The deadline for paying insurance premiums is until the 15th day of the month following the reporting month. If it is a weekend, the specified date is moved to the next working day.

The Tax Code has a separate chapter regulating insurance premiums. In addition, Federal Law No. 125 of July 24, 1998 is in force, which sets a deadline for the payment of insurance premiums for compulsory insurance against industrial accidents and occupational diseases, which remains outside the jurisdiction of the Tax Code of the Russian Federation. Payments for funded pensions, which are transferred by employers to the Pension Fund of the Russian Federation (Federal Law No. 56-FZ of April 30, 2008), also stand apart.

Use the reporting calendar from ConsultantPlus for free for the entire 2021. In it you will find deadlines for submitting all reports, current forms and instructions for filling out.

Deadlines for payment of insurance premiums in 2021: tables

We present the deadlines for payment of insurance premiums “for employees” (including injuries) in the table. Please note that for May-July micro-enterprises have new payment deadlines due to coronavirus, quarantine and non-working days in 2020.

| Period | Payment deadline |

| January 2020 | 17.02.2020 |

| February 2020 | 16.03.2020 |

| March 2020 | 04/15/2020 (postponement to 05/06/2020 for everyone) 10/15/2020 (postponement) |

| April 2020 | 11/16/2020 (postponed) |

| May 2020 | 12/15/2020 (postponed) |

| June 2020 | 11/16/2020 (postponed) |

| July 2020 | 12/15/2020 (postponed) |

| August 2020 | 15.09.2020 |

| September 2020 | 15.10.2020 |

| October 2020 | 16.11.2020 |

| November 2020 | 15.12.2020 |

| December 2020 | 15.01.2021 |

Insured individual entrepreneurs are required to pay insurance premiums “for themselves” for 2020 within the following terms:

| Condition | Payment deadline |

| Income up to 300 thousand rubles. inclusive | 31.12.2020 |

| Income over 300 thousand rubles. | 01.07.2021 |

Based on the meaning of paragraph 2 of Art. 432 of the Tax Code of the Russian Federation, payers who received more than 300,000 rubles. income, insurance premiums are transferred in 2 stages: until 12/31/2020 - a fixed amount, until 07/01/2021 - the amount from exceeding the limit of 300 thousand rubles.

It is allowed to pay contributions “for yourself” in installments. The main thing is that there is no debt on the deadline for payment.

KEEP IN MIND

Federal Law No. 172-FZ dated 06/08/2020 for individual entrepreneurs affected by coronavirus reduced the monthly fixed contributions to compulsory pension insurance (for themselves) by 1 minimum wage for the entire 2021 - from 32,448 rubles. up to 20,318 rubles. Also, Federal Law No. 172-FZ dated 06/08/2020 for organizations and individual entrepreneurs affected by coronavirus canceled (reset to zero) insurance premiums for the 2nd quarter of 2020 - from payments to individuals accrued for April, May and June 2020.

For more information, see “Features of payment of insurance premiums by organizations and individual entrepreneurs for the 2nd quarter of 2020.”

Read also

29.07.2020

What are insurance premiums?

Payments included in tax legislation from 2021 are administered by the Federal Tax Service of Russia, compulsory social insurance against industrial accidents and occupational diseases remains under the control of the FSS, and the Pension Fund of the Russian Federation monitors additional contributions to the funded pension.

According to the provisions of Article 8 of the Tax Code of the Russian Federation, insurance premiums are included in a separate obligatory payment, and their concept, as well as the definition of tax and fee, is enshrined in law. The Tax Code understands them as payments for:

- compulsory pension insurance;

- compulsory social insurance in case of temporary disability and in connection with maternity;

- compulsory health insurance.

But it is also important to timely transfer payments to the budget as part of insurance against accidents at work and payments for funded pensions, which remain non-tax payments. Changes in administration had virtually no effect on the deadline for paying taxes and contributions for individual entrepreneurs and legal entities; only the procedure for transferring money changed. It is very important to comply with the established deadlines, as this makes it possible to avoid fines.

Rates

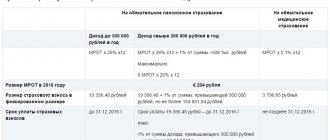

To understand the situation, let’s remember how the rates of insurance premiums for payments to Russian employees changed during 2020.

January - March 2021

In the first quarter of 2021, no anti-coronavirus benefits were yet in effect. For the majority of policyholders, the rates set out in Article 425 of the Tax Code of the Russian Federation were relevant:

- for pension contributions, if payments did not exceed 1,292,000 rubles - 22%;

- for pension contributions, if payments exceeded 1,292,000 rubles - 10%;

- for “sick leave” contributions, if payments did not exceed 912,000 rubles - 2.9%;

- for medical contributions - 5.1%.

ATTENTION.

In January - March 2021, insurance premium rates in most cases did not depend on the category of organization or individual entrepreneur. The same rates applied to both small and medium-sized and large enterprises.

Fill out, check and submit insurance premium calculations online

April - June 2021

In the second quarter, different tariffs were introduced for different categories of policyholders.

For companies and individual entrepreneurs included on the basis of a tax return for 2021 in the register of small and medium-sized businesses and belonging to the industries most affected by the pandemic, the contribution rates for April, May and June were 0%. The same applied to organizations included in the register of socially oriented non-profit organizations (SONCO), which have been receiving subsidies and grants since 2021. Zero tariffs are established by Federal Law No. 172-FZ dated 06/08/20 (see “A law has been adopted that exempts businesses from taxes and fees for the second quarter of 2021”).

ATTENTION.

You can check whether the policyholder is included in the SME register, and also find out which OKVED codes are assigned to the organization or individual entrepreneur using the “Kontur.Focus” service.

Connect to the service "Contour.Focus"

For all other SMEs, the following rule was introduced in April. The portion of the monthly payment that does not exceed the minimum wage (RUB 12,130) is taxed at regular rates. That is, according to those that were in effect in January - March 2021. The portion of the payment exceeding the minimum wage is taxed at reduced rates:

- for pension contributions (within the base and above it) - 10%;

- for sick leave contributions - 0%;

- for medical contributions - 5%.

Reduced rates were approved by Federal Law No. 102-FZ dated April 1, 2020 (see “Insurance premium rates have been reduced for small and medium-sized businesses”). Calculate insurance premiums at a new, reduced rate Try for free

If the payer of contributions was listed in the register of SMEs, but was then excluded from the register, it is necessary to switch to regular tariffs. This must be done from the 1st day of the month in which such an exception took place (see “Calculation of contributions for small and medium-sized businesses in 2021: see the algorithm from the Federal Tax Service”).

IMPORTANT.

Zero and reduced rates do not apply to pension contributions transferred at additional rates (letters from the Ministry of Finance dated 08.18.20 No. 03-15-07/72386 and the Ministry of Labor dated 08.07.20 No. 21-3/10/B-6512; see “ It is clarified whether it is necessary to pay additional contributions from payments for “harmful” work in the second quarter). Injury contributions in 2021 should also be paid at regular, non-concessional rates.

July - December 2021

In the third and fourth quarters, there are no more zero “coronavirus” rates.

All small and medium-sized enterprises (both those affected and not affected by the pandemic) use two tariffs. The part of the monthly payment that does not exceed the minimum wage is taxed at regular rates, and the part above the minimum wage is taxed at reduced rates. Namely: pension contributions - 10%, medical contributions - 5% (Federal Law dated 04/01/20 No. 102-FZ).

Calculate reduced contributions using the correct algorithm in a clear web service for small LLCs Calculate for free

Liability and fines

The deadlines must be strictly observed, otherwise the policyholders will be subject to penalties and administrative liability.

The employer is always responsible for the violation. Article 119 of the Tax Code specifies a penalty of 5% (of the contribution amount) accrued for each overdue month. The limit on this amount is at least 1000 rubles, but not more than 30% of the amount of payments.

If a budget organization deliberately underestimated the tax base (Article 120 of the Tax Code of the Russian Federation), then liability is assumed in the form of a fine of 20% of the unpaid amount of deductions (but not more than 40,000 rubles).

In Art. 121 of the Tax Code of the Russian Federation states that if the tax base is understated and, accordingly, the subsequent reduction in the amount of the contribution tax or if the amounts required for payment are erroneously calculated, the tax authorities impose a fine of 20% of the amount of unpaid contributions.

In case of partial payment or complete refusal to pay the insurance policy, the policyholder, in accordance with Article 122 of the Tax Code of the Russian Federation, is subject to penalties in the amount of 40% of the unpaid amount.

Postings

Although contributions are now regulated by the Federal Tax Service, the postings for them have been preserved. As before, the accountant must reflect all contributions in account 69. Debit 20 (25,26,23,44) Credit 69 - this posting records the accrual of contributions in the program.

In the online service Kontur.Accounting, contributions are calculated automatically. The service itself fills out payment slips, monitors exceeding the maximum base and creates reports on contributions. For the first 14 days after registration, you can work in the service for free: do accounting, payroll, automatically generate reports and use the support of our experts.

Try for free

This might also be useful:

- Reducing UTII by the amount of insurance premiums in 2021

- How to reduce the simplified tax system for insurance premiums?

- Individual entrepreneur insurance premiums for employees in 2021

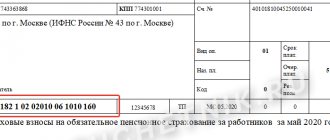

- Details for paying insurance premiums in 2021

- Insurance premiums for individual entrepreneurs “for themselves” in 2021

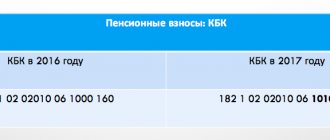

- KBC for insurance premiums for 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Payments subject to insurance premiums

Insurance premiums are levied on payments to employees based on labor relations and in accordance with civil contracts for the performance of work, provision of services and copyright orders.

Payments for which contributions are not paid are listed in Art. 422 Tax Code of the Russian Federation:

- State and social benefits;

- Compensation payments upon dismissal, payments for damages, payment for housing or food, payment for sports or dress uniforms, provision of allowances in kind, etc.;

- Prizes, additional payments to the pensions of former employees and scholarships under student contracts;

- Field allowance;

- Amounts of one-time financial assistance, for example, upon the birth or adoption of a child, upon the loss of a family member, during a natural disaster and other emergency circumstances;

- Income, in addition to wages, received by members of indigenous communities from the sale of traditional craft products;

- Insurance payments for compulsory and voluntary personal insurance;

- Payment for employee training related to professional needs;

- Other compensation and payments.

Types of mandatory pension contributions

Pension contributions are paid for employees registered under an employment contract, as well as for citizens with whom civil service agreements have been concluded.

Contributions are divided into two types:

- For compulsory pension insurance (OPI).

They are paid regardless of what activity the employee is engaged in and what contract is concluded with him. An exception is made only for self-employed citizens. There is no need to pay contributions on the income paid to them.

- Additional contributions for compulsory pension insurance.

They are transferred to the budget if the employee is engaged in work with harmful and difficult working conditions (Article 428 of the Tax Code of the Russian Federation). They are also paid by individual entrepreneurs and companies that make payments to flight crew members and mine workers (Article 429 of the Tax Code of the Russian Federation).

How to transfer

SV payments are sent monthly to the tax service. The accountant calculates the amount of contributions for the institution, draws up a payment order, checks the details and sends the payment to the Federal Tax Service.

Instructions on how to make a payment:

- “How to transfer insurance premiums to a budget organization”;

- “We fill out payments for insurance premiums.”

Tax base

Employers must determine the accrual base for each employee on a monthly accrual basis from the beginning of the pay period. If the payment amount has already exceeded the established limit, no payments are made.

The maximum value of the insurance premium base for 2021 is determined by Government Decree No. 1935 of November 26, 2020:

- compulsory pension insurance - 1,465,000 rubles;

- social insurance in case of temporary disability and in connection with maternity - 966,000 rubles;

- for other types of compulsory insurance, the maximum values have not been determined.

The database should include remuneration for full-time employees, other remuneration in favor of individuals subject to compulsory social insurance in accordance with federal laws on specific types of compulsory social insurance, determined by the norms of Article 420 of the Tax Code of the Russian Federation and 421 of the Tax Code of the Russian Federation, laws No. 125-FZ and No. 56-FZ. Thus, other remunerations in favor of individuals include:

- payment under civil contracts, the subject of which is the performance of work or the provision of services;

- payment under copyright contracts in favor of the authors of works;

- payments under agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, licensing agreements.

Employers calculate the amounts due for payment during the calendar year (settlement period) based on the results of each calendar month in the manner specified in Article 431 of the Tax Code of the Russian Federation, therefore the deadline for paying insurance premiums for December in 2021 to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation and the Compulsory Medical Insurance Fund is January 15, and for January you must pay no later than February 15.

This is interesting: Social insurance contributions.

Rules on deadlines and transfers

The procedure and deadlines for paying insurance premiums are established by Chapter 34 of the Tax Code of the Russian Federation. If in 2021 the deadline for paying insurance premiums falls on a weekend or non-working holiday, then the contributions must be transferred on the next working day. Such an indication is in paragraph 7 of Article 6.1 of the Tax Code of the Russian Federation. You can find out which day falls on a weekend or holiday in Articles 111 and 112 of the Labor Code of the Russian Federation. If holidays coincide with weekends, as a rule, they are moved to other dates.

The Government of the Russian Federation has adopted a Resolution on postponing holidays in 2021. The following holidays are postponed in 2021:

- from Saturday 5 January to Thursday 2 May;

- from Sunday 6 January to Friday 3 May;

- from Saturday 23 February to Friday 10 May.

See 2021 Production Calendar.

For which employees do I need to pay OSS contributions?

Employee social insurance contributions consist of two parts:

- Contributions in case of temporary disability and maternity (VNiM) - to the Federal Tax Service.

They are paid at a rate of 2.9% until the employee’s income from the beginning of the year does not exceed RUB 912,000. (limit for 2021). There is no need to pay contributions for incomes exceeding this value.

- Contributions from industrial accidents and occupational diseases (for injuries) - to the Social Insurance Fund.

The contribution rate depends on the type of activity, professional risk class and varies from 0.2% to 8.5%. The type of activity must be confirmed annually in order to establish a tariff for injury contributions. More information on how to confirm the main type of activity in the Social Insurance Fund can be found in this article.

The need to pay contributions to OSS depends on how the relationship with the employee is structured:

| Employment contract with a full-time employee | GPC agreement with an individual | Agreement with a self-employed person (payer of professional income tax) | Agreement with individual entrepreneur |

| OSS contributions are paid | VNiM contributions are not paid for such employees. Contributions for injuries are paid only if provided for by the terms of the contract | Contributions to OSS are not paid by either the employer or the self-employed* | Individual entrepreneurs pay their own insurance premiums |

* Formalization of relations with the self-employed must be approached seriously: an incorrectly drawn up agreement can be reclassified by the tax authorities as an employment agreement with all the ensuing consequences.

Social insurance contributions are paid to the budget taking into account the following features:

- Contributions to VNiM are transferred by employers for employees with whom employment contracts have been concluded. For performers working under GPC contracts, contributions to VNiM are not paid.

- Contributions for “injuries” can be transferred for citizens with whom civil contracts have been concluded, if the condition for this is stated in the contract. But in any case, their payment is the right, not the obligation of the employer.

- Contributions to VNiM are paid at a fixed rate of 2.9% (in some cases the rate may be reduced).

- The contribution rate for “injury” depends on the employer’s risk class and ranges from 0.2 (for the lowest class I) to 8.5% (for the highest class XXXII). The rate for contributions for injuries is set by the Social Insurance Fund based on data on the main type of activity, which all employers are required to confirm annually.