» IP management » Cash desk

Opening your own business is accompanied by the need to prepare a lot of documents that are required by the legislation of the Russian Federation. One of the most important for legal entities that sell goods is the KKM check.

- 2 Registration of a cash receipt

- 3 Checking cash register receipts

- 4 Fines

- 5 Innovations for 2021

Cash register receipt: the main document for the operation

For several years now, there has been a norm in the country that establishes the mandatory presence of a cash register for all business entities. After each transaction of selling goods, the individual entrepreneur must issue a cash receipt. It is this document that confirms open activity. On its basis, the cash discipline of individual entrepreneurs is checked, as well as compliance with all fiscal norms established by the legislation of the Russian Federation. For a failed cash receipt, the entrepreneur is expected to be punished in the form of a fine.

The check issued by

the cash register is a fiscal document that is printed on a special tape and must have a set of

mandatory details . The latter include:

- name of the individual entrepreneur according to registration documents;

- taxpayer identification number - individual entrepreneur;

- serial number that was assigned to the cash register at the manufacturer;

- serial number;

- date of purchase;

- time of the transaction shown on the receipt;

- price of purchase or service provided;

- type of fiscal regime.

All these parameters can be indicated on this fiscal document during issuance in any order. That is, there is no single structure for a cash register receipt. The main thing is that the required details are indicated.

Additional details

In addition to the above, the owner of the cash register can additionally display any correct information in the cash receipt. Federal Law-54 does not contain any restrictions in this regard.

Most often, the additional block of a cash receipt includes:

- company advertisement, text and/or graphic;

- information about special offers, promotions, drawings of valuable prizes;

- a link to an online resource where the buyer can obtain additional information about the company, products and promotions.

Placing additional details, as a rule, is justified economically - due to the large coverage of buyers by such advertising.

Issuing a cash receipt

The cash receipt must be legible. It is printed on a special ribbon. For each individual entrepreneur and type of cash register, its own settings are created, which include the basic details of the fiscal document.

In addition, there is additional information that can be printed on the check. Basically it is placed at the top of the document. It contains a greeting to the client, gratitude for choosing a retail outlet, the latest news, promotional offers or other similar information.

The name of the organization, namely individual entrepreneur, on the check can be supplemented with information with the address or telephone number of the entrepreneur. This is permitted at the request of the device owner. The main body of this fiscal document specifies the type of operation:

- sale;

- return;

- reversal and others.

This block also contains the name of the product units, their quantity and cost. The sales products section ends with a final line where information about the total amount, payment and delivery is entered. Also, after these points, the cashier’s personal identification number, date and time of purchase are written down.

The last part basically always shows the registration data of the individual entrepreneur, the serial number of the check machine, and the fiscal regime.

Receipt parameters are configured for each cash register. If failures occur during the operation and some details of this fiscal document are displayed poorly or are missing, then it is necessary to suspend the activity until the correct operation of the cash register is established.

Required details

The number of mandatory check details is quite large - about 30 items, and the legislator is constantly adding to this list.

The content of cash receipt data (cash receipt details) is determined by two main documents:

- Federal Law-54 dated 05/22/03

- by order of the Federal Tax Service No. ММВ-7-20/ [email protected] dated 21/03/17

They list the main details of a cash receipt, the form of their presentation, and the type. The order of arrangement of details on a check is not established by law.

Typically, information is arranged compactly, in separate parts, in accordance with the logic and content of the data:

- Data about the seller-owner of the cash register - in this part of the cash register receipt the name of the legal entity, its Taxpayer Identification Number or similar individual entrepreneur data is given.

- CCP data: its reg. number in the Federal Tax Service, serial number of the fiscal drive model. This block usually includes the address, place of payment - the address of the cash register and the name of the store, or the name and address of the company's trading website on the Internet, if we are talking about an online store.

- Check details. In addition to the name of the document, this includes the date and time when the check was punched through the cash register, the shift number, and the check number within this shift. Next, indicate the number in order of the fiscal document. Here the machine counts not only receipts, but also all fiscal documentation stored in the memory of the fiscal drive. Be sure to indicate the tax system. The cash register can be configured for several tax regimes, but you cannot indicate several transactions under different tax regimes in one check. In addition, the website address is indicated for the buyer to check the data, the fiscal sign of the document is a control value confirming the correctness of the entered data, the seller’s e-mail, from which he will send electronic checks at the buyer’s request.

- Information about the cashier: his full name, position, TIN, if available. If trading occurs without a seller (via the Internet or special trading devices), the details do not apply.

- Data about the product (work, service). The price, quantity, amount, and name of the subject of payment are indicated here. Discounts, markups, and VAT tax rates are also indicated here. If an advance was paid, the name is not indicated. The name and quantity are also not indicated by individual entrepreneurs who use any NO system, except OSNO, and who are not involved in the sale of excisable products (until 1/02/2021). Indicate the country of origin and TD number (for imported goods), if the calculation involves not an individual, but a legal entity and (or) individual entrepreneur.

- Product code. Despite the fact that this detail is mandatory (Regulation No. 174 of 02/21/19), it is not contained in every cash receipt. The details are required for use only in the case of the sale of goods subject to mandatory labeling in accordance with the legislation of the Russian Federation. Example: tobacco products. From 1/07/2019, labeling codes are applied to each pack; until 1/07/2020, the bulk of unlabeled tobacco products released earlier must be sold. For some types, sale without labeling is possible until 01/07/2021 (Regulation No. 224 of 02/28/19).

- Sales data. The method of payment is also indicated - cash or non-cash, the amount paid, the nature of the calculation - income, expense, return of income, expense. The amount of VAT is taken into account, if there is an OSNO - for each product separately. If the check amount is paid partly in cash and partly by non-cash money, this is also indicated. If the goods are excisable, indicate the excise tax.

- Buyer information. The buyer has the right to request an electronic check, then his e-mail and phone number must be included in the document. A similar situation can arise when shopping online. For legal entities and individual entrepreneurs, it is necessary to include the name (full name) and TIN in the document.

- QR code. Convenient for instantly reading information from a receipt.

Some of the check details, for example, the fiscal sign of the message (FPS), are not indicated in the check. This props is generated by tech. means and is assigned to the checks stored in the fiscal drive, which are then transferred to the OFD.

By the way! The more complex the format of fiscal data, the more information a cash register can generate in a check. Starting with format 1.05, you can indicate information about the subject of the transaction: goods, work, service, winnings, etc., payment method: for example, advance payment, full payment, prepayment.

Checking cash register receipts

The check machine must be used by all individual entrepreneurs who use cash as a payment method. After each transaction, a cash receipt must be printed. The issuance of these fiscal documents is verified by the tax authorities. A fine will be imposed on a check that is not cleared.

Checking the issuance of fiscal documents has several types:

- regular - a scheduled audit according to a schedule previously drawn up by the tax authorities;

- shuttle – checking the issuance of cash receipts several times a day for the same individual entrepreneur;

- cross-checking is carried out by fiscal policy authorities from other regions;

- raid - a comprehensive check by several government agencies.

The main goals of such control actions of individual entrepreneurs are their compliance with the norms of legislative acts on cash registers and the preparation of relevant documentation, as well as the completeness of the receipt of revenue.

The inspection is carried out by observation, test purchases, and document review. All data obtained during control actions makes it possible to identify violations or their absence.

How to decipher cash register pH

RN is an abbreviation meaning cash register registration number. This is a sign that the device has been registered with the Russian Tax Inspectorate according to all the rules. In the cash desk service, they undergo a fiscalization procedure, after which they can be used in the trade sector. On the receipt, this position can be found at the top of the barcode; it is designated as RN KKT or KKT with a number icon. The procedure for registering cash register equipment is strictly regulated and includes the following stages:

- A private entrepreneur signs an agreement with a fiscal data operator. The OFD plays the role of an intermediary between the apparatus and the tax office, since payment statements and data on the goods and services being sold pass through this organization. Their responsibilities include processing information, transferring it to the appropriate authority, and subsequent storage for five years. Also, the OFD can identify forgery in reporting documentation and send a message about this case to the tax service.

- Submitting a petition to the tax office from an entrepreneur. The service carries out appropriate checks, the information about which is received by the individual entrepreneur.

- During the period of registration of equipment, its fiscalization is carried out, after which it is necessary to submit a financial document to the tax office.

- Issuance of a registration card to the entrepreneur, which contains a number.

According to new amendments to the law on cash registers, OFDs must report to the tax office about the provision of services to entities. In their reports, operators indicate the serial and registration numbers of the equipment, therefore, upon completion of the registration procedure, the owner of the devices is obliged to provide the license plates of the fiscal drive and cash register, their registration numbers to the fiscal data operator.

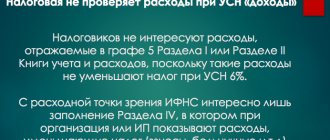

Fines

An unclogged or incorrectly drawn up check are the reasons that lead to a fine being imposed on the individual entrepreneur. The Code of the Russian Federation on Administrative Offences, Article 14.5, establishes punishment for such violations. The fine amounts range from 1.5 to 2 thousand rubles for individual entrepreneurs.

It is the issuance of fiscal documents that confirms the purchase and sale transaction. The cash receipt must be printed exclusively by the cash register. Other methods of preparing this fiscal document are not possible.

The only exceptions are those individual entrepreneurs who are permitted by law to use strict reporting forms instead of a cash receipt. In such cases, there is no penalty for failure to issue a check. But this document is used mainly by those individual entrepreneurs who provide services without selling goods.

The main reasons for imposing a fine in the process of using cash registers and issuing cash receipts are:

- non-use of cash registers;

- use of control equipment that is not registered with the tax authorities;

- use of cash register, which is not included in the State Register;

- using faulty equipment that prints incomplete receipts;

- use of a cash register without a seal;

- issuing checks with amounts different from those actually paid.

The fine is imposed by the fiscal authorities after violations are detected.

Short

- The information contained in the cash receipt, according to current legislation, must give the buyer a complete picture of the outlet, the product purchased, the expenses incurred and the seller serving him.

- In addition, the check data allows you to check the legality of a trade transaction using modern technologies and Internet resources, receive an electronic check by email online and print it at your discretion.

- The cash receipt also contains comprehensive fiscal data transmitted to the Federal Tax Service about the trade transaction and the equipment and company (OFD) servicing the information exchange with the fiscal authority.

- The law allows you to include in the cash register receipt any additional information that stimulates sales of the owner of the cash register system.

Why do you need an online check and how to get it

Another innovation for consumers is the ability to receive a fiscal receipt in electronic format. Benefit for buyers:

- storing the receipt on an electronic storage device safe from damage for a long time;

- optimization of cost accounting for services and goods - a self-created database on gadgets frees you from the need to store paper coupons and makes viewing them faster;

- If any troubles arise - the return of goods, accusations of non-payment of services, the buyer can at any time provide the authorities or the entrepreneur with a complete copy of the payment document.

Any consumer can receive a receipt in several ways:

- When checking out, the buyer indicates his email or mobile phone number. The seller sends a check electronically by letter or SMS message.

- Applications on a smartphone. Installed programs help you read the barcode on a paper ticket using the camera. Free services from PlayMarket help collect and organize received electronic copies. This method is convenient, it helps to save coupons from different organizations, stores, etc. in one place.

- The official portal of the fiscal data operator on the network. This option can be used if the consumer knows the address of the operator’s page from an existing receipt. There is a search system on the site through which you can get a copy after entering the number of the payment receipt, FP, ZN of the online cash register.

An entrepreneur may not provide a printed document to the consumer if the product or service was paid for via the Internet. Also, you don’t have to print out the receipt if vending equipment is used for sales.

In such situations, the seller retains the opportunity to use the cash register without a printed supplement. Such machines are automated, some of them can be mounted directly into the casing of vending equipment. They can also be used for online payments between consumers and sellers, as they have specially installed software. The transfer of the receipt in electronic form occurs automatically after payment for the goods, provided that the buyer indicates a mobile phone number or email address.

Introduction of online cash register. KKT, FR, FN, FD, FP and OFD - what is it and why?!

It just so happens that we have other projects that are a little outside the scope of vending, but have a common intersection with the updated law on online cash registers. Therefore, I have prepared a small material for the community from what I have collected and what we will have to go to, although there is still time and it is not clear what will happen in the end, but it will be for sure. Our colleague from Habr was ahead in the design and therefore I will not describe anything in detail, I will just add some points regarding vending, but the situation in general is exactly as described.

Online cash registers. KKT, FR, FN, FD, FP and OFD

Actually, online cash registers now need to be implemented everywhere, including in online stores selling services. Those. This is a direct payment by credit card through the website. By the way, this also intersects with vending in terms of implementation. We will need a cash register for payments to individuals. In the payment chain on the website, somewhere between the “approved” response from the payment gateway and the provision of the service, you need to insert another “pull out a check” operation. “Well, what a problem, we’ll rent an online cash register service and that’s it,” we decided. And then the harsh reality showed: all the beautiful landing pages of ATOL-online, Starrus and others are nothing more than advertising landing pages. There are no ready-to-use SaaS solutions today, or at least we couldn’t find them. As well as the vaunted integration of Yandex.Checkout with ATOL-online. The same request for technical documentation to ATOL stalled immediately at the entrance, and Starrus advised to install stand alone instead of their unready SaaS. Then the juicy details about the situation with fiscal drives became clear and it became really fun. In general, to this day, integration with Atoll-onlay is still not completed.

As a result, after conducting a market analysis, including the adequacy of communication with manufacturer support, a solution was found from Starrus: KKT RP System 1FS.

Some terminology:

- CCP - cash register equipment. In the context of the article - a cash register.

- FR - fiscal registrar. Essentially the same as CCT.

- FN is a fiscal accumulator. A cryptographic tool as part of a DF.

- FD is a fiscal document. Check, FD number - check number.

- FP is a fiscal sign. FD reference value.

- OFD - fiscal data operator. An external service that receives and accumulates fiscal data.

Fiscal registrar RP System 1FS (FA) is a new generation online cash register (cash register) with automatic sending of fiscal data to the OFD. Allows you to receive commands in JSON format over the network and “knock out receipts.” All external interaction with the OFD is blackbox, works independently and does not require any additional gestures.

Equipment

Officially, in the “register” there is only the RP System 1FA model. It is designed for vending machines and comes with a receipt printer. The model for Internet sites is called RP System 1FS, and is distinguished by the absence of a printer. But since the RP System 1FS model is not in the registry, the RP System 1FA model is sold under its guise, but without a printer included. This information will help avoid confusion when choosing and ordering a cash register.

The CCT itself is a small metal box painted black. Markings are applied to the case and all interface connectors are present in the end planes.

There is a screw-mounted hatch on the case; behind it there is a compartment for the fiscal drive (FN), which operates through the internal UART interface. The key (the pin is plugged) will not allow you to insert the drive incorrectly, but given the design features of the hatch, it is not easy to insert, and especially remove, the drive. When registering and re-registering a FN, a corresponding entry is made in the KKT passport.

The generalized status of the CCP is displayed on the body using four LED indicators. Status, data exchange, error status.

Power is supplied from any stabilized DC source from 7.5 to 24 volts. “Round” plug, “plus” inside. The power supply is not included in the kit; the supplier/manufacturer usually does not have them in stock; it is recommended to purchase a third-party compatible one.

The Ethernet controller has a preset address or receives settings via DHCP (DHCP priority over static settings).

RS232 (DB-9 in/out) operates in 115200 mode and is used for local connection to the control computer and for connecting a receipt printer, if necessary. At all stages of standard interaction with cash register systems, starting with registration of financial statements and ending with “punching” checks, it can be done exclusively via a local network via Ethernet, without interacting with RS232.

There is USB on the case, but it has not been tested.

Fiscal storage

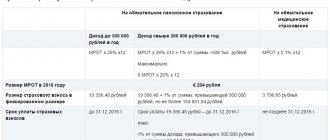

This module is a cryptographic tool; fiscal data (receipts) are stored on it; it also generates the result of cryptographic functions with input data (fiscal attribute). Structurally made of gray plastic with a holographic protective tape. The interface connector provides power to the PV in operating mode and exchanges data via UART, I2C and RS232 protocols. It contains a lithium battery that keeps the internal clock (RTC) running. The FN has an artificially limited validity period and must be replaced every 13 months.

Software

Well, this will probably be more clear to those who are familiar with computers and even with hardware on a first-name basis. Vendors will essentially have to understand approximately what they will be faced with.

You can interact with the cash register via the RS232 interface or via a local network.

The manufacturer has developed TestFR software, which allows you to organize a connection with the cash register both via RS232 and via the network. The software runs under Windows OS and has a very “raw” and not obvious interface. It must be used with caution, especially at the time of registration of the FN, since this procedure is one-time and irreversible; if the FN is registered incorrectly, it requires complete replacement, as it loses functionality. Considering the scarcity of FN, this procedure must be done with extreme caution.

The entire implementation procedure. Purchase of cash registers.

CCP is available from the supplier/manufacturer Starrus, a supply agreement is concluded and purchased at retail. There are no problems at this stage.

Purchase of FN

FN is in great short supply on the market. Manufacturers of physical funds (there are three of them) and suppliers of cash register equipment ship wholesale batches mainly to large customers. It is extremely difficult to buy FN “legally” at retail. The Federal Tax Service “promised” not to fine those who have a supply agreement, but no one concludes one. Suppliers of cash register equipment are avoiding concluding a contract for the supply of physical funds, since there is already a huge queue for them. Vicious circle. In some cases, FN can be purchased from “your” OFD operator, but in our case, our operator supplied FN only as part of a certain “cash kit”, which was not in demand by us and was mainly intended for offline retail. In our case, the only way out was to purchase FN from a “huckster” on Avito at double the selling price. When purchasing, you can check a copy of the Federal Tax Service on a special Federal Tax Service resource.

Acquisition of CEP

A qualified electronic signature is required to register a cash register in the taxpayer’s personal account on the Federal Tax Service website. In theory, you can not have a KEP and delegate the registration of a cash register to your OFD, or register a cash register at the Federal Tax Service office in person by personal appearance. But since many website operators (legal entities) already have a CCP for submitting reports and interacting with other government bodies, you can use the existing CCP for registration. The main thing is that the CEP is issued by a CA accredited by the Ministry of Communications

Conclusion of an agreement with OFD

You can select any OFD (fiscal data operator) from the list of those accredited by the Federal Tax Service. The prices are the same, the protocols for interaction with CCP and the Federal Tax Service are also unified. Services cost about 3,000 rubles per year for one cash register with an unlimited number of check transactions (must be multiplied by the number of vending machines in the network).

The three previous points can be done in parallel; they do not depend on each other. Below are the steps step by step.

Registration of CCP with FN in the Federal Tax Service

Consists of three successive steps. Basically, the classic 3-way handshake. IMPORTANT!!!! The procedure must be completed within two days (the day of the first step plus one working day).

Obtaining a cash register registration number from the Federal Tax Service

It is necessary in the taxpayer’s personal account on the Federal Tax Service website to find the item on registering a cash register in the applications section and fill out an application. Everything is simple: in addition to the serial numbers of the FN and CCP, you need to enter data on the location of the placement (detailed information is attached there), as well as indicate the type of placement; in the case of “Internet sites”, you need to list the sites served by the CCP, separated by a semicolon. As a result, a CCP registration number is automatically assigned, which will be required in subsequent steps.

Entering data into CCP and initializing FN

This step is extremely important, since the procedure for initializing the FN is irreversible and if an error is made, the FN will have to be changed, and the damaged one will have to be stored in the organization’s archive for five years!

The easiest way to do this is through the TestFR utility. At this point, you need to install the FN in the cash register, connect the power and any of the information interfaces. You need to select “registration wizard” in the utility, section 11 in the menu. Step by step, you need to enter information about the organization, SNO, serial numbers of the cash register and tax register, and the registration number of the cash register issued by the Federal Tax Service. Additionally, the wizard will prompt you to select an OFD profile from the list of proposed ones. As a result, the cash register will be transferred to fiscal mode and the first fiscal document (FD) will be produced under number 1 - “Registration Report”. The key value in this document is the fiscal attribute (FP), which is the result of the cryptographic operation FN. Also, an important value of the FD is the date and time since the registration is one of the input values for generating the FD.

If something went wrong (as in our case) and the data of the first FD has disappeared somewhere, then you can request a FD with a registration report through section “8. FN”, “Print FD by number”, specifying the number 1 as the number. The result will appear in the field on the right, but, thanks to the technical implementation of TestFR, it may not fit on the screen. In this case, CTRL+A in the desired area of the screen will help.

Confirmation of registration of cash register with the Federal Tax Service

In the same taxpayer’s personal account on the Federal Tax Service website, you must go to the section with a list of registered cash registers, select the one to be registered and enter all the data from the cash register registration report. Upon completion of the registration procedure, a KKT registration card will be generated, which can be printed and attached to the KKT and FN passports.

Drawing up acts and filling out passports

It is necessary to draw up acts of commissioning of CCP and FN; the relevant documents are integral parts of the CCP and FN passports. Enter all data and certify it with the signature of the responsible person and the identification seal of the organization, if available. These documents must be stored in the organization's archives.

Connecting cash register to OFD

It is necessary to maintain a short pause between registering a cash register with the Federal Tax Service and connecting the cash register to the OFD, since there is a slight delay in adding the registration number of the cash register to the Federal Tax Service register. In the OFD it is necessary to enter the required data that was obtained at the previous stages. As a result of a request to the Federal Tax Service register, the cash register will be connected to the OFD.

From this moment on, you can use the CCP in operating mode.

Working with CCP

In response to fiscal requests, the CCP with FN generates FP and sends data through the OFD network connection. In the event of a network interruption, the cash register continues to operate and accumulate FD. When the network connection to the OFD is resumed, the cash register will automatically send all unsent documents. This is a completely normal case.

In general, you can’t expect something simple and good. The material is generalized and gives some idea of what labor costs will have to be taken into account and the general principle of implementation. And this is without a receipt printer.

Based on materials from Habr

What does the term mean in law?

The term “fiscal check” is currently not reflected in any way and is not applied in legislation. However, the first mention of this term may have appeared in the original version of bill No. 551847-7, adopted in November 2021.

The original version contained wording that determined penalties for failure to submit a fiscal receipt to the tax service by persons with taxpayer status, but in the final version they were replaced by those that mention “information about the calculations made.”

That is, we can conclude that a fiscal receipt is a document that displays information about the calculations made.

If we talk about specific types of fiscal document, or more precisely about a cash receipt and a strict reporting form, then the requirements for them are regulated by Federal Law No. 54-FZ of May 22, 2003.

Requirements

Since a cash receipt is a type of payment document, it must meet certain requirements. These requirements determine the mandatory details on the online cash register receipt sample, as well as some conditions for its execution.

Information for the formation of a fiscal document comes from various sources. Some details come from the CCP software. Some of the details are supplied by the goods accounting system connected to other devices. The remaining part of the details comes directly from the online cash register: what was programmed when setting it up before starting work.