According to the requirements of Art. Law No. 402-FZ dated December 6, 2011 “On Accounting”, all assets and liabilities of companies are reflected in accounting registers and reporting in the currency of the Russian Federation - rubles. This rule also applies to transactions carried out with the currencies of other states: the value of property, foreign currency money supply, investments or debts are converted into rubles. The criteria for generating information about property and liabilities, the value of which is expressed in foreign currency, are determined by PBU 3/2006. Since the beginning of 2021, a number of changes have been made to this document by order of the Ministry of Finance of the Russian Federation dated November 9, 2017 No. 180n. Let's find out more about them.

Accounting for foreign currency transactions in a new way

The main changes are also given in the Information message of the Ministry of Finance of the Russian Federation dated December 12, 2017 No. IS-accounting-10. The innovations affected the following operations:

On the use of cross rates

Clause 5 of PBU 3/2006 regulates the recalculation of any balance sheet position into rubles at the rate established by the Central Bank. Now, if a company needs to convert into rubles from a currency for which the official rate is not established by the Central Bank, this must be done using the cross rate calculated on the basis of exchange rates established by the Bank of Russia.

Example:

The company carried out a foreign currency transaction, receiving an advance of 100,000 Australian dollars (AUD) from an Australian partner. Let's say the Central Bank has not set the ruble exchange rate to this currency, but it is set to the US dollar (USD). Calculation (rate values are conditional):

- AUD/USD rate - 1.4029;

- RUB to USD exchange rate – 66.5022;

- RUB to AUD exchange rate – 66.5022 / 1.4029 = 47.4034;

- The advance received in terms of rubles is 4,740,340 rubles. (47.4034 x 100000).

By recalculating the share of accrued but unpaid revenue

According to the rules in force until the end of 2021 (clause 7 of PBU 3/2006), the cost is recalculated into rubles on the dates of the transaction and reporting (except for advances received and issued, prepayments, etc.). From 2021, revenue not presented for payment that exceeds the amount of the advance received will also be recalculated. In this case, the received prepayment (advance payment) is not recalculated.

Example:

In September, the company performed work under a contract worth 6,000 euros upon receipt of an advance in the same month in the amount of 50% (3,000 euros). The company prepares quarterly accounting reports. Let’s assume that the euro exchange rate set by the Central Bank was:

- on the date of receipt of the advance (September 10) – 70 rubles/euro;

- on the day of signing the certificate of completion (September 20) – 73 rubles/euro;

- on the reporting date (September 30) – 75 rubles/euro.

How an accountant will record transactions in foreign currency:

| In 2021 | |||

| Operation | D/t | K/t | Sum |

| As of 10.09. advance received (3000 x 70) | 51 | 62/Av | 210000 |

| As of 20.09. the act was signed, revenue of 429,000 rubles was recognized. (210000 + 3000 x 73) Advance credited | 62 62/Av | 91 62 | 429000 210000 |

| As of 30.09. (3000 x (75 – 73)) positive exchange rate difference for settlements with the buyer | 62 | 91 | 6000 |

| As of 30.09. (3000 x (75 – 73)) – other expenses from recalculation of the unpaid portion of revenue | 91 | 90 | 6000 |

For hedging currency risks

The new edition of PBU 3/2006 approved a mechanism for protecting assets from fluctuations in the foreign exchange market, for example, when a company conducts foreign trade activities. Currency risks can be hedged by executing transactions for the purchase and sale of foreign currency or agreements on deferred execution terms using various financial instruments, such as options, futures, forwards or swap agreements.

According to the new rules, from 2021, exchange rate differences on foreign currency assets acquired to protect against risks can be taken into account according to IFRS criteria (clause 14.1 of PBU 3/2006). This category of differences in exchange rates will not be subject to the provisions of clause 13 of PBU 3/2006 on accounting.

On doing business abroad

From the beginning of 2021, assets used by the company in its work abroad are subject to conversion into rubles, the value of which is recalculated today as of the date of acceptance for accounting (clause 17 of PBU 3/2006). These are mainly investments in fixed assets, intangible assets, goods and materials, etc. According to the new guidance, all such currency positions will have to be recalculated at the Central Bank exchange rate as of the reporting date (clause PBU 3/2006);

For enterprises conducting economically profitable activities, mainly in foreign currency (abroad or on the territory of the Russian Federation), clause 19.1 of PBU 3/2006 has clarified the accounting rules. Such a company will be able to separately generate in accounting and reporting forms information about foreign currency assets and liabilities for the corresponding segment, allocated in accordance with PBU 12/2010 “Information by Segments”.

Having listed the main upcoming changes, let us recall how accounting of transactions in foreign currency is carried out.

III. Accounting for exchange rate differences

11. Accounting and financial statements reflect exchange rate differences arising from:

operations for full or partial repayment of receivables or payables denominated in foreign currency, if the exchange rate on the date of fulfillment of payment obligations differed from the rate on the date of acceptance of these receivables or payables for accounting in the reporting period or from the rate on the reporting date in which these receivables or payables were restated last time;

operations to recalculate the value of assets and liabilities listed in paragraph of these Regulations.

12. Exchange rate differences are reflected in accounting and financial statements in the reporting period to which the date of fulfillment of payment obligations relates or for which the financial statements were compiled.

13. Exchange differences are subject to credit to the financial results of the organization as other income or other expenses (except for the cases provided for by paragraph of these Regulations or other regulatory legal acts on accounting). (as amended by Order of the Ministry of Finance of the Russian Federation dated December 25, 2007 No. 147n on amendments to PBU 3 )

14. Exchange rate differences associated with settlements with founders on deposits, including in the authorized (share) capital of an organization, are subject to credit to the additional capital of this organization.

Accounting for transactions in foreign currency in 2021

No fundamental changes are expected in the accounting of foreign exchange transactions. As before, they are taken into account using active accounts , , , and cash transactions are attributed to the subaccount 50/4.

The debit of these accounts records the receipt, and the credit records the debit of funds from the account. For the convenience of conducting separate analytics, sub-accounts are opened. Cash transactions in foreign currency are carried out in companies conducting foreign trade operations. They are reflected in the 50/4 subaccount, while all currency flows are accounted for in rubles, recorded in the company’s cash book.

Exchange rate differences associated with market fluctuations of the ruble on different days of the assessment of foreign exchange reserves are reflected in the account of other income and expenses.

Results

When assessing the value of property, the method of its receipt by the company is taken into account: when purchased for money, in exchange for other assets, under a gift agreement or other means.

The company's liabilities are valued at nominal value, and in some cases, taking into account the probability of debt repayment or using discounting. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Foreign exchange assets and liabilities: difficulties in translation

Home → Accounting articles

The article from the magazine "MAIN BOOK" is current as of October 21, 2011.

Contents of the magazine No. 21 for 2011 Yu.A. Inozemtseva, tax expert

Accounting for exchange rate differences arising during the valuation of such objects

For management, contracts in foreign currency mean the company's entry into international markets or a proven way to insure against unpleasant surprises associated with the instability of the domestic economy. And the accountants’ alarm button goes off: “Currency? How not to make a mistake!” In addition, in the short PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in foreign currency” approved. According to Order No. 154n of the Ministry of Finance of Russia dated November 27, 2006, it is not always possible to immediately find a solution to all the problems that life throws at an accountant. Let's look for the right answers together.

Determining the dates of recalculation

So, you have accepted assets and liabilities for accounting and determined whether they need to be recalculated once or constantly. Now you need to figure out the dates for which the recalculation is being done.

As we have said more than once, the currency value of monetary items should be recalculated on the last day of each month. After all, this is the only way to ensure a reliable reflection in the reporting of foreign currency assets and liabilities (which in the future will turn into a certain amount of money) with a fluctuating ruble exchange rate. In addition, you need to recalculate the date of disposal of assets or liabilities. For money in cash and in bank accounts, these are the dates of issuance (write-off) of funds.

Advice

There is an opinion that each time money is received (written off), it is necessary to recalculate not only the amount received (departed) but the entire balance in the current account or at the cash desk. But the financial result is affected only by the difference between exchange rates at the beginning of the reporting period (at the time of recognition of the asset or liability) and at the reporting date. Even if you take into account daily exchange rate fluctuations, the financial result will be the same. “Inflating” non-existent income and expenses is not only time-consuming, but also wrong.

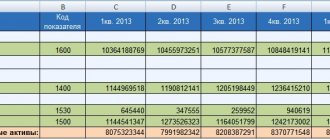

Example. Options for converting money into a foreign currency account

/ condition / At the beginning of the month there are 100 dollars in the current account (1 dollar - 30 rubles). In the middle of the month another 30 dollars arrived (1 dollar - 28 rubles). On the last day of the month, 1 dollar is equal to 29 rubles.

/ solution / Let's consider two possible options for converting foreign currency money.

OPTION 1. If you do not recalculate the balance on the current account when money arrives, then the calculation of the financial result for the period will look like this:

- income: 30 rub. ($30 x (29 rubles – 28 rubles));

- expenses: 100 rub. ($100 x (30 rubles – 29 rubles));

- financial result: –70 rub. (30 rub. – 100 rub.).

OPTION 2. If you recalculate the balance on the current account when money arrives, the financial result will not change:

- income: 130 rub. ($30 x (29 rubles – 28 rubles) + 100 dollars x (29 rubles – 28 rubles));

- expenses: 200 rub. ($100 x (30 rubles – 28 rubles));

- financial result: –70 rub. (130 rub. – 200 rub.).

The debtor and creditor must be converted into rubles for the last time on the date of repayment of the debt. 11 PBU 3/2006. For financial investments, the date of the last recalculation is the date of disposal (redemption) of securities, rights of claim, and granted loans.

What assets and liabilities are considered denominated in foreign currency?

Just imagine what a mess it would be in accounting if property and liabilities were allowed to be simultaneously accounted for in dollars, euros and any other currency. It is precisely to prevent this from happening that all entries in Russian accounting and reporting are made in rubles. 1 tbsp. 8 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”. This means that you need to convert the value of assets and liabilities denominated in foreign currency into native Russian rubles. To do this, it is enough to multiply the amount in foreign currency by the rate established by the Central Bank of the Russian Federation or by agreement. 5 PBU 3/2006, approved. By Order of the Ministry of Finance of Russia dated November 27, 2006 No. 154n. In some cases, such a recalculation must be done more than once; then, due to changes in exchange rates, differences arise, which are called exchange rates.

PBU 3/2006 talks about accounting for assets and liabilities denominated in foreign currency. But when do assets become denominated in currency?

Firstly, such assets include the currency itself (in the cash register or in a bank currency account).

Secondly, these are assets (purchased goods, securities, rights of claim), the contract price of which is set in foreign currency.

Thirdly, these are accounts receivable under contracts, the price of which is set in foreign currency.

Fourthly, if the amount of the loan in the agreement is established in foreign currency, then the lender has such a loan as an asset denominated in foreign currency.

We've sorted out the assets, let's move on to liabilities. An obligation usually arises from an agreement. 2 tbsp. 307 Civil Code of the Russian Federation. The currency in which the obligation under the contract is named is the currency of the debt. And the currency in which the obligation must be paid is the payment currency. 1 Information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 4, 2002 No. 70. This means that if the obligation is established in foreign currency and is paid in rubles, it is still considered foreign currency.

For example, if the goods under the contract cost 1,000 euros, and the buyer pays 40,000 rubles for it, then such a creditor from the buyer is an obligation in foreign currency.

And vice versa: if the price under the contract is 30,000 rubles, and they will pay for it in dollars, then the buyer has a debt for goods - not a foreign currency, but a ruble obligation. But the Russian seller will account for the currency that will be credited to the account using PBU 3/2006.