Primary documentation in the company can be signed by certain persons. To transfer the ability to sign a number of business and accounting acts, the manager can issue a special order or power of attorney, which is drawn up on behalf of the company. This allows you to assign powers to a specific person who is engaged in business activities or accounting.

The procedure for assigning responsibilities to the required person must be carried out in accordance with the law.

What are primary documents

Papers are primary if they register completed business transactions. It turns out that in order to enter facts and information into accounting, primary documentation in the form of contracts and executed transactions is required.

Any act of the primary type carries information about the economic activities of the enterprise, as well as economic facts.

Primary documents: types

Important! The papers must be kept for 4 years, since during this time the tax authority can check the availability of such data.

Basic information

Any business-type operation carried out at an enterprise or organization is accompanied by the execution of special documents, which are called primary documents.

Accounting is maintained based on the totality of documentation.

Important! Any document must be signed by a responsible person who has this responsibility.

The possibility of signature can be established by a special order, accounting policy or additional papers, which include job descriptions and powers of attorney.

According to the law, it is desirable to have a list of persons in the accounting documentation. This will avoid problems with filling out forms.

What is a signature

A signature means the signature of a representative or official. It must be handwritten and confirms the authenticity of the act or copy.

The signature consists of three main parts, including the job title, personal signature and decoding, which includes the surname and initials.

Important! If organization letterheads are used, the name of the organization is not required. Otherwise, it is necessary, for example, if the document is drawn up on a blank sheet of paper.

The signing itself means the presence of legal force, so only the person identified through various documentation should sign.

Read also: Reimbursement of training costs

What belongs to this category

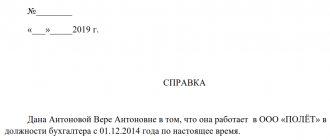

This category includes an accounting document for accountants and tax authorities. Documentation:

- invoice;

- payment order;

- Act;

- discharge;

- reference;

- invoice.

This also includes all papers that are related to the economic activities of the organization. They must be properly designed and also contain the signatures of the responsible persons.

Primary documents

Legal basis

The base includes several basic regulations. Among them:

- Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n, approving the provisions for maintaining accounting and accounting-type reporting;

- Federal Law No. 402-FZ, regulating accounting;

- Federal Law No. 129, Article 9 of November 21, 1996.

According to the latest legislative act, any process of drawing up a primary act requires the availability of details.

According to the law, correct preparation of documentation is mandatory, since records are kept on the basis of it.

Why is a primary needed?

The primary record is used to record the actions of the entrepreneur and the organization, that is, any activity is accountable.

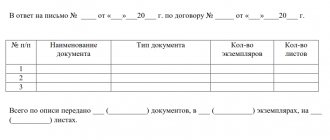

Documentation can be unified or arbitrary. It all depends on the type of activity and the presence of additional factors, for example, there is a hazardous production or the company is engaged in government supplies. Any paper contains a number of data:

- name and date of compilation;

- Business name;

- type and name of business operation;

- data of persons involved in the operation;

- the signature of the responsible person, that is, the one who has the right to carry out this operation and the execution of the form.

Painting is considered mandatory. At the same time, it doesn’t matter whether it is digital or handwritten. The main thing will be the presence of a painting and the possibility of a face on it.

Basic concepts and definitions

An employment contract between an employer and an employee is an agreement under which the mutual rights and obligations of the employee and employer are formalized.

- Tenant (employer) - a legal or physical adult registered as an individual entrepreneur has the right to conclude employment contracts as employers.

- Conclude an employment contract with minors, with school students aged 16 or 15 years . For the latter, only light, non-hard work is allowed, work that does not cause harm or discomfort to their well-being/health (Article 63 of the Labor Code of the Russian Federation).

REFERENCE! It is also possible to enter into an agreement with 14-year-old students, but their parents or guardians must give consent. The same conditions are observed here as for fifteen-year-olds, plus such work should not interfere with their studies.

It happens that by law the employer is forced to refuse:

- persons who have not reached the legal age (for example, it is impossible to enter into an agreement with minors in the Far North);

- Russians who have citizenship of another state and are applying for government jobs. service;

- citizens with a criminal record (they cannot hold certain positions).

Who has the right to sign primary accounting documents

With the exception of the head of the company, there are a number of persons who have the authority to draw up papers. These individuals are identified using:

- the charter of the company, that is, the accounting policy establishes all persons who can sign and execute the primary document;

- job descriptions;

- special order;

- powers of attorney.

Important! Access can even be granted to an outsider. An important point will be its full design.

What are primary accounting documents

An accounting option is a fixed act of completing a business transaction that is carried out in an organization. Accounting in this case is expressed by the fact that such data is required for full accounting, both accounting and tax. It turns out that accounting documents include all completed and signed forms.

Who in the organization has the right to sign primary documents

Previously, the opportunity was available to two persons in the form of the manager and the chief accountant, but after changes in legislation, by default only the manager has it. Additionally, it is vested in authorized persons. They can be authorized both by order and by job description.

Formation of a list of persons authorized to sign

The formation of a list of persons who have the opportunity to sign documentation is carried out by the manager and chief accountant.

Any financial paperwork must be completed by these individuals, as well as their deputies, if they were included in the list. According to current standards, all signatures of responsible persons must be recorded and transferred to the required institutions, for example, to a bank.

Read also: Benefits on insurance premiums in 2021

An important point will be the formation of the list already at the stage of creating the organization, that is, the information is written down in the charter.

Who approves the list of persons

The list of persons is approved directly by the manager. But approval is required from the chief accountant. In the absence of these persons, approval can be transferred by means of a special order to the responsible person.

Do I need a power of attorney?

Most often, it is used when a manager is absent for a long time or a person outside the organization is brought into the management body. The maximum validity period is three years.

Who signs during liquidation?

In normal situations, the signature belongs to the director, but this point is irrelevant in case of liquidation. From the moment the powers were transferred to the person who is the liquidator, the responsibility belongs to him, that is, after this procedure, the director’s signature will be considered invalid.

This is due to the fact that the liquidator receives the entire package of obligations during the liquidation of the organization.

Is it possible for a non-employee of the organization

A report is most often issued for an employee of an organization if this point is not taken into account in other documents, for example, in a job description. If the citizen is not an employee of the organization or is outside the state, then you will need to issue a power of attorney, agreed upon with the manager and bearing the seal of the enterprise.

There are no legislative restrictions on transferring responsibilities to other persons, that is, anyone can be given the opportunity to sign papers.

Who can sign for an individual entrepreneur

Cashiers who have this ability according to their job description can sign cash forms. All other documentation must be signed directly by the individual entrepreneur. Otherwise, he will be held accountable, since the transfer of the painting from an individual entrepreneur is not legally established.

General procedure

Let's consider the general procedure for concluding an employment contract with a worker. How to apply? What form does it take? In how many copies? The form of the employment contract is in written/printed form in two copies (not copies!). The employee's receipt of a copy of the employment contract must be confirmed by the employee's signature on the employer's copy.

In addition to the fact that an employment contract can only be concluded in writing, registration is possible:

- By verbal agreement.

- In accordance with internal regulations.

- The working conditions may be described in a letter from the employer with a specific offer.

- In accordance with established legislative standards (employee remuneration is not less than the established minimum level).

- By drawing up a collective agreement (between the employer and various associations).

If the employee is actually allowed to perform his duties, the employer has 3 working days to draw up an employment contract, in accordance with the norms.

Otherwise, he will be obliged to pay the employee funds according to the amount of time he last worked.

Who signs an employment contract first, the employee or the employer?

There is no fundamental difference in the order in which the agreement is signed. This is not stated in the Labor Code of the Russian Federation or other acts or laws . As a rule, in organizations this issue is dealt with by the HR department, whose employees are the first to give the contract to the future employee to sign, after which they present it to the employer.

Is the employer stamping the employment contract? The company seal is not a mandatory requisite , since it is not provided for by the Code of the Russian Federation, unlike the signatures of the parties. Therefore, the absence of a seal does not invalidate the contract if it bears the signatures of both parties.

REFERENCE! An employment contract is considered concluded from the moment it was signed by both parties, unless other points were established by legislative and regulatory acts (

Art. 61 Labor Code of the Russian Federation

).

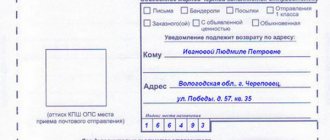

How to certify the right to sign primary documents by order or power of attorney

Certification by special order or power of attorney is used in various cases. The act is used for full-time employees. The second option can be used for any person, but most often the trustee is chosen from outside the state.

In this case, the leader himself determines how to empower a person, but the order cannot be used for unauthorized persons.

When externally corporate events are required, a power of attorney is required.

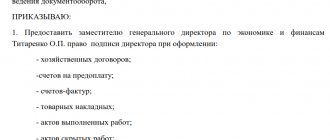

Order for the right to sign primary documents

Guarantees

All guarantees when concluding an employment contract are regulated by 64 articles of the Labor Code of the Russian Federation.

- Unreasonable and unmotivated refusal by an employer to conclude a contract is prohibited.

- It is prohibited to limit a person’s rights based on his race , gender, attitude to religion, origin, etc.

- Refusal to pregnant women or women with many children is also prohibited.

- The agreement cannot be denied to employees from another employer upon written request within 30 days.

ATTENTION! In case of refusal to enter into a contract, the employee may request in writing the reason for the refusal . The employer must also provide the document in writing within one week.

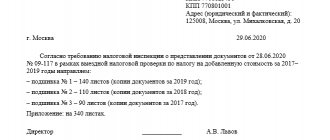

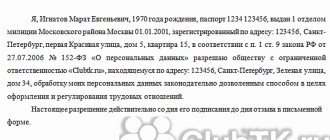

Requirements for drawing up a sample power of attorney for the right to sign primary documents

The power of attorney has a number of mandatory items that must be completed. The basic structure of a power of attorney is standard, that is, all persons and their details must be specified. Additionally, notarization will be required.

Another important point will be complete information about the organization, that is, the details are entered.

Important! The power of attorney clearly states all delegated responsibilities. There should be no vague or ambiguous wording. You also need to set an expiration date. It should not exceed three years.

What to write in the order

In addition to filling out all the necessary data and authenticating the form, you will need to register the legislative framework in the form of Federal Law No. 402, as well as the desired phrase “to comply with legal norms.”

The order specifies all the duties and types of papers for which the employee has opportunities.

Sample order on the right to sign primary documents

Sample order on the right to sign primary documents

Sample order for the right to sign financial documents

Sample order on the right to sign invoices

Sample order on the right to sign invoices

Sample order for the right to sign the chief accountant

Options

When and for how long is an employment contract concluded? The Labor Code divides contracts into two types: for an indefinite period and fixed-term. The first option is applicable if long-term cooperation is planned between the parties. The second option is necessary when an employee performs a specific task in a short time.

As already described above, concluding an employment agreement is beneficial to both parties . For the employer, this is a guarantee that the employee will fulfill his job duties and that he will comply with the general internal rules.

And for an employee, this is a guarantee of receiving a salary on time , as well as all monetary payments required by law, safe working conditions and an additional social package (free food, travel, medical care, insurance, etc.)

How to place an order

First of all, a standard form is drawn up. Next you will need to specify a number of points:

- company data;

- data of the persons who draw up the paper;

- information about employees who received new obligations;

- justification of the reason and the existence of a basis;

- a list of documentation that became available to the specified employees;

- printing and dating.

Filling out is standard, but you will need to accurately indicate the list of employees and the opportunity provided to them.

How to revoke signature rights

Revocation is carried out in two ways.

In the first case, the power of attorney expires, which means automatic cancellation. In the second option, you will need to issue an order that cancels the previous one. The order must contain all the data of the previous one and the date of cancellation. The responsible person must be notified and familiarized with the paper. If the power of attorney has not yet expired, then it will also need to be canceled. Firms registered on letterhead must be canceled by the manager using an administrative act. If the power of attorney was certified by a notary, then the cancellation of the action must take place with him.

If necessary, the organization may be assigned certain responsibilities. The manager and a number of persons who have the appropriate clearance have the opportunity to sign documentation. Additionally, this right is granted with the help of a special order or power of attorney if it is necessary to involve an outsider or transactions outside the company are required.