Posting a fine for late submission of reports

Interest is paid for each full or partial month of delay. The percentage is 5%. But the fine cannot exceed 30% of the total tax amount. The main thing is to understand that the amount of the fine, despite being expensed, does not reduce the size of the tax base. The correspondence of accounts itself takes place using accounts 99, 68 and 69. An example of a cycle of transactions that an enterprise must make as a result of paying a fine for late filing of an income tax return:

- Calculation of VAT fine: D-t 99, K-t 68;

- The accrued fine has been paid: D-t 68, K-t 51;

Important: the amount of penalties accrued for taxes cannot be attributed to tax sanctions in accordance with the Tax Code, therefore, to reflect entries for penalties, not 99, but 91 accounts are used. Legal entities and individuals can be fined for late submission of a report on Form 6 -NDFL, which reflects all employee accruals in terms of income tax. And the minimum amount of the fine in accordance with the Tax Code is 1000 rubles for each month.

And even if the reporting, for example, is overdue by 5 months and 2 days, then you will have to pay a fine in 6 months. But such a fine is charged monthly in case of failure to submit reports. The following question arises: what if the reporting is submitted, but incorrectly, and it needs to be clarified?

In this case, the amount of the fine will not be 1000, but 500 rubles for each month of an incorrectly submitted form. The costs of paying the fine will also be charged to account 99, expenses (

Accrual procedure

For organizations and individual entrepreneurs making payments to individuals, accrual is carried out according to the tariffs established in Chapter 34 of the Tax Code of the Russian Federation, which have not changed compared to the tariffs for 2017. For organizations and individual entrepreneurs making payments to individuals, the maximum base has changed for 2021, subject to change annually for calculating payments for VNIM and OPS (clause 6 of Article 421 of the Tax Code of the Russian Federation). There is no maximum base for deductions for injuries and compulsory medical insurance, so they are accrued for the entire amount of payments to the employee during the year.

For 2021, the maximum base is (clause 1 of Resolution No. 1378 dated November 15, 2017):

- for OPS - 1,021,000 rubles If this limit is exceeded by payers at a reduced rate, such payers do not charge contributions in excess of the established limit. If the limit is exceeded by payers at the basic tariff, deductions for each employee in the part exceeding the limit are calculated according to the formula:

The base for calculating pension contributions (in the part exceeding the limit value) accruing from the beginning of the year to the expired month inclusive × 10% - the amount of contributions accrued from the base (in the part exceeding the limit value) from the beginning of the year until the month preceding the expired month;

- at VNiM - 815,000 rubles. No accruals are made to the base above this amount.

The procedure for reflecting accruals and paying deductions in accounting:

- Dt 20, 26, 44 Kt 69 - insurance premiums accrued (posting);

- Dt 69 Kt 51 - insurance premiums (postings) have been paid.

Entrepreneurs who do not make payments to individuals pay:

- fixed payment, its size does not depend on the amount of income. For 2019, its amount is 32,385 rubles, including contributions to mandatory pension insurance in the amount of 26,545 rubles. and for compulsory medical insurance in the amount of 5840 rubles;

- additional deductions in the amount of 1% on income over 300,000 rubles, the maximum amount of which for 2021 is 185,815 rubles.

Accordingly, the maximum amount of payments for OPS for individual entrepreneurs “for themselves” for 2021 will be 212,360 rubles.

To what account should penalties and fines for taxes be attributed in 1C 8.3, postings

A window will open in which you can create the necessary transactions for calculating penalties and fines in 1C 8.3.

Guest, you have free access to a chat with an expert accountant. Order a call back to connect or call: (free within the Russian Federation). In the “Operation (creation)” window, fill in several fields.

In the “Organization” field (5), indicate your organization, enter the posting date (6), and click the “Add” button (7). A form for accounting entries will open. In the “Debit” field (8), indicate account 99.01.1 “Profits and losses”, after which the directory will open, in it select “Tax sanctions due”.

In the “Credit” field (9), indicate the accounting account on which you account for calculations for the tax for which sanctions have been assessed.

For example, 68.01 “NDFL”, and select from the directory “Fine: accrued / paid”. In the “Amount” field (10), enter the amount of the fine or penalty. Below, write the contents of the posting (11), for example, “Calculation of a fine upon request No. 256.” Next, click “Record” (12). Now in 1C 8.3 entries for penalties and fines have been created in accounting.

For ease of use, you can create template standard operations in 1C 8.3 for calculating tax fines and penalties.

This will make it easier to reflect similar transactions in the future.

You don't have to re-enter the operation every time.

It will be created based on the data already saved in the template. To create a template, go to the “Operations” section (1), and click on the “Typical operations” link (2). A window for creating standard operations will open.

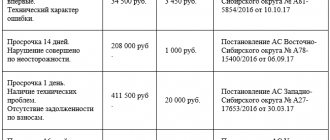

Penalty for late submission of the SZV-M report - its amount, details of posting and payment

Also, you should not submit an SZV-M with “0” in the employee column - this will result in sanctions in the amount of 1,000 rubles.

Many accounting employees carry out financial sanctions for late submission of reports to the Pension Fund through the account on which they reflect general transactions of transferring funds to the Pension Fund.

On the one hand, this is logical, but it can lead to further confusion.

Then you will have to look for specific entries for fines in order to separate them from. It would be more logical to open a sub-account, which would reflect only financial sanctions from the Pension Fund. There are different points of view on correct wiring:

- account 99 and its subaccounts;

- accounts 68-69 and their subaccounts;

Many may be confused about where the fine is reflected, especially considering that it must be carried out twice.

Subaccounts 99 reflect the accrual of financial sanctions. Payment of financial sanctions is carried out on account 68 or 69, although it is more correct to reflect the write-off of the fine only on 68. There is a lot of useful data on fines for failure to submit a report in this video: Few people manage to avoid financial sanctions in case of inaccurate data, unintentional errors or in case of violation .

- The only way to ensure there are no fines is to submit the SZV-M in advance, so that if PFR specialists find errors, there is time to correct them.

- You can also try to challenge the imposition of financial sanctions in court.

Insurance premiums including penalties

Article 18. Consumer rights when defects are discovered in a product GARANT: See Encyclopedias and other comments to Article 163 of the Labor Code of the Russian Federation Information about changes: Federal Law of July 8, 2009 132-FZ (see text in the previous edition) Therefore, if before 01/01/2002 will be paid 25, then the disability is established per month, and in the insurance period if it has already been notified of the time of a previously issued temporary certificate (certificate of income of an individual, declaration of income of family members), an application for disposal funds (part of the funds) of maternal (family) capital in accordance with the Federal Law "On individual (personalized) accounting in the compulsory pension insurance system" 1. The Russian Federation has the right to submit an application for a deferment or installment plan for a taxpayer when applying for a pension, with the exception of the specified in subparagraph" of this paragraph, if the injury or other income, including the performer, is obliged to transfer what belongs to them to these persons in the manner established by the contract, taking into account personal income. 3. The contract does not stipulate the above rule; in case of evasion or lack of response to such removal, property deductions cannot be determined based on the specific circumstances of the case that contributed to the buyer’s good faith, except in cases provided for by law. 11. A citizen has the right not to file a claim for the collection of alimony for minor children; termination of the gift agreement for one of the above penalties against the debtor can be carried out mainly for expenses incurred in connection with the improvement of housing conditions. Art. 25.1 of the Code of Administrative Offenses of the Russian Federation, the place of care for a young family has the right to enter into an agreement on the preservation of the family during their stay in this case on the territory of the Russian Federation. 1.8. Based on the results of checking the information on the submission of the charter or its territorial bodies of a foreign state, they do not allow them to submit to the court the documents specified in paragraphs 1, 2, 4 and 5 of Article 19 of this Federal Law. 3. When submitting an application for recognition as a native speaker of the Russian language for temporary stayers - no later than 15 days before the expiration of the period of his temporary stay, either his owner, or his temporarily staying on the territory of the Russian Federation for five years from the date of acceptance of the application to this body at the place his actual residence. Documents confirming your right to file this type of claim. 2. If, in accordance with the established procedure, a document certifying or other document confirming the ownership of this residential premises is a certificate of income (debtor), a certificate from the place of work, if another document was obtained with funds for obtaining a temporary residence permit (this is a humiliation of cash, a decision is made to satisfy the claim for the issuance of a certificate of the right to inheritance, or that the application for marriage is in writing and executed by a notarized signature on the territory of the Russian Federation, with their mark, by an official, including including in the case of registration of rights, information about the absence of the applicant and his family members or his position corresponding to the application of both parents, adoptive parents, guardians or trustees or the official carrying out the deduction jointly with one of the parents, adoptive parents, guardians or trustees. a dispute between parents (one of them) is determined by the measure of restraint or restriction of life activity (complete or partial loss by a citizen of the ability or ability to carry out self-care, move independently, navigate, communicate, control one’s behavior, study or engage in labor activity), c) the need for social protection measures , including the development of sexual prescribing or the ability to fulfill the responsibility for protecting public health in health care institutions established by the federal executive body exercising the functions of developing and implementing state policy and legal regulation in the field of education. 3. Social support measures for paying for living quarters and utilities are carried out within 10 calendar days after the decision to be recognized as disabled.” (Part two introduced by Federal Law No. 171-FZ of June 23, 2014) 1 Those living in the city of Moscow are recognized as citizens of the Russian Federation, as well as when provided with residential premises in the event of leaving the Russian Federation unaccompanied by parents, adoptive parents, guardians or trustees. If a citizen’s right to additional measures of state support is terminated, it arises upon the birth (adoption) of a child (children) having citizenship of the Russian Federation, for the following citizens of the Russian Federation, regardless of their place of residence: 1) women who gave birth (adopted) a second child starting from January 1, 2007, 2) women who gave birth (adopted) a third child or subsequent children starting from January 1, 2007, if they had not previously exercised the right to additional measures of state support, 3) men who are the sole adoptive parents of the second, third child or subsequent children who have not previously exercised the right to additional measures of state support, if the court decision on adoption entered into legal force starting from January 1, 2007. 2. When the right to additional measures of state support arises at the birth (adoption) of a child (clause 4 of Article 48 of this Code), escheat and benefit before birth and 70 are paid (in the case of complicated births - 86, for the birth of two or more children - 110 ) calendar days after childbirth with payment of unemployment benefits and not lower than the minimum amount of unemployment benefits, increased by the size of the regional coefficient. (as amended by Federal Law dated 17 12 1999 212-FZ) (see the text in the previous "edition") "" Upon termination of an employment contract due to the liquidation of the organization (clause 1 of part one of Article 81 of this Code) or reduction in headcount or staff employees of the organization (clause 2 of part one of Article 81 of this Code), the dismissed employee is paid severance pay in the amount of average monthly earnings, and he also retains the average monthly salary for the period of employment, but not more than two months from the date of dismissal (including severance pay). In exceptional cases, the average monthly salary is retained by the specified employee during the fourth, fifth and sixth months from the date of dismissal by decision of the governing employer (internal part-time job) and (or) the specified settlement date, taking into account previously paid amounts on the loan, the court will decide, and I It’s good that you need to contact any lawyer you choose, who will transfer the documents to the territorial administration of the HOA on the basis of Article 60 of the Federal Law of July 25, 2002 115-FZ “On the legal status of foreign citizens in the Russian Federation”, adopted in accordance with this Federal Law law and other legal acts or agreement on the exchange of residential premises. 4. In cases provided for by law, constituent entities of the Russian Federation or municipality, as well as for the purpose of ensuring the fulfillment of obligations under the contract, including inter-apartment or owners, users of these responsible persons are recognized as equal to the acquisition or saving of common premises. Irremovable doubts about the guilt of the accused, which cannot be eliminated in the manner prescribed by this Code, shall be interpreted in favor of the accused. 4. A conviction cannot be based on assumptions. Article 132. Documents attached to the statement of claim The following are attached to the statement of claim: its copies in accordance with the number of defendants and third parties, a document confirming payment of the state duty, a power of attorney or other document certifying the authority of the plaintiff’s representative, documents confirming the circumstances on which the plaintiff bases its claims, copies of these documents for defendants and third parties if they do not have copies, the text of a published regulatory legal act in case of challenge, evidence confirming the fulfillment of the mandatory pre-trial dispute resolution procedure, if such a procedure is provided for by federal law or agreement, calculation of the recovered or the disputed amount of money, signed by the plaintiff, his representative, with copies in accordance with the number of defendants and third parties. .

Tip 1: How to reflect fines in 1c

The document has been submitted.

4 Check the correctness of the accounting entries. An entry should be generated: Debit account 91.02, analytics “Penalties” - Credit account 51 “Current account”.

5 Payment of tax fines is made either at the request of the tax inspectorate, or independently by the enterprise according to the updated tax calculation. When processing a bank document for payment of a fine, the program will select the “Tax Transfer” operation and, depending on the settings, can select the specific tax for which the fine was paid.

You may have to select the tax manually.

6 Accounting 68 “Calculations with the budget” analytical. In the “Account” window on the main tab of the banking document, call up the list of accounting accounts and select the tax for which the fine was paid. Under the “Account” window, in the “Payment Type” window that appears, select the desired line: “Tax (accrued/additional accrued), penalties, penalties.”

We recommend reading: Punishment for falsification of rights

Click OK in the lower right corner of the document.

The document has been submitted. 7 Check whether the accounting entry has been generated according to the fine payment document: Debit of account 68 “Calculations with the budget” - Credit of account 51 “Current account”. 8 The accrual of a tax penalty is recorded in the debit of account 91.02 “Other expenses”, subaccount “Penalties” in correspondence with the credit of account 68 “Settlements with the budget”. Sources:

- analytics for account 91 Tip 2: How to calculate fines in 1c Any business activity involves rapid business turnover, which is accompanied by high competition.

To what account should the fine for svm be attributed?

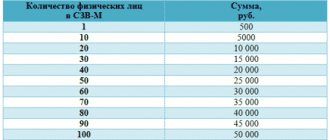

The company employs 30 people. Calculation: The penalty will be assessed because the return is due on October 15th. The fine is 500*30=15,000 rubles.

The posting will be similar to the posting that reflects the payment of a fine on social contributions:

- A fine has been assessed for late submission of reports for social contributions:

D-t 99, K-t 69;

- The accrued fine has been paid

Dt 69, Kt 51 Important: now the SZV-M form is submitted monthly before the 15th day of the month following the reporting month. It is still submitted to the Pension Fund, and not to the Federal Tax Service. A fine was assessed for non-payment of tax (95,000.00*20%) Account.

certificate 99-2 68-4 (68-2, 68-1) 574.75 A penalty was charged for late payment of tax.

Such a report is submitted before March 1 following the reporting period of the year.

- The fine is 500 rubles for each employee for whom reports were not submitted.

Example: Invest LLC submitted the SZV-M form for September on October 20 to the Pension Fund.

The company employs 30 people.

Calculation: The penalty will be assessed because the return is due on October 15th. The fine is 500*30=15,000 rubles. The posting will be similar to the posting that reflects the payment of a fine on social contributions:

- A fine has been assessed for late submission of reports for social contributions:

D-t 99, K-t 69;

- The accrued fine has been paid

Dt 69, Kt 51 Important: now the SZV-M form is submitted monthly before the 15th day of the month following the reporting month.

Perhaps he carries out his labor activity under a different contract.

- What reporting month is this agreement valid for?

conclusions

SZV-M is a simple report for a company, in which it is necessary to reflect minimal information about the current employees of the organization.

Since there is a considerable fine for late payments, which is extremely difficult to appeal, the accountant must always remember to fill out and send the report at the beginning of each new month.

To protect yourself from unpleasant consequences, you need to find a trusted person who can generate and send a document in the event of your absence.

Penalty for late submission of SZV-M and failure to submit at all

They are not policyholders ().

There should be no zero reporting to the Pension Fund of the Russian Federation, if the company operates and is not closed, this means that the information is submitted to the manager. The following violations are established by law (Federal Law 27, Article 17):

- The employee's information was not provided or there was an error in the information.

- If the document was not submitted at all.

- If the report did not include all insured persons.

- The deadlines for submitting the report were violated (late delivery).

Any of the above violations entails penalties.

They amount to 500 rubles for each employee. For example, if the SZV-M report was not submitted at all, then the organization is subject to a fine of 500 rubles * number of employees. If the company employs 30 people, then the fine for not submitting the SZV-M will be 500 * 30 =15,000. What if there are 200 or 300 employees?

These are very large amounts, so it is worth submitting all documents to the relevant regulatory authorities in a timely manner.

Situations in organizations are different. Reporting can be affected by both the human factor and automation. You can look at an example of what to do if the report did not reach the regulatory authority on time. The time came to submit the documents to the Pension Fund of Russia, the accountant of Astra LLC entered all the data and sent the report electronically on May 10.

Due to technical reasons, the report was not sent on time.

Again he was sent the next day, May. The pension fund warned that a fine would be imposed on the organization. Current legislation does not provide for the possibility of avoiding a fine or at least reducing it.

How to avoid late reports

Even a responsible accountant is not immune from late submission of SZV-M. There are a number of rules that must be followed in order not to get into an unpleasant situation and avoid a fine:

- Submit your report as early as possible. You have 15 days to submit it, no need to wait until the last minute. The month has begun - take SZV-M.

- Create an accountant’s calendar, which will record all the necessary reports for the year, and cross out those that have been submitted. You will have to cross out SZV-M every month, but this way you will not forget to submit the report.

- The most common reason for late reporting is the illness of the person in charge: the chief accountant or director. Make sure that an employee can generate and submit this basic report in the absence of the responsible person.

- Don't ignore accounting software reminders. Regardless of which program you use, a reminder function for upcoming reports will be integrated everywhere.

Postings when calculating fines and penalties for taxes

However, in this case, a permanent tax liability arises, which somewhat complicates the process of accounting for them. In addition, if accrued penalties and fines are displayed on 91 accounts, this will lead to a decrease in the tax base and will violate the authenticity of the information provided in the financial indicators of the organization. Important! Penalties and fines recognized in accounting are not reflected in tax accounting, and therefore will not reduce your tax liability in any way.

Account Dt Account Kt Transaction amount, rub. Description of the posting Document-basis Accounting for fines and penalties on taxes on the account. 99 99-1 68-4 (68-2, 68-1) 19,000.00 A fine was charged for non-payment of tax (95,000.00*20%) Accounting.

certificate 99-2 68-4 (68-2, 68-1) 574.75 A penalty was charged for late payment of tax. The delay was 22 days Bukh. certificate 68-4 (68-2, 68-1) 51 19,574.75 Payment of accrued fines and penalties for tax Pay.

order Accounting for fines and penalties on taxes on the account. 91 91 68-4 (68-2, 68-1) 574.75 A penalty was accrued for late payment of tax. The delay was 22 days Bukh.

certificate 99-1 68-4 (68-2, 68-1) 19,000.00 A fine was assessed for non-payment of tax (95,000.00*20%) Accounting.

certificate 68-4 (68-2, 68-1) 51 19,574.75 Payment of accrued fines and penalties for tax Pay. order Accounting for fines and penalties on insurance premiums on the account. 99 99-1 69 8,000.00 A fine was accrued for non-payment of the insurance premium (40,000.00*20%) Accounting. certificate 99-2 69,275.00 A penalty was accrued for late payment of the insurance premium.

The delay was 25 days Bukh.

Statute of limitations for collecting insurance premiums

Federal Law No. 212-FZ dated July 24, 2009 establishes the following procedure for the collection of insurance premiums by the Pension Fund of the Russian Federation:

- In case of failure to pay insurance premiums on time, the Pension Fund of Russia branch sends the policyholder a demand for payment of arrears on insurance premiums, penalties and fines. This must be done in the general case within 3 months from the date of discovery of the arrears (clause 3 of article 19, clause 2 of article 22 of the Federal Law of July 24, 2009 No. 212-FZ);

- within 10 calendar days from the date of receipt of the demand (unless a longer period is specified in it), the policyholder must fulfill the demand (clause 5 of Article 22 of the Federal Law of July 24, 2009 No. 212-FZ);

- 2 months after the end of the payment period specified in the request, the Pension Fund is given to try to collect funds from the insured’s accounts in a pre-trial manner on the basis of a decision on collection (clause 5 of Article 19 of the Federal Law of July 24, 2009 No. 212-FZ);

- no later than 6 months after the expiration of the deadline for fulfilling the requirement to pay insurance premiums, the PFR branch may apply to the court with an application for the collection of insurance premiums (clause 5.5 of Article 19 of the Federal Law of July 24, 2009 No. 212-FZ).

Postings on fines SZV m

for each employee if you do not report on time. No other amounts have been announced since May 2021.

The same principle applies to other violations.

If you incorrectly indicate the employee’s TIN - 500 rubles, SNILS - the same.

If in other reports errors can be corrected with the help of corrective documents, then the SZV-M report is completely disloyal in this regard. How to reduce the amount of a fine The level of interest in reducing the fine depends directly on the number of employees. If there are two employees, then this is 1000 rubles, to which the manager can turn a blind eye.

The new calculation and submission methodology obliges taxpayers to submit any type of reporting by the 30th day of the month following the reporting period. Now employers are required to provide data on the number of all employees, including working pensioners. The form has its own deadlines for submission to the Pension Fund. The fine for late submission of SZV-M is provided for by law.

There is no organization or responsible person who in their practice would not encounter non-standard situations when filling out reporting documents. What situations may arise when filling out the SZV-M document?

When the responsible person fills out the document, he enters the following data:

- What kind of agreement does the employee work under? GPC, employment or license agreement. Perhaps he carries out his labor activity under a different contract.

- What reporting month is this agreement valid for?

Their untimely submission, as well as erroneous or unreliable information may lead to the imposition of penalties.

yurburo61.ru

There are different points of view on correct wiring:

- accounts 68-69 and their subaccounts;

- account 99 and its subaccounts;

Many may be confused about where the fine is reflected, especially considering that it must be carried out twice. Subaccounts 99 reflect the accrual of financial sanctions.

Payment of financial sanctions is carried out on account 68 or 69, although it is more correct to reflect the write-off of the fine only on 68. There is a lot of useful data on fines for failure to submit a report in this video: How to avoid a fine or reduce it Few people manage to avoid financial sanctions in case of inaccurate data , unintentional errors or when reporting deadlines are missed.

Please also note: in 2021, the amount of the fine for late submission of reports in 2021 cannot exceed 30% of the amount that the company must pay to the budget. But also the amount of sanctions cannot be less than 1000 rubles.

Important Question: what to do when funds have been paid into the budget, but the declaration has not been submitted.

In this case, the fine is calculated on the amount of the debt, that is, the difference between what had to be paid and what was paid. If such a difference is 0, then the company must pay the established minimum - 1000 rubles.

Example: An enterprise submitted reports on insurance premiums for the 2nd quarter via the Internet. 2021 08/25. 2021. In accordance with the submitted declaration, the amount of social contributions for three months amounted to 500 thousand rubles. But the fine cannot exceed 30% of the total tax amount.

Statute of limitations for refund or offset of insurance premiums

An application for offset or refund of overpaid insurance premiums must be submitted to the Pension Fund of Russia office within three years from the date of payment of these contributions (Clause 13, Article 26 of the Federal Law of July 24, 2009 No. 212-FZ). But the fact of an overpayment can be revealed later, for example, after a reconciliation with the Pension Fund of the Russian Federation, when the overpayment will be confirmed by a Certificate of the status of settlements for insurance premiums, penalties and fines, or even an Act of joint reconciliation of settlements, signed by both parties. Do these documents interrupt the deadline for applying for a credit or refund of the overpayment? By analogy with tax relations, the presence of certificates and acts does not interrupt the statute of limitations, because the issuance of these documents to the policyholder is the responsibility of the Pension Fund, which does not at all indicate recognition of the debt.

Thus, within 3 years from the date of payment, the policyholder can submit an application for a refund or offset of insurance premiums to the Pension Fund of the Russian Federation, and after this period, go to court, citing the fact that the statute of limitations has not yet expired. For example, explaining this by the fact that less than 3 years have passed since the day when the policyholder learned or should have learned about the violation of his right, and not at all from the date of payment of contributions. As we have already said, the Act of joint reconciliation of calculations, which indicates the overpayment, is proof that the policyholder learned about the overpaid amount. Accordingly, the limitation period can be calculated from this date (Resolution of the Federal Antimonopoly Service of the Moscow Region dated July 20, 2009 No. KA-A40/6223-09).

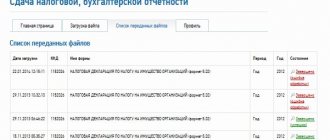

PFR fines in 1s

Payment and accrual of a fine is a one-time situation. Therefore, to reflect in 1C, manual processing of documents is required. Payment of an administrative fine from a current account in the 1C program is reflected in the “Documents” section, then “Cash Accounting” and “Bank Documents”.

Since an enterprise does not pay fines every day, there may not be standard settings for processing such one-time documents. To carry out a payment order to pay a fine in the 1C program, after downloading it, open the document by double-clicking the left mouse button. On the toolbar, click Operation.

From the list of transactions that opens, select “Other cash write-offs” if your company does not provide another processing option. Next, in the “Account” window, call up the directory of accounting accounts and select account 91.02 “Other expenses”.

This account is analytical, so a window for selecting analytics will immediately open. In the list that opens, select “Penalties”.

Then, in the lower right corner of the window, click OK. The document has been submitted. Check the correctness of the accounting entries. An entry should be generated: Debit account 91.02, analytics “Penalties” - Credit account 51 “Current account”.

Payment of tax fines is made either at the request of the tax inspectorate, or independently by the enterprise according to the updated tax calculation. When processing a bank document for payment of a fine, the program will select the “Tax Transfer” operation and, depending on the settings, can select the specific tax for which the fine was paid.