Free receipt of OS in 1C: Accounting department of a state institution 8th edition 2.0

Published 06/24/2017 00:08 Fixed assets can be supplied to an institution not only through acquisition for a fee, but also free of charge. In this article, we will consider the reflection of the gratuitous receipt of OS in the program “1C: Public Institution Accounting 8, edition 2.0”.

Receipt of fixed assets free of charge can be divided into three types: 1. free receipt from an institution subordinate to the same GRBS (intradepartmental transfer); 2. receipt of fixed assets from the founder; 3. receipts of fixed assets from other budgets (from institutions subordinate to other GRBS). Let's consider all situations sequentially. Reflection of gratuitous receipt of fixed assets in accounting is carried out using the document “Acceptance for accounting of fixed assets, intangible assets, legal acts”. You can find it:

A list of documents opens:

Click the “Create” button to add a new document:

A special window opens with a list of types of receipt of fixed assets:

Type of receipt from account 106 is used in the case when the value of the fixed asset was previously accumulated in this account as a capital investment. The type of receipt to accounts 101,102,103 is used if a finished fixed asset is received. Other types of income are on off-balance sheet accounts for simplified accounting and storage. In our case, you need to select the “Receipt to account 101,102,103” type:

The document details are filled out in the standard way. But I would like to focus attention specifically on the “Financial Security Code” detail: according to which KFO should a fixed asset received free of charge be accepted for accounting? State-owned institutions use KFO 1 - “Activities carried out at the expense of the corresponding budget.” And for autonomous and budgetary institutions, KFO options are possible - 2 “Income-generating activities (institution’s own income)”, 4 “Subsidies for the implementation of state (municipal) tasks” or 7 “Funds for compulsory health insurance”. In general, we can say that two factors play a role in the choice of CFO: - with what means the accepted fixed asset will be maintained (that is, if you accept a fixed asset free of charge, for example, vehicles, then you need to consider from what means the maintenance will be carried out this vehicle); - and the second point concerns gratuitous transfer within the budget (among institutions subordinate to one GRBS): here it is worth considering which KFO the fixed asset is disposed of, usually in this case the OS is accepted for the same KFO. This is due to the fact that the “economy” of one GRBS during a gratuitous transfer among subordinate institutions should not change (that is, the total amount of fixed assets at each of the KFOs does not change, the transfer must be under the same KFO). Next, on the “Fixed assets, intangible assets, legal acts” tab, fill in the initial data of the fixed asset accepted for accounting:

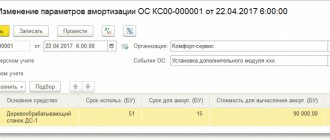

If the fixed asset is transferred with depreciation, the depreciation data is indicated on this tab. After the basic information on the fixed asset is filled in, go to the “Accounting transaction” tab:

The data on the fixed asset do not differ for all three types of gratuitous receipt. The differences only appear in the typical accounting transaction that will be used.

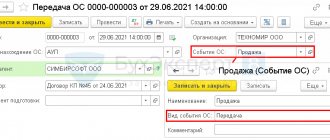

1. Free receipt from an institution subordinate to the same GRBS (intradepartmental transfer) In the case of gratuitous receipt of a fixed asset in the order of intradepartmental transfer from another institution, the following standard operation is used:

In this standard transaction, the corresponding account will be account 304.04. After posting, the document generates the following account movements:

2. Receipt of fixed assets from the founder It can be from the founder (centralized receipt) and from institutions subordinate to the same GRBS. In the case of gratuitous receipt of fixed assets from the founder, the following standard operation is used:

In this typical transaction, the corresponding account will be account 401.10. After posting, the document generates the following account movements:

3. Receipts of fixed assets from other budgets (from institutions subordinate to other GRBS) When receiving property from other budgets, the following operation is used:

In this standard transaction, the corresponding account will also be account 401.10. The difference from the previous operation is KEK: in the previous operation it is KOSGU 180 “Other income”, in this one it is KOSGU group 150 “Receipts from...”:

The document generates the following transactions:

Author of the article: Svetlana Batomunkueva

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Nailya 08/26/2019 18:46 Good afternoon, please tell me that under the donation agreement they give video recorders and a surveillance camera monitor. How to capitalize in 1C 2.0

Quote

Update list of comments

JComments

Accounting

Depreciation accrual stops from the next month after the transfer of fixed assets.

To reflect the disposal of fixed assets, a subaccount is usually opened to account 01 “Retirement of fixed assets”.

Debit 01 subaccount “Disposal of fixed assets” Credit 01

– the initial (replacement) cost of the disposed asset is written off;

Debit 02 Credit 01 subaccount “Disposal of fixed assets”

– depreciation accrued during the period of operation of the facility is written off.

There is no income from donation, and expenses are recorded in account 91.2 “Other expenses”.

Debit 91-2 Credit 01 subaccount “Disposal of fixed assets”

– the residual value of the gratuitously transferred fixed assets is written off;

Debit 91-2 Credit 10 (60, 69, 70, 76...)

– expenses associated with the gratuitous transfer of OS are written off;

Debit 19 Credit 60 (76)

– VAT is reflected on expenses associated with the gratuitous transfer of fixed assets.

Debit 68 subaccount “Calculations for VAT” Credit 19 – accepted for deduction of input VAT on expenses associated with the gratuitous transfer of fixed assets. VAT is deductible immediately after such expenses are reflected in accounting.

Debit 99 Credit 91-9 – reflects the loss from the gratuitous transfer of fixed assets.

Certificate of acceptance and transfer of property

__________________ “___” ____________ 20__

_____________________________________ represented by ______________________________ acting on the basis of ________________, hereinafter referred to as the “Lender”, on the one hand, and _____________________________________ represented by __________________________________________ acting on the basis

____________________ hereinafter referred to as the “Borrower”, on the other hand, have entered into this Act as follows.

The Lender, in accordance with the agreement for the gratuitous use of property dated “___”_________ 20__ No. ______, by means of its technical specialists in the presence of a representative of the Borrower, transferred the property in the composition specified in the Specification below.

Related documents

- Agreement for free use of property

- Agreement for free use of non-residential premises (2)

- Agreement for free use of non-residential premises

- Agreement for free use of the training track

- Agreement for the free use of part of the residential premises

- Certificate of transfer of equipment, components and technical documentation (annex to the agreement on transfer of equipment for free use)

- Certificate of acceptance of materials and technical documentation (attachment to the contract for the performance of works and services for the transfer of equipment for free use)

- Certificate of acceptance of materials and technical documentation, taking into account the customer’s comments (attachment to the contract for the performance of works and services for the transfer of equipment for free use)

- Acceptance certificate for equipment, components and technical documentation, taking into account comments on incompleteness or malfunction of equipment (appendix to the agreement on the transfer of equipment for free use)

- Certificate of acceptance of works (services) (annex to the contract for the performance of works and services for the transfer of equipment for free use)

- Free use agreement

- Agreement for free use (transfer of an apartment by a citizen to a legal entity)

- Agreement for free use of an apartment concluded between citizens

- Agreement for free use of equipment

- Agreement on the transfer of equipment for free use

- Agreement on the use of things

- Agreement for the free use of an apartment, concluded between a legal entity - an employer and an individual - an employee for the duration of the employment contract

- Agreement for free use of residential premises (apartment)

- Agreement for free use of a car

- Agreement for free use of land

- Agreement for free use of property (cooler)

You may also be interested in:

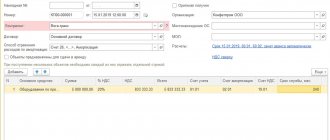

We see a list of all fields, in which we put a checkmark next to the Nomenclature field.

Reflection of VAT accrual in 1C - Setting up a list of fields in the tabular part In addition to the nomenclature and type of value in the tabular part, we fill out:

- other expenses account from which we write off VAT. I indicated the same - 91.02.1.

- event: VAT is charged for payment

- Price

- % VAT

- Quantity

You can leave or clear the remaining accounting accounts in the line; they are not included in the postings here.

And we carry out the document. To view the posting, you will need to go to the Accounting Posting Journal (click the Go button at the top of the document).

Postings for calculating VAT in 1C are not going anywhere.

Right at the bottom of the document, using the hyperlink, we create an invoice.

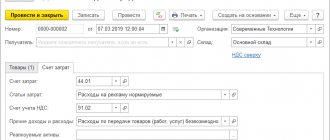

"1C: Accounting 8" (rev. 3.0). VAT accrual on donated souvenirs

On the Goods and Services tab, information about the transferred goods (materials) is indicated:

- Event (Implementation).

- Nomenclature - the name of the transferred souvenir products;

- Quantity, Price, Amount, % VAT, VAT - quantity, price and value of the transferred souvenir products, as well as the amount of accrued VAT;

- Type of value (Goods or Materials);

- Accounting account, Income account, Subconto - value accounting account, income accounting account (91.01) and the name of the article for accounting for other income and expenses - Expenses for the transfer of goods (work, services) free of charge and for one’s own needs (in the form of an element of the directory Other income and expenses flag Accepted for tax accounting must be disabled);

An invoice for donated souvenir products is created by clicking the Write an invoice button in the form of a document Reflection of VAT accrual.

After