How to count books and magazines:

Many companies subscribe to various newspapers and magazines, buy books and books. Their accounting raises many questions among accountants. The Ministry of Finance recently responded to some of them.

How to reflect payment for publications

There are two ways to pay for printed publications:

– in advance. In this case, the company first transfers money and then receives magazines or newspapers over a certain period of time. As a rule, the subscription is issued for three or six months;

– directly at the publisher or in the store. In this case, you pay money and immediately receive printed products.

Most companies use the first option. Consider the money transferred for magazines as advances issued:

Debit 60 subaccount “Advances issued” Credit 51

– money for subscription has been transferred.

Please note: the tax inspector may consider that prepayment for publications should be taken into account as deferred expenses. In this case, you will have a property tax debt. The fact is that future expenses increase this tax.

In this case, disagree with the inspector. Justify your position like this.

Costs arise when the firm's economic benefits are reduced (for example, you paid a materials supplier). This is what is written in paragraph 16 of PBU 10/99.

But this does not happen when you pay for a subscription. After all, you have not yet received any products. The company simply made an advance payment. Therefore, the transferred money must be taken into account as advances issued.

If you do not want to argue with the tax inspector, then reflect the subscription costs as deferred expenses. You can read how to do this in the “Correspondence of invoices” berator on page VIII/97/03.

Example 1.

CJSC Aktiv subscribed to the Practical Accounting magazine for the first six months of 2003. The company paid 1,200 rubles for this. (including 10% VAT – 109 rubles).

The Aktiva accountant reflected the subscription as follows:

Debit 60 subaccount “Advances issued” Credit 51

– 1200 rub. – money for subscription has been transferred.

As new issues of magazines or newspapers arrive, write off their cost as expenses. The Ministry of Finance explained how to do this in a recently published letter dated August 26, 2002 No. 16-00-12/19.

How to reflect the receipt of publications

Consider printed publications as fixed assets. Record each magazine, takeaway or book you receive separately.

Reflect the receipt of literature as follows:

Debit 60 Credit 60 subaccount “Advances issued”

Debit 68 subaccount “VAT calculations” Credit 19

– submitted for VAT deduction.

Please note: in order to deduct VAT, you must have an invoice. If you do not have this document, call the publisher and ask them to send it.

Reflect the received publications in a special book for recording literature. There is no special form for it. Therefore, enter it in any order. For example, this book might look like this:

Formation of Rules

The first step to competent organization of accounting is creating a list of Rules. They need to record all the features relating to a specific library:

- Institution status.

- Fund structure.

- Technologies used for accounting purposes.

- Deadlines within which documents/books must be registered.

- The procedure for the disposal of books from the fund.

The drawn up instructions are agreed upon with the founder. Rules govern all aspects of accounting. They must contain these provisions:

- Accounting purposes.

- A method for monitoring the reliability of information.

- Deadlines within which received documents must be registered.

- Registers for individual and general accounting.

- Elements included in the initial processing of received papers.

- Labeling methods.

- Features of document storage.

- Reasons for disposal of papers.

It is recommended that the Rules list all provisions that are significant for a particular library. It makes sense to indicate all the nuances. The write-off standard is agreed upon with the founder.

FOR YOUR INFORMATION! Common reasons for disposal, which are specified in the Rules: wear and tear, presence of defects, document contents are out of date, loss, theft, inability to reproduce on new electronic media. The listed reasons must be established by act.

Accountable persons - who are they?

Who are the accountable persons? These are employees of the organization who have the right to take money on account. The list of such people is approved by order of the head. Money can be issued from the organization’s cash desk or transferred from a current account to employees’ personal bank cards.

How exactly to issue money to an account from the cash register or make a transfer to an employee’s card, read the articles:

It must be remembered that the employee must write an application for the issuance of money regardless of the method of issuing the money.

What mandatory details should an application for the issuance of money contain, read the article “We are preparing an application for reporting - a sample for 2015–2016.”

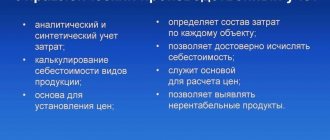

Accounting for fund components that are fixed assets

Paragraph 38 of Instruction No. 157n states that all objects included in the funds are considered fixed assets, regardless of the duration of their use. Expenses for the purchase of objects for the formation of the fund are recorded according to the expense direction code 244 and article 310 “Increase in the cost of fixed assets.”

Accounting for the components of the fund is carried out using account 101 07 (based on clause 53 of Instruction No. 157n). The objects included in the fund have a number of advantages. These are the following features:

- The components of the BF are not numbered as independent inventory items.

- These items are not included in the inventory of non-financial assets.

- Files worth up to 3 thousand rubles are depreciated.

IMPORTANT! For files worth up to 40 thousand rubles, depreciation is charged in the amount of 100% of the cost (according to the balance sheet) when the item is put into use.

Tax accounting

Any literature, including books, if purchased for production purposes, can be taken into account when calculating income tax as part of other expenses (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation).

If the purchased books are of a non-production nature, then when determining the tax base for income tax, the costs of their acquisition are not taken into account (clause 29 of Article 270 of the Tax Code of the Russian Federation).

The same rule applies to the “input” value added tax. In accounting, it is accounted for in account 91.2 and is not accepted for tax purposes, that is, for deduction.

Officials prohibit organizations that use simplification from taking into account expenses for periodicals and printed publications for tax purposes (see letters from the Ministry of Finance dated August 10, 2009 No. 03-11-06/2/151, dated January 17, 2007 No. 03-11-04/2/ 12). But there is another opinion: they can be recognized as material expenses (subparagraph 5, paragraph 1, article 346.16, subparagraph 3, paragraph 1, article 254 of the Tax Code of the Russian Federation). It is supported by some courts (for example, resolutions of the FAS PA dated October 30, 2008 No. A65-1419/2008, FAS DO dated January 30, 2008 No. F03-A80/07-2/6039). Therefore, the organization needs to decide on its own whether to accept expenses for the simplified tax system or not.

Issue money, check the correctness of the report, make entries for the receipt of purchased goods - all this must be remembered when dealing with accountable persons. Well, in a situation with the purchase of books, it is necessary to add to this list a clarification of why they are being bought, so as not to be mistaken in accepting the amounts spent as expenses.

Write-off nuances

Write-offs are carried out only if there are reasons contained in the Rules. For example, these could be the following reasons:

- Books are not popular among library visitors.

- Electronic files do not match the software.

- There are defects in the documents.

- The contents of the documents are out of date.

Write-off is a procedure that is divided into these stages:

- Preparing files to be written off.

- Formation of a commission responsible for exclusion.

- Familiarization of commission members with papers that need to be written off.

- Preparation of files for disposal.

- Conclusion of the write-off act.

- Preparation of papers confirming the loss of files.

- Approval of the act of disposal.

- Sending the act to the accounting department, its registration.

- Recording changes in accounting documentation.

- Carrying out procedures for redistributing files.

- Notification of the founder that the composition of the property has changed.

The write-off commission includes only employees with sufficient qualifications who are authorized to make decisions on changing the composition of files.

Account

An accounting account, based on the classical definition, is an accounting register. Those. a place where information about the state of an asset or a liability is stored. In fact, this is an ordinary table that has only two columns. One column was called “Debit”. The second column was called “Credit”. Accountants schematically depict an account in the form of the letter “T” and call it an airplane.

Moreover, it was initially decided that the debit part (“Debit”) is on the left, and the credit part (“Credit”) is on the right.

Each accounting account has its own attributes. The most important of them are the account code and name. Accountants use their code as the name of the account. For example, “fiftieth” is an account that has the code “50” and the name “Cashier”. “Seventy-first” is an account with code “71” and the name “Settlements with accountable persons”.

When someone starts studying accounting, the question arises: “Is it necessary to know all the accounting accounts by code and name?” I can tell you my point of view - it is necessary. But there is no need to specifically cram accounts. It’s just that in the process of learning about accounting you need to operate with codes and names of accounts, and they will gradually settle down in your head.

Each account has a balance at the beginning and at the end of a certain period. The opening balance is called the opening balance. The ending balance is called the ending balance. The movement in an account during the process of recording an operation is called turnover for the period.

The balance in an account reflected in debit is called a debit balance. The account balance reflected by the loan is called the credit balance.

Now comes the fun part. If the accounting account is intended to reflect the state of assets , then this account is active . If the accounting account is intended to reflect the state liabilities , then this account is passive . That is, active accounts reflect the status of only the assets of the enterprise. Passive accounts reflect only the state of the company's liabilities. This is very important for understanding the essence of accounting. There are situations when it becomes necessary to simultaneously reflect the status of both the assets and liabilities of the enterprise on the same accounts. For this purpose, accounting accounts that have an active-passive attribute are used.

If the account reflects assets in physical, quantitative terms, then such accounts have the “Quantitative” attribute. If the account reflects currency transactions, then such an account has the “Currency” attribute.

Active accounts always have a debit balance. This is an axiom; by definition, it (the balance) cannot be a credit balance. It is impossible to withdraw more money from the cash register of an enterprise than is in the cash register. From the point of view of the 1C company, this balance is briefly designated SD , a debit balance. The opening debit balance is designated SND . The ending debit balance is designated SKD . Debit turnover is designated DO .

On passive accounts, the balance is always in credit. This is also an axiom. An employee of an enterprise will never be paid more wages than he was accrued. The opening credit balance is denoted by SNK . The ending credit balance is designated CCM . Credit turnover is denoted by KO .

The ending account balance can be easily calculated using the opening balance and turnover.

The final balance of the active account is calculated using the formula:

SKD = SND + DO - KO

The final balance of the passive account is calculated using the formula:

SKK = SNK + KO - DO

All accounts are compiled into a separate document called the “Chart of Accounts”. This document was approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N94n. The same order approved the “Instructions for using the chart of accounts.” What is interesting about this instruction? And the fact that there is a description of the purpose of each account from the chart of accounts. The first paragraph of the description of each account tells exactly what this or that account is intended for. Now it's time to talk about types of accounting.