Sometimes it happens that enterprises act as executors for some design, scientific, construction and other workloads. And the completion of each specific stage of the entire project is reflected in the corresponding entries in accounting. In this article, we will analyze the meaning of account 46 in accounting, what typical entries are made, and also look in more detail at one of the examples of reflecting transactions for the designated position.

When to use account 46

According to the Chart of Accounts, account 46 is called “Completed stages of work in progress” (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n). Therefore, score 46 is most in demand in construction.

Thus, accounting entries for account 46 are made to summarize information about stages of work completed in accordance with concluded contracts that have independent significance.

By virtue of the official instructions for account 46, it is, if necessary, used by organizations performing long-term work, the initial and final deadlines for which usually relate to different reporting periods.

For example, entries in accounting account 46 in construction can directly reflect construction, as well as scientific, design, geological, etc. work.

The accounting department maintains analytical accounting for account 46 by type of work.

KEEP IN MIND

Completed stages of work can be reflected on account 46 only if they are paid for by the customer.

The use of account 46 must be specified in the organization’s accounting policies.

Important Features

The balance of account 46 is taken into account when calculating property tax. In this regard, the organization must remember that if the revenue for the project stages is not determined, then it is taken into account as the amount of funds spent on the implementation of the project stages. Therefore, you need to pay attention to the following points of accounting policy:

- on the procedure for recognizing the organization’s revenue (for individual stages of work or for all stages at once);

- on the method of determining the readiness of products, works, services.

Account calculation procedure 46

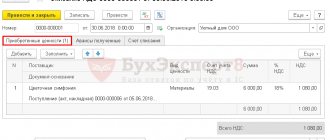

The debit of account 46 takes into account the cost of stages of work completed by the organization, paid by the customer, accepted in the prescribed manner, in correspondence with account 90 “Sales”.

At the same time, the amount of costs for completed and accepted stages of work is written off from the credit of account 20 “Main production” to the debit of account 90 “Sales”. The amounts of funds received from customers in payment for completed and accepted stages are reflected in the debit of cash accounts in correspondence with account 62 “Settlements with buyers and customers”.

Also see "".

The procedure for closing account 46 is as follows: upon completion of all work as a whole, the cost of the stages paid by the customer, recorded on account 46, is written off as a debit to account 62.

If at the time of completion of all work the stages were fully paid, account 62 for a specific customer is also closed.

When, as a result of final settlements, the customer overpaid for the work, the difference is returned to the contractor by posting:

Dt 62 – Kt 51, 52

The cost of fully completed work, recorded on account 62, is repaid from previously received advances and amounts received from the customer in final settlement in correspondence with the debit of cash accounts.

In the bay. On balance sheet 46, the account is reflected in line 1210 “Inventories,” i.e., costs of work in progress.

Also see “Work in Process: Line on the Balance Sheet.”

Are advances issued an asset or a liability - where is VAT in the balance sheet?

» Contents Reserves formed in accordance with the constituent documents Retained earnings of previous years Retained earnings of the reporting year Bank loans subject to repayment more than 12 months after the reporting date Other loans subject to repayment within 12 months after the reporting date Bank loans subject to repayment within 12 months after the reporting date Other loans subject to repayment within 12 months after the reporting date Bills payable Debt to subsidiaries and dependent companies Debt to the organization's personnel Debt to the budget and social funds Debt to participants (founders) for payment of income Reserves for upcoming expenses and payments Property organizations - assets and liabilities That is, this is all the property of the enterprise with the help of which the enterprise plans to make a profit. The solutions to problems are presented in tabular form.

Reflect changes in the balance sheet under the influence of business transactions. Balance sheet as of August 31, 20...

(thousand rubles) Debt to suppliers Debt to the budget Debt to social insurance authorities During the reporting period, the following business transactions were carried out: Balance sheet liabilities o charter captain - in joint-stock companies and limited and additional liability companies; Accounting for the authorized capital is carried out on account 80 “Authorized capital”.

There are also the following rules: In accounting reports, advances received should not be offset between the item of asset and liability, item of profit and loss.

An exception is cases when such offsets are provided for by PBU 4/99 Clause 34 The procedure for assessing individual items of accounting reports is approved by the relevant accounting standards Clause 36 Accounting items that are compiled in the reporting year are confirmed by the result of the inventory of assets and liabilities Clause 38 On the need to reflect debts on a subaccount of the account 60, 62, 76 are not mentioned in the PBU.

Important When an inventory of the calculation and reconciliation with the counterparty is carried out, all amounts of debt are identified, including VAT (namely, they are reflected in the primary documentation).

Clause 73 of the Regulations states that both parties must show the amounts that follow from the accounting records and are considered correct. In addition, it is worth taking into account such nuances as offset of advance amounts and accounting for value added tax on advance payments.

We recommend reading: Seizure of a pension card by bailiffs

You just need to find out who should transfer the funds and where - you to the treasury, or the state to you.

Asset or liability on the balance sheet Advances that were received and paid are a type of accounts payable and receivable.

Those amounts that are not repaid must be reflected in the balance sheet.

Attention The Tax Code requires, when receiving an advance, to determine the value added tax base and calculate the tax.

Later, a basis is formed for the restoration of previously paid tax.

A deduction is also possible when adjusting the terms of the contract or terminating it and returning advance funds.

Account 62.02 is passive, as it works from the moment funds are received from the buyer.

Inventories in balance with or without VAT

» Contents Accordingly, they will no longer be taken into account on line 1220 of the balance sheet. Moreover, since such amounts will be included in other expenses, they will be reflected on line 2350 of the income statement.

Lines 1230 and 1520 In general, accounts receivable (payable) are reflected in the balance sheet in full, that is, including VAT. The situation is different with the listed (received) advances. Here the situation is as follows.

Repayment of the obligation of the party that received the advance (prepayment) consists of the delivery of goods (performance of work, provision of services, transfer of property rights). Based on the requirements of tax legislation regarding the payment and reimbursement of VAT, the amount of obligations to be repaid does not include the amount of tax. If the agreement provides for stages, then revenue is recognized in tax accounting in the general manner as the acceptance certificates for work (stages) are signed.

There are two ways to smooth out these differences. First {amp}amp;#8212; provide in the contract for monthly or quarterly delivery of work (at the end of each quarter) on the basis of acts in form N KS-2 and KS-3 (if we are talking about a construction contract). These forms can (with some stretch) be called documents confirming the degree of readiness of the work.

Therefore, the accountant can recognize accounting and tax revenue on a monthly (quarterly) basis in the amounts reflected in these forms. The data will match. And in this case, you can do without using account 46 (since, in accordance with the contract, the signing by the customer of forms KS-2 and KS-3 is recognized as acceptance of work at the stage, revenue is recognized immediately as a debit to account 62, an interim account 46 is not needed). In this case, usually the final value of the indicator for calculating the standard becomes known only at the end of the year, and the expenses themselves can be collected throughout the year, and the accountant has the obligation to quarterly adjust the amount of VAT as the base from which the standard is determined increases. At the end of the year, some amounts of undeductible VAT may accumulate.

Advances transferred Line 1230 “Accounts receivable” This line reflects the full amounts of buyer (debtor) debts remaining at the end of the year, including VAT. Lines 1230 and 1520 In general, accounts receivable (payable) are reflected in the balance sheet in full, that is, including VAT.

The situation is different with the listed (received) advances.

Here the situation is as follows. Repayment of the obligation of the party that received the advance (prepayment) consists of the delivery of goods (performance of work, provision of services, transfer of property rights). Advance amounts can also be made under a “No Contract” agreement.

This means that the prepayment amount will be credited regardless of the contracts under which the goods are sold.

The seller’s obligation to prepare invoices when receiving advance funds and to charge VAT is stated in paragraph 1 of Art. NK. In typical configurations, the “Invoice issued” document is used for this.

It is entered based on extracts that were previously created.

Accordingly, they will no longer be taken into account on line 1220 of the balance sheet.

Moreover, since such amounts will be included in other expenses, they will be reflected on line 2350 of the income statement.

Lines 1230 and 1520 In general, accounts receivable (payable) are reflected in the balance sheet in full, that is, including VAT.

The situation is different with the listed (received) advances. Here the situation is as follows.

Repayment of the obligation of the party that received the advance (prepayment) consists of the delivery of goods (performance of work, provision of services, transfer of property rights). Based on the requirements of tax legislation regarding the payment and reimbursement of VAT, the amount of obligations to be repaid does not include the amount of tax.

The VAT results are reflected in the balance sheet as follows:

- in the passive - in one line (1520).

- in the asset - in two lines (1220 and 1230),

The Russian Ministry of Finance advises including in lines 1230 and 1520 receivables and payables for advances minus VAT. Note that the taxpayer has the right to act differently and not deduct the amount of tax from the debt.

However, in this case you need to be prepared to argue your position.

Individual entrepreneurs should not rush to pay 1% contributions for 2021. Firstly, because from this year the deadline for paying such contributions has been postponed from April 1 to July 1.

Accordingly, 1% contributions for 2021 must be transferred to the budget no later than 07/02/2018 (July 1 - Sunday). In this case, usually the final value of the indicator for calculating the standard becomes known only at the end of the year, and the expenses themselves can be collected throughout the year, and the accountant has the obligation to quarterly adjust the VAT amount as the base from which the standard is determined increases.

At the end of the year, some amounts of undeductible VAT may accumulate. Info Their last day of the year should be written off as other expenses, since tax amounts exceeding the amount corresponding to the calculated value of the standard will no longer be accepted for deduction.

To find out whether it is possible to legally reduce the amount of VAT paid to the budget, read the article

“How to pay less VAT: are there legal ways to save?”

.

Advances transferred Line 1230 “Accounts receivable” This line reflects the full amounts of buyer (debtor) debts remaining at the end of the year, including VAT.

Balance lines 2021: decoding

→ → Current as of: February 11, 2021

Drawing up a balance sheet is essentially transferring the balances of the accounting accounts to the lines provided for them. Therefore, to correctly draw up a balance sheet, you need not only to keep accounting records correctly and in full, but also to know which accounting accounts are reflected in which line of the balance sheet. During the consultation, we will provide a breakdown of all the lines of the balance sheet.

In this case, we will detail the balance sheet lines according to the most typical accounts, which are reflected on such lines. After all, the procedure for drawing up financial statements in general and the balance sheet in particular, as well as the reflection of certain indicators, is influenced by the characteristics of the organization’s activities and its activities.

By the way, we showed how to draw up a balance sheet in a separate example. And we talked about the content and structure of the balance sheet in another. Let us remind you that the current form of the balance sheet submitted to the tax inspectorate and statistical authorities has been approved.

Name of the indicator Code Data from which accounts are used Algorithm for calculating the indicator Intangible assets 1110 04 “Intangible assets”, 05 “Amortization of intangible assets” D04 (excluding R&D expenses) – K05 Results of research and development 1120 04 D04 (in terms of R&D expenses) Intangible exploration assets 1130 08 “Investments in non-current assets”, 05 D08 – K05 (all in terms of intangible exploration assets) Tangible exploration assets 1140 08, 02 “Depreciation of fixed assets” D08 – K02 (all in terms of tangible exploration assets) Fixed assets 01 “ Fixed assets", 02 D01 - K02 (except for depreciation of fixed assets accounted for on account 03 "Income-generating investments in material assets" Income-generating investments in material assets 1160 03, 02 D03 - K02 (except for depreciation of fixed assets accounted for on account 01) Financial investments 1170 58 “Financial investments”, 55-3 “Deposit accounts”, 59 “Reserves for impairment of financial investments”, 73-1 “Settlements on loans provided” D58 – K59 (in terms of long-term financial investments) + D73-1 (in terms of long-term interest-bearing loans) Deferred tax assets 1180 09 “Deferred tax assets” D09 Other non-current assets 1190 07 “Equipment for installation”, 08, 97 “Deferred expenses” D07 + D08 (except for exploration assets) + D97 (in terms of expenses with a deadline write-offs over 12 months after the reporting date) Inventories 10 “Materials”, 11 “Animals for growing and fattening”, 14 “Reserves for reducing the value of material assets”, 15 “Procurement and acquisition of material assets”, 16 “Deviation in the cost of material assets”, 20 “Main production”, 21 “Semi-finished products of own production”, 23 “Auxiliary production”, 28 “Defects in production”, 29 “Service production and facilities”, 41 “Goods”, 42 “Trade margin”, 43 “Finished products” , 44 “Sales expenses”, 45 “Goods shipped”, 97