He accepts the payment stipulated by his terms. For him, the use of such a form is as favorable as possible. The advantages of a letter of credit for the seller include the following:

- Payment at the place where the letter of credit is located;

- Speed of payment execution;

- Increased turnover of funds.

When the payer does not open a letter of credit on time, the seller has the right to delay delivery of products or completely abandon its contractual obligations. Also, a justified refusal may occur if the counterparty is insolvent. Accounting for a letter of credit from the buyer Accounting is maintained on account 55, subaccount 1, where the debit shows the opening of a letter of credit, and the credit shows the write-off of funds or its closure.

How to reflect settlements under letters of credit in accounting

Debit 08 Credit 76–10,000 rub. – the commission amount is included in the initial cost of the equipment; Debit 19 Credit 60–76,271 rub. – input VAT is reflected; Debit 01 Credit 08– 423,729 rub. – equipment was put into operation; Debit 68 subaccount “Calculations for VAT” Credit 19– 76,271 rub. – accepted for deduction of input VAT. June 17: Debit 60 Credit 76 “Settlements with the bank under letters of credit” – 500,000 rubles. – payment was made to the supplier from an uncovered letter of credit; Debit 76 “Settlements with the bank under letters of credit” Credit 51–500,000 rub. – the debt to the bank under the letter of credit has been repaid; Loan 009– 500,000 rubles. – an uncovered letter of credit is written off from the off-balance sheet account. Since a letter of credit is only a form of non-cash payments between organizations, in the accounting of the recipient of funds, payment receipts from the counterparty are reflected in the general manner.

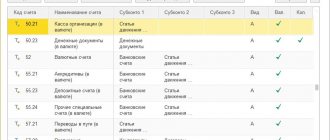

Letter of credit - what is it, transactions, accounting

Account Dt Account Kt Description of posting Posting amount Document-basis 60.01 55.01 Write-off of funds in the Letter of Credit as payment for supplied products, work, services, fixed assets, intangible assets and other assets Amount of payment to suppliers and contractors Bank statement 60.02 55.01 Transfer of advance payment to suppliers and contractors in the Letter of Credit (subject to the type of Letter of Credit with a red clause) Advance amount listed in the letter of credit Bank statement 76.01 55.01 Funds transferred from the letter of credit for settlements for insurance Amount of insurance payment Bank statement 76.02 55.01 Funds transferred from the letter of credit to settle claims Amount of payment for claims Bank extract 76 55.01 Transferred funds from the letter of credit for settlements with other debtors and creditors Amount of payment to other debtors and creditors Bank statement Letter of credit.

Accounting for transactions under letters of credit

Record its amount in off-balance sheet account 009 “Securities for obligations and payments issued.” Reflect settlements under an uncovered letter of credit using the following entries. When submitting an application to open an uncovered letter of credit: DEBIT 009 – an uncovered letter of credit has been opened.

As you use the funds on the letter of credit, make an entry: DEBIT 60 CREDIT 76 “Settlements with the bank under letters of credit” - payment was made to the beneficiary from an uncovered letter of credit. When repaying the debt to the bank under the used letter of credit, make the following entries: DEBIT 76 “Settlements with the bank under letters of credit” CREDIT 51 – debt to the bank under the letter of credit has been repaid; LOAN 009 – an uncovered letter of credit is written off from the off-balance sheet account. This procedure is provided for in the Instructions for the chart of accounts (accounts 009, 60, 76).

The basis for recording these transactions are bank notices and account statements (Part 1 of Art.

New forms approved for 2021

In 2021, the Treasury introduced new forms of documents for the execution and accounting of a treasury letter of credit. The forms were approved by order of the Treasury of Russia dated November 25, 2019 No. 34n.

The standard provides for the introduction of three new forms and rules for filling out documentation. By FC Order No. 34n dated November 25, 2019, the following were introduced:

- application for the issuance, transfer, change or withdrawal of treasury security obligations;

- information about the LLC;

- application for execution of treasury security obligations.

The forms disclose information about the customer, contractor, GRBS and details of the contract under which a treasury letter of credit is provided. Download sample forms for free.

Features of accounting for letters of credit in accounting

This operation is documented by posting:

- Debit 55 Credit 51.

If after settlements with the seller some amount remains on the letter of credit, it is returned to the current or foreign currency account:

- Debit 51 (52) Credit 55.

A letter of credit can be opened at the expense of one’s own funds (debited from the current account) and at the expense of borrowed funds. In this case, the wiring is done:

- Debit 55 Credit 66 (67).

The fact of opening a letter of credit is reflected by an entry in the debit of account 008, respectively, the closure is recorded in the credit of account 008. Bank services in the form of a commission for maintaining a letter of credit are written off to the company's expenses (Debit 91.2 Credit 51), or in the cost of purchased goods and materials (Debit 10 (41, 08...) Credit 51). Example of issuing a letter of credit: An organization is going to purchase equipment.

Special cases

If the contract provides for subcontractors, then settlements with them are carried out in a similar manner. If, as part of the execution of a government contract, treasury security for obligations is provided, and other agreements, agreements, contracts are concluded, then they must include a requirement for security.

If the amount of security changes, it is allowed to change the amount of the letter of credit from the Treasury. To do this, the customer or GRBS submits an application to the territorial branch of the Federal Treasury with a request to change the amount of security. The treasury letter of credit is changed in 2021 only if two conditions are met:

- if the new guarantee amount does not exceed the amount of the letter of credit established by the government contract;

- if the new guarantee amount does not exceed the established limits of budget obligations for the execution of the government contract.

If the conditions are not met, the security amount will not be changed. The Treasury will send a refusal to the customer in the prescribed form.

Accounting and processing of payments using letters of credit

With an uncovered letter of credit, there is no need to transfer the amount required for payment to the bank, which allows you to use the available money in circulation. The bank will pay the seller and then, at the agreed time, will withdraw the amount paid from the buyer’s account. If the buyer does not have the necessary funds, the money will be withdrawn in installments until the debt to the bank is fully repaid.

Info

Opening an uncovered letter of credit does not imply a preliminary transfer of funds to the bank, and therefore account 55.1 is not used in this case. For accounting, off-balance sheet account 009 is used, the debit of which records the amount of the opened uncovered letter of credit, and the credit records its write-off after transferring the amount of the letter of credit to the bank.

Accounting for transactions under letters of credit. accounting entries

With a guaranteed type of letter of credit, the money is withdrawn by the executing bank from the accounts of the issuing bank, after which the agreed amount is written off from the payer's accounts. Accounting from the buying party When applying the covered letter of credit methodology, all actions are carried out according to the following scheme:

- the payer opens a letter of credit with his bank;

- the financial structure debits from the client’s account the funds necessary to repay the obligations under the agreement between the client and his counterparty;

- commodity products are delivered, the bank is presented with documentary evidence of this action;

- payment for shipped products using funds included in the letter of credit;

- when there is a cash surplus, the balance is transferred back to the payer’s account;

- the letter of credit is considered closed.

Covered types of letters of credit are reflected in account 55.

Accounting for a letter of credit in accounting

The fee for creating a letter of credit is paid by the buyer or seller, its size varies and depends on the specific bank. In the first case, the buyer’s commission expenses increase the cost of the purchased assets; in the second case, these expenses from the seller are included in other expenses. Why does this type of money transfer option exist? The fact is that just with the letter of credit form of payment there are a number of important advantages: for example, the supplier receives additional guarantees of payment, and the bank controls the terms of delivery.

But this form of payment also has significant drawbacks, for example, the high interest rate charged by banks and the rather complex circulation of documents. However, thanks to the above-mentioned advantages, it still remains very popular. Accounting for a letter of credit with the seller The seller is the party in whose favor the letter of credit is created.

Equipment put into operation 223,407 Accounting certificate 68.02 19 VAT deductible received 40 119 Consignment note Invoice 008 Closing of letter of credit 263,000 Accounting certificate Uncovered letter of credit Differs from the previous one in that the supplier’s bank writes off the money independently from the correspondent. Accounts of the issuing bank, in the amount of the open letter of credit. Before write-off occurs, the company can use them at its discretion.

An uncovered letter of credit is accounted for on account 009. Settlements with the seller are reflected in standard transactions:

- Debit 60 Credit 51.

Simultaneously with the transfer of money to the supplier, this amount is reflected in Credit 009 of the account. The bank commission is written off as follows:

- Debit 76 Credit 51.

And payment of the debt to the bank for transferring the letter of credit to the supplier - Debit 76 “Settlements under letters of credit” Credit 51.

Recipient of the letter of credit accounting transaction

Tax Code of the Russian Federation or non-operating expenses (marked in %). Bank commission expenses increase the cost of purchased valuables - Deb.08 (10, 41) - Credit.76.

- The arrival of expensive items paid for under a letter of credit is reflected - Deb.08 (10.41) - Credit.60.

- Input VAT is taken into account separately – Deb.19 – Credit.60.

- VAT presented by the supplier is accepted for deduction - Deb.68 - Credit.19.

- Payment is made to the supplier using letter of credit money upon provision of the proper papers - Deb.60 - Credit.55-1.

If there is an uncovered letter of credit, then the bank, which is the executor, itself has the right to withdraw money from the account of the issuing bank. The applicant returns the money to the issuer under the letter of credit according to the written rules between the buyer and the bank.

At the time the payer opens an uncovered letter of credit, the recipient of funds (beneficiary) acquires security under the agreement. Reflect its amount on off-balance sheet account 008 “Securities for obligations and payments received”: Debit 008 – reflects the opening of a letter of credit by the payer. On the day of receipt of funds from the buyer from an open letter of credit, make the following entries: Debit 51 (52) Credit 62 (76) – funds received under the letter of credit; Credit 008 – the amount of the letter of credit is written off from the off-balance sheet account. This follows from the Instructions for the chart of accounts (accounts 62, 76, 008). The basis for recording these transactions are bank notices and account statements (Part 1, Article 9 of the Law of December 6, 2011. The executing bank sends to the issuing bank a second copy of the register of accounts with the attachment of documents required by the terms of the letter of credit, as well as a third copy of the register invoices - for delivery to the payer. This procedure is provided for in clauses 6.15–6.30 of the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P. Closing a letter of credit A letter of credit is opened for a certain period, after which the bank closes it. Before the expiration of this period, the letter of credit can be closed in cases of: - refusal of the recipient of funds (beneficiary) to use the letter of credit before its expiration (if the possibility of such refusal is provided for by the terms of the letter of credit); - demands of the payer for full or partial revocation of the letter of credit (if such revocation is possible under the terms of the letter of credit). Unused amount of the covered amount The executing bank returns the letter of credit to the issuing bank.

To enter a letter of credit, select “Letter of Credit”

from the

“Payment Documents”

“Documents”

menu The form for entering a letter of credit is similar to the forms for other bank documents.

If the “with acceptance”

, you must fill in the details

“Full name of the authorized person...”

, in which you should enter the last name, first name, patronymic and passport details of the authorized person of the buyer.

If a covered letter of credit is issued, then in the field “Account No. post.”

indicates the bank account number, which your counterparty must first inform you of. In the case of an uncovered letter of credit, this field is not available for entry and is crossed out in the printed form.

At the bottom of the dialog window there are buttons:

Please note that in the field “Supplier account number”

in the printed form of the letter of credit, the data is inserted from the

“Counterparties”

.

Collection order

To enter a collection order (instruction), select “Collection order”

from the submenu

“Payment documents”

“Documents”

menu . As a result, a dialog box will open on the screen for entering a new document.

Filling out the collection order form is similar to filling out the payment request form, but it does not contain the “With acceptance”

,

“Term for acceptance”

and

“Terms of payment”

. At the bottom of the dialog window there are buttons:

- “Print”

for generating and printing a payment request; - “OK”

to save the document in the journal; - “Close”

to cancel document entry or changes made.

The organization, when interacting with other legal entities and individuals, uses cash and non-cash funds, which can be expressed both in rubles and in. In addition, an enterprise can use letters of credit and checks for settlements with counterparties.

To account for them, the accounting department provides account 55 “Special bank accounts”, which can be divided into several sub-accounts. The first will take into account letters of credit, the second - the third sub-account is intended to account for the organization's deposits. In this article we will talk more about letters of credit. What it is? What is it used for? What types are there (covered and uncovered, revocable and irrevocable)? How are they accounted for in accounting?

A letter of credit is a monetary obligation that a bank undertakes on behalf of the company paying for the letter of credit. When carrying out a trade transaction, a separate letter of credit is opened for each participant.

Participating in a transaction involving a letter of credit are: the issuing bank (the buyer’s bank that opened A.) and the executing bank (the supplying bank that must receive money from A.).

A letter of credit is used as a guarantee - insurance that allows the selling party to protect itself from non-payment for the delivery in general or partial non-payment for the goods sent under the contract; the buying party receives a guarantee that it will receive the goods for the money transferred. Agree, it is natural for the seller to want to receive money for the shipped goods, and no less natural is the buyer’s desire to pay only when the goods have arrived at the recipient’s warehouse, that is, upon delivery. Settlements using a letter of credit are settlements with the lowest risk, especially when there is insufficient information about the business partner or prepayment is difficult. Even if you think that your transaction partner is reliable, when drawing up sales contracts in the “payment procedure” paragraph, it is better to indicate that payment will be made through a letter of credit and in what form.

A letter of credit can be closed:

- upon expiration of its validity period,

- upon receipt of an application from the supplier to refuse the letter of credit,

- when it is recalled by the buyer.

The disadvantage is that the buyer must withdraw his funds from circulation in advance and reserve them in an account to pay for the goods.

Classification

Reviewable

– allows the buyer’s bank, at its own discretion, without informing the seller, on the basis of a written order from the buyer, to change the terms of the letter of credit or cancel it altogether (the reasons for such actions may be different).

Irrevocable

,

on the contrary, cannot be changed in any way without the consent of the seller of the goods.

Irrevocable A. can be confirmed, and the supplier bank, at the request of the buying bank, confirms it. The execution of the letter of credit in this case is guaranteed by both banks participating in the transaction, which, accordingly, increases the reliability of compliance with the contract and payment for the delivery of goods.

Coated

The buyer of the goods can open a covered letter of credit (deposited) with the bank, and the buying bank immediately transfers money from the buyer’s account, or funds provided to him as a loan for the transaction, to the bank of the supplier of the goods.

Uncovered

If the buyer has opened an uncovered letter of credit (guaranteed) with his bank, then the supplier’s bank has the right to withdraw funds in the amount of the letter of credit from the account of the buyer bank. And, of course, then the buying bank debits the funds from the buyer’s current account.

Between organizations (clause 1 of article 862, article 867 of the Civil Code of the Russian Federation). The procedure for carrying out settlements in Russia is regulated by Chapter 6 of the Regulations approved on June 19, 2012 No. 383-P and Articles 867-873 of the Civil Code of the Russian Federation. When making international payments, you should be guided by the Uniform Customs and Practice for Documentary Credits published by the International Chamber of Commerce (ICC Uniform Customs and Practice for Documentary Credits UCP 600).

Letters of credit can be covered, uncovered, revocable and irrevocable (Articles 867, 868 and 869 of the Civil Code of the Russian Federation). In international practice, a letter of credit implies exclusively an irrevocable obligation and is used along with (Articles 2 and 3 of the Uniform Customs and Practice for Documentary Credits, published by the International Chamber of Commerce).

To provide for settlements under a transaction using a letter of credit, write this condition in the contract. Also agree on the type of letter of credit that the parties will use for settlements. This procedure follows from the provisions of Articles 421, 422, paragraph 1 of Article 516 of the Civil Code of the Russian Federation. Let's look at the accounting of a letter of credit.

What is treasury collateral?

LLC, or treasury letter of credit, is a payment document that is generated by the Federal Treasury. The paper is created on the basis of a written application from the recipient of budget funds (customer). In essence, this is a financial guarantee that PBS undertakes to pay the obligations of the contractor of the government contract if the established conditions are met.

In the public procurement system, it is used as a partial or complete replacement for advance payments for contracts and agreements. The type of financial instrument is used to reduce accounts receivable and eliminate advances on unfulfilled obligations.

Accounting: covered letter of credit

When opening a covered letter of credit, the bank opens a special account to which it transfers funds from the organization’s current account (clause 6.10 of the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P).

Account for movement under the letter of credit on account 55 “Special accounts in banks” subaccount 55-1 “Letters of credit”.

Reflect the transfer of funds to the letter of credit by posting:

DEBIT 55-1

CREDIT 51 (52, 66, 67)

- funds were transferred for the letter of credit.

As you use the funds on the letter of credit, make notes:

DEBIT

60 (76) CREDIT 55-1

- settlement has been made with the beneficiary using the funds of the letter of credit;

DEBIT

51 (52) CREDIT 55-1

- unused funds were returned to the current account.

This procedure follows from the Instructions for the chart of accounts.

The basis for recording these transactions are written messages from the bank, as well as account statements (Part 1, Article 9 of Law No. 402-FZ of December 6, 2011).

At the time the payer opens a covered letter of credit, the recipient of funds (beneficiary) acquires security under the agreement. Reflect its amount on off-balance sheet account 008 “Securities for obligations and payments received”:

DEBIT

008

Since a letter of credit is only a form of non-cash payments between organizations, in the accounting of the recipient of funds (beneficiary), the operation of receiving payment from the counterparty is reflected in the general manner:

DEBIT

51 CREDIT 62 (76)

- the receipt of funds is reflected;

LOAN

008

The basis for this posting is the bank’s account statements (Part 1, Article 9 of the Law of December 6, 2011 No. 402-FZ).

For more information about this, see How to reflect the sale of goods in bulk in accounting and for taxation, How to reflect the sale of finished products in accounting and for taxation, How to reflect the sale of work (services) in accounting and for taxation.

Expected changes in 2021

Officials did not limit themselves to introducing new forms of documents for treasury security of obligations carried out through the Federal Treasury. The draft instructions of the Central Bank of Russia on the approval of documentation forms for banking support of LLCs are already under consideration in the State Duma.

Officials plan to introduce two new forms:

- form for banking support of government contracts;

- application for the issuance of security for banking support of government contracts.

After approval, the new forms will become mandatory to fill out if the LLC is carried out with banking support for the execution of government contracts. Follow the process of considering the bill on the official government website.

| on changes in 2021 “Forms of LLC documents for banking support” |

| for the issuance of treasury security for obligations |

| for issuance of LLC |

| for the execution of the CC |

| for the execution of the CC |

Accounting: uncovered letter of credit

When opening an uncovered letter of credit, money is not reserved in the payer's special account at the issuing bank. In this case, the issuing bank instructs the nominated bank (the bank in which the beneficiary's account is opened) to write off funds from his correspondent account with this bank up to the amount of the letter of credit. In this case, the organization has a debt to the issuing bank in the amount of reimbursement of funds written off under the letter of credit (at the time of repayment of the debt to the seller).

This procedure follows from the provisions of paragraph 2 of Article 867 of the Civil Code of the Russian Federation and paragraphs 6.20-6.21 of the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P.

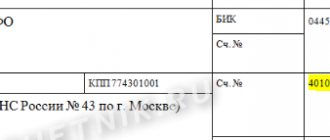

Reflect the amount of debt to the bank under an uncovered letter of credit on account 76 “Settlements with various debtors and creditors.” In this case, you can open a sub-account “Settlements with the bank under letters of credit” to account 76.

The opening of an uncovered letter of credit from the payer constitutes the issuance of security under the contract. Record its amount in off-balance sheet account 009 “Securities for obligations and payments issued.”

Reflect settlements under an uncovered letter of credit using the following entries.

When submitting an application to open an uncovered letter of credit:

DEBIT

009

- an uncovered letter of credit has been opened.

As you use the funds on the letter of credit, make a note:

DEBIT

60 CREDIT

- payment was made to the beneficiary from an uncovered letter of credit.

When repaying a debt to a bank under a used letter of credit, make the following entries:

DEBIT

76 “Settlements with the bank under letters of credit” CREDIT 51

- the debt to the bank under the letter of credit has been repaid;

CREDIT

009

- an uncovered letter of credit is written off from the off-balance sheet account.

This procedure is provided for in the Instructions for the chart of accounts (accounts 009, 60, 76).

Example

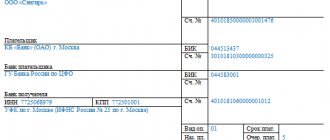

On June 1, Alfa CJSC supplied equipment from Torgovaya LLC. The cost of the equipment is 500,000 rubles. (including VAT - RUB 76,271). According to the terms of the supply agreement, payment for equipment is made from an uncovered letter of credit.

On the same day, Alpha submitted an application to the servicing bank to open an uncovered letter of credit in the amount of RUB 500,000.

The basis for transferring money to Hermes is the submission by the supplier to the executing bank of a bill of lading, a bill of lading and an invoice for payment for equipment. According to the terms of the agreement, payment is made no later than seven working days from the date the supplier submits supporting documents to the executing bank. the issuing bank is 0.3 percent of the amount of the letter of credit, but not less than 10,000 rubles.

The equipment was delivered on June 8 (“Alpha” immediately put the equipment into operation). On the same day, Hermes submitted supporting documents to the nominated bank in accordance with the terms of the letter of credit. On June 17, the bank transferred money from the correspondent account of the issuing bank to the Hermes account. On the same day, the issuing bank wrote off this amount from Alfa’s current account.

The following entries were made in Alpha's accounting.

DEBIT

009

- 500,000 rub. — an uncovered letter of credit has been opened;

DEBIT

76 CREDIT 51

- 10,000 rub. — the bank’s commission for opening a letter of credit has been written off.

DEBIT

08 CREDIT 60

- 427,729 rub. — equipment is accepted for accounting;

DEBIT

08 CREDIT 76

- 10,000 rub. — the commission amount is included in the initial cost of the equipment;

DEBIT

19 CREDIT 60

- 76,271 rub. — input VAT is reflected;

DEBIT

01 CREDIT 08

- 423,729 rub. — equipment was put into operation;

DEBIT

68 subaccount “Calculations for VAT” CREDIT 19

- 76,271 rub. — input VAT is accepted for deduction.

DEBIT

60 CREDIT 76 “Settlements with the bank under letters of credit”

- 500,000 rubles. — payment was made to the supplier from an uncovered letter of credit;

DEBIT

76 “Settlements with the bank under letters of credit” CREDIT 51

- 500,000 rubles. — the debt to the bank under the letter of credit has been repaid;

LOAN

009

- 500,000 rub. — an uncovered letter of credit is written off from the off-balance sheet account.

Since a letter of credit is only a form of non-cash payments between organizations, in the accounting of the recipient of funds, payment receipts from the counterparty are reflected in the general manner. For more information, see:

· How to reflect the sale of goods in bulk in accounting and taxation;

· How to reflect the sale of finished products in accounting and taxation;

· How to reflect the implementation of work (services) in accounting and taxation.

At the time the payer opens an uncovered letter of credit, the recipient of funds (beneficiary) acquires security under the agreement. Reflect its amount on off-balance sheet account 008 “Securities for obligations and payments received”:

DEBIT

008

- reflects the opening of a letter of credit by the payer.

On the day of receipt of funds from the buyer from an open letter of credit, make the following entries:

DEBIT

51 (52) CREDIT 62 (76)

- funds received under the letter of credit;

CREDIT 008

— the amount of the letter of credit is written off from the off-balance sheet account.

This follows from the Instructions for the chart of accounts (accounts 62, 76, 008).

The basis for recording these transactions are bank notices and account statements (Part 1, Article 9 of Law No. 402-FZ of December 6, 2011).

|

|

Treasury support

If the execution of the contract involves the use of targeted financing, then support from the Treasury is mandatory. In 2020, FC maintenance support is provided for the funds specified in Part 2 of Art. 5 of Federal Law No. 459-FZ of November 29, 2018, subject to the exceptions established in Part 3 of Art. 5 of Law No. 459-FZ.

If the purchase requires a CC, then provide a condition for a letter of credit from the Treasury at the stage of forming a draft government contract. In addition, the LLC will have to be included in contracts and agreements that are concluded as part of the execution of a government contract.

For example, cases when treasury security for obligations during treasury support is mandatory:

- budgetary investments and subsidies to organizations, except for budgetary and autonomous institutions, provided under Art. 80 BC of the Russian Federation;

- advances on state (municipal) contracts in an amount exceeding 100 million rubles (with the exception of state defense orders);

- settlements under contracts concluded with a single supplier (clause 2, part 1, article 93 of Law No. 44-FZ), and under contracts concluded as part of their execution;

- funds received by organizations and individual entrepreneurs in cases provided for by the government of the Russian Federation.

Budget funds are transferred to pay for accepted obligations only after receipt of the LLC. The security is credited to the contractor’s account only in the amount that is documented. For example, when the contractor presents documents confirming the actual delivery or shipment of goods, provision of services, or performance of work.

Letter of Credit. Transferring funds

A letter of credit is a form of payment between a buyer and a seller. The form of settlements through a letter of credit is a variant of non-cash payment between counterparties, in which the Buyer's bank, on behalf of the Buyer, undertakes to settle with the Seller the amount indicated in the letter of credit upon submission of documents by the Seller to the bank in accordance with the terms of the letter of credit within the time period specified in the text of the letter of credit.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 55.01 | 66.01 | Opening a letter of credit using a short-term loan | Amount of loan received | Bank statement |

| 55.01 | 67.01 | Opening a letter of credit using a long-term loan | Amount of loan received | Bank statement |

| 55.01 | 66.03 | Opening a letter of credit using a short-term loan | Amount of loan received | Bank statement |

| 55.01 | 67.03 | Opening a letter of credit using a long-term loan | Amount of loan received | Bank statement |

| 55.01 | 51 | Funds have been credited to the letter of credit from the current account | Letter of credit amount | Payment orderBank statement |

Banking support

The procedure for implementing the CC in case of banking support of a contract in 2021 is established by the provisions of the Ministry of Finance of Russia No. 239n, Bank of Russia No. 707-P dated December 19, 2019.

IMPORTANT!

The forms of documents and the procedure for filling them out have not been established at this time. The draft instructions of the Central Bank of the Russian Federation are under consideration in the State Duma. Before their approval, it is advisable to be guided by the procedure and forms used in 2021.

Depending on the case, fill out the application:

- the state customer - for the issuance of the LLC;

- performer or co-executor under a government contract - for translation. The application is submitted to the bank;

- the bank that provides banking support for the government contract - for execution.

Fill out the application for the issuance (transfer, execution) of the LLC with banking support according to the approved forms (Treasury Order No. 34n). In it, indicate the information required by the procedure for filling out the required form (Part 9, Article 5 of Federal Law No. 380-FZ dated December 2, 2019).

Letter of Credit. Settlements with suppliers and contractors

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 60.01 | 55.01 | Write-off of funds in the Letter of Credit as payment for supplied products, works, services, fixed assets, intangible assets and other assets | Amount of payment to suppliers and contractors | Bank statement |

| 60.02 | 55.01 | Transfer of advance payment to suppliers and contractors in a Letter of Credit (subject to the type of Letter of Credit with a red clause) | Advance amount listed in the letter of credit | Bank statement |

| 76.01 | 55.01 | Funds were transferred from the letter of credit for settlements for insurance | Insurance payment amount | Bank statement |

| 76.02 | 55.01 | Funds were transferred from the letter of credit to settle claims | Claim payment amount | Bank statement |

| 76 | 55.01 | Funds were transferred from the letter of credit for settlements with other debtors and creditors | Amount of payment to other debtors and creditors | Bank statement |