Employer reporting

Oksana Lim

Expert in tax and labor relations

Current as of February 21, 2020

Due to the reorganization of the company, salaries were paid one-time ahead of schedule: advance on the 20th, settlement on the 28th in the same month. How to withhold tax and fill out 6-NDFL? Due to financial difficulties in the organization, salaries were paid one-time on the 20th instead of the 5th. What are the features of filling out 6-NDFL?

Regulatory regulation of wage payments

Section VI of the Labor Code of the Russian Federation regulates the payment of wages.

Letter of the Ministry of Labor of Russia dated 02/03/2016 N 14-1/10/B-660 regulates the size and timing of salary payments.

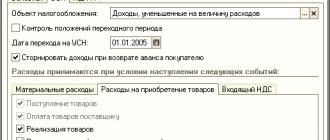

The Tax Code of the Russian Federation, Part 2 regulates the taxation of wages with personal income tax.

Order of the Federal Tax Service of Russia dated October 14, 2015 N ММВ-7-11/ [email protected] determines the form and completion of 6-NDFL.

Code of Administrative Offenses of the Russian Federation Article 5.27 defines the responsibility of the employer in the field of labor legislation.

Local acts of the organization that do not contradict the legislation in force at the moment, which determine the date (and not the period) of salary payment.

Who represents

In addition to the title page, Form 6-NDFL includes two sections:

- section 1 “Generalized indicators” - it is filled in with cumulative totals for the first quarter, half a year, nine months and a year;

- section 2 “Dates and amounts of income actually received and withheld personal income tax” - it reflects transactions that were made over the last three months of this reporting period.

However, before moving on to the nuances of filling out the calculation, let’s figure out who should submit it.

Let's start with the basics. Thus, the obligation to submit to the tax authority at the place of their registration a calculation in Form 6-NDFL for organizations and individual entrepreneurs arises if they, in accordance with Art. 226 and paragraph 2 of Art. 226.1 of the Code are recognized as tax agents. Thus, if a company or individual entrepreneur does not pay income to individuals, then they do not have the obligation to submit the said calculation. This fact is also recognized by regulatory authorities (see, for example, Letter of the Federal Tax Service dated May 4, 2016 N BS-4-11 / [email protected] ). However, officials also note that if these persons submit a “zero” calculation in Form 6-NDFL, such calculation will be accepted by the tax authority in the prescribed manner.

It must be said that this clause was made for a reason. For example, your company submitted 2-NDFL certificates for 2015 in accordance with the established procedure, which showed both the taxable income of individuals and the corresponding tax amounts. It is logical to assume that in this case the inspectors will expect payment from your organization in accordance with Form 6-NDFL. Well, if they don’t receive it, they can fine the organization for lately submitted calculations on the basis of clause 1.2 of Art. 126 Tax Code (for 1000 rubles - for each full or partial month of delay). At the same time, penalties in the amount of 300 to 500 rubles. can also be issued to the head of the company (Part 1, Article 15.6 of the Administrative Code).

Plus, in accordance with clause 3.2 of Art. 76 of the Code, in the event that a tax agent fails to submit a calculation in accordance with Form 6-NDFL within 10 days after the expiration of the established period, the tax authority has the right to suspend transactions with its “accountants”. Obviously, this kind of “misunderstanding” can be avoided in two ways - either by sending an explanation to the inspectorate why you do not submit a calculation in Form 6-NDFL (for example, for the reason that “no activity is being carried out”, “salaries are not accrued or paid ", etc.), or send a “zero” to the tax authority (in “Number of individuals who received income” we write “0”, in “Tax rate” - “13”, and in section 2 on lines 100, 120 we put either any date in the interval of the reporting period, or, as recommended by the State Scientific Research Center of the Federal Tax Service (developer of the “Legal Taxpayer” program), in section 2 in lines 100, 110, 120 we indicate the date “01/01/1900”, and leave lines 130 and 140 blank).

It seems that the second option is preferable. In any case, if a “zero” is sent to the inspectorate, then your account will definitely not be “frozen”.

Note! In the calculation form, details and totals are required to be filled in (clause 1.8 of the Procedure)

If there is no value for the total indicators, zero (“0”) is indicated.

By the way, the Ministry of Finance in Letter dated May 10, 2021 N 03-04-05/26580 confirmed that individual entrepreneurs who are not recognized as tax agents for personal income tax should not submit calculations using Form 6-NDFL.

Basis for timing of salary payment

According to the Labor Code of the Russian Federation, salaries must be paid at least 2 times a month, i.e. is allowed more often, which must be regulated by local acts of the organization. Another important condition is that the accrued salary must be paid no later than 15 days from the date of its accrual, for example, the accrued salary on the 1st must be indicated in the local act no later than the 16th of the same month, a later payment is a violation labor legislation.

The Labor Code of the Russian Federation does not reflect early payment of wages, for example, before a long weekend. Thus, local regulations can provide for early payment before long New Year holidays (on payment of wages if the payment date coincides with a holiday or day off, Article 136 of the Labor Code of the Russian Federation stipulates that it must be paid on the eve of such days), but not payment at the request of the employee .

If the norms of local regulatory acts of an organization of a constituent entity of the Russian Federation contradict the current labor legislation, then these norms are considered invalid.

Deputy Minister of Labor and Social Protection of the Russian Federation L.Yu. Eltsova.

Salary payment for tax purposes

Important! The salary payment date (but not the period) must be recorded in one of the local documents, for example, in an employment contract, etc.

Salaries are subject to taxation, in particular personal income tax, which is paid by a tax agent represented by an organization. The day of receiving remuneration in the form of salary under Art. 223 of the Tax Code of the Russian Federation is the last date of the month (except for the case of dismissal of an employee). So, when paying wages earlier than the last date of the month, it is considered ahead of schedule, that is, an advance on which the organization is not obliged to calculate personal income tax.

In the clarifications of the Ministry of Finance of the Russian Federation dated October 27, 2015 No. 03-04-07/61550: personal income tax must be withheld on the last date of the month or in the month following the payment of early salary and until the end of the month the salary cannot be considered received by the taxpayer and the tax cannot be counted. Thus, the salary that is paid before the end of the month is an advance and on the day of payment the organization should not calculate personal income tax and should not withhold it. The tax is calculated only on the last day of the month, and it is withheld only when the next payment is made. Thus, the advance payment is paid taking into account the tax, and the next payment will be deducted, for example, from the advance payment, and the payment to the budget will be made on the next business day.

Legislative acts

Filling out the report is regulated in Tax Code Art. 230 clause 2. All business entities that acted as tax agents in a calendar year are required to submit 6 personal income taxes if earnings and taxes were accrued in at least one period. The reporting quarters are considered to be 1st, 2nd, 3rd, 4th quarters. At the same time, the deadlines for submitting declarations are clearly defined.

Section 1 must be completed on an accrual basis. In the second, information is entered in the reporting period when the payments were made.

If wages are calculated in one quarter and transferred in another, the information in the declaration should be reflected after completion. This applies to situations where there is a delay in wages.

For example, wages were accrued on March 5, tax was withheld on March 6. This should be reflected in the 1st quarter report in the first section.

Tax agents miss the point of filling out the second section. In this case, the transfer of salaries to individuals was made in the 2nd quarter. In the form, in the 2nd part, you need to reflect the transfer of previously accrued income for the 1st quarter.

The Tax Code clearly states that the day of receipt of wages is recognized as the last date of the month in which income was accrued. In this case, the transfer may not be made.

According to the Tax Code, agents are required to withhold personal income tax from accrued wages at the time of transfer. The tax must be transferred no later than the next business day. This applies not only to salaries, but also to sick leave and vacation leaves.

Reporting for this situation needs to be generated, and you only need to fill in the data in section 1 regarding accrued wages. Lines to reflect taxes must be entered with zeros.

The procedure for filling out 6-NDFL when issuing salaries before the end of the month

Form 6-NDFL is submitted quarterly and organizations that issued wages on the last day of the month must reflect it in the calculation as early wages. For such a salary, the date of personal income tax withholding will be earlier than the date of receipt of income, if personal income tax is withheld from the salary on the day of payment.

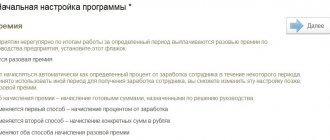

Filling procedure

Section 1:

020 – salary, including early payment

030 – standard, property and social deductions in relation to wages

040 – calculated personal income tax from payments: regular salary, and paid ahead of schedule.

070 – withheld personal income tax, despite the fact that if the tax is not withheld, it is not added, for example, if personal income tax is withheld from an early salary in September, and from an advance payment in October, then this tax is not included in the calculation.

Section 2:

Salaries paid ahead of schedule are reflected in section 2 as a separate block.

100 – indicates the last day of the month for which the salary was issued

110 – indicates the date when the tax must be withheld, for example, payment of the next advance)

120 – date of the working day after the date from line 110

130 – accrued salary

140 – withheld personal income tax

Deadline for submitting 6 personal income taxes for the 4th quarter of 2021 for 2021

The deadline for submitting 6 personal income taxes for the 4th quarter of 2021 is April 2, 2018. If reporting is not submitted on time, the tax office will impose penalties.

As noted above, paragraph 7 of Article 6.1 of the Tax Code of the Russian Federation provides a rule for cases when the deadline for submitting a report falls on weekends or holidays, in which case the deadline for submitting 6-NDFL is postponed to the first working day following weekends or holidays.

Penalties for failure to submit 6 personal income taxes on time.

The chief accountant should know that if 6 personal income taxes are not submitted on time, the organization (or individual entrepreneur) will be fined 1000 rubles. for each full or partial month of delay. This norm is provided for in paragraph 1.2 of Article 125.

In case of failure to submit 6 personal income taxes within 10 days after the established deadline, additional sanctions may be applied - the tax inspectorate has the right to suspend transactions on bank accounts.

For errors made in reporting, a fine will be imposed on the basis of Article 126.1 of the Tax Code of the Russian Federation. The fine is 500 rubles. The fine is imposed only for errors in income and tax amounts. There should be no penalties for an error in the form made in the company's address. A fine cannot be imposed on those who independently identify errors in the document and promptly submit an updated document to the tax office before the tax authorities discover inaccurate information.

Do I need to submit zero form 6 personal income tax?

There is no need to submit Form 6 Personal Income Tax. This follows from the letter of the Federal Tax Service of the Russian Federation dated March 23, 2016 No. BS-4-11/4958.

Companies and individual entrepreneurs are required to submit 6-NDFL only in cases where they are tax agents - in the case of income payments to employees (in accordance with Art.

226 of the Tax Code of the Russian Federation).

Submission of the form is not required in the following cases:

- There are no employees at all.

- There are employees on staff, but no payments were made to them during the reporting period.

- There is no economic and financial activity.

Calculation of insurance premiums for 2021

KBK NDFL 2021 for employees

The specific BCC for personal income tax in 2021 depends on who exactly the taxpayer is. In case if…

Error in salary payment dates

Local acts of the organization regulate the following salary payment deadlines: the 20th of the current month and the 5th of the next month. Is it necessary to take into account the 15-day period for issuing salaries if the payment was made due to a weekend earlier than the 20th, for example, the 18th, if there are 31 days in a month, is it necessary to issue it on the 4th?

When setting dates by local acts for the payment of wages, the number of days in a month does not matter. And regardless of the fact that the payment was made on the 18th instead of the 20th, the payment must be paid on the established day - the 5th. 15 calendar days are set as the period during which it must be paid after it is accrued (Part 6 of Article 136 of the Labor Code of the Russian Federation).

Early transfer of income

According to NK Art. 223 clause 2, the date of payment of income should be recognized as the last day of the calendar month for which the accrual was made. For reflection in the calculation, it does not matter whether it falls on a weekend or a holiday. This standard was established in letter BS 3-11/ [email protected] dated May 16, 2021.

The Tax Code does not explain the moment of taxation when reflecting early wages. When filling out page 100, you must adhere to the norms established by law and indicate the date of the last day of the reporting month.

Error when reporting pre-paid New Year's salary

Organizations issue December salaries before the new year: December 28 or 29. In this situation, you need to withhold personal income tax from the December salary only with the January advance. The salary for December will be income only on December 31, until which personal income tax cannot be withheld, but only from the advance in January, and the December salary will be paid without deducting personal income tax. In this case, the salary for December is taken into account in section 1 of the 6-NDFL calculation, lines 020 and 040 for the year and in section 2 of the calculation for the first quarter of 2021, line 070.

But in practice, the Federal Tax Service does not fine organizations for the transferred tax before January, so if personal income tax is withheld on December 29, then both the salary and the tax will fall into 6-personal income tax for the year (lines 020, 040 and 070), but the tax must be paid in January and its payment will be reflected in 6-personal income tax for the first quarter, in section 2.

How should tax be reported?

Income tax is not allowed to be transferred until the end of the month of its deduction. This payment will be regarded as payment at the expense of the business entity. This is enshrined in the Tax Code, Art. 226 clause 9. Calculation of income tax should be performed no later than the working day following the day of payment of earnings, from which the actual deduction will occur (TC Article 226 clause 6 and Article 6.1 clauses 6-7).

Despite the fact that the law does not allow advance calculation of personal income tax, tax authorities do not apply sanctions to organizations if payments arrive to the treasury in the current month ahead of schedule.

Answers to common questions

Question No. 1 : Salaries are paid on the 25th and 10th. An employee going on vacation on the 9th asks to be paid wages for the days worked before going on vacation. Do I need to pay wages for these days before the start of the vacation?

Answer : The Labor Code of the Russian Federation does not oblige the organization to pay the employee wages for the days worked before the start of the vacation. If the employer pays wages for the days worked before the vacation, before the due date for payment of wages, the employer may be brought to administrative liability under Art. 5.27 of the Code of Administrative Offenses of the Russian Federation for violating the terms of salary payments.

Salary accrued but not paid

Every employee has the right to receive timely payment for work performed.

The Labor Code of the Russian Federation establishes strict conditions for the payment of wages and failure to comply with them is fraught with serious consequences.

Employers who delay the payment of earned funds (and a delay is considered to be any period starting from a day or more) are involved:

- To the voluntary accrual of a penalty in the amount of 1/300 of the National Bank rate for each day of delay.

- To administrative liability in the form of fines and/or suspension of the organization’s activities.

- To criminal liability, which is imposed on the guilty persons.

In addition to these measures, employees themselves can also protect themselves from unlawful actions of the employer. Articles 142 and 379 of the Labor Code of the Russian Federation allow employees to suspend their work activities, provided that wages are delayed for a period of more than 15 days and with a mandatory written warning about temporary suspension from work.

How to reflect in 6-NDFL?

In quarterly tax reports, unpaid income is reflected in 6-NDFL if it was nevertheless repaid in the reporting quarter, and if not, then zeros are entered and transferred to the next quarter. In 6-NDFL, carryover wages are reflected in actual amounts indicating actual payment dates.

Differences in filling will affect the following lines of section 1:

- 070 – the total amount for the year is entered, which indicates the taxes actually withheld.

- 080 – enters the amount that was not withheld.

If we are talking about a whole quarter of unpaid salary, then zeros are entered in both lines 070 and 080. But in subsequent semi-annual reports and beyond, general final figures are indicated.

In the second section, information is entered only when income is paid, and if they have not yet been repaid, then zeros are placed in all lines except 100, where there will be information about the dates of actual accrual of income.

Such restrictions apply in 6-NDFL to both advance payments and salary arrears.