Last modified: January 2021

According to the tax code, the tax must go to the budget on the day of payment (the next) of wages at the enterprise, regardless of whether the earned funds are issued through the cash register or transferred to the employee’s bank card. The question arises: how to pay personal income tax upon dismissal, since it is necessary to pay the employee on the date of dismissal, until what date is personal income tax paid?

An employer is a tax agent for its employees. He calculates the tax amount for them, withholds it, and transfers it to the budget on time.

When should taxes be paid?

The deadline for paying income tax for a dismissed employee is specified in Article 226 of the Tax Code of the Russian Federation. The employer, being a tax agent, or, as they also say, a source of payments, must:

- Withhold tax on the day of payday or payment of other income, such as benefits.

- Transfer the withheld tax either on payday or the next day, but not later than this period. If we are talking about benefits and vacation pay, the employer pays until the end of the current month. A payment order for personal income tax upon dismissal in 2021 is drawn up and submitted to the bank no later than the final payment to the employee.

Tax legislation provides only general deadlines within which taxes are paid to the budget.

Therefore, it does not matter whether the employee received the money on the card or in person, the rules for withholding and payment are the same. Deadlines for payment of personal income tax on payments to employees

| Type of payment | Tax payment deadline |

| Advance and salary | The next day after the day of payment of wages for the second half of the month |

| Prize | The day following the date of payment to the employee |

| Final settlement | The next day after the last day of work |

| Sick leave and vacation pay | Last day of the month |

It must be remembered that if an employee is employed both at the head office and in one of the divisions, and then quits completely, then a personal income tax payment with compensation for unused vacation upon dismissal and other payments must be issued separately from both workplaces. Also, one employee must report to the Federal Tax Service twice.

Personal income tax on severance pay

Severance pay upon dismissal does not apply to mandatory payments. According to Art. 178 of the Labor Code, it is paid when the number or staff is reduced, as well as when the company is liquidated. It can also be paid by agreement with the dismissed employee, or its payment can be negotiated under the terms of a collective agreement.

The Labor Code provides for minimum limits for severance pay (if its payment is required by law). Thus, the employee is paid an average monthly salary on the day of dismissal, and another one - for the period of his employment (if he cannot find a job in the second month after dismissal). Severance pay for the third month is paid by decision of the employment service if the dismissed employee managed to register within two weeks after dismissal, and if the applying employee was not employed within 3 months.

Article 217 of the Tax Code and clarifications of the Ministry of Finance indicate that severance pay is paid only if it exceeds 3 average monthly earnings or 6 earnings for workers in the Far North. Within the specified limit, personal income tax is not charged.

Let's give an example of calculating personal income tax on paid severance pay. Engineer Potapov received severance pay in the amount of 105 thousand rubles upon dismissal. His average monthly salary was 25 thousand rubles. Accordingly, the non-taxable amount of severance pay amounted to 75 thousand rubles. From 30 thousand rubles (105000-75000) the employer must withhold and transfer personal income tax in the amount of 3900 rubles. The engineer will teach you 101,100 rubles. (105000-3900).

Which final settlement payments are subject to personal income tax?

On the last day of work, the resigning employee must be paid:

- salary on the last day of work;

- compensation for unused vacation;

- severance pay (in case of staff reduction).

Salaries and compensation for unused vacation are subject to income tax in full, and severance pay is only subject to the amount exceeding the average earnings for three months. Payment of personal income tax on salary and compensation for unused vacation upon dismissal is processed and sent to the bank no later than the next working day.

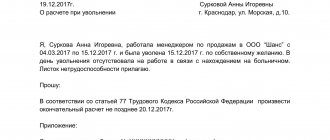

Dismissal: how is it formalized?

It is possible to terminate an employment relationship with an employee only if there are documents confirming the basis for the dismissal procedure:

- Employee application (dismissal by own decision).

- An agreement between the employee and the employer if the dismissal occurs by mutual consent.

- Notification of termination of employment if the term for concluding a fixed-term contract has expired.

Further, the employer is obliged:

- Issue an order for the dismissal of an employee, it must indicate the date and reason.

- To accompany the order, issue a settlement note indicating the number of days of unused vacation and all payments due upon final settlement.

- Make the necessary entries in the work book of the resigning employee.

- Issue a work book.

- Pay off the resigning employee.

- Issue certificates 2NDFL, 182n, SZVM-STAZH.

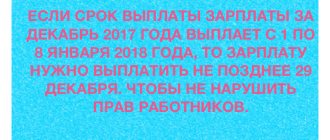

How to issue a personal income tax payment order if the next day is a non-working day

The deadline for paying income tax for a dismissed employee is postponed if the date of transfer of personal income tax upon dismissal in 2021 coincides with a weekend or holiday. For example, an employee’s last working day is April 30. A full settlement has been made with him, and the calculated amount is withheld from payments. But it will not be possible to pay it, because the next day is May 1, the official holiday of all workers. May 2–5, according to the production calendar, are non-working days in 2020. As a result, the payment for personal income tax upon dismissal is dated Wednesday, May 6, the first working day after weekends and holidays.

Income code for compensation for unused vacation upon dismissal in 2021

If in a situation where the vacation period falls within the framework of one month, everything is clear, then what to do with “rolling” vacations, the end date of which does not fall in the month when they were paid? The answer to this question has been repeatedly given by both tax authorities and the Ministry of Finance, including in the letters that we mentioned earlier: regardless of the start and end dates of the vacation, the period for receiving income will be the month in which the vacation pay was actually paid. Read about reducing the tax base for individuals in the article “Main types of tax deductions for personal income tax in 2017.” Results In the 2-NDFL certificate, payments to vacationers must be separated from wages and accounted for under a separate income code. This will allow you to comply with the requirements of tax legislation regarding the procedure for tax accounting and filling out reports.

How to fill out a payment form

Traditionally, several questions arise about what to write in a payment order when dismissing an employee: what payer status to indicate (field 101), what BCC to enter (field 104), how to reflect the period for which the tax is paid (field 107). We answer:

- In field 101 tax agent organization enters code 02; employer - individual entrepreneur - 09.

- In field 104, the tax agent organization writes 182 1 01 02020 01 1000 110; employer - individual entrepreneur - 182 1 0100 110.

- Field 107 is filled in the format MS.XX (month).2020. Please note that there is no need to enter a number, and the month data must coincide with the period when the income was actually received.

- The field “Purpose of personal income tax payment upon dismissal” contains the name of the tax and the period for which it is paid.

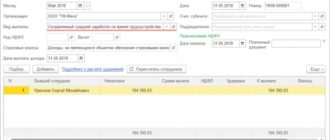

Sample payment form for personal income tax upon dismissal in 2020

The easiest way to correctly indicate all the data is to use the special free service of the Federal Tax Service “Filling out a payment document for the transfer of taxes, fees and other payments to the budget system of the Russian Federation.” It allows you to automatically enter all BCCs and payer status. The only thing where you cannot make a mistake in the personal income tax payment from salary and compensation for unused vacation upon dismissal is in the TIN, KPP and the name of the payer.

Personal income tax 2021: payment deadlines for individual entrepreneurs

Individual entrepreneurs and persons engaged in private practice in accordance with established legislation transfer personal income tax to the budget in advance payments according to the following scheme:

- until July 15, 2017 - for the reporting period January - June;

- until October 15, 2017 - for July-September;

- until January 15, 2018 - for October - December.

The procedure for paying income tax for individual entrepreneurs and persons engaged in private practice is specified in Art. 227 clause 9 of the Tax Code of the Russian Federation.

Vacation income code in personal income tax certificate 2

- All income codes that are used in the process of creating personal income tax certificate 2 are listed in Appendix No. 3, order of the National Assembly of Russia dated November 17, 2010 No. MMV-7-3/611;

- There is a specialized code that reflects data on a person’s vacation - 2012;

- Vacation funds are subject to mandatory tax deduction in the amount of 13%.

Thus, it becomes clear that when filling out the document, you will need to indicate code 2012 if the person was on vacation at some point.

A very serious point is compensation for vacation that was not used. It should be immediately noted that data on the type of income should definitely be reflected in the personal income tax certificate format 2. We need to talk about the design of this element in more detail.

Compensation for unused vacation income code

Income code 2014 - severance pay. Income code 2611 is a forgiven debt written off the balance sheet. Income code 3021 - interest on bonds of Russian companies. Income code 1010 - transfer of dividends. Income code 4800 is a “universal” code for other employee income that is not assigned special codes.

For example, daily allowance in excess of the tax-free limit or sick leave supplement. See the full list of income and deductions for reference 2-NDFL Income codes that are subject to personal income tax when the limit is exceeded Income code 2720 - cash gifts to an employee. If the amount exceeds 4,000 rubles, then tax is charged on the excess. In the certificate, the amount of the gift is shown with income code 2720 and at the same time with deduction code 503. Income code 2760 - financial assistance to an employee or former employee who has retired. If the amount of assistance exceeds 4,000 rubles, then a tax is levied on the excess.

Compensation for unused vacation personal income tax code 2019

Income from transactions with derivative financial instruments that are traded on an organized market and the underlying asset of which is securities, stock indices or other derivative financial instruments, the underlying asset of which is securities or stock indices

In addition to the benefits of hiring employees, the company has a number of responsibilities. The employer must calculate and transfer mandatory contributions to Russian state funds. Responsibilities also include the need to perform the functions of a tax agent for income tax.

Personal income tax for company employees

Remuneration is usually divided into white and black. A white salary implies registration of an employee under an employment contract and deduction of contributions to the pension fund. This payment is usually smaller, but it guarantees a calm future in retirement.

Black wages manifest themselves in the transfer of funds to an employee without proper registration under the labor code. This approach makes it possible to receive large sums, but is associated with many problems.

The majority of employers and employees prefer to work under an employment contract. It's safe, stable and legal.

Salaries are taxed. For Russian citizens it will be 13%, and for foreigners 30%. Income tax is paid not by the employee, but by the employer, with the actual payer being the employee. Regular preparation of declarations and transfer of funds to the treasury falls on the shoulders of the organization’s accounting department.

Salaries are paid once or twice a month on a certain day. A little more time is allocated for the transfer of personal income tax. The deadline is the end of the day following payday.

Tax-free income

When calculating the tax to be paid, statutory tax deductions must be taken into account. This includes income on which tax is not levied. Such deductions include, for example, a deduction from child benefits paid monthly. If it is transferred through the accounting department of the enterprise, then before calculating the entire monthly income of the employee, the accounting department must exclude the amount of the benefit from it, and then determine the amount of tax based on the remaining amount.

The right to receive a tax deduction is also available to disabled people from the Second World War, who receive benefits in the amount of 3 thousand rubles monthly, as well as Heroes of the Russian Federation, to whom the amount of 500 rubles is transferred.

Article 217 of the Tax Code of the Russian Federation establishes a list of income that is not subject to tax deduction. The main items on this list include:

- state benefits and other social payments for financial support of citizens, in particular in case of job loss, unemployment, paid on sufficient legal grounds;

- pension accruals paid in accordance with the procedure established by the state;

- compensation of various types transferred from the compulsory health insurance budget;

- established amounts of alimony payments;

- various grants and awards paid by both Russian and foreign public organizations;

- financial assistance from the employer in connection with the death or death of close relatives of the employee.

This is only part of the list specified in the article, which may concern citizens directly working at the enterprise who pay taxes. Therefore, when calculating their tax, payments received into their account while working at the enterprise must be taken into account. In general, tax calculation is carried out according to the standard scheme in the order defined above.

Compensation for unused vacation in 2021

This position is reflected in the Certificate of Income of Individuals. Calculation of compensation The Tax Code of the Russian Federation does not specify what the grounds for dismissal should be in order to exempt compensation payments from tax.

The Ministry of Finance of the Russian Federation draws attention to the fact that it does not matter for what reasons the employee was dismissed. Most often, termination of a contract occurs by agreement of the parties

Personal income tax on vacation pay - when to pay in 2021 The employer’s consent is not required for an employee to go on vacation

It is important to notify the employer six months before making a decision

First of all, this applies to women who plan to go on maternity leave, minors, citizens who have adopted a child or children under the age of three. According to Article 122 of the Labor Code of the Russian Federation, only a statement from the employee is sufficient.