The need for accounting and accounting policies

The basic provisions on the rules of accounting are contained in the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (as amended on December 28, 2013, as amended and supplemented). According to this 402-FZ, any economic entity is required to maintain accounting, unless otherwise established by this law.

According to the Federal Law “On the Development of Small and Medium Enterprises in the Russian Federation” and other regulations, an individual entrepreneur can use simplified methods of accounting , including simplified accounting (financial) reporting.

When choosing which simplified methods to use for accounting, an individual entrepreneur must proceed from the requirement of Part 1 of Article 13 of the Federal Law “On Accounting” - accounting statements must provide a reliable representation of the financial position and cash flows.

Accounting policies must provide for rational accounting.

An individual entrepreneur, when forming an accounting policy, may provide for maintaining accounting using a simple system (without using double entry, without a chart of accounts), adopt a simplified system of registers (simplified form) of accounting, or decide to conduct accounting without using accounting registers (according to PBU 1/2008 “Accounting Policy organization”, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n).

A simple form of accounting (without registers) means recording business transactions only in the Book (journal) of recording facts of economic activity. Maintaining this book allows, if necessary, to determine the availability of property and funds from an individual entrepreneur on a certain date and to draw up financial statements, i.e. solve accounting problems.

may not maintain accounting (according to the Federal Law “On Accounting”, Article 6, Part 2).

Thus, individual entrepreneurs using the simplified tax system may not conduct accounting or submit financial statements.

Content

- Does an individual entrepreneur need to keep accounting records?

- Options for maintaining individual entrepreneur records

- Online accounting is the best option for individual entrepreneurs

- Transfer of accounting responsibilities

- Independent accounting for individual entrepreneurs

- Stage 1. Selecting a tax regime

- Stage 2. Hired employees

- Stage 3. Selecting the type of accounting service

- Stage 4. Creating a calendar

- Stage 5. Maintaining and storing documents

- Automation of accounting

- Tips for doing your own bookkeeping

Transition of individual entrepreneurs to a simplified taxation system

The individual entrepreneur makes such a transition on a voluntary basis. However, there are conditions under which you cannot switch to the simplified tax system . According to clause 3 of Article 346.12 of the Tax Code of the Russian Federation, individual entrepreneurs cannot switch to and apply the simplified tax system:

- engaged in the production of excisable goods;

- engaged in the extraction and sale of non-common minerals;

- switched to paying the unified agricultural tax (USAT);

- whose average number of employees exceeds 100 people;

- who failed to notify the tax authority of the transition to the simplified tax system within the prescribed period.

Read more about the application of the simplified tax system in the article - Simplified taxation system, as well as in Chapter 26.2 of the Tax Code of the Russian Federation.

How can an individual entrepreneur switch to the simplified tax system?

In order for an individual entrepreneur to use the simplified tax system, you need to submit a notification to the tax authority in the form “26.2-1” :

notifications about the transition to a simplified taxation system.

If the individual entrepreneur has just been registered (newly), then the notification of the transition to the simplified tax system is submitted no later than 30 calendar days from the date of registration of the individual entrepreneur for tax registration. In this case, it is considered that the individual entrepreneur has switched to the simplified tax system from the date of tax registration (this day often coincides with the day of state registration of the individual entrepreneur).

If the individual entrepreneur is already operating and uses other taxation systems, then a notification of the transition to the simplified tax system from the beginning of the next year must be submitted to the tax authority no later than December 31 of the current year . That is, such an individual entrepreneur will not be able to switch to the simplified tax system before next year.

With one exception.

An individual entrepreneur who has ceased to be a payer of the single imputed tax (UTI) has the right to switch to the simplified tax system from the month in which his obligation to pay UTII ceased. To do this, he must submit a notification about the transition to the simplified tax system no later than 30 days after the termination of his obligation to pay UTII.

An individual entrepreneur who pays UTII for certain types of activities simultaneously apply the simplified tax system, but in relation to other types of activities.

In the notification, the individual entrepreneur must indicate his chosen option for the object of taxation on the simplified tax system - “income” or “income reduced by the amount of expenses.”

An individual entrepreneur who has switched to the simplified tax system does not have the right to switch to a different taxation regime until the end of the year (as well as to change the variant of the object of taxation of the simplified tax system), but has the right to simultaneously apply the patent taxation system and, as noted above, UTII.

If an individual entrepreneur has ceased the type of activity in respect of which he applied the simplified tax system, he is obliged to notify the tax authority of the date of such termination no later than 15 days.

Read more about the transition to the simplified tax system in the article - Notification of the transition to the simplified tax system.

Automation of accounting

You can do your own accounting on paper, making all the entries manually, but it is much more convenient to turn to automated systems.

Technologies do not stand still, and today various services come to the aid of an entrepreneur without an accountant, allowing:

- calculate tax amounts depending on the taxation regime;

- prepare tax returns;

- draw up bank documents, payment orders;

- control payments to employees and payment of bills;

- analyze profits and sales.

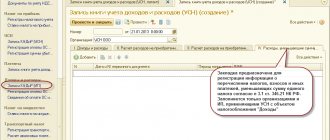

Electronic assistants can be either in the form of computer programs (for example, individual entrepreneur accounting in 1C) or in the form of online accounting.

Programs will cost the entrepreneur more: you will have to pay for the program itself, for its installation, and in the future for regular updates and maintenance by the programmer. It will be accessible only from one computer, but it can work without a permanent Internet connection.

Let’s talk about the possibilities and features of online accounting using the example of the “My Business” service.

When an individual entrepreneur loses the right to use a simplification

If during the reporting (tax) period the income of an individual entrepreneur exceeded 150 million rubles and (or) the individual entrepreneur did not comply with the above conditions for applying the simplified tax system (established in paragraph 3, paragraph 4 of Article 346.12 and paragraph 4 of Article 346.13 of the Tax Code of the Russian Federation), then such an individual entrepreneur is considered to have lost the right to the simplified tax system from the quarter in which the violations were committed.

The individual entrepreneur must report such loss to the tax authority no later than 15 days.

An individual entrepreneur can switch to the simplified tax system again, but not earlier than a year after losing the right to the simplified tax system.

If, at the end of the year, the conditions for applying the simplified tax system were not violated, the individual entrepreneur has the right to apply the simplified tax system next year.

Why is it important to collect and store primary documents?

Only primary documents confirm the completion of the transaction and the fulfillment of obligations. This is the starting point for disputes and evidence in court if it comes to that.

In addition, this is what the tax office expects when conducting a counter audit: for example, when you indicated some numbers in your reporting, and your counterparty indicated others. In this case, the tax office sends a request - you need to answer it, give an explanation and attach scans of documents. This usually takes 5-10 days. If you miss the deadline, the tax office will block the current account.

Therefore, it is advisable to collect acts, invoices and other documents immediately - this is not only common sense, but also a requirement of the law. If your counterparty is far away, then at least agree on electronic copies, because then you may not have time, who knows what. We wrote about how to arrange the exchange of documents by email in this article. But it is best to set up EDI - electronic document management; today it is the fastest and most reliable option. The tax office and courts also accept documents from EDI without problems.

What does switching to the simplified tax system give to individual entrepreneurs?

First of all, the use of the simplified tax system replaces three with one tax. In accordance with paragraph 3 of Art. 346.11 of the Tax Code of the Russian Federation, individual entrepreneurs are exempt from the obligation to pay:

- personal income tax (on income from activities as an individual entrepreneur, but excluding dividends);

- tax on property of individuals (but except for property not used by individual entrepreneurs for business activities, as well as except for property, the tax base for which is determined from the cadastral value);

- value added tax (VAT) (but excluding VAT on import transactions).

What are primary documents?

The fact of transfer of ownership of a product from one company to another or to an individual is confirmed by a special document. Such a document is called “primary” because it confirms that you actually bought/sold a product or provided a service - this is the starting point when calculating taxes.

Many entrepreneurs are accustomed to thinking that they have expenses if they paid from their current account. But for the tax office this is not the case: according to the law, you incur expenses not when you have sent the money, but when you have signed the corresponding act with the supplier.

That’s why the accountant needs primary documents, or “closers,” from the entrepreneur. They are important for both taxes and reporting. Particularly important are those that support expenses. Typically, the more there are, the lower the tax.

Expenses that may reduce income

Under the simplified tax system, not all costs of an individual entrepreneur associated with generating income can be classified as expenses that reduce income. But only those defined by Art. 346.16 of the Tax Code of the Russian Federation. This is a fairly extensive list, but it is better not to interpret it yourself.

You only need to count as expenses what is on this list.

Expenses include:

- for the purchase of raw materials;

- for the acquisition of fixed assets;

- to pay for goods purchased for subsequent sale;

- for remuneration of employees;

- to pay taxes, insurance premiums, fees and other costs.

The most important rule when accounting for expenses on the simplified tax system: expenses are recognized as expenses only after actual payment and in the presence of supporting documents.

What documents does the individual entrepreneur work with?

There are many primary accounting documents. But at first, in order to correctly formalize the purchase and sale of goods, the provision of services or the performance of work, you can get by with only a few of them. In some cases, invoices will also be needed.

- Agreement. Any transaction begins with the conclusion of an agreement. It defines the basic terms of cooperation: what the entrepreneur and the client do, for what price and in what time frame. If the client is a regular one, then you can draw up one agreement for several transactions.

- An invoice for payment. In this document, the entrepreneur indicates the amount to be paid, a list of goods sold or services provided, as well as his bank details.

- Payment documents: cash receipt or sales receipt . These documents confirm payment. Give them to the client who pays in cash or by card. If payment is made via bank transfer, it is confirmed by a payment order.

- Bill of lading is a document that the supplier issues to the buyer when shipping goods.

- An act of provision of services or work performed. This document is signed by the customer and the contractor based on the results of the provision of services or performance of work.

- Invoice. Usually it is made up of organizations and individual entrepreneurs on the general taxation system, because they pay VAT. In rare cases, invoices are issued by entrepreneurs using the simplified tax system, UTII, unified agricultural tax or patent (see “Taxes for an individual entrepreneur or LLC: how to choose a “profitable” taxation system”).

Generate invoices, acts, invoices and maintain accounting in a web service for individual entrepreneurs

Now we’ll tell you about these documents in a little more detail, and also show how you can quickly and without errors fill out primary documents and invoices using the Kontur.Elba web service.

Losses

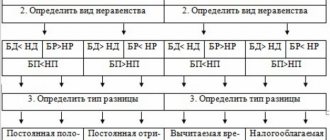

A loss is the excess of expenses over income.

Choosing an individual entrepreneur as an object of taxation under the simplified tax system “income reduced by the amount of expenses” allows you to reduce the tax base of the current year by the amount of losses from previous years. Moreover, losses can be carried forward to the next year for 10 years following the year in which losses were incurred.

Also, the individual entrepreneur has the right to add to the loss or include in the expenses of the following years the difference between the calculated tax and the minimum tax paid.

Book of income and expenses

An individual entrepreneur must take into account his income and expenses and reflect them in a special “ Book of accounting for income and expenses of organizations and individual entrepreneurs using a simplified taxation system .” This is necessary to determine the taxable base and calculate tax.

Order of the Ministry of Finance of the Russian Federation dated October 22, 2012 No. 135n (as amended on December 7, 2016 No. 227n) approved the form of the book and the procedure for filling it out.

organizations and individual entrepreneurs using a simplified taxation system.

Calculation and payment of tax simplified tax system

The tax amount is equal to the product of the taxable base for a certain period and the tax rate.

But before you count, individual entrepreneurs need to check the simplified tax system tax rate with their tax office. The fact is that a specific rate of the simplified tax system is established by a subject of the Federation, which is given the right by federal legislation to reduce the rate (and even set it to zero) for a certain period or for certain categories of tax payers.

“The tax levied on taxpayers who have chosen income as an object of taxation” (as it is called in the table of budget classification codes - KBK) is equal to the product of the tax base (amount of income, revenue) and the tax rate equal to 6%.

The amount of the simplified tax system can be reduced to 50% if you deduct the amount of insurance contributions paid for a specific reporting period for compulsory and voluntary pension, compulsory medical, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory social insurance against accidents for production and occupational diseases, as well as the amount of the trade tax (if applicable).

“The tax levied on taxpayers who have chosen income reduced by the amount of expenses as an object of taxation” is equal to the product of the taxable base (i.e., the difference between the amount of income and the amount of expenses (determined in accordance with Article 346.16 of the Tax Code of the Russian Federation) and the tax rate, equal to 15%.

Next, you need to compare the resulting tax amount with the amount of the so-called minimum tax (it is equal to 1% of revenue).

If the calculated tax amount is less than the minimum, then the minimum tax must be paid. That is, when comparing two amounts, we choose to pay the larger one.

The simplified tax system must be calculated and paid for the tax period (year). But in the middle of the year, three advance payments must be calculated and paid quarterly, which are then taken into account when calculating the tax for the year.

The calculation of advances is the same as the tax in general, but the amounts of income and expenses are taken on an accrual basis for a specific reporting period - first for the first quarter, then for six months, then for 9 months.

Advance payments of the simplified tax system must be paid by the 25th day of the month following the reporting period (quarter, half-year, 9 months):

- for the first quarter of the year (from January to March) – until April 25;

- for six months (from January to June) – until July 25;

- for 9 months (from January to September) – until October 25.

Tax for the year is paid by individual entrepreneurs no later than April 30 of the following year.

The following BCCs must be indicated in payment orders (receipts):

income - 18210501011011000110

income minus expenses - 18210501021011000110

Independent accounting for individual entrepreneurs

According to the Law “On Accounting” No. 402-FZ, accounting for individual entrepreneurs is not mandatory. This brings great relief to entrepreneurs, because it means that they do not need to post all transactions to accounts, create balances and make entries. However, it cannot be said that individual entrepreneurs do not need accounting at all. According to the same law, an entrepreneur can do without accounting if he has organized accounting of income, expenses and other taxable items. Where does the organization of accounting for individual entrepreneurs begin? Even at the business planning stage, some measures should be taken that will subsequently make it possible to organize business activities and record their indicators at the appropriate level. • Select the tax regime in which you will operate. It depends on him how the accounting for the individual entrepreneur will be kept. • Study the rules for organizing the accounting of income, expenses and other performance indicators. It is important to take into account that accounting for individual entrepreneurs on the simplified taxation system, general and other taxation systems has significant differences. • To independently acquire knowledge and skills in this area, you can use specialized services and programs. Keeping accounting records for individual entrepreneurs in 2021 You need to understand that when it comes to a private entrepreneur, you cannot talk about accounting in the classical form. The work of an accountant in this case consists mainly of tax accounting and includes the following tasks. • Determination of income, expenses and other objects of taxation in order to correctly calculate and pay taxes, as well as providing tax authorities with the opportunity to check how accurate the calculations are and whether there are overpayments or underpayments. • Calculation and payment of taxes accrued in accordance with the chosen taxation system. • Preparation and submission of reports on tax payments. • Calculation and payment of taxes, as well as employee contributions, if the individual entrepreneur uses hired labor. • Organizing the storage of documents confirming transactions performed. What exactly the accounting department needs to do for individual entrepreneurs directly depends on the chosen tax regime and whether the entrepreneur has employees. According to the current legislation, in addition to tax accounting, it is also mandatory for individual entrepreneurs to maintain procedures for accounting for employees and prepare reports on them. This is another accounting task. In addition, you should deal with primary documentation, bank and cash documents, and also perform a number of other tasks. Entrepreneurs often confuse different types of accounting and generalize them all, calling them accounting. This is an incorrect interpretation, but it has already come into use and is widespread today. Mentions of accounting in relation to individual entrepreneurs can be heard very often. However, you should understand what is actually hidden behind this formulation, i.e. what the individual entrepreneur does (in the simplified tax system this will be one accounting department, but in the general and other taxation systems it will be completely different). When answering the question of how to keep records of individual entrepreneurs (using the simplified tax system, special tax system and other tax regimes) in 2021, one should first of all mention professionalism. Accounting for an individual entrepreneur using the simplified tax system or any other system can be handled by a hired accountant or an outsource company. With a small number of operations, the costs of paying for the services of permanent specialists may be unjustified. If you are ready to organize your own accounting, we can help with this. To simplify the task of accounting for individual entrepreneurs, we suggest using the step-by-step instructions we have prepared. How an individual entrepreneur can conduct accounting independently, stage 1. Calculate what income your business is expected to receive and what possible expenses it will incur. This information is needed to determine the tax burden. Stage 2. Determine the tax regime that suits you best. You can choose a general taxation system or one of the special ones (patent, simplified tax system, unified agricultural tax or UTII). This choice determines what the tax burden will be. 3rd stage. Study what tax reporting should be under the chosen regime. Current forms can be found on our website. 4th stage. Decide whether you will hire workers or do it yourself. The simplest accounting for individual entrepreneurs is on the simplified tax system without employees. When hiring someone, you should understand that you are acquiring the status of an employer and will have to submit rather complex reports, the composition of which does not depend on the taxation system or the number of employees. In 2021, employers submit reports to the Pension Fund of the Russian Federation, the Social Insurance Fund and the tax inspectorate. In addition, it is necessary to ensure the preparation and secure storage of personnel documentation. 5th stage. Review the tax calendar for your system. If you fail to submit your report on time or pay your taxes on time, this will result in a fine, account blocking and other negative consequences. 6th stage. Determine how accounting services will be carried out. It is easier to organize accounting for individual entrepreneurs using the simplified tax system “Income”, PSN and UTII, since even if there is a hired workforce, these modes are considered simple. An individual entrepreneur can handle such accounting on his own. If you work on the general taxation system, the simplified taxation system “Income minus expenses” or carry out many operations, it is better to use the help of an outsourced accountant. 7th stage. Ensure the execution and storage of all papers related to business activities, in particular incoming correspondence, primary documentation, reporting on the use of cash registers, personnel documentation, bank statements, contracts, documents that record expenses, etc. The Tax Service can check documents of the entrepreneur even for three years after deregistration. Accounting for individual entrepreneurs on OSNO When choosing a general taxation system, organizing accounting will be the most difficult compared to maintaining accounting records for individual entrepreneurs using the simplified tax system and other special tax regimes. It is necessary to submit a 3-NDFL declaration based on the results of activities for the year, as well as quarterly reporting on value added tax. In some cases, a 4-NDFL declaration is also required. The most difficulties arise with VAT. Accounting is especially complicated due to the need to reimburse input taxes and obtain deductions. To make it more convenient to make tax payments and transfer insurance premiums, we recommend opening a bank account. Keeping accounting for an individual entrepreneur using the simplified tax system An individual accountant using the simplified tax system has much less hassle than under the general taxation regime. You only need to submit one annual return. Simplified accounting is carried out differently depending on which taxation option the individual entrepreneur has chosen: “Income”, on which 6% is paid, or “Income minus expenses”, on which 15% is paid. It’s not difficult to figure out how an individual entrepreneur on the simplified tax system “Income” should keep records of his performance indicators. In this case, the expenses do not affect taxation in any way. Let’s move on to consider the issue of how to keep an individual entrepreneur’s accounting using the simplified tax system “Income minus expenses.” The main complication compared to the simplified tax system with the “Income” object is that you need to collect documents that confirm the entrepreneur’s expenses. Among them, for example, there may be cash receipts, account statements, payment orders, etc. The tax base is reduced by their amount, so tax authorities recognize declared expenses only if all supporting documents are correctly completed. The procedure for recognizing expenses under the simplified tax system with the object “Income minus expenses” is almost identical to that provided for under the general taxation regime. In order for certain expenses to be subtracted from the amount of income when determining the amount of tax, they must be justified from an economic point of view and be present in the list contained in Article 346.16 of the Tax Code. All income and expenses are recorded in a special Income and Expense Accounting Book. Moreover, simplifiers who pay 6% take into account only income, while 15% payers must additionally take into account expenses. The tax return form under the simplified tax system for 2021 for individual entrepreneurs is posted here. Deadlines for submitting individual entrepreneur reports in 2021 The accountant’s calendar for an individual entrepreneur contains deadlines for filing declarations and reports. Thus, business entities using hired labor must submit such reports as employers, regardless of the chosen taxation system. • To the Social Insurance Fund (form 4-FSS) – once a quarter. The deadline for submitting reports depends on its form. The paper form must be submitted until January 20/April/July/October, and the electronic form must be submitted no later than the 25th of the same month. • To the Pension Fund of the Russian Federation (SZV-M, SZV-stazh) - monthly until the 15th day of the month following the reporting month and until the first of March of the following year, respectively. • In the Federal Tax Service - quarterly 6-personal income tax until the end of the month following the reporting period, and a quarterly single calculation of contributions until the 30th of the same period. Annual reporting, 2-personal income tax and a report on the average headcount are also submitted, but in 2021 this process has already been completed. The tax deadlines that must be adhered to until the end of 2020 are shown in the table.

| System | For 3-1 quarter |

| UTII | Submission of the declaration – until October 20 Making payments for the quarter – until October 25 |

| General | Submitting a VAT return – until October 25 Making payments in equal installments until October 25, November and December Advance payment for personal income tax – until October 15 |

| simplified tax system | Advance – until October 25 |

When working under the patent regime, declarations are not submitted, and the period for payment of the cost of the patent is determined based on the duration of its validity. Maintaining accounting records for individual entrepreneurs using the “My Business” service Online accounting “My Business” is a convenient program that will become an effective assistant for you in accounting for business results under any taxation system. You will no longer need the services of an in-house or third-party specialist to perform such tasks. You can handle all operations yourself. Calculations are carried out automatically, after which reports are filled out and sent to the relevant departments. The system also acts as a personnel officer, preparing the necessary documents. At the same time, each step you take is accompanied by hints, and the program makes sure that you do not make a mistake. To gain access to the service and personally experience all its benefits, you just need to register.

Tax return simplified tax system

Before April 30, an individual entrepreneur must submit to the tax office at his place of residence (registration of an individual entrepreneur) a tax return on the tax paid in connection with the application of the simplified taxation system for the past tax period (year). This deadline coincides with the deadline for paying the simplified tax system.

There is no point in waiting until the last minute to give up. And it makes more sense to submit your declaration first, and only then pay the tax.

tax return for tax paid in connection with the application of the simplified taxation system.

You can fill out the declaration using numerous software tools or on-line services.

Requirements for the list of documents

At the moment, when initializing the procedure for closing an individual entrepreneur in 2019, the following documents must be submitted to the Federal Tax Service:

- application in the form established by law;

- a receipt with a stamp indicating payment of the state duty.

It must be remembered that if an entrepreneur visits the tax office in person, an identification document is required. In this case, it will be a civil passport.

If the papers are submitted to the inspectorate with the help of an intermediary, it will be necessary to issue a power of attorney certified by a notary to represent the interests of the entrepreneur.

And finally, when sending documents by Russian post by registered mail, a mandatory inventory of all documents is required.

Documents for closing an individual entrepreneur can also be submitted electronically, but in this case, the submitter must have a valid electronic signature key (EDS).

Insurance premiums for individual entrepreneurs

For himself, without employees, the individual entrepreneur must pay contributions to mandatory pension and health insurance.

The annual amount of these payments is fixed and is paid regardless of whether the individual entrepreneur has income or not.

Fixed amount of contributions for compulsory pension insurance:

- with income for 2021 of less than 300 thousand rubles. = 36,238 rub.;

- with income for 2021 of more than 300 thousand rubles. = 36,238 rub. + 1% from amounts over 300 thousand.

Fixed amount of contributions for compulsory health insurance = 6,884 rubles.

1 percent of the amount exceeding 300 thousand rubles must be paid before July 1, 2021, and the remaining contributions must be paid before December 31, 2019.

The amounts of insurance contributions for compulsory pension and compulsory health insurance are calculated and paid separately.

KBC fixed contributions:

OPS – 18210202140061110160

Compulsory medical insurance – 18210202103081013160

If an individual entrepreneur is registered in the current year, his fixed contribution amount is proportional to the number of months starting from the beginning of his activities. For an incomplete month, the amount of contributions is proportional to the number of calendar days of that month.

If an individual entrepreneur ceases his business activities in the current year, the fixed amount of insurance premiums is determined in proportion to the number of calendar months up to the month in which state registration as an individual entrepreneur expired.

For an incomplete month of activity, the fixed amount of insurance premiums is determined in proportion to the number of calendar days of this month up to and including the date of state registration of termination of activity as an individual entrepreneur.

In case of termination of the activities of an individual entrepreneur, payment of insurance premiums is carried out no later than 15 calendar days from the date of deregistration with the tax authority.

For detailed information on individual entrepreneur insurance premiums for yourself, see the article - Individual entrepreneur insurance premiums, for employees - Taxes and contributions for individual entrepreneur employees

What does the accounting documentation of an individual entrepreneur depend on?

The document flow of a business owner is related to the tax regime, economic activity codes, and place of registration. Example. Selling flowers or shawarma in a small store for cash with a hired salesman. According to the new law No. 54 Federal Law, you will have to buy an online cash register or maintain strict reporting forms (SSR). If you sell yourself without hired employees, you don’t have to worry about online checkout until 2021. From July 1, 2021, you will need to print BSO on a special device. For home lessons or makeup services, you do not need to register an individual entrepreneur. Pay taxes as an individual. There is no need to keep books. But if you still want to register as an individual entrepreneur, you can open an account here.