Should you report or not?

Calculation of insurance premiums for employees is also referred to as DAM. The document became mandatory for registration starting in 2017. A corresponding chapter was added to the Tax Code, which describes accrual and payment and other important nuances.

The rules for filing reports and their execution state that these actions have become mandatory for citizens of the following categories:

- Individuals who pay remuneration to others, but do not themselves belong to.

- Individual entrepreneurs.

- Citizens with the status of legal entities.

The situation is slightly different for individual entrepreneurs who do not hire employees at all. According to the current law, all such citizens can be divided into two categories. These are those who calculate payments to employees, or those who do everything only for themselves. In the first case, we are talking about the category of policyholders, so filling out calculations becomes a mandatory requirement.

The latter will also be insured, but only for themselves. If there are no employees, there should be no calculations for insurance premiums. But there are situations when the requirement still comes into force.

The difference between individual entrepreneurs with and without employees

The difference between individual entrepreneurs working with and without employees is quite small. It consists in the fact that the former must submit reports to the Pension and Insurance Funds for each hired employee, but for the latter this is not necessary. There are even many special calculators on the Internet that help you calculate the amount of taxes to pay to the regional tax committee.

Important! If the income of an individual entrepreneur without employees for the entire year exceeded the minimum mark of 300,000 rubles, then he will need to pay an additional 1 percent to the state budget.

Understanding tax reporting and the deadlines for submitting it for individual entrepreneurs is not so difficult. The main thing is to make payments on time, prepare documents or reports on them, and submit them to the relevant regulatory authorities. Individual entrepreneurs who do not have employees will have to submit much less paperwork and reports in the future, but at the same time they do not have the opportunity to reduce their income by the amount of insurance payments.

Who should submit the report?

The obligation to submit reports from an entrepreneur without employees is removed. But there is a high probability that regulatory authorities will require additional clarification.

In any case, it must be reported separately that the subject simply does not have hired force. A zero report is always submitted, even when there are workers, but they are not continuing to work and are temporarily absent from the site. Document samples help you understand the filling rules.

Calculation of insurance premiums for individual entrepreneurs without employees

If an entrepreneur runs a business “alone,” that is, does not enter into employment or civil contracts with specialists, there is no need to submit a settlement. Why are such insurers not named in clause 7 of the stat. 431 NK? The logic of the tax authorities is simple: the DAM reflects the amounts of contributions only in relation to employees. If they are not there, then there is nothing to reflect.

After all, “single” individual entrepreneurs pay fixed amounts “for themselves” separately and in accordance with stat. 430 NK. But at the moment, reporting forms for this situation have not been approved. But an entrepreneur does not enter into an employment contract with himself. He conducts business activities on the basis of registration. Therefore, an individual entrepreneur is not recognized as an employee. This means that you are not required to enter information on your own into the DAM.

Rules for document execution

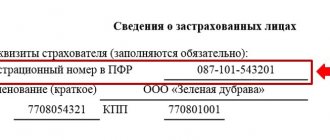

It is required to use a new form with a separate designation - KND 1151111. The form is filled out for all employees. The document contains the following types of information:

- Personal data for all persons who were insured. We need the addresses where they live and are registered, TIN.

- Information regarding who acts as the payer of insurance premiums. This type of payment is considered separately.

- Description of the same obligations, only for peasant farms.

- Description of an individual who does not have the status of an individual entrepreneur. It must be contributed by everyone who operates in the current market.

Attention! The paper version of registration and submission is chosen in most cases.

Employer Responsibilities

Hiring and staff formation leads to changes in accounting, increased payments and the appearance of a number of additional reports. A business owner who has employees must carry out the following mandatory activities:

- Pay for labor and transfer all deductions and payments for employees.

- Organize personnel document flow at the enterprise. The entrepreneur can handle this himself or hire a specialist. Responsibilities of a personnel officer include drawing up and signing agreements with hired personnel, orders, maintaining work books, hiring and firing, transfers, internships, etc.

- Go through the state registration procedure in the funds that provide personnel insurance (PFR, Social Insurance Fund, Compulsory Medical Insurance Fund).

- Submission of additional reports on hired employees to various government authorities: tax office, Pension Fund and Social Insurance Fund.

The responsibilities of an entrepreneur as an employer include the following:

- knowledge and compliance with labor laws;

- compliance of the type and volume of work with the concluded employment contract with the employee;

- ensure labor safety;

- provide the employee with the necessary tools and instructions;

- pay wages stipulated by the contract on time and in full;

- organization of collective bargaining;

- control and provision of information for the conclusion of a collective agreement by employees, if necessary.

Due dates

Calculation of insurance premiums is classified as a quarterly type of document. Usually we are talking about the following periods of time:

- Year.

- 9 months.

- Half year.

- 1st quarter. In this case, it is always necessary to transfer documents.

Until the 30th day of the month following the reporting period is the maximum period for which regulatory authorities must receive information. If the delivery day falls on a holiday or weekend, you can postpone the date until the next working day. It is acceptable to use paper and electronic media equally.

Reference! Information is provided during a personal visit or via email. Both options are acceptable. The responsible employee may suffer if at least part of the information is lost.

Generating reports for the Federal Tax Service

One of the most important activities of any enterprise is the calculation and payment of tax payments. The tasks of the inspectorate include monitoring the timeliness and completeness of tax payments. Therefore, the employer is obliged to submit reports to individual entrepreneurs for employees, observing the rules for filling out forms and the deadlines for submitting them. The tax office requires a list of the following documents:

- Information on the average number of employees. The data obtained and the calculations themselves are submitted to the inspectorate by January 20 every year.

- Form 2-NDFL.

- Declaration 6-NDFL.

- Reporting with calculation of contributions to extra-budgetary funds.

Penalty for late reporting

Fines apply even to companies that do not have employees or work at the moment. The penalties are described as follows:

- If there is no report - a fine of 1000 rubles.

- 300-500 rubles is a punishment for administrative persons on whose part violations are detected.

- Transactions on bank cards and accounts are suspended. If the shortcomings are eliminated, then the situation is corrected.

- 200 rubles when only some registration rules are not followed.

How to find out about all the individual entrepreneur’s debts to the tax authorities

You can find out the full and exact amount of the debt by going in person to the tax office at your place of residence or through online services.

You can view your tax office address and make an appointment here. At your appointment with the inspector, you should request a Certificate of Payment Status and a Statement of Transactions on Payments to the Budget. These documents show the total amount of debt and what payments and fines it came from. You can also get a certificate and an extract through Elba. We also told you how to understand them.

You can find out about debts without leaving home and pay them off right away on the Internet:

— In the Tax debt section through your personal account on State Services;

— In the individual entrepreneur’s personal account on the Federal Tax Service website. You can log in to your account through your State Services account or using your digital signature, if you have one.

Tax debts don’t just hang around in an individual entrepreneur’s personal account. First, the tax office sends a demand for payment, and then tries to write off money from all known accounts and personal cards of the entrepreneur. Inspectors can do this - Art. 76 Tax Code of the Russian Federation.

If inspectors do not find money in the accounts, the debt is transferred to bailiffs. They can come home and take the property. You can find your case in the database of enforcement proceedings.

What other calculation features are worth remembering?

Previously, such calculations were based only on information regarding profits. Now we are talking about the income received. The main thing is not to confuse the concepts with each other. The following types of income can be classified as income, depending on the chosen tax regimes:

- The amount of profit based on the relevant document when the patent system is applied. All receipts are based on existing documentation.

- With UTII, the income previously imputed for the year is summed up. Indicators from lines 100 are added up for the last several reporting periods.

- Under the simplified tax system, the amount also includes the so-called non-operating profit. For example, when payments for rent of premises are received. Such indicators are prohibited from being reduced by the amount of costs. This also applies to cases where the appropriate regime is used. This scheme does not apply only in the case of social payments.

- For OSNO, everything that is included in standard documents is taken into account.

If there is a single founder, then he is also considered the general director. It is he who receives the salary along with other forms of remuneration. And in this case, he is listed in the compulsory insurance system. Data is still transmitted to Federal Tax Service employees, albeit in a minimal form.

Important! All lines in the document are filled in, but only one person will be the recipient of the payment.

When completing zero calculations, the following components must be filled out:

- Title page.

- The first section, where the company that pays the insurance premiums describes its data.

- Second application.

- Third section.

All lines indicate the number 0 when there are no numerical indicators.

After receiving the documents, the tax service will organize a desk audit. Explanations are requested if any errors or inaccuracies are identified. The response must be sent within a maximum of 5 working days.

If there is no response, a fine of up to 5 thousand rubles may be imposed. Repeated violations result in the fine increasing to 20 thousand rubles.

The document is transferred even if all employees go on vacation at their own expense. The design is not much different from the standard rules outlined above. The obligation is completely lifted only from employers who have never been officially registered in the system.

Problems arise if at first there were employees, but then the relationship with them was broken, after which the citizen again works alone. If a citizen is not deregistered, there is a high probability of additional claims from regulatory authorities.

Submitting a report to the Pension Fund

As previously stated, personalized reporting to the Pension Fund of the Russian Federation is generated only by entrepreneurs and employers, so only they need to ask the question of how to submit a report. The composition and deadlines for submitting reports for individual policyholders are as follows:

- monthly information from SZV-M until the 15th day after the reporting month;

- once a year SZV-STAZH until 01.03.

Also, do not forget about the FSS, where the 4-FSS “injury report” is submitted every 3 months until the 20th on paper or until the 25th in electronic form.

When generating reports, please note that the old forms are outdated. New forms introduced:

- SZV-M – PFR Resolution No. 83p dated 02/01/2016, applicable from April 2021;

- SZV-STAZH – Resolution of the Pension Fund of the Russian Federation No. 3p dated January 11, 2017.

The completed SZV-M report looks like this:

The completed SZV-STAZH report looks like this:

Government agencies are trying to switch to electronic methods of interaction with citizens, so employers who employ more than 25 people are required to submit personalized reports in electronic form with a signature. Individual entrepreneurs with fewer employees can print reports on paper, but no one prohibits them from using electronic services.

Penalties for delays in submitting personalized reports or submitting them in the wrong form are established by Art. 17 of Law No. 27-FZ:

- 500 rubles for each worker for violating deadlines or for submitting false data;

- 1 thousand rubles for submitting a report on paper, if the policyholder must submit it electronically.

As a basis for a fine, the provisions of Art. 15.33.2 Code of Administrative Offenses of the Russian Federation. In this case, you will need to pay from 300 to 500 rubles.

Calculation of insurance premiums for foreign workers

In 2021, insurance premiums from remuneration to foreigners are paid according to general rules, except for those specialists who are highly qualified. The calculation is filled out in accordance with the Order of the Federal Tax Service No. ММВ-7-11 / [email protected] dated 10.10.16. The following must be submitted:

- Title of the document.

- Section 1.

- Subsections 1.1, 1.2 to section. 1.

- Appendix 2 to section. 1.

- Section 3.

What document is included in section 3? The answer was given by the Federal Tax Service of the Russian Federation in Letter No. GD-4-11/ [email protected] dated January 29, 2018. The identification of a foreigner is carried out taking into account the provisions of Statute. 10 No. 115-FZ dated July 25, 2002; Order of the Ministry of Finance No. 129n dated October 21, 2010. This is, first of all, a passport or other document. And for stateless persons - a residence permit or temporary residence permit without citizenship.