- Purpose of the article: reflection of information about borrowed funds.

- Line number in the balance sheet: 1410, 1510.

- Account number according to the chart of accounts: credit balance of 66, 67 accounts.

Borrowed funds are considered to be money received from third-party sources, which will need to be returned back under certain conditions. Such funds serve enterprises as financial support in times of crisis or other situations when their capital is insufficient.

Where are short-term loans and borrowings reflected on the balance sheet?

The form of the balance sheet was approved by Order of the Ministry of Finance dated July 2, 2010 No. 66n. In this form, 2 lines in the liability are intended to reflect debt on loans and borrowings:

- 1410 “Borrowed funds”;

- 1510 “Borrowed funds”.

Naturally, we are talking about loans and borrowings received. After all, issued loans that meet the criteria for financial investments specified in paragraph 2 of PBU 19/02 are part of the organization’s assets. We talked about accounting for financial investments and their reflection in the balance sheet in this material.

The above lines 1410 and 1510 of the balance sheet are included in long-term and short-term liabilities, respectively.

Short-term loans and borrowings in accordance with the Chart of Accounts and the Instructions for its application are reflected in account 66 “Settlements for short-term loans and borrowings” (Order of the Ministry of Finance dated October 31, 2000 No. 94n). Therefore, we can say that the balance of short-term loans and borrowings, i.e. the credit balance of account 66 as of the reporting date, should be reflected on line 1410.

But here it is necessary to take into account that the balance of account 67 “Long-term loans and borrowings” can be transferred in whole or in part to line 1410. This is possible if, as of the reporting date, account 67 contains liabilities whose maturity as of that date does not exceed 12 months. After all, the Chart of Accounts and the Instructions for its application do not provide for the transfer of short-term credits and borrowings from account 67 to account 66 (Order of the Ministry of Finance dated October 31, 2000 No. 94n). And the remaining balance of account 67 (in terms of long-term loans and borrowings) should be transferred to line 1410 (Order of the Ministry of Finance dated July 2, 2010 No. 66n).

You can read about filling out other lines of the balance sheet.

What is considered borrowed funds?

Depending on the type of organization that lent financial resources, they can be divided into two types:

- Loans.

- Loans.

The difference between types lies in the source of funding. Loans can only be provided by specialized organizations, that is, banks and other financial organizations. Loans can be issued by almost any legal entity and even an individual.

A loan is issued for the purpose of generating income for the lender, that is, at monetary interest. Loans can be interest-free. There is no benefit for a lender to risk their money without even receiving additional income. Therefore, an interest-free loan is found among affiliated and interdependent persons when several companies are united:

- to a corporation;

- holding;

- group.

Thus, you can divide the loans:

- external;

- internal.

ACCOUNTING FOR DEBT FOR CREDITS AND BORROWS RECEIVED

Loan costs in accordance with clause 4 of PBU 15/2008 must be reflected in accounting separately from the principal amount of the loan. In practice, this leads to the reflection of loans and expenses in different subaccounts of accounts 66 and 67. At the same time, according to clause 73 of the Regulations on accounting and financial reporting in the Russian Federation (approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n), debt on loans and credits received is shown taking into account interest due at the end of the reporting period. And these rules have not been changed with the entry into force of PBU 15/2008.

Consequently, in accounting, the following analytical subaccounts can be opened to account 66 “Settlements for short-term loans and borrowings”:

— 66-1-1 “Calculations for the principal amount of a short-term loan”;

— 66-1-2 “Interest on short-term loans”;

— 66-2-1 “Calculations for the principal amount of a short-term loan”;

— 66-2-2 “Interest on short-term loans.”

In a similar way, you can take into account long-term loans and borrowings in account 67.

The debt of the borrower's organization to the lender for received loans and credits in accounting should be divided into short-term and long-term.

Separating debt by maturity is necessary in order to correctly fill out the balance sheet. In addition, such division is provided for in the Chart of Accounts.

It should be recognized:

- short-term debt - debt on received loans and credits, the repayment period of which, according to the terms of the agreement, does not exceed 12 months;

- long-term debt - debt on received loans and credits, the repayment period of which, according to the terms of the agreement, exceeds 12 months.

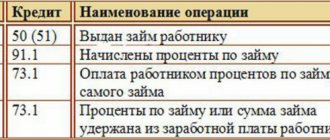

The amounts of short-term credits and loans received by the organization are reflected in the credit of account 66 “Settlements for short-term loans and borrowings” and the debit of accounts 50 “Cash”, 51 “Settlement accounts”, 52 “Currency accounts”, 55 “Special accounts in banks”, 60 “ Settlements with suppliers and contractors”, etc.

The amounts of long-term loans and borrowings received by the organization are reflected in the credit of account 67 “Settlements for long-term loans and borrowings” and the debit of accounts 51 “Settlement accounts”, 52 “Currency accounts”, 55 “Special accounts in banks”, 60 “Settlements with suppliers and contractors " etc.

Interest payable on short-term loans and borrowings received is reflected in the credit of account 66 “Settlements on short-term loans and borrowings” in correspondence with the debit of account 91 “Other income and expenses”. (Accrued interest amounts are accounted for separately.)

For the amounts of repaid short-term loans and borrowings, account 66 “Settlements for short-term loans and borrowings” is debited in correspondence with the cash accounts. Credits and borrowings not paid on time are accounted for separately. (For the amounts of repaid long-term loans and borrowings, account 67 “Settlements for long-term loans and borrowings” is debited in correspondence with the cash accounting accounts. Loans and borrowings not paid on time are accounted for separately.)

For accounts 66 and 67, it is advisable to leave the current journal with some adjustment - order No. 4-APK for credit and loan accounts and analytical accounting sheet No. 26-APK. These registers are quite well developed, and the journal used for settlement accounts - order No. 8-APK and analytical accounting sheet No. 38-APK - do not take into account most of the details necessary for recording data on loans and borrowings (terms for issuance and repayment of loans and borrowings, interest, operations on loans, discounting bills, etc.).

The data from their order journal is transferred to the General Ledger every month and subsequently transferred to the accounting financial statements.

Long-term loans and credits (balance on all subaccounts of account 67), subject to repayment in more than 12 months. after the reporting date, are reflected as part of long-term liabilities on line 510 “Loans and credits” of the balance sheet (Form No. 1).

Short-term loans and credits (balance on all subaccounts of account 66), subject to repayment within 12 months. after the reporting date, are reflected as part of short-term liabilities on line 610 “Loans and credits” of the balance sheet (Form No. 1).

In the appendix to the balance sheet (Form No. 5) in the section “Accounts receivable and payable” the following are reflected in separate lines: loans and borrowings to be repaid within 12 months. after the reporting date.

- about the presence and change in the amount of obligations under loans and credits (i.e. whether and to what extent there was an increase or decrease in borrowed debt);

— on the amounts of interest due for payment to lenders and creditors, subject to inclusion in the value of investment assets;

— on the amounts of expenses on loans and credits included in other expenses;

- on the amount, types, repayment periods of issued bills of exchange, issued and sold bonds;

— on the repayment terms of loans and credits;

— on the amounts of income from the temporary use of funds from received loans and credits as long-term and (or) short-term financial investments, including those taken into account when reducing the costs of loans and credits associated with the acquisition, construction and (or) production of investment assets;

- on the amounts of interest included in the cost of investment assets and payable to lenders and creditors for loans and credits taken for purposes not related to the acquisition, construction and (or) production of investment assets;

— about the amounts of loans (credits) shortfall in comparison with the terms of the loan agreement (credit agreement).

If an enterprise uses not only its own funds, but also borrowed funds in its activities, the accountant must reflect loans on the balance sheet. One of the main characteristics of such transactions is the attraction period. Which lines in Form 1 “Balance Sheet” indicate long-term loans, and which ones indicate short-term loans? Where should I enter information about accrued interest? More on this later.

What is the difference between a loan and a loan?

A loan represents funds transferred by a credit institution to a borrower. In this case, the latter pays interest for the use of such borrowed funds.

An important difference between a loan and a credit is that a loan is borrowed funds from organizations and individuals, expressed in money or their equivalent in kind.

Taking into account these definitions, we can highlight how a loan differs from a loan:

- a loan is issued only by a bank, and a loan can be provided by individuals, organizations and individual entrepreneurs;

- a loan implies payment of interest to the lender for using the amount issued; the issuance of loans does not contain such a mandatory condition: they can be interest-free;

- a loan is issued exclusively in cash, a loan - both in money and in the form of an equivalent in kind (in goods, for example).

Short-term loans and borrowings on the balance sheet – line

Are short-term loans an asset or a liability on the balance sheet? The designated liabilities include loans and credits received for a period of up to 1 year. Accounting for such finances is kept on account 66. In the balance sheet, the credit balance of account 66 is indicated on page 1510. Consequently, to the question: “Are short-term bank loans an asset or a liability?” the answer will be - passive.

However, in addition to the specified borrowed funds, line 1510 may also reflect loans previously presented as long-term if, as of the reporting date, the remaining repayment period for such obligations is less than 1 year (Letter of the Ministry of Finance of the Russian Federation 07-02-18/01 dated 01/28/10).

Methods for calculating financial debt

Net debt is calculated according to a predetermined scheme, which helps to avoid errors in indicators.

- First, you need to take short-term liabilities for a specific financial period and add them together. Typically, these include debts that the company has accumulated in one calendar year.

- Secondly, all points are recorded and then summed up using a regular calculator. The amount received must be entered at the very beginning of the list.

- Thirdly, it is necessary to add up long-term obligations, which usually include debts accumulated over more than one year. For example, this may include mortgage debt. The addition is carried out using the usual arithmetic addition formula in order to record the resulting amount in the list of long-term liabilities.

- Fourthly, you need to add up the finances available to the company at a particular moment. These will be indicators that include cash and its various financial equivalents. These include property, enterprise property, and various assets.

- Fifthly, it is necessary to add up short-term and long-term liabilities in order to subtract from the result obtained the amount received after adding up the enterprise’s own funds. As a result, the net debt of a particular company comes out.

Explanation of credits and loans to the presented balances

If it is necessary to clarify the information, the accountant can perform a full transcript of the borrowed funds. To do this, in the explanations for accounting (Appendix 3 of Order of the Ministry of Finance of the Russian Federation No. 66n dated July 2, 2010), the data is detailed for each loan. The number and date of the agreement, loan amount, name of the lender, repayment date, amount of debt, etc. are indicated.

Structure and objectives of the cash budget. A cash budget consists of two parts—expected cash receipts and expected payments and disbursements. To determine expected revenues for the period, information from the sales budget, data on sales on credit or with immediate payment, and data on the procedure for collecting funds from accounts receivable are used. An influx of cash is also planned from other sources, such as the sale of shares, the sale of assets, possible loans, receipt of interest and dividends, etc.

The Accounts Receivable account balance will be doubled for the quarter, the Accounts Payable balance will be reduced by 25%. Mortgage payments for the quarter will amount to 6,000, including 2,000 interest expenses. Expenses paid in advance Accounts receivable Inventory Fixed assets (residual value) Credit sales Credit sales account for 25% of total sales (75% of cash or bank sales). We assume that all debt on credit sales will be repaid within 30 days from the date of sale. At 30 September, accounts receivable will reflect the credit sales result for September (25% of 40,000). Total sales Sales on credit Sales with payment Receipt of funds from sales for cash to accounts receivable TOTAL 40,000 10,000 48,000 12,000 60,000 80,000 Accounts receivable as of December 3-1 of the previous year, rub. — 9500 The first approach is based on the interpretation of capital as money invested in the company (balance sheet liability). In this case, the general price index is calculated and all financial reporting items are recalculated in accordance with its value (for each object, the historical cost is recalculated by multiplying by a coefficient equal to the ratio of the price index of the year of recalculation to the price index of the year of acquisition of the object or business transaction). Balances for cash items (cash, accounts receivable, accounts payable) are not adjusted. All accounts receivable are classified into groups: payment has not arrived, overdue from 1 to 30 days (up to 1 month), from 31 to 90 days (from 1 to 3 months), from 91 to 180 days (from 3 to 6 months), from 181 to 360 days (from 6 months to 1 year), from 360 days or more (more than 1 year). To determine the expected receipts of funds for the period, information from the sales budget, data on sales on credit or for cash, and the procedure for collecting funds from accounts receivable are used. They also plan for an influx of funds from other sources, such as the sale of shares, assets, and possible loans. Let's assume that all 180 chairs produced are sold on credit at a price of CU 169 per chair and shipped to the buyer. Then two entries are made 1. Accounts receivable (180 chairs) 30 420 Accounts receivable - accounts receivable for the amount due to the company from customers for goods and services sold on credit. On the balance sheet, businesses are recorded as current assets. Cash in bank 111 Accounts receivable 121 Bills receivable, etc. Accounts Receivable 113 Capital Withdrawals Joan Accounts Receivable 18,000 201 Cumulative Date Accounts Receivable 2,000 Accounts Receivable (or Cash) 100 International Accounts Receivable are accounts receivable for goods sold on credit. Despite the fact that in the West there is no system- Accounts receivable X 201 Accumulated depreciation X Accounts receivable 14,000 201 Accumulated depreciation 27,000 All goods were sold at a price that was 40% higher than the cost of their acquisition. Assuming that all sales are on credit and that all cash is received, what would be the balance in Accounts Receivable at 31 December 19×0

The following forecast data is available. Accounts receivable experience shows that 30% of all credit sales are received in the month of sale, 60% in the month following the sale, and 8% in the second month after the sale. 2% of credit sales are doubtful (unreliable). All purchases are paid for in the month following the purchase. At 31 December 19×1 the balance in the Cash Account (ash) was 3,875. A ounts re eivable - accounts receivable accounts receivable from buyers and customers short-term liquid assets arising from sales on credit to wholesale and retail customers an item in the balance sheet in the current assets section after short-term financial investments. Debtor is a person who has received a product or service but has not yet paid for it. Accounts receivable are accounts receivable for amounts due to a business from customers for goods and services sold on credit. On the balance sheet, businesses are recorded as current assets. Total sales credit sales cash sales Receipts from cash sales into account receivable 40,000 10,000 48,000 6,000Q 80,000 12,000 36,000 10,000 46,000 What balance will be in the account Accounts receivable at 31 December 19X0 a) CU 50,000 b) 192 000 CU c) 250,000 CU d) 290,000 CU. A ounts re eivable - accounts receivable, debt from buyers and customers (occurs in sales with installment payments).

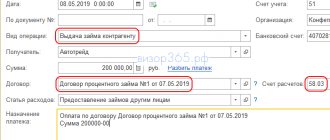

Accounting for interest-free loans issued

Let's consider the conditions from example 2, and assume that the agreement provided for the issuance of an interest-free loan.

Then the lender’s postings will look like this:

Dt 76 Kt 51 - issuance of an interest-free loan of 3,000,000 rubles.

The next and last entry in the lender's accounting will be entry Dt 51 Kt 76 (it will appear on the day the loan is repaid).

IMPORTANT! Loans issued on interest-free terms are not financial investments for the lending company (clause 2 of PBU 19/02), since the essential condition for recognizing assets as such is not met: their ability to generate income. At the same time, a loan issued that includes interest will be considered as such (clause 3 of PBU 19/02).

In the lender's reporting, the loan issued will be reflected in line 1230 “Receivables”. In this case, the organization can detail the type of receivables in the balance sheet: short-term debt with a maturity of 12 months or less and long-term debt with a maturity of more than 12 months.

Read how to account for an interest-free loan issued to an employee here.

Taxation

From a tax point of view, receiving a loan is not a profit of the organization, and is also not subject to VAT. Only if the loan was received in cash. When borrowed funds are expressed in property, VAT is charged on its value.

Interest paid for using a loan, on the contrary, is included in the tax base for profits and VAT, and for entrepreneurs - in personal income tax. They reduce profit as part of non-operating expenses, and the amount of VAT included as part of interest can be deducted by presenting invoices.

The personal income tax base for entrepreneurs is reduced by the amount of interest paid at the end of the year.

Sources:

- https://essencemarkets.com/2020/07/20/pokazatel-chistyj-dolg-ebitda-chto-eto-takoe-i-zachem-nuzhno/

- https://howtocredit.ru/2018/04/28/chistyj-dolg-po-balansu-eto-finansovyj-dolg-predpriyatij/

- https://finrange.com/dictionary/n/net-debt-ebitda

- https://dolg-faq.ru/zadolzhennost/chistyj-dolg.html

- https://www.audit-it.ru/finanaliz/terms/solvency/debt_to_ebitda.html

- https://www.finam.ru/education/likbez/kak-rasschitat-ebitda-20200706-19560/

- https://journal.tinkoff.ru/guide/ebitda-calc/

- https://bcs-express.ru/novosti-i-analitika/pokazatel-ebitda-chto-etot-takoe-i-kak-ego-schitat

- https://assistentus.ru/buhuchet/dolgosrochnye-i-kratkosrochnye-obyazatelstva/

- https://MoyDolg.com/obyazatelstva/vidy/dolgosrochnye-i-kratkosrochnye.html

- https://BusinessMan.ru/new-dolgosrochnye-kratkosrochnye-obyazatelstva-predpriyatiya-sostavlyayushhie-kratkosrochnyx-obyazatelstv-analiz-kratkosrochnyx-obyazatelstv.html

- https://saldovka.com/provodki/kredity-i-zaymy/kratkosrochnyie-i-dolgosrochnyie.html

Scope of the indicator

EBIDTA and its derivatives are widely used in the analysis of the financial activities of large companies.

- Banks and credit institutions are guided by their own EBIDTA standards, by which they assess the creditworthiness of enterprises.

- EBIDTA is of interest to business owners and company managers in terms of analyzing production processes, the financial condition of the organization and the prospects for its development.

- The indicator serves as an indicator of the professionalism and efficiency of the company's management.

- The EBIDTA value is used to judge the enterprise's income, assess its solvency and investment significance.

- This option is readily used by large enterprises with large capital expenditures. The share of depreciation of fixed assets of such companies can be up to 30% of the cost of commercial products. EBIDTA hides the need for these costs by showing investors earnings before depreciation, taxes, and interest. This metric helps a business appear more attractive than if it were measured by its actual net income.

- Analysts and investors prefer EBIDTA, as this value allows you to find out whether the invested funds will be used to expand and develop production or will be spent on covering debt obligations and paying taxes.

- This factor serves as one of the main indicators for compiling ratings of companies operating in the same industry. In this case, the size of enterprises, debts, and tax rates do not matter.

- EBIDTA is included in their reports by Russian companies that trade shares on international stock exchanges, actively attract funds from foreign investors, and plan to issue securities.

Among the holdings that show EBIDTA in their financial statements are the following joint-stock companies: Gazprom, Lukoil, VimpelCom, Magnit, Sberbank of Russia.

Small and medium-sized enterprises in Russia practically do not use the EBIDTA activity characteristic due to the specifics of reporting and the lack of proper analysis of their activities.

Economic sense

Net debt is considered an important financial indicator and may be required by the following decision makers:

- Investors. Before investing, an investor often conducts a systematic review of the company's financial condition. Calculating this indicator helps to decide whether it is advisable to buy or sell shares.

- Creditors and persons providing the enterprise with funds for use with the condition of their return. In this case, the indicator allows you to check the solvency of the company.

- Heads of organizations. The value is calculated by enterprise management to timely identify the threat of bankruptcy.

So, net debt is one of the objective financial indicators for both the lender and the investor. It allows you to assess the financial capabilities of an organization and the risks of its lending.

EBIDTA is excellent for benchmarking businesses in the same market segment and for assessing a company's net operating results.

This indicator is not suitable for studying the long-term development of a company. It does not take into account many expenditure costs: wear and tear on equipment, transport and other assets.

Guided by the value of the EBIDTA indicator, one should not forget about other multipliers that actually reflect the profitability of the enterprise.

Where can I find ready-made information?

The EBITDA indicator is present in the financial statements of large enterprises. The reporting of any public company, offered for review to investors, must reflect the EBITDA parameter, derived without taking into account depreciation and interest on loans.

The data is published on the companies’ websites, and the calculation algorithm is also provided there. There are reference services where you can get acquainted with indicators reflecting the financial condition of the company.

One of these services, Konomi.ru, is intended for investors in the Moscow Exchange stock market. “Konomi.ru” collects information about companies present on the exchange market, forecasts the financial and production prospects of issuers, and evaluates companies as objects of profitable investment of capital.

EBITDA for selected industries

When comparing companies in the same industry, analysts often use modernized EBITDA measures. For example, for the mining industry the following indicator is used:

EBITDAX = EBITDA + exploration costs

Many mining companies use different accounting policies to recognize exploration costs. Adding geological exploration and prospecting work makes it possible to ignore differences in accounting policies in different companies.

For retail, where large rental areas are concentrated, it is customary to use the EBITDAR indicator adjusted for the rental amount. It is also used in the aviation industry because... Most aircraft are purchased on lease:

EBITDAR = EBITDA + rental and operating lease costs

Thus, this method allows you to ignore the difference in rental costs and leasing maintenance for the company. Ultimately, for companies of different sizes and formats, it allows you to compare solely the commercial success of the company.

Conditions for the occurrence of each type

An important circumstance for the formation of liabilities of any type is their recognition. Only in this case do debts become part of the contractual terms. In the case of a trade or any industrial “creditor,” the claims are clearly identified and the essence of their recognition is clear. This type may be reflected by current debt with the emergence of a type of short sale.

Sometimes obligations arise without recognition by a party, but on the basis of laws

A considerable part of the responsibilities arises on the basis of concluded contracts, this includes assets purchased by the company, various services received, and responsibility for their provision on an advance payment. Often an organization accepts a duty in the form of guaranteed execution. And the recognition of these guarantees is expressed in the form of the emergence of obligations. This may mean defining the guarantee as a reserve. But when the recognition criteria are not met, they are recognized as conditional claims.

There is a form of emergence of duties imposed by law. The company's recognition of these claims occurs on the basis of notices and demands emanating from government agencies or on the basis of claims made by third parties.

A decrease in long-term liabilities indicates stabilization of the current activities of the enterprise and the ability to manage without the influence of lenders.

A decrease in short-term liabilities indicates that a competent manager is focused on reducing accumulated debts and is implementing it according to regulations. Also, timely payment affects the prestige of the institution and leads to improved business operations. Accounting is required to develop the composition and turnover of liabilities with an analysis of the criteria in dynamics, as this is important for maintaining the stability of the situation and minimizing critical situations.

The types of obligations will be discussed in the video: