In accounting, advance payments calculated from both the balance sheet and cadastral value are reflected by the following entries:

Debit 26 (44) Credit 68

– an advance payment of property tax has been accrued if reporting periods are established by regional law.

To calculate income tax, advance payments are taken into account as expenses on the accrual date (clause 1, clause 1, article 264, clause 1, clause 7, article 272 of the Tax Code of the Russian Federation, letter of the Ministry of Finance dated September 21, 2015 No. 03-03-06 /53920).

In the income tax return, advance payments are reflected on line 041 of Appendix No. 2 to Sheet 02 on an accrual basis in the total amount accrued in the reporting period (clause 7.1 of the Procedure for filling out the declaration).

General provisions

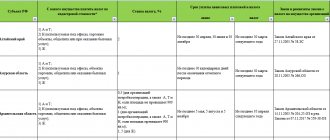

Companies are required to report on “interim” payments 3 times a year - for 3, 6 and 9 months. The deadline for submitting the form is the 30th day of the month following the reporting period.

Before filling out the calculation, you should find out a number of important nuances:

- the need to submit it in principle, since regional authorities have the right to cancel advances on property taxes on their territory;

- the rate in your region, which is set by the authorities of the subject;

- availability of tax incentives, which allows you to reduce the amount of tax;

- category of property: the method of calculating tax depends on this - by residual or cadastral value;

- cadastral numbers of taxable objects - by their first digits you can understand which territorial inspection the form should be sent to.

Object of corporate property tax

For Russian organizations, the object of taxation is movable and immovable property, recorded on the organization’s balance sheet as an object of fixed assets (account 01).

Property exempt from taxation

The following are not subject to property tax:

- Land plots, water bodies and other environmental management facilities.

- Objects of cultural heritage (historical and cultural monuments).

- Nuclear installations, storage facilities for nuclear materials, disposal of radioactive waste.

- Space objects.

- Vessels registered in the international ship registry.

- Other objects specified in clause 4 of Art.

374 Tax Code of the Russian Federation .

note

that from January 1, 2021, the benefit providing for exemption from taxation of fixed assets included in the first or second depreciation group (clause 8, clause 4, article 374 of the Tax Code of the Russian Federation) ceases to apply. The decision to extend the period of the benefit or set the tax rate has been transferred to the power of the regions, which, in the event of refusal to extend the benefit, will be able to set the rate for this tax in the amount of no more than 1.1% (at the moment the tax rate on property of organizations cannot be more than 2.2%).

Determination of the tax base

The tax is calculated according to the residual value (Section 2 of the form) or according to the cadastral value (Section 3). We'll look at what this depends on next.

The principle is the same in both cases: the value of the property is multiplied by the tax rate and divided by 4 (by the number of quarters). However, tax bases are calculated differently.

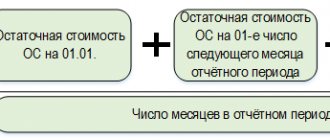

In Sect. 2 for the 3rd quarter of 2021, indicate the residual value of the objects as of the first day of each month, including October 1. Next, calculate the average property value over 10 months. This amount will be the tax base for calculating advances.

Moreover, it can be reduced if the company has preferential property that is not taxed. To do this, you need to calculate its average value for 10 months and subtract it from the average value of all property.

In the second option for calculating tax - based on cadastral value - you should clarify the list of “cadastral” objects approved in the region. If the property (and these are mainly office and retail buildings) is on the regional list, then just put it in Section. 3 cadastral value at the beginning of the year, which will be the tax base.

Example

Radius LLC, operating in Veliky Novgorod, owns an office building, the cadastral value of which is 14,851 thousand rubles. at the beginning of 2021. This will be the tax base for Section. 3.

The residual value of other objects of Radius LLC, which are subject to property tax, and the value of preferential objects are shown in the table:

| date | Residual value | Cost of preferential property |

| 01.01.18 | 78 900 | 10 250 |

| 01.02.18 | 76 008 | 10 090 |

| 01.03.18 | 75 851 | 9 989 |

| 01.04.18 | 79 852 | 11 560 |

| 01.05.18 | 78 820 | 11 020 |

| 01.06.18 | 77 001 | 10 801 |

| 01.07.18 | 76 520 | 10 020 |

| 01.08.18 | 75 006 | 9 985 |

| 01.09.18 | 73 005 | 9 020 |

| 01.10.18 | 71 006 | 8 540 |

The tax rate based on cadastral value in Veliky Novgorod is set at 2%. Let's calculate the advance payment for the 3rd quarter for the object based on its cadastral value (Ak):

Ak = KS x 2% / 4 = 14,851 x 2% / 4 = 74.2 thousand rubles.

The tax rate for property with residual value is 2.2%.

Thus, the advance payment for the 3rd quarter on property based on the residual value (Ac) will be calculated as follows:

Ac = (Co - Cl) x 2.2% / 4,

Where:

- Co - average residual value of objects for 10 months:

Co = (78,900 + 76,008 + 75,851 + 79,852 + 78,820 + 77,001 + 76,520 + 75,006 + 73,005 + 71,006) / 10 = 76,197 thousand rubles.

- Sl - average cost of preferential property:

Sl = (10,250 + 10,090 + 9,989 + 11,560 + 11,020 + 10,801 + 10,020 + 9,985 + 9,020 + 8,540) / 10 = 10,127 thousand rubles.

Ac = (76,197 – 10,127) x 2.2% / 4 = 363.4 thousand rubles.

The total advance amount for Radius LLC will be:

A = Ak + Ac = 74.2 +363.4 = 437.6 thousand rubles.

A sample calculation based on our example data can be downloaded here.

Example of calculating advance payments

On the balance sheet of Metal-Service LLC there is equipment, the residual value of which as of January 1, 2021 is equal to 90,000 rubles. Every month the equipment is depreciated by 3,000 rubles. The tax rate is the maximum. Let's calculate the advance payment for the 1st quarter.

At the end of January 2021, the residual value of the equipment will be 90,000 - 3,000 = 87,000 rubles, at the end of February 2021 - 87,000 - 3000 = 84,000 rubles, and at the beginning of March - 84,000 - 3000 = 81,000 rubles. Let's find the average quarterly value of the asset, which will be the tax base: (90,000 + 87,000 + 84,000 + 81,000) / 4 = 85,500 rubles.

We multiply the resulting tax base by the rate of 2.2 and find the percentage: 85,500 x 2.2/100 = 1881 rubles. This amount will be an advance payment for the equipment of Metal-Service LLC for the 1st quarter.

How to fill out the form

The form, which has been used since the beginning of 2021, was approved by order of the Federal Tax Service of the Russian Federation dated March 31, 2017 No. ММВ-7-21/ [email protected] . He also approved the procedure for completing the calculation (hereinafter referred to as the Procedure). The full version of the form, which all Russian and foreign organizations working through permanent missions are required to submit, consists of the following sections:

- Title page - contains all the information about the taxpayer and the reporting period.

- Sec. 1 - reflects the entire amount of tax to be paid into the budget.

- Sec. 2 - shows the amount of tax, which is calculated based on the average value of the property.

- Sec. 2.1. — contains information about objects, the tax on which is calculated at the average annual cost.

- Sec. 3 - shows the amount of tax calculated based on the cadastral value of objects.

If there are no objects that have any characteristic, dashes are placed on the form, but all pages are submitted. The shortened form of the report can only be submitted by foreign companies that do not operate through post-representative offices.

What you need to consider when filling out the Calculation

Information taken from tax legislation is not always sufficient for error-free preparation of tax reporting. In this case, the taxpayer receives great help from letters from officials (the Ministry of Finance and the Federal Tax Service). To save you time, we will tell you about the latest clarifications from these departments regarding NI and advances on it.

- When calculating advance payments, it is necessary to take into account the following nuances:

- If a company owns only one premises in a shopping center, the calculation will include the share of the cadastral value of the building corresponding to the share of the area of the premises in the total area of the building (letter of the Federal Tax Service dated March 16, 2017 No. BS-4-21/4780).

- If a building included in the list of cadastral property is divided into premises that are not recognized according to the criteria as objects taxed at cadastral value, then the calculation is made based on their average annual value (letter of the Federal Tax Service dated August 18, 2017 No. ZN-4-21/16379).

- The calculation must include the cost of common areas if you have ownership rights to them (letter of the Federal Tax Service dated June 23, 2017 No. BS-4-21/12096).

- If there was a change in the cadastral value in one of the reporting periods, advances must be calculated based on the changed value (letter of the Federal Tax Service dated January 27, 2017 No. BS-4-21 / [email protected] ).

- When calculating advances, you do not need to take into account:

- Real estate that was included in the cadastral list, but its value has not yet been determined (letter of the Ministry of Finance dated September 27, 2017 No. 03-05-04-01/62799).

- Capital investments in leased assets (letter of the Ministry of Finance dated 09/08/2017 No. 03-05-05-01/57901).

- Cost of the leased property (letter of the Federal Tax Service dated September 15, 2017 No. BS-4-21/18437).

- When completing the Calculation for the 2nd quarter of 2021:

- Pay attention to the OKOF reflection technology on page 040 of section 2.1: enter numbers from left to right, starting from the first cell. In unfilled cells, put a dash (letter of the Federal Tax Service dated August 24, 2017 No. BS-4-21 / [email protected] ).

- On page 030, indicate the OS inventory number if the object does not have a cadastral or conditional number (letter of the Federal Tax Service dated 09/05/2017 No. BS-4-21 / [email protected] ).

- After the Calculation has been generated, check for the presence/absence of errors in it (take the test ratios from the letter of the Federal Tax Service dated May 25, 2017 No. BS-4-21 / [email protected] ).

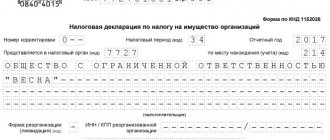

Title page

The design of the title card is practically no different from the design of other reports filled out by organizations for submission to the Federal Tax Service. It includes all the basic information about the taxpayer:

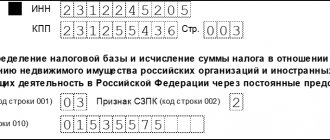

- TIN code.

- Checkpoint code.

- Page number: 001.

- Correction number. If the form is original, “–0” is entered. When the data is clarified, “–1” is entered, and for subsequent clarifications, the number of the submitted version is indicated. When submitting clarifications for periods before 2021, use the form that was valid in that period.

- Reporting period code. In the form for the 3rd quarter of 2021, enter the value “18”.

- Reporting year: value “2018”.

- Code of the tax authority where the taxpayer is registered.

- The code at the location (registration) is entered in accordance with the sign of submission to the tax office. In a standard situation, when an organization submits a form to the Federal Tax Service at its location, the value “214” is entered.

- Full name of the organization.

- Reorganization form. Fill out only when the form is handed over by the legal successor of the company. Codes for this field can be selected in Appendix. 2 to Order.

- TIN/KPP of the reorganized organization: indicate if the previous indicator is completed. They enter the data that the organization had initially.

- Contact phone number in 11-digit format.

- Number of pages. They are entered last, when all pages of the report are completed.

- Taxpayer identification. If he submits the form in person, the value “1” is entered; if through a representative, then the value is “2”.

- Full name.

- The date the form was filled out.

- Name of the document confirming authority. Fill in only if the value “2” is entered in the “Taxpayer Attribute” field.

- The field “To be filled in by a tax authority employee” is not for the report preparer, but for Federal Tax Service employees.

Reporting on property tax of organizations

At the end of each quarter, the organization must submit advance payments to the Federal Tax Service no later than 30 days

from the end of the quarter.

The tax return is submitted at the end of the year by March 30

next year.

Note

: calculations for advances and a tax return are submitted separately for each property located at the location of the organization, outside its location, separately for the property of separate divisions allocated to a separate balance sheet - to all Federal Tax Service Inspectors on the territory of which the specified property is located.

Note

: taxpayers classified as the largest ones submit declarations at their place of registration.

Section 1

Contains summary information on the amount payable to the budget. Filled in after calculating the tax base and the amount payable in the remaining sections. Contains several blocks in which information is entered based on OKTMO codes assigned to the property:

- OKTMO code. They put a code at the location of objects subject to taxation. If the code is less than 11 characters, empty cells are crossed out.

- KBK to which the payment is transferred.

- Calculated tax, which is determined as follows:

Section 2

It is devoted to the calculation of advances based on the average cost of property:

- Page 001 is filled in from Appendix. No. 5 to Order.

- Page 010 is filled in with the OKTMO code, according to which the tax will be paid.

- Data for calculating the average value of property for the reporting period. For the 3rd quarter of 2021, it is necessary to fill out pages 020-110, which contain the residual value of the property according to accounting data as of the 1st day of each month of the year until October inclusive. In gr. 3 indicate the value of the property, and in gr. 4 – cost of preferential objects, if any. If the enterprise does not use the benefit, gr. 4 are not filled in.

- On page 120, the average value of property is calculated by adding all pages 020-110 gr. 3 and dividing them by 10.

- On page 130 indicate the tax benefit code. The second part of the line is filled in only if the first part has the value “2012000”. It contains information about the norm of the regional law (number of article, clause and subclause).

- On page 140 the average cost of the preferential property is indicated, which is calculated by adding all pages 020-110 gr. 4 and dividing them by 10.

- Page 150 is filled out only if the value “02” is entered in line 001. This field contains the share of the book value of the object related to this constituent entity of the Russian Federation.

- Page 160 is filled out if the law of a constituent entity of the Russian Federation establishes a tax benefit in the form of a rate reduction. In the first part of the line, the benefit code 2012400 is indicated, and in the second part - data on the corresponding article of the regional law, similar to page 130.

- Page 170 contains data on the tax rate.

- Page 175 is filled in only regarding the railway property.

- Page 180 shows the total advance amount for the 3rd quarter of 2018, which is calculated by multiplying the difference between lines 120 and 140 by page 170 and dividing the resulting value by 4.

- Page 190 is filled out only if a benefit is established in the region. Indicate the benefit code 2012500, and then - information about the norm of the regional law, similar to pages 130 and 160.

- Page 200 reflects the amount of the tax benefit.

- On page 210 you need to indicate the residual value of fixed assets as of 10/01/2018.

Section 2.1

This contains information about property, the tax on which is calculated based on the average annual value:

- On page 010 indicate the cadastral number.

- On page 020 a conditional number is given in the absence of a cadastral number.

- The inventory number is entered on page 030 if pages 010 and 020 are empty.

- On page 040 indicate the object code in accordance with the OKOF classifier.

- Page 050 contains information about the residual value of the object as of 10/01/2018.

If, as of 10/01/2018, the object was withdrawn for any reason, then Sec. 2.1 is not filled out according to it.

Procedure for submitting the form and paying tax

The form must be submitted within 30 days after the expiration of the reporting period (clause 2 of Article 386 of the Tax Code of the Russian Federation). For the 3rd quarter of 2021, the deadline is October 30, 2018.

Small companies may submit the form on paper. If the number of employees of the organization exceeds 100 people, the calculation must be submitted electronically.

The fine for late provision of payment is 200 rubles (Clause 1, Article 126 of the Tax Code of the Russian Federation). In addition, officials may be fined from 300 to 500 rubles. (Article 15.6 of the Administrative Code).

Tax payment deadlines are not set at the federal level, so be sure to find out what regulations exist in your region.

How the date of release of movable property can affect the amount of the down payment

Analyzing the nuances of filling out the Calculation, we would like to dwell on such an important issue as the reflection in it of reliable information about the residual value of movable property. Let's explain why.

“Moveable assets” are on the balance sheet of almost every company. Until 2018, its residual value did not participate in the formation of the base for NI (including not taken into account when calculating advance payments).

As of 2021, the federal benefit for movable property has ceased to apply. It was replaced by a regional benefit (clause 1 of Article 381.1 of the Tax Code of the Russian Federation). But not all regions provide such a bonus for companies.

Regions also received the opportunity to introduce an additional benefit for fixed assets (clause 25 of Article 381 of the Tax Code of the Russian Federation) - for those “movables” that are older than 3 years (clause 2 of Article 381.1 of the Tax Code of the Russian Federation). At the same time, taxpayers may have difficulties determining this date, which can affect the correct calculation of tax “property” obligations. Let's look at them using examples, taking into account the position of the Ministry of Finance of the Russian Federation (letter dated 04/09/2018 N 03-05-05-01/23087).

- The balance sheet of Tornado LLC reflects the cost of the woodworking production line. Tornado LLC became the owner of this property last year. However, the release date of the line is unknown (not recorded anywhere).

In the region where the company is located, not all movable property is exempted, but only that which has passed no more than 3 years from the date of issue.

When preparing the Calculation based on the results of the 2nd quarter (half of the year), Tornado LLC will take into account the residual value of the production line in the taxable base for the “property” advance, following the explanations of the Ministry of Finance.

The lack of information about the date of manufacture of the equipment automatically transfers it to the category of property older than 3 years, which means that its value must be included in the tax base.

- Kvadro LLC acquired a refrigeration unit in April 2021. The plate mounted in the body of the unit is stamped with the production date of 02/03/2017. However, the technical documentation indicates a different date.

Taking into account the explanations of the Ministry of Finance, Quadro LLC did not apply the benefit established in the region for operating systems older than 3 years.

The company included the residual value of the unit in the Calculation, since there are discrepancies in its production date marked on the body and indicated in the technical documentation.

- PJSC TechService purchased a thermal curtain for the entrance group in 2021. The release date of this equipment is indicated in the data sheet as month and year: (June 2021).

The company did not include the residual value of the equipment in the “property” base for the first half of 2021 for the reason that 3 years have not passed since the date of release of the property, and in the region a benefit is provided for such fixed assets.

For those OSs in whose technical documentation the moment of release is not recorded in the full calendar date (the date or month of manufacture is missing), the following rule applies:

| What is known about the date of manufacture of the OS? | What is considered the date of manufacture? |

| Only a year | July 1 of the given year |

| Month and year | 15th of the specified month |

If the taxpayer has a lot of movable property that is not older than 3 years and has a regional benefit, its residual value can have a significant impact on the amount of advance payments. And ambiguities with the date of manufacture of the property can significantly distort the amount of the advance if the company does not take into account the explanations of the Ministry of Finance.