Today, leasing is gaining increasing popularity among individuals and entrepreneurs. This is explained by the fact that it makes it possible to buy a vehicle without having its full cost in hand. In addition, a leasing transaction is concluded faster than a loan. The client who has signed the contract and paid the advance amount can receive the car on the same day and drive away with it.

However, despite the simplicity and speed of registration, the lessee has questions related to the taxation of the vehicle. In particular, who should pay the transport tax if the car is leased - the user or the owner?

Parties to the leasing agreement

Leasing a vehicle is a financial transaction made regarding the transfer of certain property for use, in our case a vehicle, drawn up in the form of an agreement. As with any leasing agreement, it stipulates the period for which the asset is provided for use, and at the end of this period the vehicle can be retained or returned.

There are always three parties to a leasing agreement:

- lessor - an individual or organization that buys any property (including vehicles) from the owner, but not for their own use, but to transfer this right;

- lessee - a legal or private person who receives the specified vehicle for paid use for an agreed period;

- supplier (seller) – the primary owner of the subject of the contract from whom the lessor purchases the property for leasing.

Which of these parties is required to pay transport tax? This depends on a number of parameters, which will be discussed below.

How is tax paid?

Having determined which of the participants in the transaction will pay the transport tax, it is necessary to consider the conditions and procedure for fulfilling obligations to the budget. The mechanism for calculating and paying tax will consist of the following stages:

- information about permanent registration is annually transferred from the traffic police register to the tax service;

- if the lessee is obliged to pay tax under the terms of the agreement, information about the temporary registration of the car will be transferred to the Federal Tax Service when filling out tax and accounting reports;

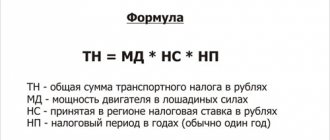

- Transport tax is calculated based on the results of the calendar year - for this, the power indicators, year of manufacture and place of production of the car are taken into account;

- for calculations, rates approved by regional regulations are used - temporary or permanent benefits may be introduced for certain categories of enterprises;

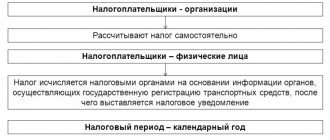

- if the Federal Tax Service sends out receipts with tax calculations to citizens, then business entities must do this themselves - the corresponding declaration is submitted to the tax authority by the payer;

- under certain conditions, transport tax can be reduced if the leasing transaction is completed within the framework of state or municipal programs.

Depending on the conditions of regional legislation and the taxation regime, an enterprise may take advantage of benefits and preferences. Such benefits cannot be of an individual nature, i.e. apply only to a specific enterprise.

The subject of leasing may be property that is not subject to taxation. For transport tax, such rules can be introduced at the federal and regional levels. For example, certain constituent entities of the Russian Federation may eliminate the obligation to charge taxes for small businesses if the vehicle’s power does not exceed 100 hp.

The final result of the leasing transaction may be the transfer of ownership to the lessee. In this case, immediately after payment of the entire leasing amount, the parties submit an agreement to the traffic police to register the transfer of ownership. Naturally, after receiving the vehicle registration certificate, all tax obligations will be borne by the former lessee.

The opposite situation may also arise when the lessee does not exercise the right to final purchase of the vehicle. If the obligation to pay tax was assigned to this party to the transaction, it will remain until the termination of the contract or its expiration. In addition, in the process of executing a leasing transaction, the parties can change the terms of the agreement, including the procedure for temporary and permanent registration of transport, and the terms of tax payment. Changes in contractual terms will be reflected in tax and accounting reporting, so the Federal Tax Service will receive a reliable transport tax return.

Be careful with car leasing

The main attractive feature of leasing agreements regarding vehicles is the opportunity to use the vehicle, even if there is no financial opportunity to purchase it immediately, as well as the prospect of obtaining ownership of it.

But there are also negative features of such a transaction that should be taken into account and the risks correctly assessed before concluding a contract:

- The credit is still lower. Interest on a leasing agreement is usually higher than bank interest. But the conditions of banks differ significantly and are not subject to revision and adjustment.

- "Medical examination" of the car. Until the end of the contract, the lessor will regularly inspect the vehicle, which is still legally owned by him.

- You'll have to ask first. The recipient of the car will not be able to carry out any legal actions with it without the permission of the lessor.

- Remember, the car is not yours yet. If during the validity of the leasing agreement the recipient violates any conditions (payments were not made on time, mandatory technical inspection was not completed, maintenance was not carried out on time, etc.), the car will not become the property of the recipient, he will lose this right.

What benefits are there?

Institutions that have at their disposal motor vehicles belonging to the third depreciation group can take advantage of benefits for paying property duties for organizations on movable assets.

Objects that are registered as a result of the liquidation of legal entities or their reorganization are deprived of preferential discounts.

Preferential programs for property duties are provided for organizations that are participants in the free economic zone, namely for purchased motor vehicles for the purpose of using them and conducting business for 10 years.

These benefits and amendments to legislation are aimed at avoiding tax evasion. After all, most legal entities, as a result of the reorganization of the institution, are trying to hide from debts to the state.

Due to changes in the law and amendments, not a large number of new taxpayers will be added.

After all, the majority of institutions will be exempt from paying duties as a result of using benefits (for the third depreciation group) or complete exemption from fees if motor vehicles belong to the first and other classification categories.

Only those companies that fall under the above exception (reorganization and liquidation of legal entities) will pay.

Legislative regulation of transport taxation

The controversial issue of payment of transport tax for the corresponding leasing is considered in a number of legislative documents:

- Tax Code of the Russian Federation:

- Art. 357 – about who is the tax payer: the person in whose name the vehicle is registered;

- Art. 358 – about objects of taxation;

- Art. 360 – about reporting tax periods;

- Art. 361 – about rates and benefits;

- Art. 362 – on the timing of payment of TN;

- Art. 363 – on the procedure for accepting payment.

- Federal Law No. 164 “On financial lease (leasing)” dated September 11, 1998 regulates relations under a leasing agreement. Art. 20 states that any party to the contract can be considered the owner of the leased object.

- Order of the Ministry of Internal Affairs of the Russian Federation No. 1001 regulates the establishment of ownership of a car by concluding a special agreement.

- Letter of the Federal Tax Service No. BS-4-11/22368 provides additional clarification regarding the payment of TN in leasing.

Ipc-zvezda.ru

From the above provisions of the Tax Code it follows that payers of the property tax of organizations are companies whose balance sheets include movable and immovable property as fixed assets according to the accounting rules, with the exception of the objects specified in paragraph 4 of Art. 374 Tax Code of the Russian Federation. The property referred to in the question is not included in the list of objects not recognized as objects of taxation. The next point that needs to be clarified when deciding on the need to calculate property tax is tied to Art. 381 Tax Code of the Russian Federation. It lists the benefits provided to property tax payers. One of them concerns movable property registered as fixed assets from 01/01/2013.

Basic postulates of TN in a leasing transaction

So, the main legal documents regarding the payment of TN when leasing vehicles state the following:

- the obligation to pay the TN lies with the owner of the vehicle;

- the lessee or the lessor may be considered the owner, depending on the circumstances;

- the person in whose name the car is registered determines the agreement concluded between the parties to the leasing transaction;

- vehicle registration can be issued for a permanent period or only for the duration of the leasing agreement;

- The transport fee is paid by the owner regardless of the registration period.

How to determine the owner

The agreement specifies the nuances of the transfer of property into ownership under the terms of leasing. Upon conclusion of the relevant agreement, it may be owned by:

- the lessor - until the leasing term expires and all its conditions, especially financial ones, are met;

- lessee - on a permanent or temporary basis (depending on the agreement).

NOTE! If the registration of ownership of the car is temporary, you must provide a copy of the leasing agreement and an agreement on the temporary registration to the car control authorities (traffic police or others).

The parties themselves decide who will be the legal owner of the leased asset and formalize it in a contract or leasing agreement.

A few important points

When calculating the transport fee, there are some features that are taken into account even if the vehicles are purchased on lease.

All regions have different rates , which differ greatly from each other. Sometimes the terms of the deal allow the car to be used in another region. If the tax payer in this case is a company, then the amount of the monthly payment is increased or decreased by the local tax rate. This rule must be specified in the contract or recorded in an additional agreement.

The second feature can be considered regional benefits applied to business entities. For example, in some areas, leasing companies associated with special economic zones have a discount on transport tax. Enterprises engaged in agricultural activities receive the same discount in a number of regions.

Some types of vehicles are not subject to tax. These include:

- passenger cars equipped for use by a disabled person;

- agricultural special equipment used in accordance with its intended purpose;

- vehicles belonging to certain executive authorities.

The correct choice of the person in whose name the car will be registered after the transaction will help optimize taxation. It is known that tax rates are different in different regions. So, you can save on fees by choosing a leasing company from a neighboring region with lower tax rates. This is especially important for large carriers or other companies that lease vehicles.

If the leasing company registers the vehicle in its name, it is obliged to issue the client a power of attorney to drive it . The client must make sure that it applies for the entire duration of the leasing transaction, and not for 2 or 3 months.

What to Consider When Choosing a Title Type

Before concluding a leasing agreement, you need to carefully weigh all the factors that could affect the value of the property being transferred and decide which agreement to transfer ownership of the car should be concluded. The following points are important:

- Differences in transport tax rates in different regions of the Russian Federation. The Tax Code of the Russian Federation states that regional authorities can increase or decrease tariff rates up to tenfold. The tax on a car leased will be calculated according to the region of the property owner, because it will fall into the budget of this region. If the difference is significant, it is better to prefer a form of agreement in which the owner will be considered a person registered in a region with a more lenient rate.

- Possibility to apply the benefit. The situation is similar to the situation with the tax rate - all other things being equal, the region of registration with tax benefits should be preferred.

- Economic expediency . If you enter into a leasing agreement without taking into account all the key factors, this can significantly increase the cost of the property, while taking them into account will benefit both parties to the transaction.

IMPORTANT! Calculation and payment of TN is carried out in accordance with regional laws at the place of registration of the vehicle.

What happens if you don’t pay tax on a leased car?

Violation of payment deadlines or failure to fulfill tax obligations leads to:

- a fine of 20% of the cost of the vehicle;

- accrual of penalties for each day of absence;

- seizure of the payer's bank accounts;

- seizure and sale of property to pay off debts to the state;

- ban on travel abroad of the Russian Federation for an individual.

These sanctions apply in all cases, regardless of the status of the taxable object and the payer.

Balance and tax

Many car owners who bought a car on lease are interested in the question: “Does the obligation to pay tax depend on whose balance sheet the property is on?”

Naturally, the lessee has no desire to pay state duties for a car of which he is not the owner. However, legally, the presence of a car in the list of fixed assets of a leasing company does not affect the tax liability of the parties. As we have already said, the tax is paid by the person in whose name the car is registered, and not by the person on whose balance sheet it is listed.

Short video on the topic of transport tax and leasing:

Transport tax accounting for car leasing

If a leased vehicle is used for the main activity of an individual entrepreneur or organization, then the transport tax will apply to expenses for ordinary activities (clause 5 of PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n).

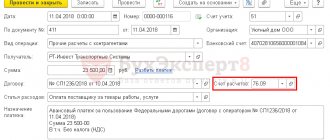

It is reflected in the debit of account 20 “Main production” and the credit of account 68 “Calculations for taxes and fees”.

When a transfer of TN is made, it is registered in the debit of account 68, the corresponding account is 51 “Current accounts”.

The legislative framework

The definition of the category “movable property” is in the Civil Code of the Russian Federation in Art. 130. All property is divided into known real estate and movable objects.

The first type of objects includes land and everything that is located on it, property that cannot be moved without causing significant damage. This includes objects and unfinished construction structures.

This also applies to the category of real estate of inland navigation vessels that are registered in the name of the state.

All other objects of taxation, such as financial assets and capital (money), documents, cars and everything that can move or move without causing harm to others are considered movable property.

Taxation of corporate profits and car leasing

Transport tax is a recognized expense of the organization. It should be taken into account when calculating income tax, not only the amount of tax itself, but also the advance payment for it. Accounting is carried out on the date of accrual as part of “other expenses associated with production and sales”.

RESULTS

- The parties to the leasing transaction, by their own will, determine who will be registered as the owner of the vehicle, at what point this right begins and for how long it is valid.

- Transport tax is paid by the lessor if ownership of the car is transferred to the recipient only upon fulfillment of all the conditions of the leasing agreement.

- Transport tax is paid by the lessee if the car is re-registered in his region on a permanent or temporary basis.

- The calculation procedure, deadlines and reporting for payment of TN depend on the rules adopted in the region of registration of the vehicle.

- The owner of the leased property bears not only the obligation to pay the technical tax, but also responsibility for late payments or reporting, arrears or non-payment, as well as for the lack of registration of the car transferred under the leasing agreement.

Features and subtleties of the process

If, after concluding the contract, it is noticed that it is missing important points (in particular, those relating to the issue of the payer of the TN), then an agreement must be concluded that will be an addition to the existing contract.

It indicates in a separate paragraph who will be the owner of the vehicle (to whom the car is registered in the traffic police), who is the payer of the corresponding fee. The choice is made based on the results of familiarization with all clauses of the contract. Sometimes unscrupulous lessors, being, according to agreements, the owners of the vehicle, shift the responsibility for paying for the technical requirements to the lessee. In the document, this is arranged in such a way that the TN amount is included in the amount of payments made by the lessee on a monthly basis.