06.06.2019

0

213

6 min.

Each economic entity of the Russian Federation provides various types of reporting to regulatory authorities: based on the results of the month, quarter, half year, for nine months and a year. The article below provides information about the features of filling out and entering data on reflecting contract agreements in the report on Form 6 personal income tax.

GPC agreement

If companies or individual entrepreneurs engage individuals to perform any work, they enter into civil law agreements (GPC) with them. Under this agreement, the date of receipt of income is in fact considered the date of payment of funds to the individual. In this case, it will not matter what was paid - an advance or the final amount. Each payment in 6-NDFL will be reflected in a separate block and under a separate date.

Important! If we compare a GPC agreement with a regular agreement, then according to the latter, the date of receipt of income will be considered the last day of the month for which wages are paid. In addition, in this case, personal income tax will not be withheld from the advance.

Contract agreement: main points

The definition is contained in the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), in article 702. A contract is an agreement between the customer and the other party, the contractor. It is drawn up in writing and is aimed at fulfilling any order of the customer with the obligation to accept the result of its full or phased implementation for a certain fee within a specified time frame, most often with the help of the contractor’s funds and materials.

Conditions of conclusion

The agreement must be drawn up in accordance with all the rules. When concluding an agreement, the document specifies the general and essential conditions:

- name of the form and date of its preparation;

- details and signatures of the parties to the agreement;

- the subject of the contract, that is, the result of fulfilling the customer’s assignment;

- time interval - the period during which the task is planned to be completed (the exact start and end dates of work/individual stages are specified).

Also, the contract must contain additional conditions that do not require mandatory prior agreement between the parties. They enter into legal force from the moment the agreement is concluded on the basis of the norms of current legislation and include the following points:

- Methods and methods of implementation (unless otherwise specified, they are determined by the contractor, in accordance with Article 703, paragraph 3 of the Civil Code of the Russian Federation).

- From what materials, by whom (contractor - Article 704, 1st paragraph of the Civil Code of the Russian Federation).

- Cost and method of calculating expenses (an approximate cost estimate is attached or a fixed cost of work is indicated; possible cases for revising the prices specified in the contract are articles of the Civil Code of the Russian Federation: 424, 451, 709, 710, 713 and 723).

- The possibility of using subcontracting, that is, the contractor engaging the services of a third party when performing the customer’s assignment (the contractor has the right to do this in accordance with Article 706 of the Civil Code of the Russian Federation).

- Distribution of the resulting savings between the customer and the contractor, if this happens (Article 710 of the Civil Code of the Russian Federation assigns the right to it to the contractor if the customer cannot prove that the result of the service provided or the work performed does not comply with the quality of the result).

- The contractor’s right to receive full payment according to a previously reached agreement for the result of the completed task (Article 711 of the Civil Code of the Russian Federation obliges the customer to make the final payment).

- The procedure for delivery by the contractor and acceptance by the customer of the final result of the work to complete the task (the main provisions are stated in Article 720 of the Civil Code of the Russian Federation).

- The customer’s assistance and assistance to his contractor when he performs the work (by default, the procedure for assistance and its volume are indicated in Article 718 of the Civil Code of the Russian Federation).

- Quality control of execution, in accordance with the specific terms of the contract or general requirements for similar orders (Articles 721 and 722 of the Civil Code of the Russian Federation).

- Further instructions (to the customer from the contractor) on the operation or application of the result of the work performed (Article 726 of the Civil Code of the Russian Federation).

The agreement may also reflect so-called “incidental conditions”, by agreement of both parties to the contractual relationship. Their presence or absence does not affect the validity of the concluded transaction, but only supplements or changes the basic requirements of the regulations.

Procedure for withholding personal income tax

Important! If an organization or individual entrepreneur hires individuals under a GPC agreement and pays them income, then they are required to reflect this in 6-NDFL, since in this case they are tax agents. This means that the organization is responsible for withholding personal income tax from payments and paying them to the treasury.

First of all, it is necessary to find out in what time frame the amount of tax on personal income should be calculated, withheld and paid to the budget.

The date on which an employee receives income under a GPC agreement is the tax withholding date. On this day, the individual is paid for work from the cash register, or money is transferred to his card. This date will need to be reflected in 6-NFDL on line 100.

Since the date on which income under the GPC is received is also the date of personal income tax withholding, which means that this date must be indicated in form 6-NDFL on line 110. This date must also be consistent with the one indicated as the settlement date in the agreement contract

As in all other cases when transferring personal income tax to the budget, this must be done no later than the next business day after the payment of funds to the individual. This date is indicated in form 6-NDFL on line 120.

Introduction

The relationship between the customer (organization) and the contractor (performer) is formalized by a civil contract. The contract reflects the responsibilities of the contractor - to complete the scope of work, and the customer - to accept and pay for the work in accordance with the acceptance certificate. In addition, the customer is required to reflect the accrued and withheld tax in the calculation.

Each type of profit that individuals receive. persons are subject to taxation. Personal income tax is calculated from each income. The difference between the GPC and the employment contract is only in the date of reflection of the receipt of profit. According to the employment contract, this is the last day of the accrual month.

How to reflect GPC in 6-NDFL

In 2021, Form 6-NDFL for GPC is filled out on the basis of Federal Tax Service order No. ММВ-7-11/450 dated 10/14/2015. The order specifies the following filling requirements:

- For each OKTMO the form is filled out separately. The organization also needs to indicate the code of the municipality in which the company's division is located.

- Payment for GPC in form 6-NDFL is not indicated in certain sections. This amount must be indicated in reporting on a general basis. The first section should contain data on income and tax that was calculated and paid on an accrual basis for 1 quarter, half a year, 9 months and a year. For each tax rate, the first section is completed. Reporting data for the reporting period are indicated in the second section.

- If in one tax period personal income tax was paid at different rates, then information for each rate is entered into 6-personal income tax separately. To ensure that the tax office does not impose penalties, you must carefully check the correctness of the information entered.

Based on the specified requirements, the GPC in 6-NDFL is reflected and submitted for each reporting period no later than the last day of the month following the reporting period.

Filling out the declaration 6

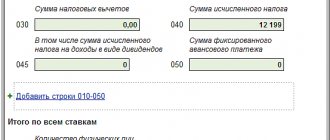

Part 1 of the report is completed on a cumulative basis from the beginning of the year; the second part includes information only from the reporting period.

In 6 personal income taxes, remuneration under a civil contract is formed during the period of completion of the operation.

- In field 020 – the total expression for GPC;

- in field 040 and 070 - personal income tax, which is accrued and withheld from profit in column 020;

- block of fields 100 -140 – filled in for each payment date under contracts.

When filling out the declaration, we are guided by the following legislative acts:

- letter of the Ministry of Finance 03-04-06-24982 dated May 26, 2014;

- letters from the Federal Tax Service BS 4-11-14329 dated July 21, 2017, BS 3-11-4816 dated October 17, 2021;

- NK article 223 clause 1.

An example of reflecting GPC in 6-NDFL

Continent LLC entered into an agreement with individuals for the provision of services from April 1 to May 31. The cost of services provided under the contract is 10,000 rubles, the amount of personal income tax on this amount is 1,300 rubles. The payment was made on June 10.

On line 070 of form 6-NDFL, the amount of withheld personal income tax is recorded, that is, 1,300 rubles. On the same day, personal income tax was withheld, which means that on lines 100 and 110 the same amount is indicated under the date June 10. The total amount of income paid is 10,000 rubles. This value is entered on line 130 of form 6-NDFL.

General rules of reflection

According to the norms of the Tax Code of Article 223, paragraph 1, subparagraph 1, the day of reflection of profit under the GPC is the date of receipt. In part 1 of the declaration, line 020, information about earnings is reflected in the period on the day of payment.

Income is calculated on the day of receipt of profit under a legal contract (TK Article 226, paragraph 3). The day of payment is considered the day when income is paid through the organization's cash desk or transferred to the current account of an individual (Tax Code Article 223, paragraph 1).

In column 100 of the second part of the report indicate the number of actual receipts of income.

Withholding of personal income tax from profits received under GPC agreements is calculated on the day when the income is paid. Accordingly, the dates indicated in cells 100 and 110 of the second part of the calculation will be the same.

To transfer tax, you must be guided by the general requirements of the Tax Code:

- Article 226 clause 6 paragraph 1;

- Article 6.1 clause 7.

The transfer of tax must be made no later than the day following the date of payment under the GPC agreement.

Reflection in 6-NDFL of interim payments and final settlement under the GPC agreement

Section 1: 1 section is completed in the usual manner. All payments made under the GPC agreement will be included in total income and reflected on line 020. From this amount, personal income tax will be indicated below on lines 040 and 070.

Section 2: the advance payment, as well as the final payment that was paid over the last three months, will be indicated in a separate block on lines 100-140. This is due to the fact that they were paid at different times.

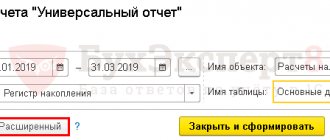

Nuances of generating a report when transferring advances

When transferring advance payments for work that are formalized by civil and process agreements, they are included in cell 020. The line is filled in with a cumulative total from the beginning of the year. Otherwise, filling out the section occurs as usual.

If no payments under the contract were made during the reporting period and only accrual is reflected, you need to fill in the corresponding total indicators in cells 020 and 040. Personal income tax should be withheld only when the profit is paid. Therefore, column 070 is filled out during the period of income transfer.

In the second part of the declaration, information is indicated in relation to transactions of this reporting period. If summary expressions are listed on the same day according to the GPA with several contractors, they are combined into one block of fields 100-140.

Features of reflecting income in 6-NDFL

Organizations and individual entrepreneurs enter into contractual relations with individuals, individual entrepreneurs or non-residents. When companies generate a report, certain filling features will be highlighted for each case. For example:

- Entrepreneurs independently calculate the amount of tax and reflect it in their reporting. If the GPC is issued with an individual entrepreneur, then 6-NDFL will not be filled out, and the organization should not calculate personal income tax. The customer does not reflect in the certificate the payments under the GPC agreement with the individual entrepreneur. This is due to the fact that the individual entrepreneur independently pays personal income tax payments to the budget, and, accordingly, reports on them independently.

- If the contract is concluded with an individual who is not a resident, the personal income tax rate will be 30%.

Example of filling out a declaration

- The advance is 70,000 rubles;

- On November 30, a transfer was made minus income tax - 9100. The tax was transferred to the treasury simultaneously on November 30:

- the act for contract work was signed on December 29;

- professional deduction amounted to 95,000 rubles;

- the transfer of profit to the contractor in the amount of 100,000 rubles was made on December 30;

- personal income tax withholding, taking into account the deduction, was made on December 30 in the amount of 650 rubles;

- The accountant completed the transfer of income tax on the first working day after the holidays - January 9.

The GPC agreement in declaration 6 of personal income tax in the annual report will be as follows:

The final payment is not included in the annual report. You show it in the second part of the report for January – March.

Tax calculation

To calculate tax, the amount of income of an individual must be determined. Income is considered to be payment in cash and in kind received by the contractor from the customer. The amounts paid by the customer are subject to taxation, but the cost of work and compensation costs should be separated.

As for whether the customer should levy income tax on compensation amounts, the Ministry of Finance has its own opinion, and the Federal Tax Service has its own. The Ministry of Finance believes that compensation paid for housing is a direct benefit of the contractor, that is, income, which means that personal income tax must be withheld from it. This practice is explained in Letter of the Ministry of Finance of the Russian Federation dated March 20, 2012 No. 03-04-05/9-329. The Federal Tax Service, in turn, distinguishes one situation into several related ones; in one situation, an accrual is made, and in the second, no tax is levied. Judicial practice shows that even the calculated tax on compensation amounts can be returned to the executor in court. Therefore, the situation with the calculation of personal income tax from compensation for expenses is a rather controversial practice.

In general cases, personal income tax on the income of individuals is calculated by charging the entire amount of the established amount of income tax.

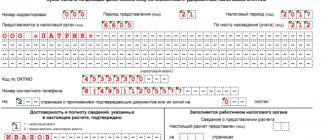

Filling out the title page and first section of the form

Let's start looking at filling out the reporting form from the title page.

At the top of the form you must indicate the company's Taxpayer Identification Number (TIN) and KPP.

Next, we indicate which report is being submitted - primary or corrective. If a corrective report is submitted, the adjustment number is entered in order, starting with one. In addition, the code must indicate the period for which the report was generated, as well as the tax period for which the report was compiled.

The line below is filled in with the tax authority code and the company location code.

Next you should write down the full or short name of the organization

If a reorganization has been carried out in relation to the company, then fill in the information about it.

Below we indicate the OKTMO code and the phone number where you can call a company representative

It is important to remember that if there are several OKTMO codes, then the report is filled out for each of them.

Section 1 contains generalized information and is filled in with a cumulative total. The following information must be filled in:

- We indicate the tax rate that is levied on the amount of remuneration under the contract, as a percentage. For Russian citizens the rate in most cases is 13%, for non-residents – 30%

- We reflect the amount of the contractor's remuneration under the contract. If the contract stipulates an advance, then its amount is also reflected here

- We write down the amounts of deductions that reduce the taxable income of the performer. Along with an employment contract, various types of deductions can be quite legally applied to GPC contracts. This issue is discussed with the customer in advance

- We show the amount of personal income tax calculated from the amount of remuneration minus deductions due to the employee

- We reflect the number of individuals who received income during the year. That is, here you need to indicate all those who work or worked in the company and received income throughout the year

- In the next line we indicate the amount of tax withheld. This is the amount of tax that is transferred to the budget on time

The section is filled out in the same way as when working under an employment contract.

Withholding taxes on remuneration

Each concluded contract document has an agreed upon financial reward.

When drawing up a contract, the contractor undertakes to complete the scope of work specified in it within the established time frame, and the customer undertakes to accept it and pay for it. When setting payment for work, one should be guided by the norms of the Civil Code of the Russian Federation.

Article 709 of the Civil Code of the Russian Federation states that the contract price is formed from two main indicators:

- The cost of the work performed.

- Compensation for the contractor's expenses.

The first point does not have any special restrictions or questions. When reaching an agreement on the final value of the relationship, only the opinion of the two parties is important. The agreement can include both a fixed price and a floating price, which allows you to reduce or increase it later.

But the second point raises many more questions. What exactly should the customer compensate? Compensation may relate to rental housing and food, but the customer is not obliged to pay travel allowances in their full understanding. If compensation amounts are included in the agreement, should personal income tax be paid on them under the agreement? This is perhaps the key question because it affects exactly what amounts taxes will be calculated on. Only those expenses that are supported by documents (checks, invoices and other forms) and that fall within the framework of the preliminary agreement are reimbursed.

The income of contractors is subject to personal income tax tax at the general level. Residents are charged 13%, non-residents 30%. But contributions to the Social Insurance Fund and Pension Fund are made only if such a condition is reflected in the agreement.

The nuances of “contract” payments

A contract may be concluded with an individual:

- having the status of individual entrepreneur;

- being a non-resident (a subject staying on the territory of Russia for less than 183 calendar days within 12 months).

For 6-NDFL this means:

- The money paid by an individual entrepreneur under a contract is not reflected in 6-NDFL by the tax agent - the entrepreneur himself pays taxes on the income received and reports on them;

- “contract” income of a non-resident is taxed at a rate of 30% (instead of the usual 13%).

Payment of income to a non-resident will not in any way affect the completion of the dates in the 2nd section of 6-NDFL, and pages 130 and 140 of this section and the lines of section 1, reflecting the personal income tax calculated from “contract” income, will change and will be reflected as follows:

Thus, the status of an individual affects the fact of reflecting “contract” income, as well as the amount of personal income tax.

The article “Tax resident of the Russian Federation is…” will tell you more about the status of a tax resident.

Income received by an individual under a contract is reflected in 6-NDFL separately for each payment date (including all advance payments). If the work was performed by an individual entrepreneur, “contract” income and the corresponding personal income tax amounts are not reflected in 6-NDFL at the source of payment.

What it is?

This form of interaction does not imply the emergence of labor relations between the participants. The parties to the transaction are the customer and the contractor. The first one orders a certain service, for example, equipment repair, the second one performs the work within the time period established by the contract. The customer accepts the contract work, this fact is recorded in the act of completion, after which payment for services is made. The document itself is regulated by the Civil, not the Labor Code.

This type of relationship is beneficial to employers, since performers under it are deprived of the guarantees established by the Labor Code of the Russian Federation (vacation, sick leave, working hours, etc.). A GPC agreement can be concluded for one-time work or for a long period. There are several varieties of it, one of them is a contract. The obligation to withhold and pay personal income tax remains with the organization.

Important! If an enterprise has chosen an individual entrepreneur as a contractor, it is exempt from paying taxes under this agreement, because An individual entrepreneur is not an individual. person and independently pays and reports on his taxes.

What is a civil contract?

A GPC agreement is a separate specific type of agreement. It can be as close as possible in its essence to labor, or it can be strikingly different from it.

A civil contract is concluded for the performance of certain work, which must be completed once and within a specified time frame.

Remuneration under such an agreement is usually paid based on the results of work, after signing a certificate of completion. However, by agreement with the customer, an advance payment may be provided.

Just as in the case of an employment contract, personal income tax is withheld from remuneration and transferred to the budget. The transfer of insurance premiums is usually not provided for in the contract, but by agreement with the customer such a clause can be included in the contract.