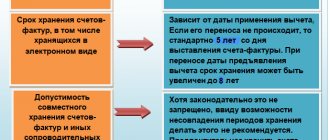

Intermediary activities are formalized by an agency agreement and must be accompanied by competent documentation - in accounting, such transactions are reflected in accordance with the established provisions of the accounting policy (PBU 1/2008), and the criteria for maintaining books of sales and purchases and issuing invoices (SF) must comply with the Rules , approved by Government Decree No. 1137 of December 26, 2011 (as amended on January 19, 2019).

Both parties to the agency agreement have to issue invoices to each other. Let's figure out in what situations and which of the parties to the transaction needs to do this. The publication does not consider the issuance of a SF by an intermediary for an agent's remuneration (including payment in advance from the principal's amounts), since this document is drawn up in the usual manner, meaning the presentation of the amount of remuneration for the work performed, indicating VAT and serving as the basis for claiming tax for deduction.

Purchasing goods for the principal: algorithm for re-issuing an invoice

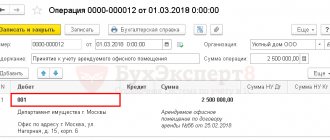

When purchasing goods for the principal, the chain of interaction for issuing an invoice differs from that described above:

- the supplier issues an invoice in your name (as an agent) and registers it in its sales book;

- you enter it in part 2 of your invoice journal;

- then, on your behalf, issue an invoice with similar indicators to the principal (indicate the actual supplier as the seller) and record it in Part 1 of the accounting journal;

- The principal records the invoice received from you in his purchase ledger.

Familiarize yourself with the position of the Ministry of Finance on the nuances of issuing agency invoices.

If an agent purchased goods for several principals and the invoice contains data for the entire purchase, when re-issuing an invoice to each principal, the agent must transfer information only on those goods (services or works) that were intended specifically for this principal (letter of the Federal Tax Service dated April 18 .2014 No. GD-4-7/ [email protected] ).

Read about deducting VAT from the principal when purchasing goods through a chain of intermediaries here.

Legislative justification

Re-issuance of the SF is a procedure that is regulated by these regulations:

- Article 169 of the Tax Code of the Russian Federation . It states that invoices can be issued by agents selling goods/services on their own behalf.

- Articles 171, 172, 169 of the Tax Code of the Russian Federation . These articles indicate the conditions for deducting VAT. In particular, these are the following circumstances: acceptance of products for registration, use in work subject to VAT or use for resale, receipt of an invoice from the supplier.

- Article 1011 of the Civil Code of the Russian Federation . The SF is first filled out for the agent.

When filling out, you must take into account the provisions of Government Decree No. 1137 of December 26, 2011.

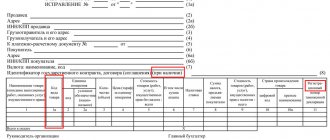

How can an intermediary, forwarder, or developer issue an invoice?

The procedure for filling out an invoice by intermediaries (developers, forwarders) from 01/01/2019 is shown in the table:

| Line number (columns) of the invoice | Content |

| Line 1 |

The serial numbers of such invoices are indicated by each taxpayer in accordance with their individual chronology of invoicing |

| Line 1a | The serial number of the correction made to the invoice and the date of this correction. When drawing up an invoice, before making corrections to it, a dash is placed in this line |

| Line 2 |

|

| Line 2a |

|

| Line 2b |

|

| Line 3 | The intermediary indicates the full or abbreviated name of the shipper in accordance with the constituent documents. If the seller and shipper:

When drawing up an invoice for work performed (services provided), property rights, the seller puts a dash in this line. When drawing up an invoice by a commission agent (agent) purchasing goods and materials from two or more sellers on his own behalf, the full or abbreviated names of the shippers and their postal addresses are indicated (through the sign “;” (semicolon)) |

| Line 4 | The intermediary indicates the full or abbreviated name of the consignee in accordance with the constituent documents and his postal address. When drawing up an invoice for work performed (services provided), property rights, the seller puts a dash in this line. When the principal (principal) draws up an invoice issued to a commission agent (agent) selling 2 or more goods and services buyers on his own behalf, the full or abbreviated names of consignees and their postal addresses are indicated (through the sign “;” (semicolon)) |

| Line 5 |

|

| Line 6 |

|

| Line 6a | The address of the buyer indicated in the Unified State Register of Legal Entities, within the location of the legal entity, the place of residence of the individual entrepreneur indicated in the Unified State Register of Individual Entrepreneurs - when the principal (principal) draws up an invoice issued to the commission agent (agent) selling goods and services on his own behalf |

| Line 6b | The intermediary indicates the INN and KPP of the taxpayer-buyers through the sign “;” (semicolon) |

| line 7 | The intermediary indicates the name of the currency for the goods listed in the invoice and its digital code in accordance with OKV (All-Russian Classifier of Currencies) |

| Line 8 | The line is filled in when issuing an invoice under a government contract for the supply of goods (performance of work, provision of services), a contract (agreement) on the provision of subsidies from the federal budget to a legal entity, budget investments, contributions to the authorized capital (if any) |

| Box 1 |

|

| Box 1a | The column is intended to reflect the code of the type of product in accordance with the unified Commodity Nomenclature of Foreign Economic Activity of the EAEU. The data is indicated in relation to goods exported outside the territory of the Russian Federation to the territory of a member state of the EAEU; If there is no data, a dash is placed |

| Columns 2 and 2a | If there is an indicator, a unit of measurement (code and the corresponding symbol (national) in accordance with sections 1 and 2 of the All-Russian Classifier of Units of Measurement) (if it is possible to indicate it). If there are no indicators, a dash is placed |

| Column 3 | Quantity (volume) of goods (work, services) supplied (shipped) according to the invoice of the principal (principal) based on the accepted units of measurement (if it is possible to indicate them) |

| Column 4 | The price (tariff) of a product (work performed, service rendered), transferred property right per unit of measurement (if it is possible to indicate it) under an agreement (contract) excluding VAT, and in the case of using state regulated prices (tariffs) that include VAT, taking into account the amount of tax. If there is no indicator, a dash is placed |

| Box 5 | The cost of the entire quantity (volume) of goods supplied (shipped) according to the invoice of GWS without VAT |

| Box 6 | The amount of excise duty on excisable goods. If there is no indicator, the entry is made: “Without excise tax” |

| Column 7 | Tax rate |

| Column 8 | VAT amount |

| Column 9 | The cost of the entire quantity of goods and materials supplied (shipped) according to the invoice, including VAT, and in the case of receiving a payment amount, partial payment on account of upcoming supplies of goods and materials - the received amount of payment, partial payment |

| Columns 10 10a | Country of origin of the product (numeric code and corresponding short name) in accordance with the All-Russian Classifier of Countries of the World. These columns are filled in for goods whose country of origin is not the Russian Federation |

| Box 11 | This column is filled in for goods whose country of origin is not the Russian Federation, or for goods released in accordance with the customs procedure for release for domestic consumption upon completion of the customs procedure for the free customs zone on the territory of the SEZ in the Kaliningrad region |

When does an agent need to issue an additional invoice?

In addition to shipping invoices (the procedure for issuing which is described above), the agent must issue another one to the principal. This need arises for agents who pay VAT.

This is due to the fact that for an agent - a VAT payer, income for tax purposes is the remuneration under the agency agreement (clause 1 of Article 156 of the Tax Code of the Russian Federation), therefore, for its amount the agent:

- issues an invoice to the principal (as in the normal sale of goods, work or services);

- registers it in the sales book with code 01 (Articles 168–169 of the Tax Code of the Russian Federation).

The costs transferred by the agent to the principal under the agency agreement (related to its execution) do not form an object of VAT taxation - the agent does not need to take into account their amount when calculating income tax (subclause 9, clause 1, article 251, clause 9, article 270 of the Tax Code of the Russian Federation) .

Find out when and how consolidated invoices can be issued in agency relationships.

The reseller acted instead of the principal

An intermediary firm or intermediary is an organization or person that represents an intermediate link between consumers and producers of services, works, and goods. These companies promote trade turnover by acting as a catalyst for market relations by solving and identifying problems.

Trade intermediary institutions are those firms that do not depend on the consumer or manufacturer of goods, either economically or legally. The reseller's profit can be accrued in the form of a bonus for the services he provides or as revenue from the difference between the purchase price and the selling price.

Trade and intermediary organizations are classified:

- According to the work performed:

- universal;

- specialized;

- By the nature of operations and type of subordination:

- dependent (from production);

- formally independent;

- independent (full or narrow range of services).

Invoice and agent report: what to look for

When preparing an invoice, it is important for the agent to ensure that the information indicated there is identical to the data reflected in another important document - the agent’s report. The invoice data and the agent's report should not differ in information about the quantity of goods, their price and other indicators.

The presence of discrepancies may indicate:

- about arithmetic or technical errors made - in this case you will have to start correcting an incorrectly drawn up document;

Find out the algorithms for correcting erroneous data in an invoice on our website .

- adjustments to the price and/or quantity that have occurred that have not been taken into account by the agent, which requires the execution of an additional agreement to coordinate the changes and an adjustment invoice.

Inconsistencies in documents may be caused by:

- discounts provided by sellers and not taken into account by the agent when compiling the report;

- revision of prices in the conditions of initial shipment of goods at preliminary prices;

- in other cases (when returning goods, identifying shortages or discrepancies in quality, etc.).

The articles posted on our website will help you correctly correct errors that arise in your current business activities:

- “How to make a correction in a work book - sample”;

- “Corrections in the cashier-operator’s journal - sample”.

Results

The agent, as a link between the principal and a third party (buyer or supplier), is responsible for re-invoicing. An agent selling on his own behalf the goods of the principal in invoices issued in the name of buyers indicates himself as a seller. Using such a document, the buyer can safely claim a VAT deduction. If the agent purchases goods or services on behalf of the principal, then when re-invoicing he must indicate information about the supplier on pages 2, 2a and 2b.

Download step-by-step instructions for re-invoicing here .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is mediation

Mediation is the work of an intermediary-performer who solves the client’s problems: concludes a deal, from which the customer receives income. To formalize mediation, one of three contracts is chosen.

Agency agreement

The provisions of the agreement are governed by Chapter. 49 of the Civil Code of the Russian Federation. According to its terms, the attorney performs the tasks of the principal. As a result, the customer acquires the rights and obligations specified in the contract to third parties.

Having concluded a transaction, the executor immediately transfers everything received under it to the principal. The customer compensates for the expenses incurred by the attorney, and also pays for his services, if provided for in the contract.

Since the executor works on behalf of the principal, he needs an official power of attorney.

Commission agreement

The provisions of the commission agreement are regulated by Chapter. 51 Civil Code of the Russian Federation. A commission agent is a person who, on behalf of the customer and at his expense, enters into sales transactions with third parties.

The commission agent works on his own behalf. Therefore, in concluded transactions, only he bears all rights and obligations. But the commission agent does not have ownership rights to the goods.

The commission agreement is paid. The commission agent will provide the customer with the result of the work in a report; its deadlines and delivery procedure are specified in the contract. Upon acceptance of the report, the customer pays a reward.

Since the contractor is responsible for the concluded transaction, he does not need a power of attorney from the customer.

Agency contract

Adjustable by ch. 52 of the Civil Code of the Russian Federation. Under the contract, the agent undertakes to perform certain actions requested by the customer. An agency agreement combines a commission agreement and a guarantee agreement. Therefore, under a concluded transaction, rights and obligations may arise for both the contractor and the customer. It all depends on the terms of the contract.

Like the commission agent, the agent is also obliged to provide the customer with a report on the work done, accompanied by documents related to the transaction.

See the differences between intermediary agreements in the table.

| Characteristic | Order | Commission | Agency |

| Who is financing the deal? | Customer | Customer | Customer |

| Who acquires rights and obligations | Customer | Commissioner | Customer/Agent |

| Is remuneration expected under the contract? | Not really | Yes | Yes |

The choice of the type of mediation agreement depends on the situation. A surety agreement should be concluded to perform legally significant actions: registering a trademark, registering property, and so on.

A commission agreement is often used in sales transactions. The buyer may not know that he is working with a commission agent, since the contractor acts on his own behalf.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service