In everyday life, a modern person is increasingly faced with the need to present a package of documents, which includes, among other things, a certificate of income. This primarily applies to those who are planning to take out a loan. The bank is interested in maximally insuring its risks, therefore it takes into account the documented solvency of the potential client. As a rule, the requirements state that the certificate must have a certain form - 2-NDFL. However, since relatively recently, instead of a certificate in the established format, a certificate in the bank’s form is valid, which is aimed at simplifying the lending procedure for a number of citizens. Let's consider what the features of obtaining and filling out such a certificate are, as well as cases in which it is convenient to resort to it.

What is an income certificate

An income certificate is a special document from which the bank can see the salary of a potential loan recipient in order to assess his solvency.

Credit institutions ask to provide it when applying for any type of loan (mortgage, consumer, car loan), credit cards, debit cards with overdraft. Some lenders do not require proof of solvency if the loan amount is small. In other cases, failure to provide a document is fraught with refusal to issue a loan, an increase in the interest rate, and collateral requirements.

08.05.2020

149

How to apply for a loan to all banks: review of the 25 best offers

A convenient list of links to online loan applications from all the best banks.

The main document for confirming income is Form 2-NDFL, developed by the tax service. Its purpose is to show the monthly calculation of income tax on all types of employee earnings, the amounts of personal income tax transferred to the budget and the deductions made. Among this information, the lender only needs salary information.

Not all employers can provide their employees with a 2-NDFL certificate. In order not to lose customers, credit organizations have developed an alternative option - a bank certificate of income.

After reading, you will understand how to stop working for pennies at a job you don’t like and start LIVING truly freely and with pleasure!

The document form can be downloaded from the website or taken from the nearest bank branch. It looks simpler than 2-NDFL, because the credit institution is not interested in tax information. Each lender has its own form to fill out. It is not legally enshrined anywhere.

The income document is valid from 14 to 30 days, so fill it out last, when the main package of documents (especially for the mortgage) is already ready. If you submit an application to different organizations, you will have to prepare several options for each lender separately.

What does this certificate mean for the employee and the employer?

Banks do not yet transmit information from the received certificates to the tax and police, as they are interested in issuing a loan on which they earn interest. Otherwise, it could collapse the entire credit market. However, everyone understands that legislation can change at any time. In conditions of budget deficit, an increase in tax revenues will come in handy. Therefore, it cannot be ruled out that changes will be made to the legislation obliging banks to provide information about their borrowers to the tax inspectorate.

In the meantime, employees can feel relatively calm, which cannot be said about employers. By confirming the employee’s “gray” salary with such a certificate, they give him evidence with which he can go not to the bank, but, for example, to the tax office, the prosecutor’s office or the State Labor Inspectorate. After all, workers often have no real way to get a “white” salary from their employer. With such a certificate there will be more chances. That is why employers sign such documents with great reluctance.

It is important to know that responsibility for non-payment of taxes extends not only to the employer, but also to the employee. In accordance with Article 198 of the Criminal Code of the Russian Federation, tax evasion is punishable by a fine in the amount of 100 thousand to 300 thousand rubles or in the amount of wages or other income of the convicted person for a period of one to two years, or by forced labor for a period of up to one year. , or arrest for a term of up to six months, or imprisonment for a term of up to one year.

For tax evaders on a large and especially large scale (600 thousand and 1 million rubles over three years, respectively), the punishment is even more severe.

If such a crime is committed for the first time, and tax debts along with fines and penalties are returned to the budget, then the violators will be released from criminal liability.

The employer is also subject to Article 199 of the Criminal Code of the Russian Federation “Evasion of taxes and (or) fees from an organization.”

Reasons for issuing a certificate instead of 2-NDFL

The main reasons for issuing a bank form instead of a tax form:

- The so-called “gray” salary, when the company officially shows only part of the employee’s earnings to the tax service, and gives the rest in an envelope. In this case, there is a high probability that the manager will be afraid to show real numbers and refuse to sign the paper.

- The company's head office is located in another city. Most often, the accounting department is also there. It is easier for an employee to fill out a banking form and have it signed by the branch manager than to send a request to another city and wait for the finished document by mail.

- Work under an employment contract. In fact, another type of salary in an envelope. The manager did not register the employee as a staff member, but entered into an agreement with him. No documents are prepared for the tax service, but for the creditor the employee has cash receipts, and the employer is ready to confirm them.

- A special category of borrowers. For example, individual entrepreneurs or business owners. They do not provide the tax service with 2-personal income tax, but can confirm their solvency in another way: for example, with a tax return, movement of money through a current account or a bank certificate.

How to confirm unofficial income for the bank?

Confirmation of official income is described above. But not all people work permanent jobs. Someone minds their own business and has other sources of income that are not confirmed by the tax service. What to do with this if you need to take out a loan from a bank? Let's look at this issue below.

Some people rent out their property and this is their main source of income. Such earnings can be confirmed. To do this, you need to provide the bank with a document confirming payment of taxes on the money received. Not everyone will want to show their unofficial income and pay part of their own money in taxes to the state. This applies not only to the “rental” way of earning money; there are quite a large number of other sources of income. The category of citizens with this type of income may include: programmers, web developers, designers, copywriters, video bloggers, musicians, writers, artists, private apartment repairmen and many others.

There is another way to prove your solvency to banks, but it is dubious. To do this, you can get a plastic card at the bank that you have chosen to apply for a loan and regularly transfer funds to it. Subsequently, you can demonstrate to the bank your “regular income”. At the same time, you can provide an example of your work from which you earn income.

Structure and filling requirements

Despite the fact that the certificate is free-form, the basic structure is the same for all:

- Full name of the employee, length of service in the organization.

- Details of the organization (name, TIN, telephone numbers of the director and chief accountant, actual and legal addresses).

- Employee's salary by month.

- Signature of the manager, chief accountant.

- Seal of the organization.

Approximate type of document:

Filling rules:

- The requirements for the filling method in banks are different. Some allow you to enter information by hand with a ballpoint pen. Others accept only the typewritten version. Information about this can be seen on the form itself.

- Corrections are not allowed. If any information is missing, “Missing” is written in the field or a dash is entered.

- Only reliable information is entered. Any borrower is carefully checked by the credit department and security service. An employee of a financial institution can call the phone numbers of the manager and chief accountant indicated on the form and ask questions about the borrower.

- The signatures of the head of the enterprise or etc. are required. O. manager, chief accountant or etc. O. chief accountant. If the company operates without a chief accountant, then this must be noted when filling out.

- Company seal at the end of the form. If the document is drawn up by an individual entrepreneur, then a seal is required only if it is available.

Where can I get a bank certificate?

Almost all banks offer to fill out a form on their official website, but filling it out by hand after downloading is not prohibited. Different financial institutions require you to provide information about income over different periods of time. Usually this is the last 3, 6, 12 months. The bank form certificate can be on company letterhead or on a regular A4 sheet.

You can also ask for the form at the branch if you are filling out a loan application there. In this case, the specialist will answer all questions. Some institutions ask you to indicate the total amount of income, other payments and deductions. Others will require condensed information only about the amount of money received in hand.

How to fill out a certificate using the bank form?

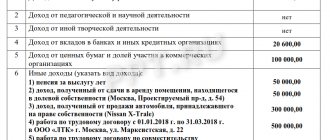

Correctly filling out a certificate means filling out all the fields that are on it. In the vast majority of cases, these include the following:

- full name of the organization, its details, address and contact telephone numbers;

- personal information about the employee (last name, first name and patronymic; some banks also require passport information);

- position held, length of service in the organization;

- income received over the last six months, broken down by month).

Certificate forms with download links

I have made a single table for you in which you will find links to download a bank form to confirm solvency. It included the 15 largest banks in the country.

| Bank | Download link |

| Renaissance Credit | |

| Sberbank | |

| VTB | |

| Gazprombank | |

| Alfa Bank | |

| Rosselkhozbank | |

| Credit Bank of Moscow | |

| Bank “FC Otkritie” | |

| UniCredit Bank | |

| DOM.RF | |

| Sovcombank | |

| Rosbank | |

| Uralsib | |

| Bank "Saint-Petersburg | |

| Home Credit Bank |

Please see the completed certificates as an example. Forms of other credit institutions are drawn up similarly:

- Renaissance Credit – see sample.

- Alfa-Bank - see sample.

- Sovcombank - see sample.

Stages of document verification

Did you manage to get a certificate? Great, but that's only half the battle. In order for this document to be approved by a credit institution, it must pass a security check by the bank. The first stage is checking that the form is filled out correctly. The second is checking the accuracy of the information contained in the document. Therefore, in 99% of cases, a call will definitely come to the accounting department to make sure whether you really work at this enterprise, what position you hold and what is the amount of your permanent income. The third stage is checking the credit status - a request to the BKI about the absence of arrears and debts in other financial institutions. In rare cases, they may be asked to provide information about the availability of owned real estate (house, apartment, land) or car.

Fill out form

The way the certificate form is filled out makes it possible to draw certain conclusions. For example, the grounds for refusal may be;

- signing of a document by a person not authorized for these purposes. If another person signs, the basis must be indicated: an order for the organization or the number of the issued power of attorney;

- the location of the seal is in the wrong place - it should be on the letters M.P., below and to the left;

- blurred (fuzzy) seal impression;

- imposition of signature and seal. The signature of the tax agent must be in the appropriate column labeled “signature”;

- lack of decryption of the signature.

The above errors are not critical; just as in the case of technical errors, they lead either to the replacement of the document or to a denial of the loan.

Is it possible to get a loan without providing a 2-NDFL certificate?

Sberbank is a well-known and reliable organization that the vast majority of citizens seek to turn to.

But it will not be so easy, because an impressive amount of documentation will be required. To confirm the borrower's solvency, it is necessary to have an extract from the place of employment. Sometimes there are situations when employers either prescribe a minimum income or do not register their employees at all. In such a situation, it is impossible to obtain an extract; what should you do in such a situation?

In fact, you may be approved for a loan in this case, but only if certain conditions are met.

When a bank issues a loan, employees carefully review the credit history and assess how solvent the individual is. For this purpose, the following facts must be provided:

- Salary card.

- Debit card.

- Checking the availability of a loan and its solvency.

If all this is available, then Sberbank lends money even without a 2-NDFL certificate. In this case, they provide an identification document, a loan application and any document that can confirm income. But in this case, you can borrow funds at interest in an amount of no more than 1.5 million rubles.

If a citizen does not have official employment, the loan will not be issued.

Do banks check 2-NDFL?

Bank specialists will definitely check the contents of the certificate. They analyze the data entered on the form.

- They can call the accounting department with a question about a person’s affiliation with this organization and find out his income;

- They check with other banking institutions about the presence of debt on loans;

- They study your full credit history over several years.

An initial and deeper check is carried out, then special banking security services are involved. The latter is necessary for a loan, the amount of which is very large. This could be a car loan or a mortgage.

For what period is an extract required?

See also: “How to receive money by inheritance in Sberbank: testamentary disposition of a deposit”

For those who apply to a bank for a loan for the first time, it will be especially useful to find out for what period they will need to obtain a 2-NDFL certificate in order to submit it to Sberbank. There are no clear deadlines on this issue. And the period itself is indicated by the organization from which you take out the loan.

According to Sberbank, data on income and taxes are provided to this organization for at least the last six months. If an individual constantly changes his place of work, he will need to provide another document, but from his previous place of work.

Checking the certificate

Sberbank sets clear conditions for issuing funds on credit and cooperates only with those who officially work and can document their solvency. Sberbank employees focus on the following points when checking:

- Comparison of the enterprise’s TIN with the numbers indicated on the form.

- No marks or erasing with an eraser.

- Correctness of calculations.

- No errors in every section.

If the amount is insignificant, then such a check will be enough, but if the amount is large, then Sberbank employees can call relatives. This is done in order to obtain more information about plans, prospects and family status. If an individual has had bad experience with loans, it will be much more difficult for him to get a new one.

See also: “How to find out the personal account number of a Sberbank card”