What penalties are provided for failure to submit calculations in Form 6-NDFL for separate divisions?

Within what time period must 6-NDFL be submitted for separate divisions if a request has been received from the tax office? How to submit 6-NDFL for the first quarter of 2021: as a primary report or as an updated form? These issues were considered by experts from the Legal Consulting Service GARANT 07/22/2016

Recently, the following situation arose in practice: the organization submitted a calculation in form 6-NDFL for the first quarter of 2021 for all employees at the location of the parent organization only. Forms 6-NDFL were not submitted at the location of separate divisions for the first quarter of 2021. On June 10, 2016, a notification was received via telecommunication channels (hereinafter referred to as TCS) about the submission of tax reporting - calculations in Form 6-NDFL for each separate division separately. The organization has the questions listed above. Let's look at each of them in detail.

Responsibility for failure to submit 6-NDFL

Starting from 2021, tax agents are required to quarterly submit to the tax authorities the calculation of personal income tax amounts calculated and withheld by the tax agent in Form 6-NDFL, formats and in the manner (hereinafter referred to as the Procedure), which were approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected]

Until 2021, Article 230 a tax agent with a separate division information on Form 2-NDFL Specialists from the financial and tax departments explained that such organizations provide information on the income of individuals in relation to employees of a separate division at the place of registration of the organization with the tax authority at the location of this division. See letters of the Ministry of Finance of Russia dated 03/18/2013 No. 03-04-06/8323, dated 02/06/2013 No. 03-04-06/8-35 , dated 01/22/2013 No. 03-04-06/3-17 , dated 12/07. 2012 No. 03-04-06/8-345 , dated 04/05/2012 No. 03-04-06/8-103 , Federal Tax Service of Russia dated 05/30/2012 No. ED-4-3/ [email protected] , dated 12/09/2010 No. ShS-37-3/ [email protected] and others.

From January 1, 2021, in the fourth paragraph of paragraph 2 of Art. 230 of the Tax Code of the Russian Federation directly states that tax agents - Russian organizations with separate divisions - submit a document containing information on the income of individuals for the expired tax period and the amounts of tax calculated, withheld and transferred to the budget system of the Russian Federation, and the calculation of the amounts of personal income tax calculated and withheld by the tax agent, in relation to employees of these separate divisions to the tax authority at the place of registration of such separate divisions, as well as in relation to individuals who received income under civil law contracts, to the tax authority at the place of registration of separate divisions that entered into such agreements (see letter of the Ministry of Finance of Russia dated November 2, 2015 No. 03-04-06/62935, letters of the Federal Tax Service of Russia dated March 23, 2016 No. BS-4-11/ [email protected] , dated February 26, 2016 No. BS-4-11/ [email protected] , dated 02/25/2016 No. BS-4-11/ [email protected] , dated 12/30/2015 No. BS-4-11/ [email protected] ).

In the letter of the Federal Tax Service of Russia dated December 28, 2015 No. BS-4-11 / [email protected] , the tax department indicated that the calculation in form 6-NDFL is filled out by the tax agent separately for each OP, regardless of the fact that these separate divisions are registered in one tax authority.

Thus, tax agents with separate divisions submit Form 6-NDFL in relation to employees of these separate divisions to the tax authority at the place of registration of such separate divisions, as well as in respect of individuals who received income under civil contracts, to the tax authority at the place of registration of separate divisions that have entered into such agreements.

Failure by a tax agent to submit a calculation in accordance with Form 6-NDFL within the prescribed period entails the collection of a fine from the tax agent in the amount of 1000 rubles for each full or partial month from the day established for its submission (clause 1.2 of Article 126 of the Tax Code of the Russian Federation).

For obvious reasons, there is currently no arbitration practice on this issue in relation to the new norms of the Tax Code of the Russian Federation.

Therefore, we can conclude that failure to submit separate 6-NDFL forms in relation to employees of a separate division may entail the application of the organization's liability provided for in clause 1.2 of Art. 126 of the Tax Code of the Russian Federation.

Previously (during the period of validity of the previous edition of clause 2 of Article 230 of the Tax Code of the Russian Federation), judges indicated that the submission by an organization of certificates in Form 2-NDFL to any of the inspection offices where it is registered within the period established by tax legislation is the proper performance of duties (see , for example, decisions of the Eighth Arbitration Court of Appeal dated 02/25/2014 No. 08AP-10750/13, FAS of the West Siberian District dated 04/09/2012 No. F04-792/12 in case No. A27-8884/2011, dated 04/27/2009 No. F04- 2593/2009(5604-A70-26), FAS of the East Siberian District dated February 12, 2009 No. A33-7606/2008-F02-228/2009, FAS Moscow District dated June 15, 2006 No. KA-A40/5048-06).

However, from January 1, 2021, paragraph 2 of Art. 230 of the Tax Code of the Russian Federation has undergone significant changes. In this regard, the above logic of the judges is not so relevant. Therefore, we do not rule out that the submission of Form 6-NDFL regarding employees of a separate division to the parent organization may entail the application of sanctions to the organization provided for in clause 1.2 of Art. 126 of the Tax Code of the Russian Federation. Explanations regarding bringing to responsibility are also presented in the materials of regional tax authorities (see Information from the Federal Tax Service of Russia for the Vladimir Region dated 02.26.2016 “Tax agents are required to submit calculations of personal income tax amounts from 2021”, Information from the Federal Tax Service of Russia for the Vladimir Region dated 03.11 .2015 “On the submission of calculations for personal income tax by tax agents from January 1, 2021”, Information from the Federal Tax Service of Russia for the city of Sevastopol “Features of filling out reports on personal income tax”, Information message from the department of work with taxpayers of the Federal Tax Service of Russia for Irkutsk region dated 02/12/2016 “The rules and conditions of reporting have changed for tax agents”).

Filling out 6-NDFL for separate divisions

On the question of how to submit 6-NDFL (as a primary report or as an updated form), we inform you as follows.

According to clause 2.2 of the Procedure, on the line “Adjustment number”, when a tax agent submits the initial Calculation to the tax authority, “000” is entered; when submitting an updated Calculation, the correction number (“001”, “002”, and so on) is indicated.

In the case under consideration, an organization with separate divisions submitted the 6-NDFL calculation at the location of only the parent organization.

In our opinion, when submitting the 6-NDFL calculation at the place of registration of separate divisions, in the line “Adjustment number” the correction number of the primary calculation “000” is indicated, since the calculation was not submitted.

We believe that in the situation under consideration, at the place of registration of the parent organization, it is also necessary to submit a 6-NDFL calculation with updated indicators of income and withheld amounts of personal income tax in relation to employees of the head office. Since in this case, the calculation will be submitted again at the place of registration of the parent organization (minus information about the amounts of personal income tax calculated and withheld from the income of employees of a separate division), then in the line “Adjustment number” you should enter “001”.

Deadline for submitting 6-NDFL

Regarding the deadline for submitting 6-NDFL at the location of separate divisions, we inform you as follows.

In accordance with paragraphs. 7 clause 1 art. 23 of the Tax Code of the Russian Federation, taxpayers are obliged to comply with the legal requirements of the tax authority to eliminate identified violations of the legislation on taxes and fees, and also not to interfere with the legitimate activities of tax authorities officials in the performance of their official duties. In turn, paragraphs. 8 clause 1 art. 31 of the Tax Code of the Russian Federation, tax authorities are given the right to demand that taxpayers, fee payers, tax agents, and their representatives eliminate identified violations of the legislation on taxes and fees and monitor compliance with these requirements.

Failure to submit 6-NDFL calculations for separate divisions is a violation of tax legislation; accordingly, the tax authority has the right to demand that this violation be eliminated, and the taxpayer is obliged to eliminate it.

The norms of the Tax Code of the Russian Federation do not regulate the procedure for submitting a notice of submission of tax reports (in the case under consideration - submission of the 6-NDFL calculation).

In the letter of the Federal Tax Service of Russia dated December 28, 2015 No. BS-4-11/ [email protected] “On the direction of Control Ratios” it is explained that if the date of submission of the 6-NDFL calculation exceeds the deadline established by Art. 230 of the Tax Code of the Russian Federation, then an act is drawn up in the manner prescribed by Art. 101.4 of the Tax Code of the Russian Federation for making a decision on bringing to responsibility in accordance with clause 1.2 of Art. 126 of the Tax Code of the Russian Federation.

The procedure for delivering an act on the discovery of facts indicating tax offenses provided for by the Tax Code of the Russian Federation is established in clause 4 of Art. 101.4 Tax Code of the Russian Federation. An act on the discovery of facts indicating tax offenses provided for by the Tax Code of the Russian Federation is handed over to the person who committed the tax offense against a receipt or transferred in another way indicating the date of its receipt.

In the case under consideration, a notification about the provision of tax reporting was received via the TKS (and not an act in the prescribed form in accordance with Article 101.4 of the Tax Code of the Russian Federation). At the same time, the Tax Code of the Russian Federation does not regulate the deadlines for receiving notification of the submission of tax reports. Accordingly, in our opinion, the obligation to submit 6-NDFL calculations for separate divisions by a certain date does not arise in the case under consideration.

However, if an organization does not submit a 6-NDFL calculation for separate divisions in accordance with the notification received, this may have negative consequences: collection of a fine for late submission of a document ( clause 1.2 of Article 126 of the Tax Code of the Russian Federation) or submission of false information, as well as suspension of account transactions. We repeat, in accordance with clause 1.2 of Art. 126 of the Tax Code of the Russian Federation for each full or partial month of violation of the established deadline for submitting a calculation for calculated and withheld personal income tax amounts, 1000 rubles are collected. We believe that this responsibility is also provided for each 6-NDFL calculation that is not submitted at the place of registration of separate divisions. In addition, the tax authority has the right to decide to suspend transactions on bank accounts and electronic money transfers if the calculation of calculated and withheld personal income tax amounts is not submitted within 10 days after the end of the established period (clause 3.2 of Article 76 of the Tax Code of the Russian Federation ). For each document submitted with false information, the tax agent faces a fine of 500 rubles. Exemption from liability is possible if the tax agent submitted updated documents to the inspectorate before learning that the submitted information was found to be unreliable ( Article 126.1 of the Tax Code of the Russian Federation). See also Information from the Office of the Federal Tax Service for the Primorsky Territory dated March 31, 2016 “Tax agents have a new duty.”

Recently, the following situation arose in practice: the organization submitted a calculation in form 6-NDFL for the first quarter of 2021 for all employees at the location of the parent organization only. Forms 6-NDFL were not submitted at the location of separate divisions for the first quarter of 2021. On June 10, 2016, a notification was received via telecommunication channels (hereinafter referred to as TCS) about the submission of tax reporting - calculations in Form 6-NDFL for each separate division separately. The organization has the questions listed above. Let's look at each of them in detail.

We are opening a separate division: how and where to submit 6-NDFL

The company's obligation to register and submit 6-NDFL for separate divisions (OP) arises if income is paid:

- employees performing labor duties at stationary workplaces geographically remote from the head office (created for a period of more than 1 month);

- to individuals under civil contracts concluded by authorized persons on behalf of the OP.

If income is paid to at least 1 such individual, the accounting service may have a question: how to fill out and submit 6-NDFL for a separate division?

Each OP is required to submit 6-NDFL at the place of its tax registration, regardless of:

- on the number of OPs registered by the company;

- the number of individuals receiving income from the OP;

- other conditions of the OP’s activities.

See also: “The Federal Tax Service has explained how to submit 6-NDFL for employees in another city.”

Tax agents - the largest taxpayers (CT) have the right to choose the address for filing 6-NDFL at the place of registration:

- companies as CN;

- or their OPs.

From 01/01/2020, it is possible to switch to centralized submission of 6-NDFL for OPs that are located in the same municipality. 6-NDFL on them can be submitted to the tax office at the location of one of these divisions, or to the Federal Tax Service of the parent organization, if the head office is located in the same municipality as the OP (even if the OP is the only one (see letter from the Federal Tax Service dated November 15, 2019 No. BS-4-11/23247).

To select the responsible department, you need to submit the following notification to the Federal Tax Service. The deadline is defined as the first working day of the corresponding year, but notifications for 2021 were accepted until 01/31/2020 inclusive.

The notification only needs to be submitted to one inspection - the one that takes into account the responsible OP, the rest of the Federal Tax Service will be notified automatically.

How to open an OP and organize accounting in it - see this article .

The algorithm for filling out sections 1 and the 6-NDFL report for separate divisions is no different from a similar report for the parent company.

NOTE! The requirements for filling out 6-NDFL are contained in the order of the Federal Tax Service of Russia dated October 14, 2015 No. MMB-7-11/ [email protected] (as amended on January 17, 2018).

Close attention will require filling out the title page of the 6-NDFL report, or rather the cells intended for the codes of the tax authority to which it is submitted, as well as the checkpoint and OKTMO department.

On the title page of 6-NDFL, it is necessary to reflect the checkpoint and OKTMO of the OP that paid income to individuals, and with centralized reporting from 2021 - the checkpoint of the responsible OP.

New tax rules

New rules for paying personal income tax and submitting reports - 2-NDFL certificates and 6-NDFL calculations - were established by Federal Law No. 325-FZ of September 29, 2019, which amended clause 7 of Art. 226 and paragraph 2 of Art. 230 Tax Code of the Russian Federation. The updated versions came into force on January 1, 2021.

Companies with several separate divisions

Now tax agents - organizations with separate divisions - can transfer personal income tax not for each “separate division”, but centrally - through the responsible division or directly through the parent organization. But the rule applies only if both the organization itself and the separate divisions (or several divisions) are located in the same municipality, that is, they have one OKTMO.

This means that the new procedure does not apply when the organization and divisions or several divisions are located in different areas of federal cities: Moscow, St. Petersburg or Sevastopol (letter of the Federal Tax Service of Russia dated December 27, 2019 No. BS-4-11 / [email protected] ) .

Also, the new procedure does not apply to individual entrepreneurs, since individual entrepreneurs cannot have separate divisions.

It is believed that the organization is located where its permanent executive body is located: general director, director, president. This locality must be indicated in the organization’s charter (Article of the Civil Code of the Russian Federation).

And the location of the unit is recognized as the place where the organization conducts activities through this separate unit (clause 2 of Art. Tax Code of the Russian Federation).

If separate divisions are located in the same municipality as the central office, then it is impossible to appoint one of them responsible and transfer personal income tax through it for all “separate divisions”. In such a situation, only the parent organization can perform the role of a centralized payer.

It is possible to appoint a separate division as responsible and transfer personal income tax through it for all “separate units” under this OKTMO only if the organization itself is located in another municipality.

Companies with one separate division

In paragraph 7 of Art. 226 of the Tax Code of the Russian Federation speaks only of organizations with several separate divisions. If we strictly follow the text of the Tax Code of the Russian Federation, it turns out that if she has the same OK, she cannot switch to the new procedure for paying personal income tax.

The Federal Tax Service had to correct this defect of the legislator. The agency clarified that companies with one separate division can also switch to centralized payment of personal income tax if the division has the same OKTMO as the parent organization (clause 2 of the Federal Tax Service letter dated November 15, 2019 No. BS-4-11/23247).

In the same letter, the Federal Tax Service explained that when switching to centralized payment of personal income tax, the tax must be transferred to the budget in one payment - without breaking down the amounts - and with the OKTMO indication of the responsible payer: the parent organization or the responsible “isolation”.

We have summarized information on centralized personal income tax payment in the table.

| Option for centralized personal income tax payment | Can switch to a centralized scheme | Cannot switch to centralized scheme |

| Through the central office | If the parent organization has the same OKTMO as the OP | The OP is located in another municipality or district of a federal city |

| Through the responsible OP | Separate divisions have an OKTMO that is different from the OKTMO of the central office | Separate units are located in the same municipality as the “head” |

A separate division is closing: where to submit 6-NDFL upon closure

If a division closes, how to submit 6-NDFL? A similar question may arise at any time after a decision is made to liquidate one or more OP of the company.

In this case, employees of this OP may be:

- Transferred to another OP or head office.

Important to consider! Recommendation from “ConsultantPlus”: In the transition month, if an organization transfers employees of a closed division to work in another division that pays wages, such income and the tax on them must be included in 6-NDFL, submitted at the place of registration... (for more details, see K +).

For information on how to fill out a report when an employee moves between departments, read the material “How to fill out 6-NDFL if the employee “roams” between departments (examples).”

- Fired. If the company as a whole is liquidated along with all OPs, the final 6-NDFL report drawn up under this OP will be the last report that will reflect the amounts of income and personal income tax, as well as the corresponding dates (receipt of income, withholding of tax and its transfer) for dismissed employees .

For information on the procedure for dismissing employees during a company reorganization, see the article . ”

When registering 6-NDFL for OPs that are planned to be liquidated, you must adhere to the following rules:

- reporting period for 6-NDFL - from the beginning of the year (or from the moment of registration of the enterprise, if it is created and liquidated during the calendar year) until the date of deregistration (completion of the liquidation process);

- The latest 6-NDFL report must be submitted at the location of the OP being closed.

About the features of reflecting payments upon dismissal in 6-NDFL, read the material “How to correctly reflect payments upon dismissal in 6-NDFL?”

Tax agents - CNs - are again given the opportunity to choose: submit the latest 6-NDFL report for the liquidated OP to the inspectorate with which the company is registered as a CN, or at the place of registration of the liquidated OP.

What to do if it was not possible to report to the place of registration of the OP before its closure, see here .

How to switch to a new order

Here, too, everything is ambiguous. All tax authorities with which the organization is registered at the location of its separate divisions must be notified of the transition to centralized reporting and personal income tax payment (clause 2 of Article 230 of the Tax Code of the Russian Federation). However, it is not stipulated that inspections need to be notified only in the territory where the new procedure will be applied.

In other words, strictly according to the letter of the Tax Code of the Russian Federation, if an organization, for example, has two divisions in Irkutsk and one in Khabarovsk, then when switching to the “one window” principle, it must send notifications to three Federal Tax Service Inspectors at once (to Irkutsk at the location of each divisions and in Khabarovsk). Considering that the tax authorities are a unified and centralized system (clause 1 of Art. Tax Code of the Russian Federation), such a notification procedure is clearly redundant. This was confirmed by the Federal Tax Service of Russia, which indicated that it is necessary to submit a notification about the transition to centralized payment of personal income tax only once - to the “responsible” division (parent organization). The Federal Tax Service will send out all further notices itself (letters from the Federal Tax Service of Russia dated December 27, 2019 No. BS-4-11 / [email protected] and dated December 16, 2019 No. BS-4-11 / [email protected] ).

As for the deadline for submitting a notification about the transition to centralized payment of personal income tax, the Tax Code requires this to be done before January 1 of the next year (clause 2 of Article 230 of the Tax Code of the Russian Federation). But since January 1 is always a day off, the deadline is moved to the first working day of the year (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). And for 2021, this could have been done right up to the end of January (letter of the Federal Tax Service of Russia dated December 25, 2019 No. BS-4-11/26740). The notification form was approved by Order of the Federal Tax Service of Russia dated December 6, 2019 No. ММВ-7-11/ [email protected]

Alexey Krainev, tax lawyer

Results

6-NDFL for separate divisions is submitted to the tax office at the place of their registration. The same rule applies when submitting the last 6-NDFL report in case of closure of a unit.

The largest taxpayers have a choice: to report for the division in Form 6-NDFL to the inspectorate for the largest taxpayers or at the place of registration of the division.

From 01/01/2020, in some cases, it is possible to submit a single 6-NDFL in several separate sections.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 14, 2015 No. MMB-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Fines

For non-payment or partial non-payment of personal income tax, the company will be punished with a fine of 20% of the tax amount. If the tax on a separate division was paid at the place of registration of the head office or other branch, there should be no recovery.

Late filing of 6-NDFL will entail a fine of 1 thousand rubles for each full or partial month of delay. If the calculation for a separate division is not submitted within 10 working days after the deadline for submission, the inspection may suspend monetary transactions on the accounts of the entire organization. If the calculation is submitted on time, but to the wrong inspection department, most likely there will be no fine - the law does not provide for liability. In this case, it is recommended to provide a clarification with zero indicators and submit the initial calculation to the correct branch of the tax authority.

For late submission of a 2-NDFL certificate, the penalty will be 200 rubles for each document. If the report is submitted on time, but to the wrong branch of the Federal Tax Service, it is recommended to cancel the certificate and resubmit it to the correct tax authority. For failure to comply with the submission format (in paper, not electronic form), the fine is 200 rubles for each certificate. Indicating false information in reports is punishable by a fine of 500 rubles for each incorrectly filled out document.

Personal income tax by individual

Income tax is paid both at the location of the parent organization and at the location of its divisions.

Personal income tax, which must be paid for separate units, is calculated and withheld from the amounts of income of employees of these separate units, drawn up both under labor and civil law contracts (clause 7 of Article 226 of the Tax Code of the Russian Federation).

If an employee has workplaces both in the main office and in a separate division, then personal income tax must be transferred to the appropriate budgets both at the location of the organization and at the location of each separate division, taking into account the time actually worked by such employee. The calculation is made on the basis of the working time sheet, taking into account the information from the employee’s location certificates for the corresponding billing period.

Similarly, personal income tax is transferred for each separate department, taking into account the time worked, if the employee works in several “separate departments” during the month.

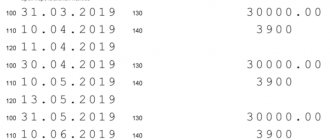

Example.

Work in several separate divisions On April 8, 2021, the employee, with his consent, was transferred from the parent organization to a branch located in another city. The employee’s monthly salary is 48,000 rubles. For April, he was accrued wages:

- for work in the parent organization in the period from April 1 to April 7 – 12,000 rubles;

- for work in a branch during the period from April 8 to April 31 – 36,000 rubles.

Personal income tax on income accrued to the employee in the parent organization in the amount of 1,560 rubles. (RUB 12,000 × 13%) must be transferred to the budget at the place of registration of the parent organization.

Personal income tax on income accrued at the branch in the amount of 4,680 rubles. (RUB 36,000 × 13%) – to the budget at the place of registration of the branch.

Thus, the amount of tax payable at the location of the divisions is determined based on the amount of income paid to the employees of these divisions.

Payment for liquidated separate divisions

If a division that has the characteristics of a separate structure is planned to be closed, Form 6-NDFL for it must be submitted according to the general rules. In the situation with branches that have ceased to exist, reports on the results of their work must be drawn up within the time limits specified by law and submitted to the regulatory authority. When closed, separate divisions are deregistered with the Federal Tax Service, therefore, personal income tax payments for them must be sent to the place of registration of the parent organization, and the details indicate the checkpoint of the division that has ceased operations.

Read also

20.11.2017

Should GPC agreements be taken into account?

There is one more flaw: when establishing the “one-window” principle for calculating 6-personal income tax, the legislator for some reason only indicated the income of department employees. Whereas, as a general rule, it also includes data on income under GPC agreements.

There are no, even indirect, explanations about this yet. In its letters, the Federal Tax Service quotes clause 2 of Art. 230 of the Tax Code of the Russian Federation as is, mentioning only workers. At the same time, the Procedure for filling out 6-NDFL does not say that you need to fill out a separate calculation for GPC payments. Therefore, we believe that the “centralized” 6-NDFL can include not only payments in favor of employees, but also income under GPC agreements.

Rules for submitting reports

Where to submit 6 personal income taxes for a separate division - to the Federal Tax Service at the place of registration or to the inspectorate selected according to the new rules for all OPs using one OKTMO code.

Serving options:

- directly to the inspectorate - as an authorized representative on the constituent documents or by a notarized power of attorney by other employees;

- according to TKS - an electronic signature is required.

Important! To send files to the Federal Tax Service via online communication, you will need to register an enhanced qualified digital signature and enter into an agreement with an operator from the register of digital signature operators.

The report is submitted 4 times in one year.

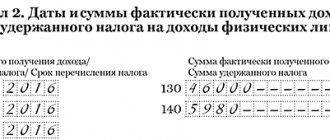

Table 1. Deadlines for filing 6 personal income taxes by separate divisions.

| Period | Submission deadline |

| I quarter | Until the end of April |

| 6 months (aka for the second quarter) | Until the end of July |

| 9 months (aka for the third quarter) | Until the end of October |

| Year (aka for the fourth quarter) | Until March 1st of the new year |

We recommend additional reading: Submission of tax return 6 personal income tax for individual entrepreneurs with and without employees

If any of the specified dates falls on weekends and holidays, the deadline is shifted to the first working day.

Note! Penalties are provided for late submission of tax reports to the Tax Code of the Russian Federation.

Design of the title page - code of the place of presentation

If the enterprise has separate structures, the Income Tax Calculation form must be sent to two branches of the Federal Tax Service. To identify which of the forms is submitted at the place of registration of the head office, and which is linked to the location of a separate division, different codes are placed on the title page of the form:

- code 212 is used when submitting the form to the authority located at the place of registration of the parent structure of the company;

- the numerical combination 213 is indicated by the largest taxpayers who have decided to submit reports only at their place of registration;

- the number 220 means that 6-NDFL is submitted to the tax authority that registered and controls settlements with the budget of a separate unit.