In order to ensure that the financial condition of any company does not turn out to be deplorable in the event of non-fulfillment of obligations by counterparties, companies must create a certain reserve cash reserve that will cover losses in the event that the debt is not repaid. The creation of such a reserve indicates that enterprises are ready to admit the possibility of losses due to doubtful debts owed to them.

In this article, we will look at how a reserve fund is created in case of losses due to doubtful debts, how accounting for such transactions is kept, what typical accounting records exist, and we will also consider one of the cases in practice.

Regulations

Accounting for account 63 is regulated by the Chart of Accounts and Instructions for its application (Order of the Ministry of Finance dated October 31, 2000 No. 94n), Guidelines for inventory of property and financial liabilities (Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49), PBU 4/99 “Accounting reporting of the organization”, PBU 21/2008 “Changes in estimated values”, the Law “On Accounting” dated December 6, 2011 No. 402-FZ and other regulatory documents.

Any organization may encounter an unscrupulous counterparty: for example, the buyer may not pay for goods delivered to him on time, and the prospective supplier may receive advance payment under the contract, but fail to fulfill the subject of the contract by the specified time - fail to provide goods, perform work, or fail to provide services.

Such a debt is recognized in accounting as a doubtful debt - a debt not guaranteed by any property security, which most likely will not be paid in the future.

The conditions for recognizing doubtful debts are established in the Accounting Policy.

ATTENTION! The formation of such a reserve is the responsibility (not the right!) of the company.

When and by whom should the reserve be created?

Clause 70 of the regulations on accounting and accounting, which, in addition to the definition of doubtful debt, also reflects the basic rules for working with it, does not make any exceptions from the circle of legal entities obligated to create a reserve for debts recognized as doubtful. Thus, the principle of mandatory creation of a reserve is assigned to all organizations without exception.

Note! Small enterprises are required to form reserves for doubtful debts in accordance with the generally established procedure. Even if simplified accounting methods are used (PBU 21/2008 “Changing estimated values”).

In what situations is it necessary to create a reserve? When a debt that meets the criteria for doubtful debt is identified. At the same time, the provision on accounting and accounting does not limit the type of such debt in any way, i.e. it can be any receivable debt, from the debt of an accountable person to the debts of buyers.

But the regulations on accounting and accounting do not establish the rules that must be followed in identifying doubtful debts. And the organization itself will have to determine, reflecting the established procedure in its accounting policies, the following points:

- frequency of debt inventory;

- signs by which a debt should be considered doubtful;

- debtor insolvency criteria;

- principles for assessing the likelihood of repaying the debt in full or in part;

- factors influencing the size of the created reserve.

For information on how the results of debt inventory are compiled, read the article “Inventory of receivables and payables.”

Characteristics of account 63 (active or passive, reflected in the balance sheet as a line... etc.)

After conducting regular (monthly/quarterly/annual) inventory, before reporting is generated, accounts receivable are identified in the accounting of the affected organization (according to Dt 60, 62, 76, 58.3), which any company (small enterprise is no exception!) is obliged to recognize as doubtful and create a reserve according to Kt 63 in correspondence with Dt 91.2. The creation of these reserves is another expense of the organization.

Is count 63 active or passive? Of course, the account is passive, the recognition of the reserve is accounted for as a credit to the account, and its decrease is recorded as a debit.

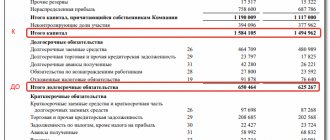

The amounts of the credit balance (unused reserve) are included in the calculations of the amount of accounts receivable when preparing the balance sheet and in the results of the income statement. Account 63 in the balance sheet is reflected in line 1230 “Accounts receivable” of the balance sheet with a minus sign (the amount of doubtful debts is subtracted from the total amount of receivables) and as part of line 2350 “Other expenses” of the income statement.

Information about reserves should be disclosed in the notes to the financial statements.

There are no subaccounts to the account in the Chart of Accounts. Analytics for account 63 represents a separate accounting of the amounts for each doubtful debt.

Accounting reserve

The reserve is not shown as a separate line in the accounting statements. By its amount, the amount of receivables is reduced, reflected in the corresponding line in the balance sheet (clause 35 of PBU 4/99, approved by order of the Ministry of Finance of Russia dated July 6, 1999 No. 43n).

If the amount of the reserve changed during the reporting period, then in the explanations to the statements it will be necessary to disclose the reasons for this change and its impact on the reporting data of the current or future periods (clause 6 of PBU 21/2008). In relation to reserves formed for transactions with related parties, organizations that do not have the right to prepare simplified reporting are required to provide information about such reserves in explanations (clause 3 and clause 10 of PBU 11/2008).

Rules for writing off bad debts in accounting

Doubtful debts may eventually be classified as bad debts. In this case, the debt is written off from the created reserve.

The criteria for recognizing a counterparty's debt as bad are established in clause 2 of Art. 266 Tax Code of the Russian Federation. Bad debts that are impossible to collect are debts for which:

- The statute of limitations (3 years) established by law has expired.

- The obligation was terminated due to the impossibility of fulfilling it on the basis of:

- act of a government agency;

- liquidation of the enterprise;

- resolution of the bailiff (the whereabouts of the debtor, his property/valuables have not been found, or the debtor does not have property that can be recovered).

If the amount of the created reserve was not enough to write off bad debts, the required amount is written off against other expenses from Dt 91.2.

The written-off amount of bad debt must be reflected in off-balance sheet account 007 for a period of 5 years, so that changes in the financial condition of the bad counterparty can be monitored and the possibility of restoring this write-off.

ATTENTION! There are significant differences in the legal requirements for accounting for provisions for doubtful debts in accounting and tax accounting.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

In accounting:

- the exact duration of the debt in days is not taken into account;

- the debtor's solvency is assessed;

- the amount of the reserve is not limited;

- when applying PBU No. 18/02, DTA (deferred tax assets) are formed.

Calculation of the reserve amount

Another point that should be fixed in the accounting policy is the algorithm for determining the amount of the reserve. The size of the reserve in accounting, unlike the reserve created in tax accounting, is not regulated. Therefore, the organization must independently develop not only a list of those factors on which its size will depend (the financial condition of the debtor, the likelihood of him repaying all or part of the debt), but also a formula for calculating the specific amount of the created reserve.

The amount of the reserve, depending on the assessment of the probability of payment of the debt, may not coincide with the total amount of the debt.

Postings to account 63 with an example of accounting with ONA accrual

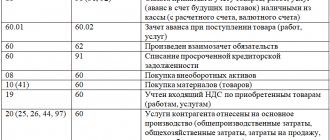

The most typical entries for account 63 - Provision for doubtful debts:

| Debit | Credit | Contents of operation |

| 91.2 | 63 | A decision was made to create a reserve for doubtful debts |

| 63 | 60, 62, 76, 58.3 | The bad debt of the supplier / buyer / other debtor / borrower is written off from the reserve |

| 63 | 91.1 | The reserve amount has been restored |

An example of accounting with the accrual of IT

Conditions:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

On 06/03/2017, the seller shipped a consignment of goods in accordance with the supply agreement in the amount of 158,000 rubles. Payment from the buyer must be received within 25 days after shipment. On July 3, 2017, partial payment was received in the amount of RUB 65,000. By the end of the year, the remaining debt had not been repaid.

Calculations:

158,000 × 20% = 31,600 - IT when creating a reserve

65,000 × 20% = 13,000 - SHE to be restored with partial payment

| Debit | Credit | Sum | Contents of operation |

| 91.2 | 63 | 158 000 | The creation of a reserve for doubtful debts is reflected |

| 09 | 68.2 | 31 600 | SHE is taken into account |

| 51 | 62 | 65 000 | Partial payment received |

| 63 | 91.1 | 65 000 | Part of the reserve has been restored |

| 68.2 | 09 | 13 000 | Part of ONA restored |

Which debt is considered doubtful?

Unfortunately, in the process of conducting commercial activities, the lion's share of enterprises have to deal with unscrupulous partners - customers, clients and other debtors who cannot repay their debts on time.

Therefore, it is necessary to create an appropriate reserve in order to obtain reliable data on the amount of debt. A debt is doubtful if it meets a certain list of conditions. Within the framework of Article 2 of the Tax Code of the Russian Federation, the following elements can be classified as bad debts:

- those for which the statute of limitations has expired;

- debts for which the obligation has been terminated due to impossibility of fulfillment;

- if collection is impossible due to a decision by a bailiff.

With all this, a debt obligation can be considered hopeless, even after passing the dubious stage. For a debt to be considered bad, the presence of at least one of the listed grounds is sufficient.

***

After inventory of receivables, in case of doubts about their repayment by the debtor, the company must create a reserve for doubtful debts. This reserve is taken into account in account 63 of the same name as other expenses.

If a doubtful debt is recognized as a bad debt, its amount is written off at the expense of this reserve under Dt 63 and Kt 60, 62, 76 or 58.3. If the amount of the reserve for write-off is not enough, the remaining part is written off from Dt 91.2. The entire amount written off is written off to the balance of account 007 and the possibility of changes in the financial condition of the bad debtor is monitored over a period of 5 years.

The balance of the reserve for doubtful debts is subtracted from the amount of accounts receivable at the end of the year and the resulting value is shown on line 1230 in the balance sheet. The credit balance of account 63 is included in line 2350 in the income statement. Information on reserves for doubtful debts should be disclosed in the notes to the financial statements.

The reserve is accrued and changed: postings

The entry for creating a reserve for doubtful debts will be the same, regardless of which account the debt recognized as doubtful is recorded in. In it, the amount of the reserve accrued for the corresponding debt on account 63 will correspond with account 91:

Dt 91 Kt 63.

A change in the amount of the reserve when factors affecting its size change can lead to either an increase or a decrease in the reserve. Postings in both cases can be of 2 types:

- In correspondence with score 91:

- Dt 91 Kt 63 - with an increase in reserve;

- Dt 63 Kt 91 - when the reserve decreases.

- In correspondence with score 97:

- Dt 97 Kt 63 - if the increase in the reserve affects data for future periods;

- Dt 63 Kt 97 - if the decrease in the reserve was also reflected in the data previously taken into account for this reserve in expenses of future periods.

The write-off of the reserve data reflected in account 97 will occur in the period to which the change in the amount of the reserve relates, taken into account with this change as deferred expenses (clause 4 of PBU 21/2008):

Dt 91 Kt 97.

Example:

Based on the results of the first quarter of 2021, Sigma LLC carried out an inventory of settlements with debtors and identified the following doubtful debts:

Contractor: Smiley LLC

The amount of debt is 100,000 rubles.

The repayment period under the agreement is 01/20/2021.

The basis for recognizing a debt as doubtful is that bankruptcy proceedings have been opened against the debtor, and there is no security for payment.

The accountant of Smiley LLC prepared an accounting statement and, on its basis, increased the reserve for doubtful debts by posting Dt 91.2 Kt 63.

In tax accounting, the accountant showed contributions to the reserve on line 200 of Appendix No. 2 to sheet 02 of the income tax return. There is no need to show the write-off of bad debt through the reserve in the declaration.

Further, having signed the order with the manager, he wrote off the receivables of Smiley LLC, which were unrealistic for collection from the reserve for doubtful debts, by recording Dt 63 Kt 62.

See also “Limitation Period for Accounts Receivable.”

Features of tax accounting

In tax accounting, the payer is not assigned an obligation to create a reserve for doubtful debts. This is his right, which is enshrined in Art. 266 Tax Code of the Russian Federation. For profit tax purposes, a debt associated with payment for shipped commodity items or work performed or services rendered is recognized as a questionable element for the buyer.

- If repayment does not occur within the period established by the agreement.

- If there is no security in the form of a pledge and surety, as well as a bank guarantee.

Within the framework of tax accounting, operations for calculating reserves related to doubtful debts are carried out as follows:

- for doubtful debt obligations with a period of occurrence of 90 days or more;

- for debts for a period of 45-90 days, with 50% of the debt included in the reserve amount;

- for doubtful obligations up to 45 days, while the debt does not contribute to an increase in the amount of the reserve.

At the same time, this amount cannot exceed 10% of the amount of revenue excluding VAT for the reporting year.

Active accounts

Active accounts are those that are used to record information about the property of the enterprise. For example: money, including in foreign currency, transfers in transit, own shares.

An increase in funds in an active account is reflected as a debit, and a decrease as a credit. At the end of the period, the balance of the active account is debit.

Active accounts include: , , 04, 07, 08, 09, , 11, , , 21, 23, 25, , , 29, , , 44, 45, 46, , , 52, 55, 57, 58, 81, , 97.

Example

Shtrabak LLC purchased a laptop. The cost of the laptop is 87,000 rubles. without VAT. The debit of account 01 “Fixed assets” has an opening balance of 0 rubles. The accountant reflected the acceptance of the laptop as a debit, since the account used is active. The final debit balance is RUB 87,000.