Transport tax is a regional duty paid by individual entrepreneurs, companies and individuals who own vehicles of various types: water, air, automobile, motorcycles and other movable vehicles. Last year, when paying the fee in the payment receipt, citizens used the 2021 transport tax for individuals to indicate the type of payment, KBK; in 2019, new ones are used. Budget classification codes for individuals and individual entrepreneurs are the same, but for companies they use different numbers that determine the type of collection.

A little about transport tax

It should be understood that transport tax refers to regional taxes, and therefore the income from its payment is received by the subject of the Russian Federation in which it is paid. As already mentioned, transport tax is paid by both individuals and legal entities. However, there are some situations when this tax does not need to be paid. This applies, for example, to cars used by disabled people, rowing boats, and tractors. A more complete list can be found in the Tax Code of the Russian Federation.

Regional legislation may contain various benefits for the payment of transport tax. For example, pensioners and large families may sometimes be exempt from paying it. Instead of a waiver, a larger discount may also be provided.

KBK for individuals

All people who own vehicles must pay tax. Unlike companies that calculate it themselves, citizens are sent a notification from the tax service. If there was no notification, the individual should inform the tax authorities himself that he has a vehicle that needs to be taxed.

According to the law, citizens who own a car must make timely tax payments before the first of December of the coming year.

| Tax for individuals | KBK |

| KBK transport tax for 2021 and 2021: | 182 1 0600 110 |

Penalties for transport tax of legal entities and citizens

So, in case of late payment, you will need to pay a penalty. It is important that if there is a delay, it is necessary to pay the tax as quickly as possible, because penalties will be charged for each day of delay in the amount of 1/300 of the current refinancing rate of the Bank of Russia. This means that, for example, if you are one day late with your payment, you will not suffer any major negative consequences. But if the delay is much more days, this may result in the need to pay a large sum of money.

Transport tax 2021 changes

KBC for insurance premiums for 2021

Check the BCC for insurance premiums with the tables below before sending the payment to the bank. Please note that there are no separate codes for additional pension contributions for old periods. Although the codes for other contributions are divided by year. The BCCs for these contributions are not divided into periods, since this is not necessary. All contributions for additional tariffs must be transferred to single codes.

BCC for insurance premiums for employees for 2021 (table)

| Payment type | KBK | |

| contributions for periods up to 2021 | fees for January, February, etc. in 2017-2018 | |

| Pension contributions | ||

| Contributions | 182 1 0200 160 | 182 1 0210 160 |

| Penalty | 182 1 0200 160 | 182 1 0210 160 |

| Fines | 182 1 0200 160 | 182 1 0210 160 |

| Contributions for temporary disability and maternity | ||

| Contributions | 182 1 0200 160 | 182 1 0210 160 |

| Penalty | 182 1 0200 160 | 182 1 0210 160 |

| Fines | 182 1 0200 160 | 182 1 0210 160 |

| Contributions for injuries | ||

| Contributions | 393 1 0200 160 | 393 1 0200 160 |

| Penalty | 393 1 0200 160 | 393 1 0200 160 |

| Fines | 393 1 0200 160 | 393 1 0200 160 |

| Contributions for compulsory health insurance | ||

| Contributions | 182 1 0211 160 | 182 1 0213 160 |

| Penalty | 182 1 0211 160 | 182 1 0213 160 |

| Fines | 182 1 0211 160 | 182 1 0213 160 |

KBC for insurance premiums for 2021 (table for individual entrepreneurs)

| Pension contributions | KBK for periods up to 2021 | KBC for 2017-2018 |

| Fixed contributions to the Pension Fund based on the minimum wage | 182 1 0200 160 | 182 1 0210 160 |

| Contributions at a rate of 1 percent on income over RUB 300,000. | 182 1 0200 160 | 182 1 0210 160 |

| Penalty | 182 1 0200 160 | 182 1 0210 160 |

| Fines | 182 1 0200 160 | 182 1 0210 160 |

| Medical fees | ||

| Contributions | 182 1 0211 160 | 182 1 0213 160 |

| Penalty | 182 1 0211 160 | 182 1 0213 160 |

| Fines | 182 1 0211 160 | 182 1 0213 160 |

KBC for insurance premiums for 2021 (table) at additional rates

| Additional pension contributions at tariff 1 | ||

| Contributions | 182 1 02 02131 06 1010 160, if the tariff does not depend on the result of the special assessment 182 1 02 02131 06 1020 160, if the tariff depends on the result of the special assessment | |

| Penalty | 182 1 02 02131 06 2100 160 | 182 1 02 02131 06 2100 160 |

| Fines | 182 1 02 02131 06 3000 160 | 182 1 02 02131 06 3000 160 |

| Additional pension contributions at tariff 2 | ||

| Contributions | 182 1 02 02132 06 1010 160, if the tariff does not depend on the result of the special assessment 182 1 02 02132 06 1020 160, if the tariff depends on the result of the special assessment | |

| Penalty | 182 1 02 02132 06 2100 160 | 182 1 02 02132 06 2100 160 |

| Fines | 182 1 02 02132 06 3000 160 | 182 1 02 02132 06 3000 160 |

What is KBC?

Having dealt with the transport tax and the responsibility for its late payment, you should study the topic of the BCC, which must be indicated when paying penalties. KBK, or budget classification code, is intended for the preparation and execution of budgets, as well as reporting. With the help of the KBK, the purpose of those financial resources that are paid by tax entities is indicated.

A budget classification code is required when one of the parties to legal relations is the state or its authorized bodies. Thus, the payment of taxes and penalties is precisely such a case due to the public nature of such legal relations.

Procedure for filling out a transport tax return

BCC for VAT in 2021

A company that mistakenly indicated the KBK of another tax in its payment has the right to clarify the payment. This was officially confirmed by the Federal Tax Service. For example, a profit tax code was entered in the VAT payment slip. Because of this, a debt arose for VAT, and an overpayment arose for profits.

If you submit an application to clarify the payment, then the tax authorities must correct the BCC in the budget settlement card and reset the penalties to zero (clause 7 of Article 45 of the Tax Code of the Russian Federation). But in order not to create unnecessary problems for yourself, check the KBK of value added tax for 2021 in advance using our table.

KBC for VAT transfers in 2021

| Payment Description | Mandatory payment | Penalty | Fines |

| VAT on goods (work, services) sold in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| VAT on goods imported into Russia (from the Republics of Belarus and Kazakhstan) | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| VAT on goods imported into Russia (payment administrator - Federal Customs Service of Russia) | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

Penalties for transport tax: KBK 2018

So, we have come to the most important topic of this article: how to properly pay penalties if there was a delay in paying transport tax?

To pay penalties, you must fill out the payment order correctly. It is very important, in particular, to correctly fill out the KBK penalties for transport tax. Any mistake in even one figure can turn out badly for an organization or individual. This will be discussed in more detail below.

So, what budget classification codes are provided for transport tax?

BCC for other taxes, fees and obligatory payments for 2018

Below we present the BCC for all other taxes, fees, and obligatory payments. Check the codes on your payment slips with the tables to avoid errors.

KBK on UTII (single tax on imputed income) 2018

| Tax | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

| Fines | 182 1 0500 110 |

KBK for 2021 for individual entrepreneurs (patent)

| Purpose of payment | Mandatory payment | Penalty | Fine |

| tax to the budgets of city districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| tax to the budgets of municipal districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| tax to the budgets of Moscow, St. Petersburg and Sevastopol | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| tax to the budgets of urban districts with intracity division | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| to the budgets of intracity districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

BCC for Unified Agricultural Tax for 2021

| Tax | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

| Fines | 182 1 0500 110 |

KBK for water tax for 2021

| Tax | 182 1 0700 110 |

| Penalty | 182 1 0700 110 |

| Fines | 182 1 0700 110 |

BCC for land tax (table)

| Payment Description | KBK tax | KBK penalties | KBC fines |

| For plots within the boundaries of intra-city municipalities of Moscow and St. Petersburg | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of urban districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of inter-settlement territories | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of rural settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of urban settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of urban districts with intra-city division | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of intracity districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

KBC for mineral extraction tax 2018

| Payment Description | KBK tax | KBK penalties | KBC fines |

| Oil | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Combustible natural gas from all types of hydrocarbon deposits | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Gas condensate from all types of hydrocarbon deposits | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Extraction tax for common minerals | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Tax on the extraction of other minerals (except for minerals in the form of natural diamonds) | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Mineral extraction tax on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation, when extracting minerals from the subsoil outside the territory of the Russian Federation | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Mineral extraction tax in the form of natural diamonds | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Mineral extraction tax in the form of coal | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

Payments for the use of subsoil (KBK 2018)

| Payment Description | KBK |

| Regular payments for the use of subsoil for the use of subsoil (rentals) on the territory of the Russian Federation | 182 1 1200 120 |

| Regular payments for the use of subsoil (rentals) for the use of subsoil on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation and outside the Russian Federation in territories under the jurisdiction of the Russian Federation | 182 1 1200 120 |

Payments for the use of natural resources - KBK for 2018

| Payment Description | KBK for payment |

| Payment for negative impact on the environment Payment for emissions of pollutants into the air by stationary facilities | 048 1 1200 120 |

| Payment for emissions of pollutants into the atmospheric air by mobile objects | 048 1 1200 120 |

| Payment for discharges of pollutants into water bodies | 048 1 1200 120 |

| Payment for disposal of production and consumption waste | 048 1 1200 120 |

| Payment for other types of negative impact on the environment | 048 1 1200 120 |

| Payment for the use of aquatic biological resources under intergovernmental agreements | 076 1 1200 120 |

| Payment for the use of federally owned water bodies | 052 1 1200 120 |

| Income in the form of payment for the provision of a fishing area, received from the winner of the competition for the right to conclude an agreement on the provision of a fishing area | 076 1 1200 120 |

| Income received from the sale at auction of the right to conclude an agreement on fixing shares of quotas for the production (catch) of aquatic biological resources or an agreement for the use of aquatic biological resources that are in federal ownership | 076 1 1200 120 |

KBK for fees for the use of wildlife objects (2018)

| KBK for fees | BCC for penalties | KBC for fines |

| 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

BCC 2021 for fees for the use of aquatic biological resources

| Payment Description | Codes | ||

| Tax | Penalty | Fines | |

| Fee for the use of aquatic biological resources (excluding inland water bodies) | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Fee for the use of objects of aquatic biological resources (for inland water bodies) | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

KBK 2021 for trading fee

| Payment Description | KBK for payment |

| Trade tax in federal cities | 182 1 0500 110 |

| Penalty trading fee | 182 1 0500 110 |

| Interest trading fee | 182 1 0500 110 |

| Fines trade fee | 182 1 0500 110 |

KBK 2021: tax on gambling business

| BCC for tax | BCC for penalties | KBC for fines |

| 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

State duty: BCC for 2021 (table)

| Payment Description | KBK |

| State duty on cases considered in arbitration courts | 182 1 0800 110 |

| State duty on cases considered by the Constitutional Court of the Russian Federation | 182 1 0800 110 |

| State duty on cases considered by constitutional (statutory) courts of constituent entities of the Russian Federation | 182 1 0800 110 |

| State duty on cases considered by the Supreme Court of the Russian Federation | 182 1 0800 110 |

| State duty for state registration: – organizations; – individuals as entrepreneurs; – changes made to the constituent documents of the organization; – liquidation of the organization and other legally significant actions | 182 1 0800 110 |

| State duty for the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of legal entities | 182 1 0800 110 |

| State duty for carrying out actions related to licensing, with certification in cases where such certification is provided for by the legislation of the Russian Federation, credited to the federal budget | 182 1 0800 110 |

| Other state fees for state registration, as well as performance of other legally significant actions | 182 1 0839 110 |

| State duty for re-issuance of a certificate of registration with the tax authority | 182 1 0800 110 |

Income from the provision of paid services and compensation of state costs: KBK 2018

| Payment Description | KBK for payment |

| Fee for providing information contained in the Unified State Register of Taxpayers | 182 1 1300 130 |

| Fee for providing information and documents contained in the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs | 182 1 1300 130 |

| Fee for providing information from the register of disqualified persons | 182 1 1300 130 |

KBC 2021: fines, sanctions, damages

| Payment Description | KBK for payment |

| Monetary penalties (fines) for violation of legislation on taxes and fees, provided for in Art. 116, 118, paragraph 2 of Art. 119, art. 119.1, paragraphs 1 and 2 of Art. 120, art. 125, 126, 128, 129, 129.1, art. 129.4, 132, 133, 134, 135, 135.1 | 182 1 1600 140 |

| Monetary penalties (fines) for violation of legislation on taxes and fees provided for in Article 129.2 of the Tax Code of the Russian Federation | 182 1 1600 140 |

| Monetary penalties (fines) for administrative offenses in the field of taxes and fees provided for by the Code of Administrative Offenses of the Russian Federation | 182 1 1600 140 |

| Monetary penalties (fines) for violation of legislation on the use of cash register equipment when making cash payments and (or) payments using payment cards | 182 1 1600 140 |

| Monetary penalties (fines) for violation of the procedure for handling cash, conducting cash transactions and failure to fulfill obligations to monitor compliance with the rules for conducting cash transactions | 182 1 1600 140 |

Source

Source

What are the consequences of filling out the CBC incorrectly?

As mentioned above, it is necessary to carefully check each figure when filling out the KBK. However, it happens that a mistake is still made, which is noticed only later. What to do in such a situation?

An error in filling out a payment order is not critical in a situation where it did not result in non-transfer of tax to the treasury. In this case, all you need to do is write a statement in which you need to point out this very mistake. At the same time, it must be accompanied by evidence of the error - a copy of the payment order with an incorrect indication of the KBK.

But how can you understand whether such an error was the reason for not transferring penalties on transport tax for individuals and organizations? Here it should be said that judicial practice proceeds from the following position: if an error is made in indicating the BCC, this in itself does not lead to non-payment of tax. Thus, there is no need to worry about this.

Similar articles

- Property tax - current BCC for organizations

- KBK for organizations and individuals on transport tax

- What is the BCC for transferring penalties for personal income tax?

- BCC for penalties on transport tax in 2016-2017

- Calculation of transport tax in 2021

Decoding the code

Since the administrator of these payments is the Federal Tax Service, the codes always begin with the numbers 182. Further they contain the following information:

- 1 - tax nature of budget income;

- 06 - object of taxation (property);

- 04011 — appointment (for transport);

- 02 — budget level (subject of the Russian Federation);

- the next four digits are the subtype of income (tax, penalties, fine or interest);

- 110 - tax income in accordance with the Tax Code of the Russian Federation.

In this case, you should not confuse the administrator and the recipient who appears in the payment document. We are talking about the Federal Treasury Department. The Federal Tax Service is given in parentheses, for example: “UFK for the city of St. Petersburg (INFS of Russia for the city of St. Petersburg).

Common Questions

Question 1: How to prepare documents that certify that a car has been stolen. How to calculate the tax on a car while it is on the wanted list?

Guided by the norms established by Art. 28 of the Tax Code, the company will need to obtain a certificate from the relevant authorities containing information about the date and place of the theft and identification data of the vehicle. You can contact the investigative authorities for it. Next, transfer information about the theft to the traffic police and tax officials.

The date of the theft will serve as the starting point for suspending the accrual of transport tax. Its calculation should be stopped in the month following the month the vehicle was stolen (clause 7, clause 2, article 358 of the Tax Code). The basis will be the same certificate from the internal affairs bodies, which indicates the month of the theft.

Who pays vehicle tax?

The discussed deduction for transport to the country's treasury is required to be paid by representatives who own transport vehicles that have undergone the registration procedure in accordance with legislative norms, in addition, recognized as objects subject to taxes, presented in a specialized list.

In addition, transport tax must also be paid to those persons who received a car or other means of transportation in accordance with a power of attorney issued to them, the date of issue of which was any day before the 29th day of July.

Note! The Civil Code of the Russian Federation clearly states that a power of attorney for a vehicle is valid for no more than three years, after which it requires renewal. It turns out that when the indicated 36 months after its registration have passed, even if the power of attorney was issued before the date indicated above, the obligation to pay the tax falls on the shoulders of the actual owner of the transport, that is, the owner indicated in the documents.

Article 186 of the Civil Code of the Russian Federation, establishing the validity period of the power of attorney

The collection of data on holders of mobility devices is sent to the Federal Tax System by transport registration authorities.

Video - Transport tax 2021

What to do if the code is incorrect

When paying tax, it is very important to indicate the correct BCC. If the code is specified incorrectly, then two scenarios are possible:

- the funds will still go to the state budget;

- payment will not go to the state budget.

How to calculate transport tax, details in this video:

The first situation is possible when an error was made in the KBK, but the number entered by the payer still corresponds to the code that is relevant for another payment to the state budget.

If the code entered by the payer is not relevant for any payment, then the funds will not go to the state budget at all.

In the first situation, the tax service will most likely oblige you to pay a fine for inattention. However, if the payer does not want to pay the fine, then it is possible to challenge it in court, appealing to the actual receipt of funds into the budget.

Is it possible to find out a fine by car number, how to do this is described here.

However, paying a fine will be much easier than dealing with government officials in court.

If the funds do not reach the state budget at all, then the only way out of the situation will be to pay the tax again. Here it is very important to detect the error in time, since if funds are not received into the budget on time, the payer may also be punished with a fine, which will be impossible to challenge.

Budget classification codes must be indicated in the payment details when paying any contributions to the budget of the Russian Federation.

At the same time, before making a payment, it is very important to check the relevance of the BCC, since they can be changed at any time.

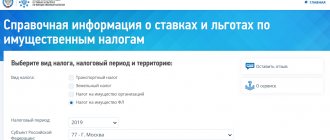

Find and check KBK transport tax

Information about current BCCs for all types of payers is regularly updated. One of the regular sources is the website of the Federal Tax Service. Here you can also clarify other details of the recipient, i.e. who do we pay:

- Full name of the recipient;

- TIN and checkpoint;

- Recipient's bank and current account;

- Address of the Federal Tax Service.

Also, using the service, select the necessary data on OKTMO, the payment period, clarify the encoding of the payment status and the payer himself. The generated payment document is available for saving in a convenient format, printing or instant payment (for individuals).

If the taxpayer has a personal account on the Federal Tax Service server, then all payment requirements have already been generated by tax officials, the amount of tax or arrears is visible, as well as sanctions in the form of penalties in case of failure to meet payment deadlines.

You can also track changes to outdated or inactive BCCs in the tax reference book. The error-free preparation of payment documents allows you to quickly transfer funds to the budget, where employees will identify the payment, credit it to the payer’s personal account, and the arrears will be automatically repaid.