What benefits on insurance premiums are available to companies and individual entrepreneurs using the simplified tax system in 2021?

By a benefit on insurance premiums when paying taxes under the simplified tax system, it is legitimate to understand the opportunity to pay insurance premiums in a smaller amount (at reduced rates). At the same time, there is a very wide range of grounds on which these rates are applied, as well as criteria that determine the specific value of the reduced rates.

Let us consider them in more detail - in the context of the distribution of taxpayers entitled to benefits according to the categories listed in paragraph 1 of Art. 427 of the Tax Code of the Russian Federation, as well as the rates established in the same article of the code for various categories.

See also: “Is it possible to recalculate contributions if the income condition for preferential simplified taxation system activities is met mid-year?”

You can learn more about the specifics of the simplified taxation system in the article “Deadlines for payment of the simplified tax system for 2016–2017.”

Payers of insurance premiums.

Was: Art. 5 of Federal Law No. 212-FZ.

Became: Art. 419 of the Tax Code of the Russian Federation.

According to paragraphs. 1 clause 1 art. 419 of the Tax Code of the Russian Federation, payers of insurance premiums are persons who are policyholders in accordance with federal laws on specific types of compulsory social insurance and who make payments and other remuneration to individuals:

- organizations;

- individual entrepreneurs;

- individuals who are not individual entrepreneurs.

At the same time, pp. 2 of this paragraph contains a more detailed list of payers who do not make payments to individuals: individual entrepreneurs, lawyers, notaries engaged in private practice, arbitration managers, appraisers, mediators, patent attorneys and other persons engaged in private practice in accordance with the legislation of the Russian Federation.

As before, in a situation where the premium payer belongs to several categories simultaneously, he calculates and pays insurance premiums separately for each basis.

For your information

The Tax Code does not contain provisions according to which federal laws on specific types of compulsory social insurance may establish other categories of policyholders who are payers of insurance premiums (clause 2 of article 5 of Federal Law No. 212-FZ).

Benefits for contributions under the simplified tax system: intellectual activity

Business entities or partnerships using the simplified tax system that carry out activities in the field of intellectual development (including those related to the use of computer programs) have the opportunity to pay contributions:

- for compulsory pension insurance (MPI) - at a rate of 8% in 2017, then increasing (13% in 2018, 20% in 2019);

- for compulsory social insurance for temporary disability and maternity (OSS for VNIM) - at a rate of 2% in 2017, then, again, with an increase (2.9% - in 2018 and 2019);

- for OSS for temporary disability for foreigners - at a rate of 1.8%;

- for compulsory health insurance (CHI) - 4% in 2021, 5.1% in 2018 and 2019.

At the same time, firms must apply research results in practice (produce products based on developments), and also enter notifications about the formation of business entities and partnerships into the accounting register - quarterly in the manner prescribed by law.

Additional rates for special assessments

If an organization, in accordance with legal requirements, has carried out a special assessment of working conditions (special assessment) in the above-mentioned harmful or difficult jobs, then the rates of contributions for compulsory pension insurance in 2021 may be adjusted. They will depend on the established class (subclass) of working conditions (clause 3 of Article 428 of the Tax Code of the Russian Federation). Here is a table of tariffs, which depend on the results of a special labor assessment:

| Class of working conditions | Subclass of working conditions | Additional tariff for pension insurance |

| Dangerous | 4 | 8% |

| Harmful | 3.4 | 7% |

| 3.3 | 6% | |

| 3.2 | 4% | |

| 3.1 | 2% | |

| Acceptable | 2 | 0% |

| Optimal | 3 | 0% |

Read also

25.10.2016

Benefits for social contributions: business in special economic zones

Firms (including those working under the simplified tax system) that have entered into agreements on technology-innovation activities with SEZ management bodies, as well as making payments to citizens working in these SEZs, have the right to pay contributions using the same rates differentiated by year that simplifiers use in field of intellectual developments.

The same applies to companies that have entered into agreements to conduct tourism and recreational activities in the SEZ and make payments to citizens working in these SEZs. The taxation system does not matter - it may be a simplification.

Contribution benefits: business in the field of information technology

Legal entities (including those on the simplified tax system) working in the field of information technology (outside the SEZ) can pay contributions (in 2017–2023):

- for OPS - at a rate of 8%;

- OSS for VNiM - at a rate of 2%;

- OSS under contracts with foreign workers - at a rate of 1.8%;

- Compulsory medical insurance - at a rate of 4%.

Moreover, if a company is classified as newly created, then it must be:

- accredited as an IT firm;

- a business that receives at least 90% of its quarterly revenue from IT activities (for example, from the sale of software);

- an employer with an average number of employees in the quarter of at least 7 employees.

If the company is not newly created, then it must meet the same criteria, but in terms of income and average headcount in relation to 9 months of the year preceding the one in which the transition to reduced contributions is made.

Object of taxation of insurance premiums.

Was: Art. 7 of Federal Law No. 212-FZ.

Became: Art. 420 Tax Code of the Russian Federation.

Clause 1 of Art. 420 of the Tax Code of the Russian Federation provides that the object of taxation of insurance premiums for organizations and individual entrepreneurs are payments and other remuneration in favor of individuals subject to compulsory social insurance in accordance with federal laws on specific types of compulsory social insurance:

1) within the framework of labor relations and under civil contracts, the subject of which is the performance of work, the provision of services;

2) under copyright contracts in favor of the authors of works;

3) under agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on granting the right to use works of science, literature, art, including remunerations accrued by organizations for managing rights on a collective basis in favor of the authors of works under agreements concluded with users.

However, the following are not subject to insurance premiums:

- payments under civil law contracts, the subject of which is the transfer of ownership or other real rights to property, and contracts related to the transfer of property (property rights) for use, with the exception of the contracts listed in paragraphs. 2, 3 p. 1 art. 420 of the Tax Code of the Russian Federation (clause 4 of Article 420 of the Tax Code of the Russian Federation);

- payments in favor of individuals who are foreign citizens or stateless persons under employment contracts concluded with a Russian organization to work in its separate division, which is located outside the territory of the Russian Federation (clause 5 of Article 420 of the Tax Code of the Russian Federation);

- payments to volunteers as part of the execution of contracts concluded in accordance with Art. 7.1 of the Federal Law of August 11, 1995 No. 135-FZ “On Charitable Activities and Charitable Organizations” civil contracts for reimbursement of volunteers’ expenses, with the exception of food expenses in an amount exceeding the daily allowance provided for in paragraph 3 of Art. 217 of the Tax Code of the Russian Federation (clause 6 of Article 420 of the Tax Code of the Russian Federation);

- payments to foreign citizens and stateless persons under employment contracts or civil contracts, the subject of which is the performance of work, provision of services, in connection with participation in events for the preparation and holding of the 2021 FIFA World Cup and the 2021 FIFA Confederations Cup in the Russian Federation (clause 7 of article 420 of the Tax Code of the Russian Federation).

For your information

Payments under civil contracts, the subject of which is the performance of work, the provision of services, concluded with an individual entrepreneur, are not subject to insurance premiums.

Contribution benefits: shipping

Taxpayers making payments and other remuneration to the crews of ships registered in the Russian International Register have the right not to charge contributions on these payments and remuneration (from 2021 to 2027):

- on OPS;

- OSS for VNiM;

- Compulsory medical insurance.

The above-mentioned contributions for the performance of labor duties of ship crew members are not accrued to the corresponding payments and remunerations.

At the same time, vessels should not be used for the purpose of storing and transporting oil or petroleum products within the seaports of the Russian Federation.

The procedure for registering a taxpayer in the register of ships is established by Order of the Ministry of Transport of the Russian Federation dated December 9, 2010 No. 277 and involves inclusion in the register of passenger, cargo ships, as well as ships used to provide related services.

Are non-taxable amounts included in the calculation of insurance premiums?

To reflect non-taxable payments in the calculation of insurance premiums, appropriate lines are allocated. Thus, subsection 1.1 of Appendix 1 indicates the amount not subject to mandatory “pension” contributions (line 040), in subsection 1.2 - the amount not subject to insurance contributions (line 040) for compulsory medical insurance, in Appendix 2 - the amount not subject to contributions for compulsory health insurance. case of illness and motherhood (line 030). The lines are filled in taking into account the provisions of Art. 422 of the Tax Code of the Russian Federation (Appendix No. 2 to the Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/551).

Contribution benefits: production and services on the simplified tax system and individual entrepreneurs on a patent

In 2017–2018, companies using the simplified tax system have the right to pay contributions to the Pension Fund at a rate of 20% and not to pay contributions to the Social Insurance Fund for sick leave and maternity leave and to the Federal Compulsory Medical Insurance Fund, which:

1. Are engaged in production (in accordance with the list reflected in subparagraph 5, paragraph 1, article 427 of the Tax Code of the Russian Federation).

2. Carry out activities in the field of science, innovation, healthcare, social services, and sports.

3. They are engaged in processing recyclable materials,

4. They are engaged in construction.

5. Services provided:

- for vehicle maintenance and repair;

- for the removal of wastewater and waste;

- transport;

- in the field of communications;

- personal;

- repair of household products;

- in real estate management.

6. They are engaged in film production.

7. Organize the work of libraries, archives, museums, protect historical places and buildings.

8. Organize the work of botanical gardens, zoos, and nature reserves.

9. Are engaged in activities in the IT field (but do not belong to companies classified in subparagraphs 2 and 3 of paragraph 1 of Article 427 of the Tax Code of the Russian Federation).

10. Are engaged in retail trade in medicines and orthopedic products.

The main condition for applying a reduced tariff is that one of the above types of activities is the main one. Moreover, these taxpayers must have an annual income of no more than 79,000,000 rubles. and extract at least 70% of its value within the framework of a preferential type of activity.

An individual entrepreneur on a patent has the right to pay contributions at the same preferential rates that are established for listed companies on the simplified tax system, subject to the implementation of types of activities not specified in subparagraph. 19, 45–48 paragraph 2 art. 346.43 Tax Code of the Russian Federation.

Conditions for applying the reduced insurance premium rate

The tariff rates established for preferential categories are specified in Art. 427 Tax Code of the Russian Federation.

If certain conditions are met, benefits are provided:

- societies, partnerships on the simplified tax system;

- Russian IT companies;

- owners of Russian ships;

- non-profit and charitable organizations on the simplified tax system;

- a number of others.

IMPORTANT!

Since 2021, legislators have abolished benefits on insurance premiums for a number of economic entities. These include:

- organizations and individual entrepreneurs using the simplified tax system, according to the types of activities listed in clause 5 of Art. 427 Tax Code of the Russian Federation;

- pharmacies (individual entrepreneurs or organizations) with a license for pharmaceutical activities that use UTII;

- Individual entrepreneur on the PNS - in relation to payments and rewards accrued in favor of individuals engaged in the type of economic activity specified in the patent (with the exception of individual entrepreneurs carrying out the types of business activities specified in paragraphs 19, 45-48, paragraph 2 of Art. 346.43 Tax Code of the Russian Federation).

A complete list of business entities entitled to receive benefits on insurance premiums (Chapter 34 of the Tax Code), confirming documents for the right to apply preferential rates and the values of contribution rates are presented in table form.

| Name of business entity | Conditions | Confirmation document | Rule of law | Bet on OPS | Compulsory medical insurance rate | Bet on the case of VNiM |

| Business companies and partnerships | Activities of practical application (implementation) of the results of intellectual activity:

| Intelligence:

| Norm Art. 427 Tax Code of the Russian Federation:

Other standards:

| 2020 — 20,0 %. | 2020 — 5,1 %. | 2020 — 2,9 %. Foreign citizens and stateless persons temporarily staying in the Russian Federation, with the exception of highly qualified specialists - 1.8%. |

| Russian organizations operating in the field of information technology | Activities in the field of information technology (except for organizations that have entered into agreements (contracts) with the management bodies of special economic zones):

Organizations have the right to use this benefit:

Income is determined within the framework of Art. 248 of the Tax Code of the Russian Federation, while the income specified in clause 2, 11, part 2 of Art. 250 Tax Code of the Russian Federation:

| Intelligence:

| Norm Art. 427 Tax Code of the Russian Federation:

Other standards:

| 2017-2023 — 8,0 %. | 2017-2023 — 4,0 %. | 2017-2023 — 2,0 %. Foreign citizens and stateless persons temporarily staying in the Russian Federation, with the exception of highly qualified specialists - 1.8%. |

| Payers making payments and other remuneration to ship crew members for the performance of labor duties of a ship crew member | The crews of the ships are registered in the Russian International Register of Ships, with the exception of ships used for storage and transshipment of oil and petroleum products in the seaports of the Russian Federation. | Intelligence:

| Norm Art. 427 Tax Code of the Russian Federation:

| 2017-2027 — 0,0 %. | 2017-2027 — 0,0 %. | 2017-2027 — 0,0 %. |

| Non-profit organizations (except for state (municipal) institutions) on the simplified tax system | Scope of activity in the following areas:

The application of preferential rates is subject to the following conditions:

| Intelligence:

| Norm Art. 427 Tax Code of the Russian Federation:

Other standards:

| 2020 — 20,0 %. | 2020 — 0,0 %. | 2020 — 0,0 %. |

| Charitable organizations on the simplified tax system | The application of preferential rates is subject to the following:

| Intelligence:

| Norm Art. 427 Tax Code of the Russian Federation:

Other standards:

| 2020 — 20,0 %. | 2020 — 0,0 %. | 2020 — 0,0 %. |

| Organizations (IP) operating under agreements with authorities of special economic zones | Activities within:

| Intelligence:

| Norm Art. 427 Tax Code of the Russian Federation:

Other standards:

| 2020 — 20,0 %. | 2020 — 5,1 %. | 2020 — 2,9 %. Foreign citizens and stateless persons temporarily staying in the Russian Federation, with the exception of highly qualified specialists - 1.8%. |

| Organizations that have received the status of participants in the Skolkovo project | Carry out the following types of activities within the framework of the law of September 28, 2010 No. 244-FZ:

The validity period for the application of reduced insurance premium rates is 10 years from the date organizations receive the status of a participant in the Skolkovo project, from the 1st day of the month following the month in which the participant status was received. If the total profit exceeds 300 million rubles, then the reduced tariff rates are terminated on the 1st day of the month following the month in which the specified profit volume is exceeded. The amount of profit is calculated in accordance with Ch. 25 of the Tax Code of the Russian Federation on an accrual basis from the 1st day of the year in which the project participant’s revenue exceeds one billion rubles. | Intelligence:

| Norm Art. 427 Tax Code of the Russian Federation:

Other standards:

| 14,0 %. | 0,0 %. | 0,0 %. |

| Organizations (IP) that have received the status of participant in a free economic zone in the territory of the Republic of Crimea and the federal city of Sevastopol | They carry out activities within the framework of the law of November 29, 2014 No. 377-FZ. The validity period for the application of reduced insurance premium rates is 10 years from the date organizations (IEs) received the status of a participant in a free economic zone (FEZ) from the 1st day of the month following the month in which the participant status was received Features of the application of the benefit are defined in the Letter of the Federal Tax Service of Russia dated September 19, 2018 No. BS-4-11/ [email protected] and the Letter of the Ministry of Finance of Russia dated September 10, 2018 No. 03-15-07/64834. | Intelligence:

| Norm Art. 427 Tax Code of the Russian Federation:

Other standards:

| 6,0 %. | 0,1 %. | 1,5 %. |

| Organizations (IEs) that have received resident status in the territory of rapid socio-economic development | They carry out activities within the framework of the law of December 29, 2014 No. 473-FZ. The validity period for the application of reduced insurance premium rates is 10 years from the date organizations (IEs) receive the status of a resident of the territory of rapid socio-economic development from the 1st day of the month following the month in which the status was received. | Intelligence:

| Norm Art. 427 Tax Code of the Russian Federation:

Other standards:

| 6,0 %. | 0,1 %. | 1,5 %. |

| Organizations (IPs) that have received resident status of the free port of Vladivostok | They carry out activities within the framework of the law of July 13, 2015 No. 212-FZ. The validity period for applying the reduced tariffs of insurance premiums is 10 years from the date of receipt by organizations (IP) of the status of resident of the free port of Vladivostok from the 1st day of the month following the month in which the status was received. | Intelligence:

| Norm Art. 427 Tax Code of the Russian Federation:

Other standards:

| 6,0 %. | 0,1 %. | 1,5 %. |

| Russian organizations included in the Unified Register of Residents of the SEZ of the Kaliningrad Region | Activities are carried out in accordance with the Federal Law of January 10, 2006 No. 16-FZ “On the Special Economic Zone in the Kaliningrad Region and on Amendments to Certain Legislative Acts of the Russian Federation.” | The information must be confirmed by the relevant certificate of a SEZ resident. | The norm is enshrined in paragraph 11 of Article 427 of the Tax Code of the Russian Federation. | 6,0 %. | 0,1 %. | 1,5 %. |

| Russian companies creating and selling animation products | The activity of the subject is directly related to the production and sale of animated audiovisual products, regardless of the type of contract and (or) provision of services (performance of work) for the creation of animated audiovisual products. Explanations on the application of the benefit are contained in the Letter of the Ministry of Culture of Russia dated December 14, 2018 No. 2376-03-5 and the Letter of the Federal Tax Service of Russia dated April 25, 2018 No. BS-4-11 / [email protected] | Please note that there are exclusive provisions for newly created and non-newly created entities. | The standards are enshrined in paragraph 12 of Article 427 of the Tax Code of the Russian Federation. | 8,0 %. | 4,0 %. | 2,0 %. For foreigners - 1.8%. |

Sample certificate

Let's look at examples.

Example 1. Individual entrepreneur Zaborov I.P. is on the simplified tax system. Has a certificate of registration as a resident of a special economic zone.

The base for calculating insurance premiums is 450,000 rubles.

We calculate insurance premiums in 2021 for a SEZ resident:

| Name of the SV | OPS | VNiM | Compulsory medical insurance | FSS NS and PZ |

| Bet size | 8 % | 2 % | 4 % | 0,2 % |

| Amount (rubles) | 36 000,00 | 9000,00 | 18 000,00 | 900,00 |

Example 2. Organization, main activity: development and implementation of IT technologies. Has an extract from the register of accredited organizations operating in the field of information technology. The base for calculating payments is 327,000 rubles.

We calculate insurance premiums in 2021 for organizations whose activities are related to the implementation of IT technologies:

| Name of the SV | OPS | VNiM | Compulsory medical insurance | FSS NS and PZ |

| Bet size | 8 % | 2 % | 4 % | 0,2 % |

| Sum | 26 160,00 | 6540,00 | 13 080,00 | 654,00 |

Contribution benefits: charitable organizations and NPOs

Charitable organizations using the simplified tax system can pay compulsory health insurance contributions at a rate of 20% in 2017–2018, but not pay compulsory medical insurance and compulsory medical insurance contributions. The main thing is that the company’s activities correspond to the goals stated in the constituent documents. The authorized federal body monitors compliance with this criterion.

Non-profit organizations (NPOs) on the simplified tax system that operate in the field of:

- social services;

- Sciences;

- education;

- healthcare;

- mass sports;

- culture and art.

These NPOs can pay compulsory health insurance contributions at a rate of 20% in 2017–2018, and not pay compulsory health insurance and compulsory health insurance contributions, provided they receive at least 70% of total income from:

- targeted financing of NPOs;

- grants;

- carrying out economic activities of those types that are reflected in paragraph. 17–21, 34–36 sub. 5 p. 1 art. 427 Tax Code of the Russian Federation.

You can learn more about the features of the work of non-profit organizations in the context of accounting in the article “Features and tasks of accounting in non-profit organizations.”

Changes from 2021

Since 2021, insurance premiums have come under the control of the tax authorities. Insurance premiums will be subject to the provisions of the Tax Law. As for the basic tariffs of insurance premiums, for 2007 they are established by Article 425 of the Tax Code of the Russian Federation. At the same time, reduced insurance premium rates are also provided for 2017-2018. They are given in Article 427 of the Tax Code of the Russian Federation. Reduced rates will be able to apply only to some insurance premium payers (for example, organizations using the simplified tax system that use certain types of activities). Also see "Insurance premiums from 2021: overview of changes."

The following circumstances influence the amount of insurance premium rates in 2021:

- organizational and legal form);

- type of activity of the employer;

- taxation system;

- a person’s status - a citizen of Russia or a foreigner, a stateless person - taking into account whether he lives or is temporarily staying in Russia;

- the amount of payments to an employee during the year - whether it exceeds the limits of the base for calculating insurance premiums established for 2017.

Contribution benefits: Skolkovo residents

Residents of an innovative center have the right, within 10 years after receiving resident status of a given center (from the 1st day of the month following the one in which the corresponding status was received), to pay contributions to compulsory health insurance in the amount of 14%, and not to pay to compulsory social insurance and compulsory medical insurance, provided :

- receiving a profit of no more than 300,000,000 rubles, which is calculated on an accrual basis from the beginning of the year;

- receiving revenue of no more than 1,000,000,000 rubles. at the end of the year.

From the 1st day of the month following the one in which the company exceeded the specified indicators, the use of the benefit in question on insurance premiums is not carried out.

Information on the revenue and profit of a Skolkovo resident is provided to the Federal Tax Service by the management company of the corresponding business entity.

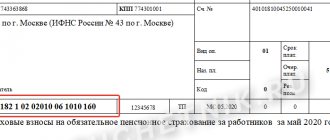

Benefits for all small and medium-sized businesses

During the coronavirus epidemic, the president promised to reduce contributions. Starting with the salary for April 2021, they are calculated in a new way. The scheme will be valid until the end of 2021 - Art. 4 and art. 5 amendments to the Tax Code of the Russian Federation.

Who belongs to small and medium-sized businesses?

Any company that, according to last year data:

- No more than 2 billion rubles per year in income,

- No more than 250 employees,

- No more than 49% of the share is at the disposal of large companies,

- No more than 25% of the share is at the disposal of the state, regions and NPOs.

Government agencies maintain a list of such companies - a register of small and medium-sized businesses. Companies are added automatically, but there are mistakes. Search your company in the registry. If it is unfairly not there, sign the application on the tax website.

How to get a benefit?

When you are sure that you are included in the register, simply count the contributions in a new way. There is no need to submit any applications.

How to calculate contributions?

Media headlines have confused entrepreneurs. Everyone wrote that employee contributions were reduced to 15%. But the new rate does not apply to the entire salary, but only to part of the minimum wage. The higher the official salary, the greater the effect of the benefit. So officials supported employers who work according to the law.

For calculations, the federal minimum wage is used, not the regional one. At the time of writing, it is equal to 12,130 ₽. The easiest way to explain the calculation is with an example.

According to the contract, the employee receives 30,000 rubles.

Under the old scheme, the employer would pay 30% * 30,000 ₽ = 9,000 ₽.

Under the new scheme, the employer will pay 30% * 12,130 + 15% * (30,000 - 12,130) = 3,639 ₽ + 2,681 ₽ = 6,320 ₽.

Savings = 2680 ₽.

The actual rate in this case decreased from 30% to 21%.

This is what the phrase “15% of the amount above the minimum wage” means. Not all of our users understood it, so they asked: “I will raise my salary to 12,140 rubles and will pay 15% of the contributions, right?” You already understand what is wrong. In this case, the savings will be 15% of 10 rubles.

What exactly will the contribution rates be:

— Pension: 22% from the minimum wage, 10% from excess.

— Medical: 5.1% with minimum wage, 5% with excess.

— Sick leave: 2.9% with minimum wage, 0% with excess.

How to start applying the benefit in Elba?

In Elba, the benefit is called “tariff for small and medium-sized businesses - 15%.” A universal way to enable it is to indicate it in the Details → Employees section.

To ensure that users do not miss the news, we have added a special step to the “Pay contributions from salary” and “Submit a report on insurance contributions” tasks. There will also be a list of benefits and the opportunity to select “15%”.

When you switch to the new contribution rate, Elba will recalculate contributions from the beginning of the year:

— Salary contributions for April 2021 and subsequent months will be calculated at the new rate.

— Salary contributions for January, February and March 2021 - at a general rate of 30%.

Before choosing a benefit, read about possible situations.

Let’s say an entrepreneur switches from the general tariff to “15%”.

a) If he has already paid contributions for April 2021 and later months, after recalculation there will be an overpayment. This is not scary: we will simply take it into account in the following tasks, and the regulatory authorities will not receive anything unnecessary.

b) If an entrepreneur is just planning to pay and, for example, has already downloaded payments, it is better to go into the task and receive payments with updated amounts. Why create an overpayment in vain; it would be better if the money was in circulation.

In most cases, switching from the old preferential tariff to the new “15%” is unprofitable. The fact is that the old preferential tariff applies to the entire amount of contributions, and the rate is usually even lower than 15%. For example, residents of Skolkovo and LLCs with IT accreditation pay 14%, and participants of the FEZ in Crimea pay 7.6%. Unless NPOs pay 20%: for them the transition is profitable if the official salary is more than 37 thousand rubles.

NGOs should take into account: since this is a rare scenario, Elba does not support the transition from the “20%” to “15%” tariff. It will count contributions as if the organization applied the general tariff before April 2021, and after that - “15%”. As a result, there will be an underpayment on paper, and payments for contributions will have to be redone manually.

Submit reports without accounting knowledge

Elba is suitable for individual entrepreneurs and LLCs with employees. The service will prepare all the necessary reporting, calculate salaries, taxes and contributions, and generate payments.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

Contribution benefits: residents of special economic territories and ports

The following have the right to pay contributions to compulsory health insurance at a rate of 6%, compulsory social insurance at a rate of 1.5% and compulsory medical insurance at a rate of 0.1%:

- legal entities and individual entrepreneurs operating in Sevastopol and Crimea as participants in free economic zones;

- organizations and individual entrepreneurs with the status of resident of the priority development territory;

- organizations and individual entrepreneurs with resident status of the free port in Vladivostok.

These business entities have the right to apply benefits on social contributions for 10 years after they acquire one of the designated statuses (from the 1st day of the month following the one in which the status was received).

In this case, firms must have time to obtain a preferential status within 3 years after the entry into force of the legal acts establishing the corresponding statuses.

Results

Payers of the simplified tax system, and in many cases - payers of any tax system, have the right to take advantage of the opportunity to pay contributions to compulsory health insurance, compulsory health insurance for VNIM and compulsory medical insurance at reduced rates or not to pay them at all. The magnitude of these rates, as well as the possible duration of application, may depend on the type of activity of the business entity, its organizational and legal form, and the region of operation.

You can learn more about the use of the simplified tax system by various business entities in the articles:

- “What are the insurance premiums for the simplified tax system in 2017?”;

- “Procedure for maintaining accounting under the simplified tax system (2015–2016)”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.