal income tax on the last day of the month (clause 2 of article 223 of the Tax Code of the Russian Federation). Therefore, even if it was paid in the 4th quarter, it should be recorded in the RSV and 6-NDFL for 9 months.

Payments to “physicists” under the GPC agreement are also recognized as transferable. For contributions, the date of accrual of remuneration is important, and for personal income tax - the day of payment. They may fall on different reporting periods and, therefore, be reflected in different reports.

The difference may also arise due to different approaches to calculating personal income tax and contributions.

For example:

| Type of income | Personal income tax | Contributions |

| Cash gifts | Personal income tax is calculated on amounts exceeding 4 thousand rubles. (Clause 28, Article 217 of the Tax Code of the Russian Federation) | Gifts for the purposes of calculating insurance premiums are not considered income, regardless of the amount, and are not reflected in the DAM (letter of the Ministry of Finance dated January 20, 2017 No. 03-15-06/2437) |

| Compensation for delayed wages | Not subject to personal income tax (clause 3 of article 217 of the Tax Code of the Russian Federation) | It’s safer to charge contributions: officials insist on this (letter from the Ministry of Finance dated March 21, 2017 No. 03-15-06/16239) |

If the tax authorities ask questions, in an explanatory letter write down a list of payments from which contributions and income tax were calculated differently. To exclude possible claims, we recommend providing a detailed justification with references to letters from officials and norms of the Tax Code of the Russian Federation.

Having accepted the ERSV for 2021, inspectors begin a desk audit. If errors are found in the calculation, a notification is sent to the policyholder. Within 10 working days from the receipt of this notification, errors must be corrected (clause 7 of Article 431 of the Tax Code of the Russian Federation).

If you fail to correct the calculation on time, the due date will be considered the day the corrected form is submitted. And this threatens with a fine, the minimum amount of which will be 1 thousand rubles. (clause 1 of article 119 of the Tax Code of the Russian Federation).

Read also

03.02.2017

Reporting on insurance premiums to the Pension Fund of Russia

Two types of reporting must be submitted to the Russian Pension Fund:

- SZV-M

The report is regulated by Resolution of the Pension Fund Board of February 1, 2016 No. 83p. It must include information on all full-time employees and performers under GPC agreements. The SZV-M must be submitted no later than the 15th day of the month following the reporting month. If the deadline is violated, the organization is subject to penalties in accordance with Art. 17 of the Federal Law of April 1, 1996 No. 27-FZ, namely 500 rubles. for each person.

The report can be submitted in paper form (for fewer than 25 people) and must be submitted electronically (for 25 people or more). If this point is not taken into account, a fine of 1 thousand rubles is possible;

- SZV-STAZH

The report was approved by Resolution of the Pension Fund Board of January 11, 2017 No. 3p. It must be presented in the following situations:

— if an employee quits and requests information about his work experience. The report is issued on the last working day of the resigning person or within 5 calendar days upon the usual request of employees;

- if the employee retires. SZV-STAZH must be sent to the Pension Fund within 3 calendar days;

- after the end of the calendar year. The report is submitted for all employees, and for 2021 - no later than March 1, 2021.

Where and how to submit the RSV for 2021

The calculation of insurance premiums is submitted to the Federal Tax Service at the registration address of the employer company or at the place of residence of the individual entrepreneur. “Osoboki”, which independently calculate and pay remunerations to employees, submit it at the place of their registration and indicate their checkpoint and OKTMO codes (clause 7 of article 431 of the Tax Code RF).

The calculation can be submitted:

- In electronic form according to TCS - if the average number of personnel (ASN) for 2021 was 26 people or more.

- On paper or by TKS - if the SSC has 25 employees or less.

For violating the method of submitting the calculation (on paper instead of electronic format), the policyholder will be fined 200 rubles. (Article 119.1 of the Tax Code of the Russian Federation).

Calculation of contributions to VNiM - Appendix 2 to section. 1

In the “Payment attribute” field, put “2” (offset system), if you calculate and pay employee benefits yourself. If employees receive benefits directly from the Social Insurance Fund, put “1” (direct payments).

In line 070, indicate accrued benefits at the expense of the Social Insurance Fund. The date of payment of the benefit and the period for which it was accrued do not matter. For example, child care benefits for December were accrued on December 29 and paid on January 9. It must be shown in column 5 of line 070.

The amount in column 1 of line 070 of Appendix 2 must be equal to the amount in column 3 of line 100 of Appendix 3 to section. 1.

The indicator for column 2 of line 090 is calculated using the formula (Letter of the Federal Tax Service dated November 20, 2017 No. GD-4-11/):

If the result comes with a “+” sign, that is, contributions to VNiM exceeded benefits from the Social Insurance Fund, in column 1 of line 090, put the sign “1”. If the value of the indicator turns out to have a “-“ sign, put the sign “2” (Letter of the Federal Tax Service dated 04/09/2018 No. BS-4-11/).

In the same order, calculate and fill out columns 4, 6, 8, 10 of line 090.

Example:

There are 10 people in the organization; the organization calculates and pays benefits to them itself. The amounts of payments, contributions to VNiM and benefits accrued from the Social Insurance Fund for all employees for 2021 are shown in the table.

| Index | 9 months | October | november | December | year |

| Payments | 1 153 000 | 303 837 | 304 018,45 | 328 696 | 2 089 551,45 |

| Non-taxable payments | 18 300 | 7 179 | 11 781,90 | 7 179 | 44 439,90 |

| Contribution base | 1 134 700 | 296 658 | 292 236,55 | 321 517 | 2 045 111,55 |

| Contributions to VNiM | 32 906,30 | 8 603,08 | 8 474,86 | 9 323,99 | 59 308,23 |

| Benefits from the Social Insurance Fund | 18 300 | 7 179 | 11 781,90 | 7 179 | 44 439,90 |

Line indicator 090 of Appendix 2 to section. 1 is equal to:

- in column 2 – 14,868.33 rubles. (RUB 59,308.23 – RUB 44,439.90);

- in column 4 – 262.03 rubles. (RUB 26,401.93 – RUB 26,139.90);

- in column 6 – 1,424.08 rubles. (RUB 8,603.08 – RUB 7,179);

- in column 8 – -3,307.04 rub. (RUB 8,474.86 – RUB 11,781.90);

- in column 10 – RUB 2,144.99. (RUB 9,323.99 – RUB 7,179).