Filling out a certificate by citizens in the form of form No. 460 implies providing information about the income they receive, the expenses they make, as well as the real estate they own and current property obligations. In this material, we will look at who fills out the 460 income certificate, what is the procedure for entering data into it, and whether there are any features of its implementation.

Certificate 460 about income

How to fill out the form

The current form of income certificate - 2-NDFL - is approved by Appendix No. 1 to the order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/566. The same document approved:

- the procedure for filling out this certificate (Appendix No. 2, hereinafter referred to as the Procedure);

- electronic format 2-NDFL (Appendix No. 3).

The official name of the document in question is “Certificate of income and tax amounts of an individual” (form 2-NDFL).

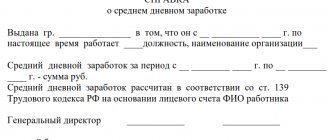

Upon dismissal and registration of pension

Upon dismissal, in addition to the work record book, the employee receives information from the employer about the amount of salary. This information about average earnings is necessary for presentation at the place of your next employment, for applying for unemployment benefits and in other authorities that use this data in their work.

To calculate benefits provided by the Social Insurance Fund, the employee must be issued a document in form No. 182n. Its form was approved by order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n.

It contains information about average earnings for the last and two previous years.

Structure of the income certificate

2-NDFL consists of the following parts:

- general part (header);

- Section 1 “Data about the individual recipient of the income”;

- Section 2 “Total amounts of income and tax based on the results of the tax period”;

- Section 3 “Standard, social and property tax deductions”;

- Appendix “Information on income and corresponding deductions by month of the tax period.”

Please note that it is more convenient and correct to fill out the income certificate completely out of order. In what order to fill out the 2-NDFL certificate, find out from ConsultantPlus:

We recommend filling out the 2-NDFL certificate in the following order: ... (read more).

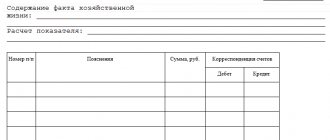

Benefit calculation

SzM = DZ/KdG, where:

SzM - the amount of salary for the month.

DZ - salary income for the year. Bonus payments are not taken into account.

KdG - number of days worked in a year.

P = SzM x KdM, where:

P is the amount of benefit.

SzM - the amount of salary for the month.

KdM - the number of days in three months (worked).

The benefit amount can be calculated using a special formula

Important! The accrued amount of vacation pay is not taken into account.

General rules for filling out income certificate 2-NDFL

The document is filled out for the tax period. This is a calendar year. Data is taken from tax registers.

Unacceptable:

- correcting errors by corrective or other similar means;

- double-sided printing and binding of sheets, leading to damage to the certificate;

- specifying negative numeric values.

Use black, purple or blue ink.

Each reference indicator corresponds to one field, consisting of a certain number of familiar places. Only one indicator is indicated in each field. The exception is the date (DD.MM.YYYY) or decimal fraction (two fields separated by a dot).

Fill out the help fields from left to right from the first (left) familiarity.

When filling out on a computer, the values of numerical indicators are aligned to the right (last) familiarity. It is acceptable to have no frames for familiar places and no dashes for empty familiar places.

Fill in CAPITAL PRINTED characters in Courier New font with a height of 16-18 points.

| SITUATION | SOLUTION |

| There is no indicator | In all familiar places in the corresponding field there is a dash. |

| To indicate any indicator, you do not need to fill out all the fields | In empty spaces there is a dash on the right side of the field. |

| No value for total indicators | Indicate zero (0) |

| Help cannot be completed on one page | Fill out the required number of pages located before the Application |

Continuous numbering. For example, for the first page - 001, for the twelfth - 012.

How long is the document valid?

The legislation does not limit the period of validity. For example, if a certificate is issued for the tax office, it may be valid for several years. However, when submitting to Social Security, you need to take into account the requirements that this organization sets.

All government agencies require that such documents be prepared no earlier than 30 days before their submission. If a citizen wants to carry out actions with banking institutions, then the validity period of the paper can be extended even up to 10 days .

Filling out the general part of the income certificate 2-NDFL

| FIELD | HOW TO FILL OUT |

| INN checkpoint | Organizations indicate the tax agent identification number (TIN) and the reason for registration code (RPC) at the location of the organization according to a certificate from the tax office. Individuals - tax agents - only the TIN from the certificate of registration with the tax authority of the individual at the place of residence in the Russian Federation. If the certificate is submitted by an organization with separate divisions, after the TIN indicates the checkpoint at the location of the organization at the location of the separate division. In practice, a separate division may be closed. How to fill out 2-NDFL in this case, there is a separate explanation from the Federal Tax Service of Russia in ConsultantPlus: Federal Tax Service in connection with incoming requests from tax agent organizations regarding the submission of information on the income of individuals and the amounts of personal income tax in Form 2-NDFL (hereinafter referred to as certificates in Form 2-NDFL) and the calculation of amounts of personal income tax , calculated and withheld by the tax agent (form 6-NDFL) (hereinafter - calculation according to form 6-NDFL), in the event of liquidation (closing) of a separate division of the organization, reports the following. |

| Help number | A unique serial number in the reporting tax period assigned by the tax agent. When submitting a corrective or canceling certificate by a tax agent, in place of the previously submitted one, indicate the number of the primary one. When submitting a corrective or canceling certificate by the legal successor of the tax agent - the number of the previously submitted certificate by the tax agent. |

| Reporting year | Tax period for which the certificate was prepared |

| Sign | Indicate:

As a result of a technical error, the personal income tax for the resigned employee may not be fully withheld, but the 2-NDFL certificate for him has already been submitted to the tax office. After the tax period, do I need to submit two income certificates for it at once? See ConsultantPlus about this Fulfillment by the organization of the obligation to report the impossibility of withholding tax and the amount of tax in accordance with clause 5 of Art. |

| Correction number | Indicate:

A certificate of income of an individual whose personal income tax was recalculated for previous tax periods in connection with the clarification of his tax obligations is drawn up in the form of a corrective certificate. In the form of the revocation certificate, fill out the title, as well as the indicators of section 1 indicated in the previously submitted certificate. Sections 2 and 3, as well as the Appendix, are not completed. A sample of the correct completion of the cancellation certificate in form 2-NDFL is available in ConsultantPlus: Alpha LLC made a mistake when submitting certificates for 2021: the certificate in relation to I.I. |

| Submitted to the tax authority (code) | Four-digit code of the Federal Tax Service, to which the tax agent submits the income certificate. The first 2 digits are the region code, and the second two are the number of the Russian Federal Tax Service inspection in the region. |

| tax agent name | When submitting a certificate by a tax agent - a legal entity or a separate division, indicate the abbreviated name (in case of absence - the full name) of the organization in accordance with its constituent documents. If a legal successor, then the name of the reorganized organization or its separate division. When submitted by an individual recognized as a tax agent, indicate the full last name, first name, patronymic (if any) without abbreviations - in accordance with his identity document. In the case of a double surname, use a hyphen. |

| Form of reorganization (liquidation) (code) | Indicate the code in accordance with Appendix No. 2 to the Procedure:

Required when filling out the “Characteristic” field with a value of 3 or 4. |

| TIN/KPP of the reorganized organization | Accordingly, the TIN and KPP of the reorganized organization or its separate division. If you are not filing 2-NDFL for a reorganized organization, the fields “Form of reorganization (liquidation) (code)” and “TIN/KPP of the reorganized organization” are not filled in. Required to fill out when filling out:

|

| OKTMO code | Code of the municipality on whose territory the organization or separate subdivision is located. OKTMO codes are contained in the All-Russian Classifier of Municipal Territories OK 033-2013 (OKTMO). In free spaces to the right of the code value (if it has 8 rather than 11 characters) no symbols are placed. Individual entrepreneurs, private notaries, lawyers and other private practice specialists recognized as tax agents indicate the OKTMO code at their place of residence. Individual entrepreneurs recognized as tax agents who are registered at the place of activity in connection with the use of UTII or PSN, in relation to their employees, indicate the OKTMO code at the place of their such registration. The legal successor of the tax agent indicates the OKTMO code at the location of the reorganized organization or its separate division. |

| Telephone | City telephone code and contact telephone number of the tax agent, through which, if necessary, reference information regarding the taxation of personal income, as well as the credentials of this tax agent, can be obtained. |

As you can see, there are a number of features in filling out the 2-NDFL certificate during reorganization. All of them are listed in an accessible form in ConsultantPlus:

The legal successor submits certificates with the attribute “3” or “4” when it is necessary to report for the reorganized organization (clause 2.7 of the Procedure for filling out the 2-NDFL certificate).

Read completely.

Filling out section 1 of the income certificate

| FIELD | HOW TO FILL OUT |

| TIN in the Russian Federation | Identification number of an individual confirming his registration with the tax authority of the Russian Federation. If the tax agent does not have information about the TIN of the income recipient, they do not fill it out. |

| Surname Name Surname | Without abbreviations in accordance with the identity document. The middle name may be missing if it is not indicated in the identity document. For foreign citizens, it is permissible to indicate the last name, first name and patronymic in letters of the Latin alphabet. |

| Taxpayer status | Taxpayer status code:

As you can see, in relation to a non-resident foreigner, you also need to fill out certificates in form 2-NDFL. of how to do this in ConsultantPlus: In October 2021, the organization hired a citizen of Tajikistan, a non-resident of the Russian Federation, under an employment contract with a salary of 45,000 rubles. |

| Date of Birth | Date, serial number of month, year - by sequential writing in Arabic numerals. |

| Citizenship (country code) | Numerical code of the country of which the individual is a citizen. According to the All-Russian Classifier of Countries of the World (OKSM) (approved by Resolution of the State Standard of Russia dated December 14, 2001 No. 529-st). If you do not have citizenship, indicate the code of the country that issued the identity document. |

| Identity document code | Taken from Appendix No. 1 to the Procedure:

|

| Series and number | Details of the taxpayer’s identity document – series and number, respectively. The “No” sign is not placed. |

One-time allowance for the third child

At the birth of a third child, starting from February 2021, a benefit in the amount of 17,479.73 rubles is accrued. The following documents are submitted along with the application:

- passport;

- child's birth certificate;

- certificate of family composition.

At the birth of children, lump sum benefits are also paid

Attention! The benefit will be paid 10 days after submitting the application with documents attached. In the event of an unmotivated refusal to pay, the decision must be appealed in court.

Filling out section 2 of the income certificate

The totals are shown here:

- accrued and actually received income;

- calculated, withheld and transferred personal income tax at the appropriate rate specified in the “Tax rate” field of section 2 of the certificate.

| FIELD | HOW TO FILL OUT |

| Total income | The total amount of accrued and actually received income, excluding deductions from Section 3 and Appendix to the certificate |

| The tax base | On which the tax is calculated. The indicator corresponds to the amount of income from the “Total Amount of Income” field, reduced by the amount of deductions from Section 3 and the Appendix. If the amount of deductions in Section 3 and the Appendix exceeds the total amount of income, indicate 0.00. |

| Tax amount calculated | Total tax amount calculated |

| Amount of tax withheld | Total amount of tax withheld |

| Amount of fixed advance payments | The amount of fixed advance payments accepted to reduce the amount of calculated tax |

| Tax amount transferred | Total amount of tax transferred |

| Amount of tax over-withheld by the tax agent | Indicate:

|

| Amount of tax not withheld by the tax agent | The calculated amount of tax that the tax agent did not withhold in the tax period |

In case of payment of income during the tax period to an individual recipient, taxed at different rates, fill out the required number of pages of the certificate. Then, on the second and subsequent pages of the certificate, fill out “TIN”, “KPP”, “Certificate Number”, “Reporting Year”, “Characteristic”, “Adjustment Number”, “Submitted to the tax authority (code)”, section 2 and, if necessary section 3. The remaining fields of the certificate are filled in with dashes.

When filling out a certificate with sign 2 or 4 :

| FIELD | HOW TO FILL OUT |

| Total income | The amount of accrued and actually received income from which personal income tax is not withheld by the tax agent, reflected in the Appendix |

| Tax amount calculated | Tax amount calculated but not withheld |

| Amount of tax withheld Tax amount transferred Amount of tax over-withheld by the tax agent | Zero (0) |

| Amount of tax not withheld by the tax agent | The calculated amount of personal income tax that the tax agent did not withhold in the tax period |

If you paid income to an individual, but were unable to withhold tax from it, you must report this to the Federal Tax Service (clause 5 of Article 226 of the Tax Code of the Russian Federation). To do this, you need to fill out a 2-NDFL certificate with sign 2. A sample of correct completion if it is impossible to withhold personal income tax is available in ConsultantPlus:

In December 2021, at the request of an employee who is a tax resident of the Russian Federation, the organization paid for his treatment, the cost of which was 45,000 rubles.

The specified amount is not returned by the employee. The employee was not paid any other income in cash in December 2021. See sample filling.

Completing Section 3

The information is shown here:

- about standard, social and property tax deductions provided by the tax agent;

- relevant notifications issued by the tax authority.

| FIELD | HOW TO FILL OUT |

| Deduction code | Selected from Appendix No. 2 to the order of the Federal Tax Service dated September 10, 2015 No. MMV-7-11/387. For a complete list of deduction codes for 2-personal income tax, see a separate file here. Accountants are usually confused about the last 620 code on this list. It is open in nature, because it reflects “other amounts that reduce the tax base...”. Which deductions are reflected by code 620 in 2-NDFL, see ConsultantPlus: Each deduction has its own code. At the same time, deduction code 620 reflects other amounts that reduce the tax base for personal income tax, for which... (read more). |

| The amount of the deduction | Amounts of deductions corresponding to the specified code |

| Notification type code | Indicate:

|

| Notification number Date of issue of notice Code of the tax authority that issued the notification | If notifications are received more than once, the tax agent fills out the required number of pages of the income certificate. |

Here are a few features of filling out section 3 of the income certificate:

| SITUATION | HOW TO FILL OUT |

| Providing deductions corresponding to different codes during the tax period | Fill in the required number of fields “Deduction Code” and “Deduction Amount” |

| The number of deductions provided during the tax period exceeds the number of fields allocated for filling them out | Fill out the required number of help pages. On subsequent sheets of the certificate, fill in the fields “TIN”, “KPP”, “Page”, “Certificate number”, “Reporting year”, “Characteristic”, “Adjustment number”, “Submitted to the tax authority (code)”, “name tax agent", "Deduction code", "Deduction amount". The remaining fields are filled in with dashes. |

| Failure to provide deductions during the tax period on income taxed at the appropriate rate | The fields “Deduction Code” and “Deduction Amount” are not filled in |

| When there are no notifications | The fields “Notification type code”, “Notification number”, “Date of issue of notification” and “Code of the tax authority that issued the notification” are not filled in |

Filling out the Income Certificate Appendix

Here is information about income accrued and actually received by an individual:

- in cash and in kind;

- in the form of material benefit.

Fill out by month of the tax period and corresponding deductions, for each personal income tax rate.

| SITUATION | HOW TO FILL OUT THE APPENDIX TO 2-NDFL |

| Filling out a certificate form with sign 1 or 3 | Indicate in the appropriate fields:

|

| Filling out a certificate form with sign 2 or 4 | Indicate the amount of income actually received, from which personal income tax is not withheld by the tax agent |

Standard, social and property tax deductions are not reflected in the Appendix to the income certificate.

By the way, the Appendix to the 2-NDFL certificate reflects vacation pay. How to do this correctly, see ConsultantPlus here.

| FIELD | HOW TO FILL OUT |

| Help number Reporting year Tax rate | The corresponding certificate number, reporting year and tax rate at which personal income tax is calculated, reflected on the corresponding sheet 2-NDFL |

| Month | In chronological order - the serial number of the month of the tax period for which income was accrued and actually received |

| Revenue code | Selected from Appendix No. 1 to the order of the Federal Tax Service dated September 10, 2015 No. MMV-7-11/387. For a complete list of income codes for 2-NDFL, see a separate file here. An individual can receive paid goods/work/services as income. Usually here the accountant has difficulty deciding which income code to indicate in the certificate - 2510 or 2520. This situation is discussed in detail in ConsultantPlus: Let us note that the Order does not establish new types of income, but only codes those defined by the Tax Code of the Russian Federation. |

| Amount of income | The entire amount of accrued and actually received income according to the specified income code |

| Deduction code | Selected from Appendix No. 2 to the order of the Federal Tax Service dated September 10, 2015 No. MMV-7-11/387. For a complete list of deduction codes for 2-personal income tax, see a separate file here. Indicate if the amount of the corresponding deduction is available. For the relevant types of income for which appropriate deductions are provided or which are not subject to personal income tax in full, indicate the deduction code selected from the specified document. |

| The amount of the deduction | Should not exceed the amount of income indicated in the corresponding column “Amount of Income” |

For income from transactions with securities and derivative financial instruments (Article 214.1 of the Tax Code of the Russian Federation), from repos with securities (Article 214.3 of the Tax Code of the Russian Federation) and from loans with securities (Article 214.4 of the Tax Code of the Russian Federation) in relation to one income code may be Several are indicated . In this case:

- the first deduction code and its amount are indicated below the corresponding income code;

- other codes and amounts of deductions are indicated in the corresponding columns in the lines below;

- the fields “Month”, “Income Code” and “Income Amount” opposite such codes and deduction amounts are filled in with dashes.

If the tax agent accrued to an individual during the tax period income taxed at different rates, sections 1, 2 and 3 (if necessary), as well as the Appendix, are filled out for each of the rates.

As for lawyers, they can receive different types of income - remuneration for providing legal assistance to the client, for performing work duties, as well as other types of remuneration. Which income code to indicate for each situation, see ConsultantPlus:

A lawyer has the right to enter into labor relations as an employee in the event of carrying out scientific, teaching and other creative activities. Income from the work of a lawyer as an employee is indicated in the 2-NDFL certificate with code... (read more).

In relation to whom information is being collected

The citizen filling out the certificate is obliged to provide information not only for himself, but also for some persons related to him, that is, for:

- wife or husband, depending on the gender of the person providing the data;

- for minor children (for each of them separately).

Data is entered for each person on a separate piece of paper.

Let's give an example. You hold one of the previously listed positions, and have a spouse, daughter and son, 16 and 17 years old, respectively. It turns out that when you hand in the completed form for yourself, you must submit three more for your family. That makes only four.

It is unacceptable to indicate several people on one copy of the form.

Reporting periods and deadlines for transferring data for processing vary between civil servants and government employees. The first ones provide:

- information on the funds received by them, for 12 calendar months, as well as on the income of the wife, husband, minor offspring, for the same time period, submitted for the next year;

- information about property-related objects owned by the person submitting the information, the wife/husband of this citizen and minor children, and about property-related obligations.

Employees provide certificate No. 460 every twelve months:

- entering information about the financial resources received and spent by one’s own, husband’s, wife’s, and offspring who have not reached the age of majority, which were received or spent in the calendar 12 months that have passed before the current annual period when the information is provided;

- indicating data on the real estate owned by him, as well as the property of the spouse, children under the age of majority, according to the status of the last day of December of the year preceding the twelve-month period of providing the certificate.

Providing data to employees is mandatory if at the end of December of the reporting year one of the following circumstances occurred:

- the position that was filled by him is among the items on the list of relevant areas of activity;

- the position is filled temporarily and is on the list of relevant activities.

An employee who has assumed the corresponding post is not required to provide information on the form if he is in it temporarily and the appointment to it did not come into effect on January 1 or during the entire next year following the reporting twelve-month period.

How to identify family members about whom information must also be provided

As we have already mentioned, an employee is obliged to provide current information about himself on a specific date, consisting of expenses and income he receives, and is also obliged to declare the property of his family, that is, his wife or husband, as well as children under eighteen years of age.

When an organization decides on the importance of declaring information on the husband or wife of an employee, it is necessary to take into account the paragraphs of Article No. 25 of the RF IC. It says that only the citizen with whom the marriage is officially sealed through the registration procedure and the presence of an act of the corresponding status of citizens is a spouse. The marriage also ends by receiving a similar act of dissolution and making a note in the registration book.

Article 25. Moment of termination of marriage upon its dissolution

If, as of December 31 of the reporting year, the employee was no longer the spouse of someone, then information about his former other half is not provided. In this case, it does not matter how many times during the year you got married or divorced, only the status of the official on the reporting date of providing information matters.

As for children who have not reached the age of majority, it must be taken into account that, according to the Constitution, the day following the day of birth becomes the day of majority for a child.

Let's give an example. You provide data on finances, which became your income, money spent, property and financial and property obligations in 2017, over the past year. Your daughter reached adulthood last May. Since the reporting period is December 31, 2021, there is no need to fill out the form and submit it to the organization.

The same situation will be for a child who turned 18 on December 30, since on the next reporting day for providing documentation, he is already considered an adult. If the birthday passed on December 31, and the daughter’s majority did not come into effect until January 1, 2021, a certificate on it will need to be filled out and submitted for consideration.

If it is not possible to provide data on family members, and this state of affairs arose objectively, the employee is obliged to write and submit a corresponding statement to a number of government bodies.

Certification of income certificate pages

| FIELD | HOW TO FILL OUT |

| I confirm the accuracy and completeness of the information specified in this Certificate | Indicate:

|

| surname, name, patronymic signature | Last name, first name, patronymic (if any) of the authorized person who submitted the certificate, and his signature |

| Name and details of the document confirming the authority of the representative of the tax agent (successor of the tax agent) | Filled out in case of submission of a certificate by a representative of the tax agent (his legal successor). |

Do I need a stamp on the 2-NDFL certificate? There is a separate explanation about this in ConsultantPlus: read here.

Let's sum it up

As you can see, certificate form No. 460 is a rather voluminous paper form, inside of which you need to enter a large amount of various information. To avoid mistakes, it is advisable to consult with specialists in the accounting department at the place of employment, otherwise you will have to re-issue the paper several times. Don’t be afraid, in fact, it’s not all that scary; most employees filling out the form skip many sections, since only very wealthy people need to enter data on all of them. In practice, their combination is quite rare.

We wish you good luck in filling it out!

Example of filling out an income certificate

Let’s assume that Alexander Alexandrovich Sergeev worked at Alpha LLC in 2021 and received the following income:

- January – 22,000 rubles: salary;

- February – 22,000 rubles: salary (17,000 rubles) + sick leave (5,000 rubles);

- March – 22,000 rubles: salary;

- April – 22,000 rubles: salary;

- May – 22,000 rubles: salary;

- June – 52,000 rubles: salary (22,000 rubles) + bonus (10,000 rubles) + vacation pay (20,000 rubles);

- July – 2,000 rubles: salary;

- August – 22,000 rubles: salary;

- September – 22,000 rubles: salary;

- October – 22,000 rubles: salary;

- November – 22,000 rubles: salary;

- December – 22,000 rubles: salary.

Total: 274,000 rub.

For each month of 2021, Alpha LLC provided A.A. Sergeev receives a standard deduction for the first child.

Next, a sample income certificate in form 2-NDFL for A.A., fully correctly filled out by the accounting department of Alpha LLC. Sergeev , see ConsultantPlus HERE .

The employer is obliged to issue a 2-NDFL certificate to a resigned employee if during the calendar year he was unable to withhold personal income tax from his income. In this case, it must be filled out taking into account a number of features that are disclosed in ConsultantPlus:

Read the complete solution.

Read also

01.09.2020

Low-income families with minor children

Poor citizens with minor children are often in difficult life situations due to a lack of means for subsistence. This circumstance is caused by the fact that after the birth of a child, one of the parents is forced to not work and care for the child. The state tries to maintain a decent standard of living and helps meet the needs of sections of society. The authorities finance targeted assistance, smooth out the inequality of citizens, and take an active part in providing material benefits to those in need.

Attention! In the constituent entities of the Russian Federation, the executive branch sets the subsistence level. For different demographic groups of the population, a different indicator is established, depending on the cost of the minimum set of goods necessary to maintain life (the consumer basket).

The state seeks to help families with children, since their expenses inevitably increase, and incomes may only decrease