Starting with version 3.0.53 “1C: Accounting 8”, the cost of production can be calculated taking into account the specific costs of manufacturing specific items of products or semi-finished products. 1C experts talk about options for calculating product costs, the features of accurate cost calculation in 1C: Accounting 8 edition 3.0, taking into account the new capabilities of the program, as well as how to simplify the process of filling out production documents.

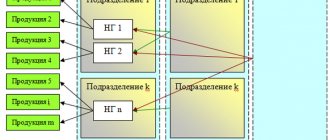

Previously, the cost of production was calculated in “1C: Accounting 8” edition 3.0 in proportion to the planned cost within “its” product group. Therefore, before we talk about production operations and accurate costing, let us remember what nomenclature and nomenclature groups are in program terms.

Formation of product costs

Enterprises engaged in the production of products are faced with the need to calculate the cost of manufactured products. What does the cost include, how is the cost of finished products formed, what is costing and costing items? We will discuss all these questions below.

There are such concepts as “full cost” and “production cost”.

Any production is accompanied by certain costs: raw materials, semi-finished products, materials, wages, social contributions, depreciation, etc. All these costs form the production cost of the finished product.

The total cost includes, in addition to costs associated with production, also costs associated with the sale of these products that arise at the sales stage.

During the production process, costs are accumulated in the accounts associated with the production process. When finished products are sent for sale, the accumulated costs associated with the production of these products are written off as expenses of the organization. The income from the sale will be the proceeds from the sale.

Expenses and income participate in the formation of the financial result from the sale of products.

So. The process of forming the cost of finished products begins with the accumulation of costs associated with its production. All costs are collected by debiting the accounts involved in production. What accounts are used for savings?

Accounts for recording production costs:

20 “Main production” - used to form the actual cost of finished products; direct costs of the main production are collected here.

21 “Semi-finished products of own production” - the debit of this account collects all costs incurred in connection with the production of semi-finished products.

23 “Auxiliary production” - costs of auxiliary production, for example, costs associated with equipment repair, transport services, energy provision, etc.

25 “General production expenses” - the debit of this account collects costs associated with servicing the main and auxiliary production.

26 “General business expenses” - the debit of the account collects expenses for administrative and managerial needs

28 “Defects in production” - this account collects all losses from defective products.

Product cost calculation

What does the cost include? Costs associated with the production and sale of finished products.

Costs are formed using the so-called costing method.

All costs are grouped by costing items. Costing is the calculation of costs according to costing items.

The costing object is each individual type of product (product, semi-finished product, work, service), for which its cost can be determined by breaking it down into costing items.

In the process of forming the cost price for each costing object, you need to select a costing unit - a unit of production for which the cost will be determined. The calculation unit can be expressed in natural or conditionally natural form. In the first case, the calculation unit can be kilograms, tons, liters, meters; in the second case, the unit is determined by calculation methods using various coefficients.

Costing items:

- Raw materials

- Returnable waste

- Semi-finished products and purchased products

- Fuel and energy

- Depreciation of fixed assets and intangible assets

- Employees' wages

- Insurance contributions from employees' salaries

- Preparation and development of production

- General production expenses

- General running costs

- Losses from marriage

- Other costs associated with production

- Expenses on sales of products

All these costing items form the full cost of production. If we exclude the last point, we get the production cost.

Classification of production costs

What are the costs?

Direct and indirect

All costs, according to the method of inclusion in the cost, are divided into direct and indirect.

Direct – relate to a specific type of product (materials, semi-finished products, depreciation).

Indirect – evenly distributed across all types of products (general economic, general production). Indirect costs accumulate over the course of a month, at the end of which they are written off as cost.

Basic and invoices

According to their economic role in the production process, costs are divided into basic and overhead.

The main ones are directly related to the process of manufacturing products, performing work, services (materials, wages, depreciation).

Invoices - related to the maintenance and administration of the production process (general production and general economic).

Single element and complex

According to their composition, costs are divided into single-element and complex.

Single-element - consist of one element (depreciation, raw materials, semi-finished products).

Complex - consist of more than one element (general plant, workshop).

Variables, conditionally variable and conditionally constant

In relation to production volume, costs are divided into variable, semi-variable and semi-fixed.

Variables - depend proportionally on the volume of products produced (semi-finished products, raw materials).

Conditional variables are not a direct dependence on the volume of products produced (general production).

Conditionally constant - practically do not depend on the volume of production (general economic).

Productive and unproductive

Depending on their effectiveness, costs can be either productive or unproductive.

Productive - for the rational production of products of established quality.

Unproductive - arising due to imperfections in the production process (defects, downtime).

Current and one-time

Based on the frequency of occurrence, costs are divided into current and non-recurring.

Current - occur with a certain frequency (raw materials, supplies).

One-time — one-time costs (launching new equipment).

Industrial and commercial

Based on their participation in the production process, they are divided into industrial and commercial.

Production - related to the production of products.

Commercial - related to the sale of products.

Features of the service sector

The service sector is the production and sale of intangible goods. Consumers here can be a variety of entities - not only “ordinary” individuals, but also organizations, individual entrepreneurs or government agencies.

A service is any result obtained from the interaction between a supplier and a consumer. This could be, for example:

- Training is an educational service.

- Transmission of useful information is a consulting service.

- Treatment or prevention of diseases is a medical service.

- Providing the right to use property – rental service.

- Delivery of passengers or cargo is a transport service.

Services have important features that distinguish them from goods:

- Intangibility - check by touch.

- Individual character - the service is provided to a specific consumer or a specific group of consumers.

- Impossibility of storage and transportation - the service cannot be stored or transported.

- Strict relationship between production and consumption of services in time and space.

When maintaining accounting records, you need to take into account the features of the service sector as a type of business:

- A request for a service always occurs before its production.

- There is an inextricable link between demand and consumption of services.

- The service cannot be resold.

Postings for accounting for production costs

The full cost of finished products includes production costs and sales costs. How production and sales costs are accounted for in accounting, what accounts are used and what postings are made.

Accounting accounts for production costs

There are several accounting accounts for recording production costs. In the chart of accounts, Section 2 is devoted to the production process, which provides a list of accounts involved in this process.

Main production (count 20)

Direct costs of main production are collected in the debit of the account. 20.

Account 20 “Main production” is intended to take into account the direct costs of the main production and form the actual cost of production.

The direct costs are:

- Raw materials - posting Debit 20 Credit 10

- Semi-finished products of own production - posting Debit 20 Credit 21

- Depreciation of fixed assets - posting Debit 20 Credit 02

- Amortization of intangible assets - posting Debit 20 Credit05

- Staff salaries – posting Debit 20 Credit 70

- Insurance premiums from staff salaries - posting Debit 20 Credit 69

- Services of third parties – posting Debit 20 Credit 60

Postings for cost accounting of main production:

| the name of the operation | ||

| 20 | 02 | Depreciation was calculated on fixed assets used in the main production |

| 20 | 05 | Depreciation was accrued on intangible assets used in the main production |

| 20 | 70 | Wages accrued to employees of main production |

| 20 | 69 | Insurance deductions are calculated from the salaries of production workers |

| 20 | 10 | Raw materials and supplies released into production are taken into account |

| 20 | 21 | The cost of own semi-finished products was written off to the main production |

| 20 | 60 | The cost of third-party services for main production is taken into account |

Ancillary proceedings (account 23)

Account 23 “Auxiliary production” is intended to account for the direct costs of auxiliary production, which include the repair of fixed assets involved in the production process, transport services, and power supply.

The postings for accounting for these costs look similar, only instead of invoice. 20 is taken count. 23.

General production expenses (account 25)

This account is intended to collect costs associated with the maintenance of main and auxiliary production. These are indirect costs that are collected in the debit of the account during the month. 25

The same costs include depreciation, staff salaries and deductions from them, materials, etc. The postings for accounting for general production expenses look the same as for the main production, only instead of invoices. 20 is taken count. 25.

General expenses (account 26)

The debit of this account collects expenses for administrative and managerial needs, these are also indirect expenses that are collected throughout the entire month in the debit of the account. 26.

Defects in production (count 28)

Another type of cost that must be taken into account in the production process is losses from defects.

If defective products are produced during the production process, then eliminating them will require certain costs, which include depreciation, materials, raw materials, semi-finished products, wages and deductions from them. Accounting for the costs of correcting defects occurs on account 28 “Defects in production”, in the debit of the account. 28, all these costs are collected using the postings indicated above (instead of account 20, account 28 is taken).

Thus, at the end of the month, according to the debit of the account. 20 collected direct costs associated with basic production in the debit of the account. 23 – direct costs associated with auxiliary production, in the debit of the account. 25 – indirect overhead costs, in the debit of the account. 26 – indirect general business expenses, in the debit of the account. 28 – costs associated with defective products.

The next step in the formation of production costs is the distribution of auxiliary production costs between main production, general production and general economic needs.

Postings for distribution of costs of auxiliary production:

| Debit | Credit | the name of the operation |

| 20 | 23 | The cost of auxiliary production allocated to the main production was written off |

| 25 | 23 | The cost of auxiliary production allocated for general production needs was written off |

| 26 | 23 | The cost of auxiliary production allocated for general business needs has been written off |

The next step in the formation of product costs is the write-off of general production and general business expenses.

Postings for writing off these costs are D20 K25 and D20 K26.

General production costs can be written off proportionally:

- Salaries of main production personnel

- Wasted materials

- Amount of direct costs

- Revenue from the sale of manufactured products

General business expenses are written off:

- By distribution between types of products

- In full at the end of the month

The last step is to write off losses from marriage.

Accumulated by debit account. 28, the costs of correcting defective products are written off to the debit of account 20 by posting D20 K28.

As a result of the manipulations performed on the debit of the account. 20 the production cost of products is formed.

The next stage is the formation of the cost per unit of production using calculation.

Accounting data used to complete line 2120

Important! To line 2120, it is necessary to enter additional lines for which costs will be reflected corresponding to each type of revenue allocated by the company, if several types of cash receipts are allocated in the financial structure of this company, each of which for the reporting period is at least 5% of the total volume of revenue separately.

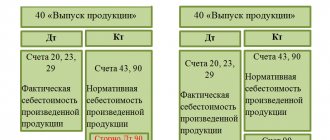

The value of the cost of goods sold (goods, works, services) indicator is entered in line 2120 “Cost of sales” in parentheses. To determine this value for the reporting period, information about the total debit turnover on the account is taken into account. 90 (s/ac. 90-2) for the reporting period in correspondence with accounts 43, 41, 40, 29, 23, 20 and others.

However, according to clause 23 of PBU 4/99, turnover according to Dt account. 90 (s/sch. 90-2) in correspondence with Kt sch. 44 or with Kt sch. 26 (if any) are not taken into account.

Product cost calculation

Product costing is the calculation of the cost of manufactured, finished products.

A costing object is a separate type of product for which the cost can be determined by breaking it down into costing items.

Costing items are costs associated with the production of products. We talked earlier about costing and costs. Let us dwell in more detail on the methods and methods that are used to form the cost of a unit of production using calculation.

In fact, the cost of production is the sum of all costs associated with the production of this product.

To determine the cost, you need to allocate production costs between finished goods and work in progress. Work in progress includes those products that have not passed all the necessary stages of production, testing and acceptance, as well as materials, raw materials, semi-finished products that have already entered production and are already involved in the process (their processing has begun), but the finished product has not yet been received .

Having data on total production costs for the month and on the balances of work in progress, you can determine the costs of finished products and the cost per unit.

Costing methods

- Cost summation method

- Normative method

- A way to eliminate costs for by-products

- Method of proportional distribution of costs

- Direct calculation method

- Combined method

Of these six methods, the first is the most popular.

Cost summation method

The method consists of summing up the costs of individual parts of a product or its manufacturing process. For each individual type of product, the total production costs for the month are calculated, the balance of work in progress at the beginning and end of the month is recorded, and losses from defects for the month are determined. Based on these data, the cost of finished products is calculated using the formula presented below.

Formula for calculating cost using the cost summation method:

Cost = Work in progress beginning month. + monthly costs – work in progress end month. - losses from marriage.

To calculate the cost per unit of production, you need to divide the resulting value by the number of units.

Standard method of calculating cost

It is used with the standard method of cost accounting and calculation, which consists of preliminary calculation of the standard cost for each product based on established standards and cost estimates. The essence of the method is to determine deviations from current standards.

A way to eliminate costs for by-products

The method is actively used in non-ferrous metallurgy, chemical and oil refining industries. It lies in the fact that in production all products are divided into by-products and main products; when determining the cost of the main products, the costs of by-products are not taken into account and calculations are not made for them. This method is appropriate if it is possible to divide all products into by-products and main ones, while the by-products make up a small proportion of the main ones.

Direct calculation method

The simplest way to calculate the cost of finished products. All costs for the production of a product are distributed among costing items, the sum of all costs is divided by the number of units of the product.

Combined calculation method

This method consists of an appropriate combination of several cost calculation methods.

Accounting for defects in production

Defects in production are a normal phenomenon that we have to put up with. It is important to know how to correctly account for losses from defects and what postings to make depending on its type.

Let's start by defining what marriage is and what it can be like.

If during the production process a product, product, or part is received that does not meet the approved standards and specifications, its operation and use for its intended purpose is not possible or is possible only after making certain adjustments, then the received product will be considered defective.

Further actions may be as follows:

- Correction (if possible)

- Write-off (if correction is not possible)

You also need to take into account that defective products can be identified at the enterprise itself, or maybe after they are sold to the buyer after some time. Accounting in these two cases will be noticeably different. In the case when a defect is detected at the enterprise, it is called internal, when at the buyer it is called external.

So, marriage happens:

- Correctable and Incorrigible

- Internal and external

Whatever it is, its write-off or correction is accompanied by certain costs, called losses from marriage. To account for them in accounting, accounting account 28 is used.

First, let's look at the features of accounting for defective products identified within the organization.

Accounting for internal correctable defects

During the production process, defective products were received; as a result of the analysis of the defects, it was determined that they can be corrected.

In this case, the first thing to do is to determine the cost of correcting the defective product or part. Cost is formed by expenses, therefore all costs associated with correcting defects are collected in the debit of the account. 28. Costs may include:

- Raw materials (posting for cost accounting D28 K10)

- Semi-finished products (wiring D28 K21)

- Remuneration of personnel involved in correction (posting D28 K70)

- Insurance premiums for compulsory insurance from the salaries of this personnel (entry D28 K69)

- Services of third parties, if they were involved (D28 K60)

In the course of studying the causes of the defect, the guilty employee may be identified. In this case, penalties may be applied to him, which will reduce the cost of corrections. Amounts collected from the guilty employee are accounted for under credit account 28 (entry D73 K28). Further, the amount can be withheld from the salaries of the guilty persons (D70 K73) or deposited by them into the cash desk of the enterprise (D50 K73).

Thus, the debit of account 28 collects all losses related to the correction of defects, and the credit of the amount of collections from the guilty persons. The difference between debit and credit will be the final loss, which is written off by posting D20 K28.

For convenience, we will collect all the above transactions in one table.

Postings for accounting for correctable defects:

| Debit | Credit | the name of the operation |

| 28 | 10 | Materials and raw materials written off |

| 28 | 21 | Semi-finished products written off |

| 28 | 70 | Employees' salaries taken into account |

| 28 | 69 | Insurance premiums are calculated from the salaries of these employees |

| 28 | 60 | The cost of third-party services is reflected |

| 73 | 28 | The amount of recovery from the guilty employee is reflected |

| 70 | 73 | The amount of the recovery is withheld from the salary of the culprit |

| 50 | 73 | The recovery amount was paid in cash to the cash desk |

| 20 | 28 | Losses from defects are written off to the cost of production |

Accounting for internal irreparable defects

If a defective product cannot be corrected, it must be written off. The cost at which it will be written off is determined using calculation.

All actual costs for the production of a given product are collected, that is, the cost of defects is determined. After which a posting is made for the received amount D28 K20.

If the guilty parties are identified, the total amount of losses or part of it can be recovered from them (entry D73 K28). The recovery amount will reduce the overall losses from the defect.

At the end of the month, the total amount of losses on account 28 is determined and written off by posting D20 K28.

When disposing of discarded defective products, waste may remain. If they are useful for further use, then they are supplied with D10 K28 wiring. This amount will also reduce the overall losses.

Postings for accounting for irreparable defects:

| Debit | Credit | the name of the operation |

| 28 | 20 | The actual cost of an irreparable defect was written off |

| 10 | 28 | Returnable waste has been capitalized for further use. |

| 73 | 28 | The amount of recovery from the guilty employee is reflected |

| 20 | 28 | Losses from defects are written off to the cost of production |

What documents are used to document the provision of services?

When preparing accounting documents in the service sector, it is necessary to determine their list, which depends on the specific situation. In general, such documents can be divided into two groups:

- General ones that need to be completed regardless of what types of services the provider provides:

- agreement;

- an invoice for payment;

- the act of providing services;

- payment documents - checks, receipts, payment orders.

- Particulars, which make up in individual cases, for example:

— waybills and waybills when transporting goods;

— design and estimate documentation for the provision of repair and installation services.

If the type of service does not require a mandatory written form of the transaction, then theoretically the contract does not need to be signed. The transaction will be considered concluded after the customer pays the invoice, which reflects the type of service and the conditions for its provision.

But it is better, even for one-time services, to draw up all the “basic” documents: agreement, invoice and deed. This will help avoid disputes both with counterparties and with tax authorities in the event of an audit.