The collection of taxes from vehicle owners is provided for by the legislation of most states. In the Russian Federation, the need for its payment by citizens and legal entities is enshrined in Chapter 28 of the Tax Code. Based on its provisions, transport tax in our country is regional. Accordingly, each subject of the Federation sets the collection procedure, current rates and payment terms independently, in accordance with its legal regulations.

What is transport tax

The procedure according to which the transport tax is collected, as well as the timing of its payment, are regulated in the current year 2021 by a legislative act that came into force back in 2008.

According to this decree, Russian residents who own a vehicle are required to make annual payments to the state treasury so that the state, in turn, has funds to ensure the stable functioning of the country's road transport network.

In particular, funds received into the budget from owners of cars and other means of transportation go to the restoration of road surfaces, the organization of new highways, payments to service personnel and other equally important areas.

The annual transfer of money to the budget is made, contrary to popular belief, not only for the ownership of passenger cars. Vehicles also include:

- buses;

- scooter;

- motorbike;

- self-propelled transport;

- aircraft propelled by turbines and blades;

- water vessels equipped with a sailboat, motor and other elements;

- snowmobiles;

- tracked transport.

- motor sleigh;

- other means of transportation.

In terms of level, transport tax is classified as a regional deduction. Its size, method of payment and time frame for transfer to the state treasury are determined by the authorities of each subject of the country. In addition, they also determine the form of reporting that must be submitted for taxes.

At the federal level the following is carried out:

- determination of objects subject to the required fee;

- the procedure for calculating the financial base to determine the amount of the fee;

- time period for taxation;

- the procedure in which the fee under discussion is calculated;

- maximum and minimum bet values.

As mentioned above, objects subject to taxation include not only the passenger cars we are used to, but also public transport, motor vehicles, aircraft used privately and publicly, watercraft, self-propelled and towed, and the like.

We would like to draw your attention to the fact that vehicle owners who are obligated to make payments are not only people, but also various organizations. In the second case, both individual entrepreneurs and legal entities are required to pay.

As for the values of tax rates, they are set at the federal level, but the final values for each region are determined by representatives of its government structures

To determine the amount of tax, you need to know not only the rate, but also a certain base on the basis of which the final calculation is made. The basis is not the cost of the vehicle at which it was purchased, nor its current price. The measure for the formation of a charge is the power of a particular vehicle, which can be indicated in the following units:

- for cars and buses, as well as some watercraft and other machines of a similar design, the measurement is made in so-called horsepower;

- for jet engines, data is provided in kilograms - their thrust force;

- large shipping engines are taxed by registered tons;

- Other units of measurement are also used.

Among other things, the following elements influence the formation of payments.

- The type to which the vehicle belongs is one of the main characteristics for calculating tax. In addition, subtypes also matter. Thus, cars can be cars or trucks, water vessels can be represented by huge barges or elegant motor boats.

- The year of manufacture of the vehicle also plays a role. As items become obsolete, the tax rate applied to them also changes.

- The time period in which the vehicle is owned in the current tax period also plays a role.

- As mentioned above, the tax rate is determined individually for each region.

It was previously assumed that the sought tax levy would be cancelled. This event was supposed to happen within three years from the onset of 2009, however, this government decision was never made and, as a result, did not come into force.

According to the letter of the law of the Russian Federation, the rates used to determine the amount of tax will increase or decrease by 10 times. Among other things, rates can be differentiated for the following reasons:

- according to the vehicle category;

- a certain period of its useful use;

- provided that the owner of the vehicle belongs to the category of so-called beneficiaries.

The only category of vehicles that is not subject to the possibility of increasing or decreasing the rate tenfold are passenger cars whose engine power does not exceed 150 horsepower.

Who pays and for what

Transport tax, according to the Tax Code, refers to regional taxes. The authorities of the relevant subjects independently set tariffs.

Payers are ordinary citizens, individual entrepreneurs and legal entities to which vehicles are registered, i.e. their owners. Even if you don’t actually drive a car, but gave it to your son, matchmaker, or brother, you still remain a car tax payer. For an ordinary person, the tax office will calculate the annual amount; organizations must do this themselves using certain formulas and transfer the money to the regional budget.

Until the end of 2021, various sports organizations are exempt from car tax. For example, UEFA, FIFA, RFU. This relaxation was made in connection with the organization of the World and European Football Championships and the Confederations Cup.

After reading, you will understand how to stop working for pennies at a job you don’t like and start LIVING truly freely and with pleasure!

For individuals, payment benefits are possible only at the regional level. Regional authorities either completely exempt citizens of certain categories from payments, or partially. As a rule, these are veterans, heroes of the USSR and Russia, parents of many children, pensioners, and disabled people.

Not only cars are subject to taxation, but also many other types of vehicles. Full list:

- cars and trucks;

- motorcycles and scooters;

- buses;

- self-propelled vehicles on caterpillar and pneumatic drives;

- aircraft (planes and helicopters);

- water transport (yachts, sailing ships and boats, jet skis);

- snowmobiles and motor sleighs;

- tugs.

There are exceptions to this extensive list. The following types of transport are not taxed:

- oar boats and small motorboats (up to 5 horsepower);

- specially equipped cars for disabled people, as well as received from social services. protection, but with an engine power of no more than 100 hp. With.;

- vessels used for catching river and sea fish;

- water and air transport, which belongs to organizations and individual entrepreneurs engaged in passenger and cargo transportation;

- numerous agricultural vehicles (for example, tractors, combines, milk tankers, etc.);

- military equipment;

- air transport of medical services;

- special platforms and drilling rigs;

- cars are stolen.

Calculation formula

Every taxpayer who has set this goal at least once can calculate transport tax. To complete the task, you need to know the formula for calculation and the meaning of its components in order to substitute your own indicators in place of each.

- First of all, you need to find out how much horsepower your car has. This indicator varies for all items, since each machine is equipped with a motor with a certain power. It’s easy to find out how many “horses” your car has. Just look at the passport of the technical device or its registration certificate and find out the indicator you are interested in. The required unit of power measurement is relevant for vehicles such as: cars;

- motorcycles;

- scooters;

- buses;

- motor boats, etc.

In the table below you can familiarize yourself with the tax rates specified in the Tax Code of the Russian Federation.

Tax rates from the Tax Code of the Russian Federation

Please note that the calculation of tax deductions, according to Law No. 248, from 2013 will be carried out at the place of registration of the individual.

If you find that the region has not established specific rates, then the values prescribed in the Tax Code of Russia will be applied.

So, the formula itself looks like this: A*B*C*D, where “A” is the horsepower of the vehicle, “B” is the current tax rate, “C” is the share of funds owned by a particular taxpayer, “D” is the time period of ownership of the car in a specific tax period.

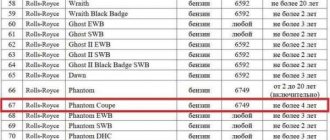

With the onset of 2014, the provisions of the Tax Code of the Russian Federation concerning taxation in the field of transport have undergone some changes. It took place to establish specialized coefficients for increasing rates, relevant for vehicles whose value exceeds 3 million units of Russian currency.

The values of the increasing coefficients are presented in the table.

Table 1. Increasing coefficients for transport tax

| Cost of a car | Size of the multiplying factor |

| From 3 to 5 million rubles up to 3 years from the date of issue | 1,1 |

| From 5 to 10 million rubles up to 5 years from the date of issue | 2 |

| From 10 to 15 million rubles up to 10 years from the date of issue | 3 |

| From 15 million rubles to 20 years from the date of issue | 3 |

The formula for calculating the tax on “luxury” cars takes on an additional element. It looks like this: A*B*C*D*K. The rate that is relevant for a specific region of the country is multiplied by the engine power (number of horsepower). Then the resulting set is again multiplied by the indicators of the period of ownership of the vehicle and the size of the share of a particular taxpayer, and then also multiplied by a multiplying factor.

In our article we will discuss the luxury tax on cars in detail, and in general terms we will describe how it applies to real estate.

The more power the vehicle has, the higher the rate will be used when determining the amount of tax deduction. It follows from this that if you do not own a car, but a motorcycle or scooter, or other motorized transport, you will pay much less to the state treasury than motorists.

In addition, some constituent entities of the Russian Federation have introduced exemptions from transport tax payments for the following categories of vehicles:

- cars;

- motor transport.

Exemption is made only on the condition that the engine power of the required items does not exceed the legal limit

Truck and car: we calculate advances and the total tax amount

An example will help us understand the calculation of intra-annual payments (advances) and determining the amount of tax after the end of the year.

Zelenaya Polyana LLC has two cars on its balance sheet. The company transfers quarterly advances and, taking them into account, determines the final tax amount. The data for calculation (according to the regional regulatory legal acts) and the calculated amounts of advances are presented in the table:

| Vehicle | Tax base, l. With. | Tax rate, rub./l. With. | Amount of advance payment, rub. |

| GAZ-53 | 180 | 50 | ¼ × 180 ×50= 2 250 |

| Volkswagen Passat | 220 | 75 | ¼ × 220 × 75= 4 125 |

| Total | 6 375 | ||

Every quarter, Zelenaya Polyana LLC sent 6,375 rubles to the budget. At the end of the year, you will have to pay the remaining amount of your annual tax liability:

(180 × 50 + 220 × 75) - (6,375 + 6,375 + 6,375) = 6,375 rubles.

Thus, at the end of the year you need to pay an amount equal to the quarterly advance payment. This rule is valid for the case where the taxpayer owned the vehicle for the entire year and the data for calculating the tax (rates, engine power, etc.) remained unchanged.

The deadlines for paying transport tax and advances on it have changed. Find out exactly how in the ready-made solution from ConsultantPlus by receiving trial demo access to the K+ system. It's free.

Calculation examples

To make it easier for you to make calculations related to transport taxes yourself, we will give you a few examples.

Imagine that you own a car with an engine power of 140 horsepower. Let us assume that the rate relevant for the subject of the country in which the vehicle was registered is 3.5. You are the sole owner of the car. The period of ownership of the object is a calendar year.

The formula will look like this: 140 * 3.5 = 490. The final value will be the very amount of tax collection that the state expects you to receive.

If, at the time of determining the tax amount, the vehicle had not been in your possession for a full year, but only for seven months, the formula would have been as follows: 140 * 3.5 * (7:12) = 140 * 3.5 * 0.58 = 284 units of Russian currency.

Now let’s imagine that the cost of your car classifies it as a “luxury” vehicle, amounting to three and a half million rubles. Moreover, only four months have passed since its release. Then the calculation would look like this: 140 * 3.5 * 1.5 = 735 Russian rubles.

If your car was owned for only two months, and its price was 6 million Russian rubles, while the engine power was the same 140 “horses,” the calculation would be made as follows: 140 * (2:12) * 3, 5*2 = 166 rubles 6 kopecks.

Now let's consider the situation with a car with more power, and apply the general tax rate to it. Let's imagine that you own a car with an engine power of 270 horsepower, and the ownership period is a full 12 months. Then the value is calculated as follows: 270 * 15 = 4 thousand 50 Russian rubles.

If the car had been owned for 7 months less, the formula would have taken the form: 270 * 15 * 0.42 = 1 thousand 701 Russian rubles.

When a car with the required power is owned for a whole year, and its cost reaches 4 million, while only two and a half year periods have passed since the year of its production, the tax amount is calculated as follows: 270 * 15 * 1.1 = 4 thousand 455 rubles .

If the cost of the same car is raised to 12 million, provided that you have owned it for only six months, you need to calculate the tax according to the presented ratio: 170 * 15 * 0.5 * 3 = 6 thousand 75 rubles.

Above, you were presented with examples of calculating the amount of tax collection on cars. Now let's look at several problems in which the vehicle will be a motorcycle. Let's take the general tax rate.

You are the proud owner of a motorcycle, the ownership period of which is a full year. The power of the unit is 40 horsepower. The calculation formula is very simple: 40 * 5 = 200 units of Russian currency. If the period of ownership of the “iron horse” was only nine months, then the ratio of this period to a full year must be added to the required formula, that is, in fact, it must be multiplied by 0.75 (9:12). The result will be an amount equal to 150 rubles.

Note! The price of a motor vehicle is not a basis for changing the rate by adding an increasing factor to it.

Now let's try to give an example of calculating the transport tax for a bus. Let's imagine that the engine power of such a car is 300 horsepower. Let's take the rates from the general category. Let's assume you own this bus for a full year. Then the calculation will look like this: 300*10= 3 thousand Russian rubles.

If the period of ownership of the bus was only 8 months, then we add to the formula the ratio of this period to a full year, that is, 0.67 (8:12), multiply the indicators among themselves and get a value equal to 2 thousand 10 rubles.

As in the case of motorized transport, the price at which the bus was purchased is not the basis for changing the rate established by the Tax Code or other legislative act

Video - Calculation of transport tax

Results

To calculate the transport tax for a car for the year , you need to find out the tax rate from the regional law and multiply it by the engine power indicated in the vehicle passport. This amount should then be adjusted for special factors and amounts of deductions and benefits to which the taxpayer was entitled in the reporting year.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Regional rates

The authorities of the constituent entities of the Russian Federation independently regulate the basic and increasing coefficients, which are used to calculate the amounts of transport tax for all its payers. According to statistics, changes associated with their magnitude are made annually. In addition, regional authorities can regulate the parameters of benefits provided to certain categories of citizens.

In each part of Russia, rates will vary greatly. Its value is directly dependent on the location of the region relative to the capital and the degree of its industrial development. The funds received by the local budget, collected through the transport tax, are further used to improve the conditions in which drivers “rotate” every day. In other words, this money is used to repair road surfaces, build new roads, and improve conditions for drivers in other ways.

Most often, the greater the number of vehicles in a particular region, the higher the tax rate that is relevant for this region will be.

What transport tax do you need to pay for less than a month?

What do deputies think about increasing the VAT rate? In Nakhodka there is a scammer Leonid Leonidovich Grekov, a swindler, do not contact him and his many... How can you find a scammer by card number? Let me explain - I didn’t pay attention to the fact that the new counterparty was a one-day company, although all the signs were there... 1.5 billion for the scheme, the need for accountants and the suggestion for counterparties: what colleagues discussed The employer increased the salary, but reduced the bonus. There will never be an increase in salary in Russia... New minimum wage: how employers raise wages without raising them But I, as an interested party, am curious how mothers of twins/triplets/…

points will be awarded... How can you accumulate experience and points for retirement without working? I remember going for an interview with some people. They ask: “What will be your actions if...

Nuances related to the payment of transport tax

A citizen who owns a vehicle is obliged to pay transport tax before the end of the time period determined at the state level. Thus, individuals are required to deposit funds before December 1 of the year following the twelve-month period for which the deduction amount was calculated.

Since organizations are also taxpayers, they also have clear deadlines for making payments to the state budget. Thus, the Tax Code states that before the first day of February of the month following the taxation period of the year arrives, funds due to the country cannot be transferred.

The responsibility for determining the amount of tax deduction lies on the shoulders of the Federal Tax Service, to which the owner of the vehicle belongs. Once the amount has been established, the taxpayer will receive a notice from the tax service containing the following information:

- the amount of payment due to be sent to the country’s budget;

- details with which you can make payment;

- time frame within which the transfer of funds must be completed.

Tracking the completion of all transport tax payments is the responsibility of the Federal Tax Service

If the payment was not made on time, tax officials have the right to charge a penalty in excess of its amount.

If the car ceases to be used, however, it is not deregistered, even if it is dismantled for spare parts or processed as scrap, it will be necessary to continue paying tax deductions for it to the state automobile inspectorate.

Unfortunately, as in any other area of life, various confusion may arise when calculating tax and determining its base. The taxpayer must be able to independently calculate the amount of tax and monitor the accuracy of the calculations carried out by the tax inspectorate, and not leave everything to chance.

How to calculate transport tax for less than a month of car ownership

Info

Situation 4 If an organization does not register vehicles immediately after purchase, but say after a couple of months, then the tax and coefficient Kv are calculated from the first day of the month of registration, but taking into account some nuances. How to determine the full months of ownership No. Situation Solution 1 Vehicle was registered before the 15th day of the month inclusive The month of registration is a full month 2 The vehicle was deregistered/registered after the 15th day of the month The month of deregistration is a full month 3 The vehicle was registered after the 15th the th day of the month The month of registration is not taken into account 4 vehicles were deregistered/registered before the 15th day of the month inclusive The month of deregistration is not taken into account EXAMPLE An enterprise purchased a truck in May 2021, but registered it only on August 17th. And already on September 6 of this year, the vehicles were resold and deregistered.

Transport tax for legal entities

As mentioned above, payments for transport tax should be made not only by ordinary people, that is, citizens of our country, but also by organizations whose legal form is a legal entity.

Companies can also be owners of vehicles that are on their balance sheet. In other words, payments must be made by companies that have passed the registration procedure with the state automobile inspection. It does not matter whether they own a car or another vehicle.

Even if a registered car is not used for its intended purpose, and simply sits idle in a garage, not generating income, until it is written off from use, after going through the appropriate official procedure, you will have to pay transport tax to the treasury.

Most often, the fee is charged on cars and trucks. In addition, companies often use buses to transport employees or clients. However, if a company has a specific focus of its main activity, it will have to pay fees on other types of vehicles.

Thus, yacht clubs provide boats, powerboats, and yachts for rent to clients, therefore, for each item they are required to pay transport tax to the state at established rates

We would like to draw your attention to the fact that only companies that own officially registered vehicles must make tax payments. If they do not own the vehicle, but rented it or received it on lease, then the obligation to pay the fee falls on the shoulders of the owner of the vehicle.

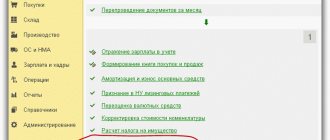

Compared to ordinary citizens who receive notifications from the Federal Tax Service at the end of the tax period, organizations are required to independently make the required calculations and determine the amount of deductions. The information received is entered into the declaration form, which is then submitted for verification to the tax authority that previously registered the legal entity.

Acceptance of documents starts no earlier than the first day of February of the following reporting year. Since the tax is in the nature of a local fee, the authorities of a particular entity have the right to introduce advance payments, which are required to be paid into the state treasury every three months of the organization’s operation.

Since companies are required to calculate the amount of the tax levy themselves rather than wait to receive a notice, the company accountant needs to understand the calculation method and know how to apply the calculation formula.

Please note that, as in the case of citizens’ personal transport, to obtain the required tax amount you need to know the following elements:

- the tax rate;

- the number of horsepower or other units of measurement of engine power;

- the time period during which the company owns the transport;

- Is it necessary to apply increasing coefficients in each specific case?

Let's give an example. owns a car of the famous German brand “BMW”. The desired vehicle was released in 2015. Its engine power is 102 horsepower. The price of the name was one and a half million Russian rubles. This means that no multiplying factor will be applied. The company is located and operates in the glorious city of Yekaterinburg. The current rate for it for 2017 was 9.4. According to the existing conditions, it is necessary to multiply the engine power by the desired rate. As a result, we receive a tax equal to 959 rubles.

Let's look at the second example. I bought a car in the spring, in March of this year, the brand of which is the famous Mercedes. The name was not purchased secondhand, but directly from the showroom. The engine power of the desired vehicle was 140 horsepower. The price of such an “iron horse” turned out to be very high. It is equal to 3 million 200 thousand rubles. As you can see, the cost of the car is the basis for applying the increasing factor. This company is also located in Yekaterinburg, where the transport tax rate is fixed and amounts to 9.4 units of Russian currency. It turns out that, taking into account the fact that the car was not owned for a full year, but was purchased in March, the final amount due for deduction to the budget was 1 thousand 645 rubles.

Existing benefits for this tax

As already written above, a number of individuals and legal entities are completely exempt from paying taxes by the state. However, regional executive authorities can establish their own rules regarding certain categories of citizens required to pay transport tax.

For example, large families are most often exempt from the tax burden. Depending on the situation, they are provided with either a discount or a complete exemption. However, there are regions in Russia where such benefits are not provided. To find out exactly who is entitled to concessions in a region, territory or republic, you need to familiarize yourself with the law on transport tax in force in a particular territory. For example, in the Yamal-Nenets Autonomous Okrug this will be the “Law on Transport Tax Rates on the Territory of the Yamalo-Nenets Autonomous Okrug”, and in Crimea - the Law of the Republic of Crimea “On Transport Tax”.

The tax office takes into account discounts and benefits independently; the notification indicates the total amount. However, in order for the coefficients to be applied, the citizen is required to provide a corresponding application.

If a transport tax payer is entitled to a benefit that he did not know about, he can submit an application for recalculation for the three previous years.

Let's sum it up

Calculation of transport tax is a procedure that taxpayers must be able to perform. It doesn’t matter whether we are talking about a citizen of the Russian Federation or an entire company. In the first case, it is necessary to monitor the procedure for your own good. Any organization, including the Federal Tax Service, can make mistakes, and in the end, you will be forced to overpay significantly.

As for companies, they must independently calculate the amount of the tax due to the state and send it to the treasury. To avoid fines and penalties, you must do it correctly, otherwise you will be considered a willful defaulter.

The calculation is easy; to do this, you just need to use the formula presented in the article you are looking for, substituting your own indicators into it. Be confident in your abilities, practice using third-party examples and everything will work out.

How the list might be expanded next year

The list of “luxury cars” is updated every year on March 1st. The Ministry of Industry and Trade will publish the next list next year, taking into account price changes in the domestic market. According to experts, the list of cars for which the increasing coefficient is established by the Federal Law will be significantly expanded. This is due to the continued depreciation of the ruble against major world currencies throughout the year, and to the rise in prices for road transport. Moreover, this price increase applies not only to foreign products, but also to the domestic automobile industry.

Expert opinion

Maria Mirnaya

Insurance expert

OSAGO calculator

Next year, many passenger cars that do not belong to the premium category may cross the 3 million price threshold. As a result, many mass-produced models may be included in the list of the Ministry of Industry and Trade, especially in their luxury configuration. Nothing is known yet regarding the revision of the price criteria by which cars are classified as premium.

What parameters are taken into account when calculating transport tax?

In order to calculate the fee for a vehicle, you must have the following information:

- the size of the vehicle tax rate in the region of vehicle registration (in some cases, the rate is calculated based on the year of production of the vehicle);

- vehicle engine power indicator;

- year of transport production.

If all the information is available, the owner will be able to use the above formula and calculate the transport tax.

To do this, you just need to multiply the car’s power by the rate established, according to the year of production of the car.

For trucks

When calculating the vehicle tax for a truck, it is worth basing it on Article 358 of the Tax Code of the Russian Federation. In this article you can view a complete list of vehicles that are subject to taxation.

When calculating the fee for a vehicle, the basis is the indicator of the capacity of the freight transport.

The current legislation stipulates the following tax rate indicators based on the engine power of the vehicle:

| with a truck power of up to one hundred horsepower | the rate will be 2.5 rubles per 1 hp. |

| from 100 to 150 horsepower | the tariff is set at 4 rubles per 1 hp. |

| from 150 to 200 horsepower | the tariff is set at 5 rubles per 1 hp. |

| from 200 to 250 horsepower | the rate was set at 6.5 rubles per 1 hp. |

| with a power rating of more than 250 horsepower | the rate will be 8.5 rubles per 1 hp. |

These rates are considered federal and may be subject to change based on the regional location of the vehicle. However, current legislation prohibits raising the established rate above ten times the amount.

The deadline for paying the vehicle tax on a truck is set depending on the region of registration, as well as the rate indicator itself.

Many car owners, wanting to save on paying car tax, register a vehicle in a region in which the regional rate is noticeably lower than others.

In order to calculate the tax duty on a truck, the car owner must have information about the engine power rating and the regional tax rate.

To convert power to horsepower, use the following formula:

one kilowatt = 1,359 horsepower

If you encounter difficulties in calculating transport duty on a cargo vehicle, you can use numerous online calculators located on the Internet.

The online calculator will require the following indicators:

- taxable period;

- truck engine power indicator;

- the territory in which the vehicle was registered.

Saving on transport tax is possible and is not prohibited by law, however, it should be understood that this action is not encouraged by the state. There is no criminal or administrative liability for this action.

For buses

To calculate the transport duty, the rate established at the regional level is used, but not every territory has its own rate. In this case, the federal rate established by the Tax Code is taken into account.

The formula used to calculate the fee for a bus is no different from the formulas for other vehicles:

engine power indicator x regional or federal tax rate indicator x period of actual use / twelve months.

In practice, tax rates vary from eleven to fifty rubles. The tax rate depends on the region (city, country) where the bus was registered.

Thus, the more prestigious and powerful the vehicle, the higher the tax rate will be.

Do not forget that in addition to the huge duty on the vehicle, the owner of such a car will have to pay for quite expensive spare parts and consumables during its operation. An engine with considerable power requires high fuel consumption.

Are there transport tax benefits for combat veterans in Moscow? It is shown in the article: transport tax benefits for combat veterans. For a sample tax notice for transport tax, see the page.

Step-by-step instructions for paying transport tax through Sberbank online are presented in this information.