Terms and concepts

Financial investments - These are assets (investments in assets) owned by an organization that are not directly located in the enterprise, but are capable of generating income, at the same time there is a risk of losing these assets partially or completely.

Accounting for financial investments is regulated by PBU 19/02 ACCOUNTING FOR FINANCIAL INVESTMENTS.” This PBU covers the following points:

- Conditions for accepting assets as financial investments.

- What assets are not recognized as financial investments.

- Evaluation of financial investments.

- The procedure for disposal of financial investments.

- Income and Expenses on financial investments.

- Depreciation of financial investments.

- Disclosure of information in reporting on financial investments.

- Examples of calculating the value of retired financial investments are given.

To accept assets as financial investments, the following conditions must be met:

- Documenting.

- Financial risks.

- The asset must have the ability to generate income.

Financial investments do not include:

- Treasury shares purchased from shareholders for resale or cancellation.

- Bills issued by the organization of the drawer to the seller, bills issued are reflected in account 60 sub-account “Bills issued”, and bills received in account 62 sub-account “Bills received”

- Fixed assets intended for rent.

- Precious metals, etc.

Financial investments include:

- Securities.

- Contributions to the authorized capital of other organizations.

- Deposits.

- Deposits under a simple partnership agreement.

- Loans issued.

- Purchased accounts receivable.

One type of security is a Share. And there are many more securities.

Promotions, in turn, are:

1a) Ordinary.

1b) Privileged (give the right to receive a fixed dividend)

2a) Registered (contains the name of the holder and is in the register).

2b) To bearer.

3a) At par price.

3b) At market value. (No comments).

Also, one type of securities is a Bond (Read on the internet our lesson on accounting and not the securities market :))

There are 2 types of financial investments:

-Short-term.

-Long-term.

Criteria for recognizing assets as financial investments

Not all objects are recognized as financial investments. The regulatory conditions for classifying assets as financial investments are listed in clause 2 of the Regulations. Several criteria must be met at the same time:

- The company has properly completed documentation for ownership rights to the object and benefits (money or assets) from its use.

- Transfer to the company of all risks arising from the ownership of investments - this is, for example, the risk of low liquidity, insolvency of the company, price fluctuations, etc.

- The actual ability to provide a company with various benefits in the form of interest, cash dividends, price appreciation and other revenues in future periods.

Evaluation of financial investments.

Financial investments in accounting at original cost. (Approximately like OS).

The initial cost refers to all the costs of acquiring financial investments. These are costs such as:

- The purchase price from the seller of financial investments. Let's say the stock price.

- Consulting services for the acquisition of financial investments.

- Remuneration for intermediaries.

If the costs (except for the price paid to the seller of the Finnish investment) are not significant, then these costs can be written off as other expenses account 91.

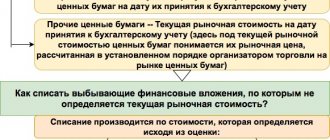

Financial investments by price and by the method of current assessment are divided into:

- By which the market price is determined. (Reflected in financial statements taking into account adjustments to the market price) (In tax accounting, income in the form of an increase in the price of a share is not taken into account in the base)

- For which the market price is not determined. (Reflected in reporting at historical cost).

There is one more nuance for debt securities for which the market value is not determined; it is possible to adjust the initial value to the nominal value, income and expenses from this operation are attributed to other income and expenses (to account 91 Debit or Credit, another account in the posting 58).

When disposing of financial investments (for which the market price is not determined), various methods are used to assess the cost of the disposed financial investment (Asset). Since there may be 2 shares at different prices, one thing has been disposed of - you need to determine at what price to write off.

There are the following methods:

- At the original cost of each unit.

- Based on average initial cost.

- According to FIFO.

(these methods are identical to the prices for the supply of materials, read the article material accounting account 10)

Types of securities

According to Art. 142 of the Civil Code of the Russian Federation, a security is a document certifying property rights, the exercise or transfer of which is possible only upon presentation.

The circulation of securities means their purchase and sale and other actions leading to a change in the owner of the securities.

Any enterprise, joint-stock companies (JSC) and credit institutions have the right to issue securities.

Securities include shares of joint stock companies, bonds, certificates of deposit, bills, etc. The issue and circulation of securities are regulated by the legislation of the Russian Federation.

A share is a security confirming the contribution of funds by its owner to the authorized capital of a joint-stock company, giving the right to receive income from its activities, distribution of the remaining property upon liquidation of the company and to participate in the management of this company.

The promotion has no validity period and exists as long as the JSC operates. Shares can be registered or bearer; ordinary and privileged.

Registered shares contain the name of the owner and are recorded in the share registration book, indicating in it information about each registered share, the time of acquisition and the number of shares of individual shareholders.

For bearer shares, only their total number is recorded in the book; they do not contain the name of the owner.

Ordinary shares give the right to participate in the management of the joint-stock company and to receive dividends in the amount determined by the meeting of shareholders at the end of the reporting period.

Preferred shares provide the owner with a preferential right to receive dividends in the form of a firm fixed percentage, but do not give him the right to vote in the joint-stock company.

A bond is a security that confirms an obligation to compensate its holder for its nominal value with payment of a fixed interest.

The holder of the bond is a creditor of the joint-stock company or enterprise that issued the bonds.

Bonds can be issued registered or bearer, interest-bearing or interest-free, freely circulating or with a limited circulation.

The joint-stock company issues bonds only after full payment of all issued shares in the amount of no more than 25% of the authorized capital.

Interest on bonds is paid either periodically during the period for which they are issued or in a lump sum upon the maturity of the bond.

A bill of exchange is a security that certifies the unconditional obligation of the drawer to pay, upon maturity, a certain amount to the holder of the bill (the owner of the bill).

A bill of exchange is not only a convenient form of payment, but also a type of commercial loan, since payment of a bill does not occur immediately, but after a certain time, during which the amount of the bill is at the disposal of the drawer.

A bill of exchange is a unilateral monetary debt obligation in which only the drawer undertakes to pay the amount specified in it

Securities are a means of financing, lending, redistributing financial resources, and investing cash savings.

According to the nature of the object issuing securities, they are:

- government;

- non-state;

- securities of foreign issuers.

Depending on the nature of the operations and transactions hidden behind the issue of securities, as well as the purposes of their issue, they are divided into:

- stock, or monetary. These include stocks and bonds and securities derived from them that are traded on stock exchanges;

- commercial (capital), servicing the process of trade turnover and certain property transactions (bills, checks, mortgages, etc.).

Capital securities are issued for the purpose of forming or increasing the capital of an enterprise necessary for the development of production.

Depreciation of financial investments.

Depreciation of financial investments is a steady decrease in the expected benefit from the Finn. investments for which the market value is not determined.

Here is how it is written in PBU 19/02:

A sustained significant decrease in the value of financial investments for which their current market value is not determined, below the amount of economic benefits that the organization expects to receive from these financial investments under normal conditions of its activities, is recognized as impairment of financial investments. In this case, based on the organization’s calculations, the estimated value of financial investments is determined, equal to the difference between their value at which they are reflected in accounting (accounting value) and the amount of such reduction

For Impairment of Financial Investments, the following conditions must be met simultaneously:

- At the reporting date and at the previous reporting date, the accounting value is significantly higher than their estimated value.

- During the reporting year, the estimated value of financial investments changed significantly only in the direction of its decrease;

- At the reporting date, there is no evidence that the estimated value of these assets will increase significantly in the future.

If an audit comes to the conclusion that the Finnish investments have become worthless, the organization creates a reserve for the depreciation of financial investments as the difference between the book value and the estimated value of such financial investments.

Financial investments are shown in the balance sheet net of provisions for impairment of financial assets. investments.

Depreciation of financial investments, I think, occurs in such cases when the issuer of securities (these securities are owned by the organization) has a borrower who goes bankrupt.

Accounting for issued loans, deposits and purchased receivables

In accounting for financial investments , loans, deposits and purchased receivables will be displayed by the amounts actually invested in them in the following entries:

- Dt 58 Kt 50 (51, 52) – issuance of a loan.

- Dt 58 (55) Kt 50 (51, 52) – deposit. The use of account 58 or 55 to account for such a deposit must be specified in the accounting policy.

- Dt 58 Kt 76 – acquisition of debt.

Distinctive features of accounting for financial investments in the form of loans and deposits are:

- Regular accrual of interest income on them, expressed by the entry: Dt 76 Kt 91.

- Separate accounting (on financial results accounts) of expenses associated with their maintenance: Dt 91 Kt 51 (76).

If there is a threat of bankruptcy of the interest payer, then you can create a reserve to reduce the amount of the loan or deposit: Dt 91 Kt 59.

Thus, the amounts of financial investments available in accounting for deposits and loans throughout the entire period of their existence correspond to the actual amounts issued. They are closed at the time of return: Dt 50 (51, 52) Kt 58.

The financial result of investing in the purchase of receivables becomes clear after receiving it from the debtor (offset of debts is possible) or further sale: Dt 76 Kt 91 and Dt 91 Kt 58.

Accounting of financial investments.

Financial investments in accounting are accounted for in account 58 “Financial investments”. The financial investment account is Active. That is, an increase in assets by debit is reflected by a decrease in credit. In accordance with the instructions for using the chart of accounts, sub-accounts can be opened for account 58:

-58/1 “Units and shares”;

-58/2 “Debt securities”;

-58/3 “Loans provided”;

-58/4 “Deposits under a simple partnership agreement”

Consider the following examples:

- Accounting for deposits.

- Accounting for the purchase of shares.

- Accounting for adjustments to financial investments (shares for which the market price is determined).

- Accounting for adjustments to bonds (for which the market price is not determined).

- Accounting for contributions to the authorized capital.

- Creation of a reserve for depreciation of securities.

1) Accounting for deposits.

Let's look at the transactions for accounting for deposits:

- Debit 55/3 (58/Deposit) Credit 51 - 50,000 rubles. - A deposit has been opened in the bank.

- Debit 76 Credit 91/Income - 15,000 rubles - Interest accrued on the deposit.

- Debit 51 Credit 58/Deposit - Funds from the deposit were returned.

- Debit 51 Credit 76-15,000 rubles - Interest received on the current account.

Comments: Deposits can be taken into account in both account 55 and account 58.

2) Accounting for the purchase of shares.

Let's look at the entries for accounting for the purchase of shares:

- Debit 58/Shares Credit 76/Seller-10,000 rubles.- Shares purchased.

- Debit 58/Shares Credit 76/Intermediary 1-5000 rubles - Intermediary services are reflected.

- Debit 58/Shares Credit 76/Intermediary2-1500 rubles -Reflects the services of intermediary 2.

- Debit 76/(Seller, intermediary1,2) Credit 51-16500 rubles (10,000+5000+1500) - Paid through a bank account to the seller and intermediaries.

Comments: 16,500 rubles (10,000+5000+1500) will be called the initial cost.

3) Accounting for adjustments to financial investments (shares for which the market price is determined).

Problem conditions:

01/01/2018 DaxNet CJSC bought 10 shares for 3,000 rubles.

These shares are traded on the securities market.

As of May 1, 2019, the price of shares was 3,200 rubles per share.

Let's make the wiring:

- Debit 76 Credit 51-30,000 rubles (10*3000) - Paid for shares.

- Debit 58 Credit 76-30,000 rubles. - Shares accepted as financial investments.

- Debit 58 Credit 91-2,000 rubles. ((3200-3000)*10) - Share price adjusted.

4) Accounting for adjustments to bonds (for which the market price is not determined).

Conditions of the problem:

01/01/2019 JSC "Tredax" bought 100 bonds at a price of 10,000 rubles.

Nominal value 12,000 rubles.

Quarterly income 5%.

CJSC "Tredax" will adjust the initial cost to the nominal value for 4 quarters.

Solution to the problem (wiring):

- Debit 76 Credit 51- 1,000,000 rubles. (100*10000) - Bonds purchased, paid.

- Debit 58 Credit 76-1,000,000 rubles - Bonds accepted as Finnish. investments.

- Debit 76 Credit 91-60,000 rubles. (12000*100*0.05) - Interest accrued on the bond.

- * Debit 58 Credit 91-50,000 rubles. ((12000-10000)*100)/4 - 1/4 of the difference between the initial and par value of the bonds is taken into account

*-Such posting will be carried out 3 times at the end of the quarter.

5) Accounting for contributions to the authorized capital.

Making a contribution to the authorized capital of the transaction:

- Debit 76 Credit 51-100,000 rubles - Money transferred as a contribution to the authorized capital.

- Debit 58 Credit 76-100,000 rubles. - The deposit is reflected as financial. investments.

If a company invests property in its authorized capital, then the postings will be slightly different (since there is an agreed upon value of the property valuation contribution and the actual price recorded in the property accounting account)

- Debit 76 Credit 43.10 - 10,000 rubles. - The book value of the property was written off as a contribution to the authorized capital of another organization.

- Debit 76 Credit 01/09-25,000 rubles. -The residual value of the fixed asset transferred as a contribution to the authorized capital has been written off.

- Debit 58 Credit 76-40,000 rubles. (10,000+25,000+Difference) - The contribution to the authorized capital is reflected as part of financial investments, at an agreed price with the founders, in the constituent agreement.

- Debit 76 Credit 91/Income - 5000 rubles (40000-25000-10000) - The difference in price between the contract price and the book value of the assets that were contributed to the authorized capital is reflected. In this case, as income, since the valuation of the contribution is greater than the actual value of the contributed assets.

- Debit 91/Expense Credit 76-?, If the value (balance sheet) had been added. agreed value of the deposit. There would be other expenses.

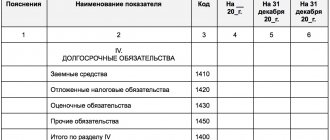

Reflection in the balance

As part of the financial statements of the organization:

Short-term financial investments are reflected in the second section of the asset of the Balance Sheet “Current assets” according to the total line “Financial investments” (code 1240 ), divided into:

- shares (12401);

- debt securities (12402);

- loans provided (including interest on them) (12403);

- contributions under simple partnership agreements (12404);

- acquired rights as part of the provision of financial services (12405);

- deposits (12406);

- deposits in foreign currency (12407).

This indicates the amounts of investments whose maturity (circulation) occurs no later than one year after the reporting date.

Other financial investments are considered long-term and are indicated in the first section of the active part of the Balance Sheet “Non-current assets” on the line “Financial investments” (code 1170 ).

The accounting policy of the organization provides for the timing and procedure for transferring long-term assets to short-term ones.

The balance sheet line “Financial investments” contains the debit balance of account 58 formed at the end of the reporting period, minus the credit balance of account 59 “Provisions for impairment”.

What is VAT: for dummies and not only.

How to calculate income tax is described here.

Formulas for capital productivity, capital-labor ratio, and capital intensity are discussed at: https://helpacc.ru/ekonomika/analiz-hoz-deayt/formula-fondootdachi.html.

Accounting for the costs of purchasing bonds

Bonds are classified as debt securities and are accounted for in account 58, subaccount 2 “Debt securities”. An organization's costs for purchasing bonds and other similar securities often do not equal their face value. In these cases, there is a difference between actual costs (sales value) and nominal value. This difference must be amortized so that by the time the bond matures, the actual value equals the face value.

According to the Regulations on Accounting and Reporting, the difference between the amount of actual costs for the acquisition of bonds and their nominal value during their circulation period is applied evenly (monthly) to other income (expenses).

If the actual value of the bonds is greater than their nominal value, then the difference is charged to expenses by posting: D-t 91 K-t 58/2, and if the acquisition cost is less than their nominal value, then it is charged to the organization’s income: D-t 58/2 K-t 91. Thus, by the time of maturity, the actual value of the bonds reaches the nominal value.

Example.

CJSC Luch purchased bonds for 40,000 rubles, their nominal value was 34,000 rubles. The maturity of the bond is 2 years. The annual percentage of income is 30%.

In accounting, these transactions will be reflected in the following entries:

1) when registering D-t 58/2 K-t 76 - 40,000 rubles;

2) payment of bonds D-t 76 K-t 51 - 40,000 rubles;

3) the difference between the actual and nominal value will be: 40,000 - 34,000 = 6,000 rubles.

This difference must be repaid in 2 years. The amount of monthly depreciation will be: 6,000 rubles. : 2 : 12 = 250 rub. A monthly entry is made for the amount of depreciation: D-t 91 K-t 58/2 - 250 rubles;

4) for the amount of accrued annual income: D-t 76 K-t 91—RUB 10,200. (34,000 x 30%);

5) Receipt of income to the current account: D-t 51 K-t 76 - 10,200 rubles.

Valuation of securities

The following types of valuation of securities are distinguished: Nominal value - the amount indicated on the form of the security (CB). The total value of all shares at par value reflects the amount of the organization's authorized capital.

Exchange (market) value is the price determined as the result of the quotation of securities on the secondary market, i.e., reflects the real value based on supply and demand in a certain time interval.

Issue price is the selling price of a security during its initial placement. It may not coincide with the nominal value. The difference between the sale price and the nominal value constitutes the organization's share premium.

The book value of shares is determined according to the balance sheet by dividing the own sources of property by the number of issued shares, i.e., the value at which the securities are reflected in the balance sheet.

Book value is the cost at which securities are reflected in the accounting accounts.

Liquidation value is the value of the property being sold by a liquidated organization in actual prices paid per share or bond.

In accordance with the Regulations on Accounting and Reporting, financial investments are taken into account in the amount of actual costs for investors.