Returnable waste in accounting

Industrial waste is generated as a result of processing raw materials into finished products.

Residues from raw materials and materials that have completely or partially lost their properties are called waste. Waste can be irretrievable or returnable. The first of them cannot be reused by the enterprise due to technological features, and also cannot attract a buyer. They are disposed of and are not reflected in accounting. Returnable waste (hereinafter referred to as RR), on the contrary, can either be used a second time as raw materials for the main production, or for auxiliary production, or sold to third parties. Examples of VO can be whey in the production of cottage cheese, sawdust in the wood processing industry, scrap metal in the production of metal structures, sunflower husks in the production of vegetable oil, etc.

Starting from 2021, materials must be accounted for according to the new Federal Accounting Standard “Reserves”. The new accounting rules are discussed in detail in the Ready-made solution from ConsultantPlus. If you do not have access to this legal system, a full access trial is available for free.

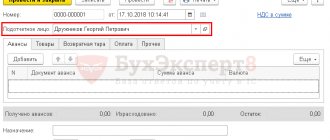

Accounting for VO is regulated by clause 111 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n. When delivering waste from production to a warehouse or when moving it to another workshop, an invoice is issued for the internal movement of materials (clauses 57, 111 of the Methodological Instructions). You can use for these purposes the unified form M-11, approved by Decree of the State Statistics Committee of the Russian Federation dated October 30, 1997 No. 71a, or develop such a primary document yourself. The process of waste collection and transfer is described in internal regulations. To control their safety, it is necessary to organize analytical accounting of VOs by their types and storage locations. VO are accounted for at the prices prevailing for these wastes on the market, that is, at the price of possible use or sale, by posting Dt 10 Kt 20, 23, 29. Thus, waste materials newly supplied to account 10 reduce the cost of materials that are transferred to production .

Note! If no economic benefit is expected from the resulting waste, then such waste does not need to be taken into account on the balance sheet. However, the enterprise must organize accounting of waste movement to ensure the collection of complete information about the places where waste occurs, its types, as well as the quantitative composition of waste. In this case, it is necessary to keep records in a separate off-balance sheet account or in a separate analytical register intended for such property.

How to determine the price of VO? There are several options:

- Take the price from the contract for the sale of this waste.

- If the sale price is not yet known, determine the market value at the time the waste is received into the warehouse.

- Conduct an expert assessment of the price of their possible use as the ratio of the consumer properties of the starting materials and VO to their cost.

The first and second methods are relevant if the waste is sold. If they are reused at the enterprise, then the second and third options can be used. The method of determining the price must be fixed in the accounting policy.

For general information about materials accounting, read the article “Accounting entries for materials accounting.”

Legislative regulation

The main provisions and responsibilities for waste management are contained in Federal Law-89. Responsibility for waste disposal lies with the original owner, the organization where it was generated.

Production waste is divided into irrecoverable and returnable. The first are materials with completely lost original useful properties. Their implementation or reuse is not possible. The latter can be used in production or sold for further use.

Irrevocable waste is not reflected separately in the balance sheet. These are production (technological) losses, the standard of which is included in the consumption rates of raw materials when calculating the cost of the finished product: shrinkage, volatilization, waste, evaporation. According to the “Basic provisions for calculating the cost of products” clause 27 (approved 20/07/70, valid document), irrecoverable waste is not subject to assessment. This means that the accountant does not need to determine their value and create postings. We can say that indirectly their disposal is paid for by the company itself through the mechanism for calculating production costs. All that is required is their technological accounting.

Returnable waste can be disposed of directly. Federal Law 89 defines waste disposal as its use in the production of products, services, and work. At the same time, for accounting purposes, residues of materials that have retained all their consumer properties and are transferred to other departments and workshops are not recognized as waste (Article 254-6 of the Tax Code of the Russian Federation).

Tax accounting of returnable waste

In the Tax Code, the definition of VO is given in paragraph 6 of Art. 254. The legislator clarifies that if the remaining materials are used for the manufacture of other goods by other divisions as full-fledged material, then they are not VO, just like by-products.

It is necessary to reduce the amount of material costs by the cost of returnable materials, and the method for assessing VO directly depends on their future fate:

- use - the price of possible use or the reduced price of raw materials;

- sale - selling price.

In the first case, the assessment method is determined using special calculations, which depend on the type of production, the material used, and the technological process. The calculation takes into account the beneficial properties of the waste, the beneficial properties of the product that will be obtained from this waste, physical indicators, etc. For each enterprise this will be its own specific calculation, which needs to be fixed in the accounting policy.

As for sales, if the sales price is already fixed in the contract or specification, then there are no problems. If it is not yet known what price of the transaction will be set, then the question of its determination will affect the amount of material costs. The desire to reflect the VO at the actual actual selling price that will be established in the future can become a serious problem for the accountant. Why? Let's consider two options:

- the receipt of waste and its sale occurred in the same reporting period;

- The receipt of waste occurred in the current period, and their sale - in the next.

If we did not guess correctly with the selling price and capitalized the waste at an underestimated or overestimated cost, then in the first case we will find that the reduction in material costs and the increase in the cost of goods sold will occur by the same amount. Therefore, the income tax result will not be affected.

If we underestimate the selling price of waste in the second case, then the material costs of the current period will be overestimated, which leads to underpayment of income tax, penalties and fines. And in the next period, on the contrary, it will overpay. You will have to submit clarifications and answer questions from tax specialists, which is extremely undesirable. Therefore, let us turn to the explanations of the Ministry of Finance. Letters dated 04/26/2010 No. 03-03-06/4/49, dated 09/18/2009 No. 03-03-06/1/595 state: “VO should be assessed based on market prices determined in the manner prescribed by Art. 40 of the Code." Let us clarify that the market price is determined at the time of receipt of waste, because that is when we need to evaluate it for reflection in accounting.

The Ministry of Finance also explains in the mentioned letter No. 03-03-06/4/49 that when selling VO, revenue is reduced by their value determined in tax accounting, and profit from such a transaction is taxed. It is worth noting that no one is insured against loss, since the amount of income from the sale determined in accordance with clause 1 of Art. 249 of the Tax Code of the Russian Federation, may be less than the cost of waste, which is included in expenses in accordance with subparagraph. 2 p. 1 art. 268 of the Tax Code of the Russian Federation and for which material costs were reduced. Let's look at the example of accounting and tax accounting of VO.

Example

LesTorg LLC sells VO - sawdust that remains after processing logs into timber. Let's assume that the cost of manufacturing the timber amounted to 8,756,000 rubles. before accounting for VO. 1 ton of sawdust has been received into the warehouse, the selling price of which is 5 rubles. per kg excluding VAT. LesTorg has an agreement concluded with the buyer, which stipulates the specified price. The manufactured timber was sold for RUB 11,388,000, including VAT of RUB 1,898,000.

| Operation | Dt | CT | Amount, thousand rubles |

| The costs of manufacturing timber are reflected | 20 | 02, 10, 70, 69, | 8 756 |

| Posted to the VO warehouse | 10.6 | 20 | 5 |

| The cost of finished products is reflected | 43 | 20 | 8 751 |

| Reflected revenue from the sale of timber | 62 | 90.1 | 11 388 |

| VAT on the sale of timber is reflected | 90.3 | 68 | 1 898 |

| The cost of timber is reflected | 90.2 | 43 | 8 751 |

| Finnish reflected result from the sale of timber | 90.9 | 99 | 900 |

| Reflected revenue from the sale of sawdust | 62 | 91.1 | 739 |

| VAT on the sale of sawdust is reflected | 91.2 | 68 | 1 |

| The cost of sawdust is reflected | 91.2 | 10.6 | 6 |

| Finnish reflected result from the sale of sawdust | 91.9 | 99 | 0 |

In tax accounting we receive the following data:

| Index | Finished products - timber, thousand rubles. | Returnable waste - sawdust, thousand rubles. | Total, thousand rubles |

| Sales income | 9 490 | 5 | 9 495 |

| Cost price | 8 751 | 5 | 8 756 |

| Taxable income | 739 | 0 | 739 |

Let's consider the situation if LesTorg LLC did not have an exact amount for the sale of returnable waste, but used market prices. For example, the market price of sawdust at the time of their receipt was 3 rubles. per kg (the selected price can be fixed by attaching, for example, a competitor’s price list to the primary documents). LesTorg LLC sold 1 ton of returnable waste for the same price of 5 rubles. per kg excluding VAT (VAT - 0.833 rubles). We receive the following entries in accounting.

| Operation | Dt | CT | Amount, thousand rubles |

| The costs of manufacturing timber are reflected | 20 | 02, 10, 70, 69, | 8 756 |

| Posted to the VO warehouse | 10.6 | 20 | 3 |

| The cost of finished products is reflected | 43 | 20 | 8 753 |

| Reflected revenue from the sale of timber | 62 | 90.1 | 11 388 |

| VAT on the sale of timber is reflected | 90.3 | 68 | 1 898 |

| The cost of timber is reflected | 90.2 | 43 | 8 753 |

| Finnish reflected result from the sale of timber | 90.9 | 99 | 737 |

| Reflected revenue from the sale of sawdust | 62 | 91.1 | 6 |

| VAT on the sale of sawdust is reflected | 91.2 | 68 | 1 |

| The cost of sawdust is reflected | 91.2 | 10.6 | 3 |

| Finnish reflected result from the sale of sawdust | 91.9 | 99 | 2 |

In tax accounting we receive the following data:

| Index | Finished products - timber, thousand rubles. | Returnable waste - sawdust, thousand rubles. | Total, thousand rubles |

| Sales income | 9 490 | 5 | 9 495 |

| Cost price | 8 753 | 3 | 8 756 |

| Taxable income | 737 | 2 | 739 |

Expenses in accordance with articles of KOSGU

Quite often the question arises as to which articles of the KOSGU to include certain waste-related expenses. Article 225 of KOSGU is intended for funds spent under the contract. The subject of the agreement may be recycling, removal of solid waste or industrial waste. In this case, the choice of KOSGU article does not depend on the type of waste. There are no specific instructions in this regard. It is important who performs the work under the contract. According to the order of the Ministry of Finance of July 1, 2013 No. 65n, 225, Article KOSGU is applied if all work under the contract is performed by one contractor. KOSGU articles are selected in such a way that accounting is carried out in the most convenient way. It is important that these articles of KOSGU and the accounting system should not conflict.

The collection or disposal of industrial waste, as well as solid waste, may be classified under Article 225 or 226 of KOSGU. This also includes funds spent on paying for the contract under which the burial is carried out by the contractor. Thus, withdrawal costs are Article 225 of KOSGU, transportation costs are Article 225 of KOSGU, and burial costs are Article 226 of KOSGU. Regardless of the type of industrial waste.

Below you can watch a useful video

Results

In both accounting and tax accounting, capitalized VOs reduce the amount of material expenses. The organization must choose a method for determining the price at which VOs will be capitalized in accounting, and consolidate this in the accounting policy.

For many industries, the presence of returnable packaging is also relevant, about accounting for which read in the article “Accounting for returnable packaging: price, postings, taxes.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Disposal procedure

The owner can go two ways.

- Entrust removal and further disposal to a specialized company. To do this, you will need accounting data on waste volumes recorded in documents. Hazardous waste (Article 4.1 of Federal Law-89) requires a disposal license.

- Independently take into account waste and make decisions about its disposal, for example, about transferring waste to production.

In order to have grounds for reflecting recycling in accounting and accounting records, it is necessary to create an internal waste write-off commission. It includes technical specialists, economic service employees, and the manager. The commission determines the inventory items to be disposed of. The decision of the commission is formalized in an act.

OSNO and UTII

If an organization combines UTII and the general taxation system, it needs to organize separate accounting for profit tax and VAT (clause 9 of Article 274, clauses 4 and 4.1 of Article 170 of the Tax Code of the Russian Federation). As a rule, returnable waste can be attributed to some type of activity of the organization. Those returnable waste that relate to the organization’s activities on the general taxation system will reduce material costs for income tax (clause 6 of Article 254 of the Tax Code of the Russian Federation). Do not take into account returnable waste received from activities on UTII for tax purposes (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

Situation: is it necessary to distribute returnable waste, for which it is impossible to unambiguously determine the type of activity to which it belongs, between activities on the general taxation system and UTII?

Answer: no, it is not necessary.

Returnable waste itself is not an expense for the organization. Material costs are reduced by their amount, which must then be distributed according to the rules of paragraph 9 of Article 274 of the Tax Code of the Russian Federation.