What is additional capital and why does an organization need it?

Additional capital can be defined as the amount of own funds generated within the company, the emergence of which is not associated with the appearance of any obligations to counterparties.

As a general rule, the more equity a company has, the higher the value of its net assets, and therefore, the more stable its financial position. For information on net assets, see the article “What are net assets and how to calculate them?”

Consequently, the greater the additional capital, the more stable the company is financially. Therefore, additional capital acts as a kind of insurance against certain crisis situations, a “safety cushion”.

IMPORTANT! The company's additional capital cannot be formed at the arbitrary request of the management team. There are strictly defined situations that entail the formation and growth of additional capital. Such situations are established in the Regulations on accounting, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n.

Additional capital in an organization can be formed in 3 ways (clause 68 of Regulation No. 34n):

- as a result of obtaining positive results from the revaluation of non-current assets (revaluation);

- if the cash income from the sale of a share in the company in value exceeds the nominal value of such share (share premium of the joint-stock company);

- in a situation where the company has received other amounts that are similar in their legal meaning.

In addition to these methods, a company can increase additional capital at the expense of part of the profit (remaining after payment of dividends), as well as when target funds are transferred to its address (Chart of Accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n).

The legislator establishes not only possible cases of formation, but also cases when the company has the right to spend its additional capital partially or completely. The latter include:

- repayment of the identified depreciation of previously overvalued non-current assets;

- increasing the authorized capital of the company;

- distribution of additional capital among business owners.

In addition, there are some ways of using additional capital, the legality of which in practice is often controversial.

ConsultantPlus experts spoke in more detail about ways to form additional capital. To do everything correctly and avoid disputes with tax authorities, get trial access to the system and go to the Information Bank Guide. It's free.

Thus, additional capital in the company plays the role of an important financial insurance, despite the fact that its use is limited. Therefore, the accounting service of each organization should know how to keep records of additional capital, as well as what transactions should be made for transactions to change it.

In what account is additional capital accounted for and how is it reflected in the statements?

Since additional capital is the company’s own funds, and according to general accounting rules they belong to the organization’s liabilities, therefore, accounting for additional capital should be carried out in the context of a passive account.

This account is account 83. Credit transactions on account 83 mean that additional capital is growing. If the entry is made as a debit, then, on the contrary, this means that the operation reduces additional capital.

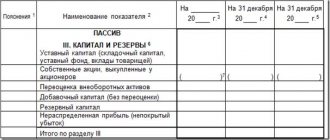

When preparing the company's financial statements for any specific date, the value of additional capital is also subject to reflection in the company's own funds. For this purpose, there is line 1350 in the balance sheet “Additional capital without revaluation.” It should indicate the amount of additional capital, excluding from it the amount of the identified positive revaluation (revaluation) of fixed assets.

How to do this in practice? It is necessary to subtract from the total balance on the credit of account 83 the amount attributable to the previously identified total revaluation of the company’s non-current assets.

ATTENTION! In accordance with clause 68 of Regulation No. 34n, each amount forming additional capital must be reflected in accounting separately. Consequently, when accounting for additional capital, companies conduct analytics of individual amounts that form additional capital in separate subaccounts in the context of account 83. Therefore, the company is able to identify the total amount of revaluation of fixed assets by looking at the credit balance in the corresponding subaccount of account 83.

The amount of revaluation of fixed assets, in turn, is recorded in another line of the balance sheet, namely in line 1340.

Find out how to reflect additional capital on the balance sheet in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

For information about what aspects are important for an accountant to know when keeping records of other parts of a company’s equity capital, see the article “Procedure for accounting for an organization’s equity capital (nuances).”

In practice, as stated above, there are several possible situations in which a company's additional capital can be formed or used. Moreover, some situations are “mirror”, i.e. under some circumstances they increase additional capital, and under others they decrease it.

Let's consider such situations.

Normative base

The use of the account is carried out in accordance with the regulatory framework of the Russian Federation, which contains a large number of documents:

- government and departmental regulations;

- orders;

- agreements drawn up between the enterprise and partners;

- local acts and regulations;

- instructions and legal provisions related to the functioning of additional capital.

Failure to comply with these legal norms by the accountant and other employees entails administrative and criminal liability. As practice shows, the legislation in this regard is strict.

Permanent differences when revaluing fixed assets

Another important nuance is associated with the revaluation of non-current assets, which forms the company’s additional capital: the amount of the revaluation is not recognized as taxable income of the company (clause 1 of Article 257 of the Tax Code of the Russian Federation).

Consequently, an increase in the initial cost of overvalued fixed assets will not affect the amount of accrued depreciation on such objects in tax accounting. This means that depreciation on overvalued fixed assets according to accounting rules will be accrued in a larger amount than according to tax accounting rules.

Therefore, permanent differences will be formed in accounting, which, in turn, form a permanent tax liability for the company (clauses 4, 7 of PBU 18/02 “Accounting for income tax calculations”, approved by order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 114n) . Accordingly, in accounting it is also necessary to reflect the accrual of a permanent tax liability (PNO) for the amount of the difference between depreciation accepted in accounting and tax accounting entries:

Dt 99 (sub-account “PNO”) Kt 68.

For more information about deferred tax liabilities, taxable and deductible temporary differences, see the article “What is deferred income tax and how to account for it?”

Otherwise, if the fixed asset has been discounted, depreciation in accounting will be lower than tax, which will also lead to the formation of a permanent difference. In this regard, the company forms a permanent tax asset, which must be reflected by posting:

Dt 68 Kt 99 (sub-account “PNA”).

HIGHLIGHTS OF THE WEEK

01/20/202111:18 Personnel

New labor protection rules – new responsibilities of the employer

21.01.202109:00

Litigation

How did a “penny” test purchase ruin an individual entrepreneur, a pensioner?

25.01.202114:58

Business organization

Debtors will retain a minimum income

21.01.202112:30

Special modes

A new declaration form for the simplified tax system has been approved

25.01.202109:22

Personnel

New requirements for non-cash payments are coming soon

PODCAST 4.12.2020

What has changed in taxes and reporting since 2021?

All episodes

Comments on documents for an accountant

Do I have to pay personal income tax if the employer pays for the issuance of bank cards for employees?

01/26/2021 Payment by the employer of the bank commission for issuing and servicing employee salary cards is not…

Payment of income to a foreign company that does not have the actual right to it: tax consequences

01/26/2021 A foreign organization that directly receives income and is not a private income fund cannot claim...

Is the New Year bonus for employees not subject to insurance contributions?

01/25/2021 The court supported the Pension Fund of Russia, which fined an organization that paid bonuses to all employees and did not accrue...

‹Previous›Next All comments

Other cases of formation of additional capital of the company

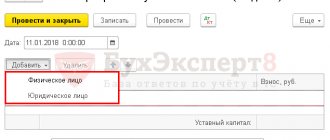

The next way to form (increase) additional capital is to sell shares (for JSC) or a share of ownership (for LLC) in the company at a price higher than the nominal price.

In this case, only the nominal value of the share in the company will be used to increase the authorized capital. The excess of the sales price over the nominal price will be written off as additional capital. Therefore, if an organization received such additional income from the sale of a share, it will have to reflect in its accounting both an increase in the authorized capital and an increase in the additional:

Dt 75 Kt 80 (in the amount of the nominal value of the share);

Dt 75 Kt 83 (in terms of excess).

In this case, the actual receipt of funds to pay for the purchased share from the new owner will be recorded by the following posting:

Dt 51 Kt 75.

The chart of accounts provides that account 83 can correspond with account 84. Therefore, the decision by the company’s management to increase additional capital at the expense of existing retained earnings will be documented by posting:

Dt 84 Kt 83.

In addition, current legislation allows an organization to increase additional capital at the expense of funds that the owners contributed to the business in order to increase net assets (this follows from subclause 3.4, clause 1, article 251 of the Tax Code of the Russian Federation). In this case, after the receipt of funds from the founders (which is documented by posting Dt 51 Kt 75), the increase in additional capital must be reflected by posting:

Dt 75 Kt 83.

Share premium

See what “Share premium” is in other dictionaries:

- Share premium is the income of a joint stock company generated by the difference in the price of all shares if the market price of shares is higher than the issue price. The share premium goes to the reserve fund or increases the total balance sheet profit. In English: Issue profit See ... Financial Dictionary

- Share premium - (paid in capital) a premium to the par value of shares, an excess of the par value of issued shares, received in cash or other form ... Economic and mathematical dictionary

- share premium - A premium to the par value of shares in excess of the par value of issued shares, received in cash or other form. Topics: economics EN paid in capital... Technical Translator's Guide

- Share premium is the income of a joint-stock company generated by the difference between the nominal and selling (market) prices of shares... Commercial electric power industry. Dictionary-reference book

- ISSUE INCOME - the difference between the sale price and the par value of a security (share) ... Encyclopedic Dictionary of Economics and Law

- Share premium - Amounts received in excess of the nominal value of issued shares by a joint-stock company (minus the costs of their sale). clause 44 of the Methodological Recommendations on the procedure for forming indicators of the organization’s financial statements, approved. By order... ... Dictionary: accounting, taxes, business law

- Share premium of a credit organization (JSC) - The share premium of a credit organization in the organizational and legal form of a joint stock company is understood as: the positive difference between the value (price) of shares when they are sold to the first owners and the par value of the shares and (or) the difference... ... Official terminology

- Share premium of a credit organization (LLC) - The share premium of a credit organization in the organizational and legal form of a limited (or additional) liability company for the purposes of these Regulations is understood as: the positive difference between the cost of shares of a credit... ... Official terminology

- Premium to the nominal value of shares (share premium) - excess of the nominal value of issued shares in cash or other form ... Economic and mathematical dictionary

- issue income - The amount of the difference between the par value and the sale price of a security. Accounting is carried out on the credit of the Reserve Capital account, the sub-account Share premium, and the debit of the accounts for accounting for funds or other valuables transferred to the company in payment... ... Technical Translator's Directory

Reflection of other cases of use of additional capital on account 83

The situations related to changes in the company’s additional capital, including as a result of the revaluation of fixed assets, were listed above.

In relation to non-current assets, one more point is also important. By virtue of clause 15 of PBU 6/01, if an asset is disposed of, then the amount of the remaining revaluation for it should be attributed to retained earnings. Therefore, if for some reason (sale, liquidation, transfer as a contribution to the authorized capital, etc.) the fixed assets in the company are disposed of, the accounting must reflect the operation to reduce additional capital by the amount of the additional valuation for such fixed assets:

Dt 83 Kt 84.

Please pay attention! Additional capital can be written off as profit only if the asset has been disposed of. Therefore, if a non-current asset is fully depreciated, but not disposed of, additional capital should not be written off. After all, a company can always modernize or reconstruct such an OS object, which will increase its value, which means that such a new value will have to be re-evaluated again.

Additional capital can be used to increase the authorized capital. This follows from the Law “On JSC” dated December 26, 1995 No. 208-FZ and the Law “On LLC” dated February 8, 1998 No. 14-FZ, which allow increasing the authorized capital of a company at the expense of its own funds. In accounting, the corresponding transaction is reflected by the accounting entry:

Dt 83 Kt 80.

In addition to the above methods of spending additional capital, it can be partially or fully distributed among shareholders (owners). Such an accounting transaction is reflected by the following accounting entry:

Dt 83 Kt 75.

Please pay attention! The above entry reflects the formation of the organization's debt to the owners in accounting.

The actual payment of funds to the founders from additional capital will subsequently be recorded in successive entries:

Dt 75 Kt 51 (in terms of basic amounts paid to owners),

Dt 75 Kt 68 (personal income tax withholding).

In practice, a controversial question arises: is it possible to use additional capital to cover losses of previous years? Currently the law does not prohibit this. The regulatory authorities believe that losses cannot be compensated only by the amounts of additional valuation of fixed assets, but at the same time they note that the Tax Code does not provide for sanctions for this (letter of the Ministry of Finance of the Russian Federation dated July 21, 2000 No. 04-02-05/2). Therefore, we can assume that companies are not yet deprived of the right to use their additional capital to cover losses. To do this, you need to reflect the following entry in accounting:

Dt 83 Kt 84.

Operations related to changes in exchange rate differences on founders' contributions

The founder of PJSC Glarex contributed 1,000 euros to the authorized capital in April. This means that in the next month, May, the founder will become indebted for the contribution to the management company in the amount of the ruble amount of the contribution at the Central Bank exchange rate, which was 65 rubles per euro.

In fact, the contribution was transferred in September, when the exchange rate was already 70 rubles per euro.

In the organization's accounting, these transactions are reflected by the following entries:

| Month | Dt | CT | Operation description | Sum |

| May | 75.1 | 80 | Reflection of debt on contribution to the authorized capital (65 * 1000) | 65000 |

| September | 52 | 75.1 | Reflection of the transfer of the currency amount of the contribution (70*1000) | 70000 |

| 75.1 | 83 | Reflection of positive exchange rate difference ((70-65)*1000) | 5000 |

Results

Thus, correct accounting of additional capital allows the company to smooth out such potentially negative situations as identifying a markdown of non-current assets, lack of funds to pay dividends to participants, etc. In addition, there are other areas for the possible use of the company’s additional capital.

According to accounting rules, the formation and increase in additional capital is reflected in the credit of account 83, and its decrease is reflected in the debit.

It is important for the company’s accounting service to remember that correct accounting is only possible if detailed analytics are maintained for each component of additional capital (which includes amounts that are identical in their economic nature) in the corresponding subaccount of account 83. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

When to use this account

Account 83 is intended to summarize materials about the presence and movement of additional capital of an enterprise. Changes in the value of assets must be reflected in the debit of the line in which the increase is determined, as well as in the credit of element 83. In addition, the loan reflects the following areas:

- increase in size;

- the amount of the difference between the selling and nominal value;

- other quantities.

Monies that were credited to this account are traditionally not subject to write-off. Debit entries can only take place in exceptional situations:

- repayment of the value of assets that are not in circulation, revealed as a result of revaluation;

- if funds were allocated to increase the authorized reserve (capital);

- if the amounts are distributed among the founders of the company.

The organization of analytical accounting must be debugged in such a way that the formation of an information base is ensured within the framework of the sources of formation and directions of expenditure of funds.