BCC for insurance premiums for 2021 are budget classification codes, the purpose of which is the grouping and distribution of payments received by the budget and extra-budgetary funds.

Insurance contributions to extra-budgetary funds must be paid by all organizations and entrepreneurs, although there are differences in individual insurance contributions for companies with and without employees. There is one detail on which the correct transfer of insurance premiums in 2021 depends - KBC. We will find out what it is, why it is needed and how it changes.

When to pay

Despite the fact that budget transfers for social insurance from 2021 are transferred to different authorities (to the Federal Tax Service and the Social Insurance Fund), the payment deadline is the same for each SV. Policyholders are required to transfer all necessary payments to the relevant authorities before the 15th day of the month following the reporting month (clause 3 of Article 431 of the Tax Code of the Russian Federation, clause 4 of Article 22 125-FZ).

Read more: payment deadlines for all social insurance payments

Here is a list of the main insurance premiums that must be paid for employees, and the KBK table for insurance premiums for 2021 contains all the data that specialists will need when paying insurance premiums.

This might also be useful:

- Changes in individual entrepreneur taxation in 2021

- What taxes does the individual entrepreneur pay?

- Calculation of income tax from salary

- How much taxes does an individual entrepreneur pay in 2021?

- The amount of insurance premiums for compulsory health insurance and compulsory medical insurance for individual entrepreneurs in 2021

- Fixed payments for individual entrepreneurs in 2021 for themselves

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Budget classification codes

| Payment Description | Payment type | Budget classification code |

| Compulsory pension insurance at basic rates (KBK for pension contributions) | NE | 182 1 0210 160 |

| Penalty | 182 1 0210 160 | |

| Fines | 182 1 0210 160 | |

| Compulsory health insurance | NE | 182 1 0213 160 |

| Penalty | 182 1 0213 160 | |

| Fines | 182 1 0213 160 | |

| Compulsory social insurance | NE | 182 1 0210 160 |

| Penalty | 182 1 0210 160 | |

| Fines | 182 1 0213 160 |

Fixed payments for individual entrepreneurs in 2021

For entrepreneurs, fixed amounts of contributions for health and pension insurance are established. It does not matter whether he is active or not, personal contributions will still have to be paid (except for the cases listed in the Tax Code of the Russian Federation).

After the transfer of insurance payments for compulsory medical insurance and compulsory health insurance under the control of the Federal Tax Service, the federal law establishes a new procedure for determining individual entrepreneur contributions, which is not tied to the minimum wage. Since 2018, officials have established personal contributions for entrepreneurs for each reporting year.

So in 2021, the mandatory medical payment for individual entrepreneurs is set at 8,426 rubles.

Pension contributions to the Federal Tax Service in 2021, as well as the previously paid contribution to the Pension Fund, depend on the income of the entrepreneur (in rubles):

- income within three hundred thousand - the amount of contributions to compulsory pension insurance is 32,448 rubles;

- income exceeding three hundred thousand - the amount of contributions to the compulsory pension insurance consists of a fixed payment (32,448) and 1% of the amount exceeding three hundred thousand.

Example 1. In 2021, entrepreneur Ivanov I.I. received an income of 430,000 rubles. He calculated the amount of contributions payable to the OPS as follows:

32,448 + 1% × (430,000 − 300,000) = 33,748 rubles.

Note that the contribution to pension insurance should not exceed the maximum amount, which is equal to the product of the fixed pension payment by eight. For 2021, its size is 259,584 rubles (32,448 × 8).

An entrepreneur can transfer personal contributions in a lump sum in the established amount or in installments throughout the year in order to apply a tax deduction. In any case, contributions to compulsory medical insurance and compulsory health insurance in a fixed amount for 2021 must be paid before December 31, 2021, and the 1% pension contribution must be paid before July 1, 2021.

Example 2. In 2021, entrepreneur Ovechkin K.K. received income in the amount of 22,500,000 rubles. He calculated the amount of pension contributions payable using the formula:

32,448 + 1% × (25,500,000 − 300,000) = 284,448 rubles.

Since the amount received is greater than the maximum allowable for pension contributions, you need to pay the maximum amount established by law - 259,584 rubles. At the same time, 32,448 rubles Ovechkin K.K. must be paid by December 31, 2021, and the remaining 227,136 rubles by July 1, 2021.

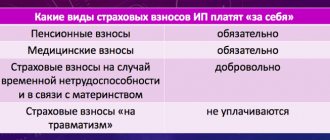

As for contributions in case of temporary disability and maternity (VNiM), entrepreneurs are not required to pay “for themselves”, but, if they wish, they can register with social insurance and transfer contributions to social insurance. The payment period is similar to contributions for compulsory medical insurance and compulsory health insurance, but the amount is set based on the minimum wage at the beginning of 2021 and amounted to 4,280 rubles. 4 kopecks

OPS at additional rates

| Type payment | BCC for OPS - the tariff does not depend on the results of the special assessment | Code - the tariff depends on the results of the special assessment |

| List 1 - insured persons employed in work in accordance with clause 1, part 1, art. 30 400-FZ | ||

| Basic payment | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 182 1 0210 160 | 182 1 0200 160 |

| Fines | 182 1 0210 160 | 182 1 0200 160 |

| List 2 - insured persons employed in work in accordance with clause 2-18, part 1, art. 30 400-FZ | ||

| NE | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 182 1 0210 160 | 182 1 0200 160 |

| Fines | 182 1 0210 160 | 182 1 0200 160 |

Additional SV is paid by the employer and the insured person for separate codes, directly to the Pension Fund.

Here are the BCCs for insurance contributions to the Pension Fund in 2021 used for transfers by the employer:

- at the expense of the employee - 392 1 0200 160;

- at the expense of the employer - 392 1 0200 160.

The insured person independently - 392 1 0200 160.

Use similar BCC values for insurance premiums for May 2020 when filling out payment orders.

The need for BSC

The KBK code system was created to regulate financial flows at the state level. Thanks to the Budget Classification Codes, a budget program is drawn up and implemented at the municipal and federal levels.

Individual entrepreneurs should also know the BCC. The fact is that individual entrepreneurs make numerous monthly and annual contributions to non-budgetary organizations and funds, taxes and other budget payments. BCCs are indicators on payment orders and help streamline financial reporting. In addition to the fact that the BCC is indicated in payment documents, the procedure for drawing up some reports also requires the BCC to be indicated in them.

In 2021, just like last year, field 104 is intended for indicating the BCC in the payment order.

Who pays

Insurance refers to payments to the budget system of the Russian Federation, which are transferred by employers who attract workers under labor and civil law contracts. They are transferred to the budget for the purpose of further redistribution to the needs of citizens upon the occurrence of certain insured events: temporary disability, pregnancy and parental leave, retirement, etc.

Specialists must transfer payments for compulsory pension and health insurance, maternity and temporary disability to the territorial tax office. Payments for accidents and occupational diseases (injuries) are sent to the regional Social Insurance Fund.

The insured is any legal entity or individual who uses hired labor in their activities. Insurance payers include the following categories of policyholders:

- legal entities - commercial and non-profit organizations, budgetary institutions;

- individual entrepreneurs who pay remuneration to employees;

- individual entrepreneurs working for themselves;

- individuals who hire workers to meet their household needs.

IMPORTANT!

At the end of the reporting period, SV payers must provide information about accruals and payments made to regulatory authorities. Learn more about current reporting information.

Changes for 2021

There will be several important changes in the activities of individual entrepreneurs next year, that is, when studying the KBK insurance premiums to the Compulsory Medical Insurance Fund in 2021 for individual entrepreneurs for yourself, you need to know about all the innovations, because not only insurance premiums are important, but also compliance with all norms. For example, it is worth saying that tax holidays will be introduced for newcomers, and individual entrepreneurs in the field of information technology will receive benefits.

New registration form. Starting from the new year, individual entrepreneurs will need to submit an updated application form to register. It added some changes, for example, added a line for an email address and added names by place of residence.

Taking into account the fact that the world is moving to remote work, it is almost impossible to run a business without email, so if such a tool is not yet available to an entrepreneur, you need to make sure that it does appear.

Tax holidays have been extended. If earlier this privilege was supposed to be valid until the end of 2021, today it was decided to extend it until the end of 2023. We are talking about vacations for new entrepreneurs. And regional authorities have the opportunity to establish additional conditions for the regions that relate to this issue.

Tax on professional income. The point is that the tax regime for self-employed citizens in 2021 will apply throughout the country. Those entrepreneurs who combine self-employed SMS employment should also know about this. This happens quite often today.

Information about employees, more precisely about the average number of employees, will now be included as part of the insurance premium. The previous submission form has become invalid since January 2021 and now the average number of employees will need to be reported quarterly, along with insurance premiums, otherwise KBK insurance premiums will be fined.

Benefits for the “World” card. Now benefits paid at the expense of the Social Insurance Fund can only be paid to the Mir card. This innovation does not affect sick leave payments - for the first three days, the employer transfers the payment to any card. The same will apply to wages, bonuses and benefits for sick children.

However, speaking about the “Mir” card, it will now receive all benefits for the birth of a child, payments for child care, as well as other budget transfers. If you don’t have such a card, you can replace the payment with a bank account or postal order. However, you need to understand that in this case the period for transferring money may increase significantly.

Important fact. Due to the pandemic, experts who previously advocated for a mandatory law on transferring pension payments on the Mir card have extended the deadline for the transition to these cards until July 1, 2021.

Direct payments to KBK FSS. Starting this year, all regions of the country should switch to direct payments to the Social Insurance Fund. The principle for calculating benefits will be the same, but the company that receives documents for benefits from a person sends them to the fund electronically, and it is the fund that pays the money personally.

The country switched to this system in stages, and the transition began back in 2011, but this year should be the final period of the transition. The employer is exempt from paying benefits.

BCC for trade fee of legal entities 2021

The fee was introduced in the capital by Moscow Law No. 62 dated December 17, 2014; it is not collected in other regions.

| KBK | Decoding |

| 182 1 0500 110 | Trade tax paid in the territories of federal cities |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| KBK | Decoding |

| 048 1 1200 120 | Environmental fee |

| KBK | Decoding |

| 182 1 1500 140 | Fee for the use of resort infrastructure (resort fee) |

The list of codes is supplemented by two BCCs for penalties for non-payment of the recycling fee for self-propelled vehicles and trailers for them imported into the Russian Federation from Belarus and other countries (approved by order of the Ministry of Finance of the Russian Federation dated September 20, 2018 N 198n).

| KBK | Decoding |

| 153 1 1200 120 | Recycling fee for wheeled vehicles and trailers imported into the Russian Federation (except for those imported from the Republic of Belarus) |

| 153 1 1210 120 | penalties |

| 153 1 1200 120 | Recycling fee for wheeled vehicles and trailers imported into the Russian Federation from the Republic of Belarus |

| 1 1210 120 | penalties |

| 153 1 1200 120 | Recycling fee for wheeled vehicles and trailers for them produced and manufactured in the Russian Federation |

| 153 1 1200 120 | Recycling fee for self-propelled vehicles and trailers for them, produced or manufactured in the Russian Federation |

| 153 1 1200 120 | Recycling fee for self-propelled vehicles and trailers for them imported into the Russian Federation, except for self-propelled vehicles and trailers for them imported from the territory of the Republic of Belarus |

| 153 1 1220 120 | penalties |

| 153 1 1200 120 | Recycling fee for self-propelled vehicles and trailers for them imported into the Russian Federation from the territory of the Republic of Belarus |

| 153 1 1230 120 | penalties |

kbk 2018