Instruction 1: they forgot to include the employee in SZV-M

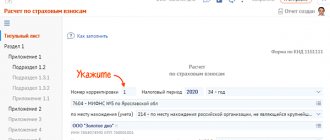

If you forgot to include a person in the SZV-M, you should fill out an adjustment report form. To do this, take the usual form SZV-M, approved. Resolution of the Board of the Pension Fund of 01.02.2016 No. 83p, and fill it out as follows:

- In sections 1 “Insured Details” and 2 “Reporting Period”, indicate the same data as in the original SZV-M, which needs to be supplemented if there were no errors in these sections of the original SZV-M.

- In section 3 “Form type (code)”, enter the code “additional” - this means that the form is submitted to supplement the information about insured persons previously accepted by the Pension Fund for the reporting period.

- In section 4 “Information about insured persons”, include information about the “forgotten” employee. There is no need to repeat information about other employees already reflected in the original SZV-M.

Give the completed adjustment SZV-M form to your manager for signature and then send it to the Pension Fund.

In what form should the supplementary SZV-M be presented?

As a general rule, companies with 25 or more employees can submit SZV-M exclusively in electronic form (Clause 2 of Article 8 of Law No. 27-FZ). If the number is smaller, the choice is up to the employer: you can report on paper or via the Internet.

If the initial report is sent based on the number of individuals in electronic form, the supplementary SZV-M should also be sent in the same form. It does not matter that it will provide information on only one or several employees.

Let us remind you that for submitting SZV-M in paper form instead of electronically, the fine is 1,000 rubles. (clause 2 of article 8, clause 4 of article 17 of Law No. 27-FZ, clause 41 of Instruction dated 04/22/2020 No. 211n).

Example and sample

We will show you how to use the instructions described in the previous section with an example.

The original SZV-M, prepared by the accountant of SpetsStroyka LLC for January 2021, contained information about 48 employees of the company. The report was submitted on 02/10/2020. After the SZV-M was accepted by the Pension Fund of Russia, the accountant discovered an inaccuracy in it - the report did not reflect the employee with whom the GPC agreement was in effect in January 2021.

What to do? There is an urgent need to adjust SZV-M for one employee.

In order to supplement the information of the original SZV-M for January with the missing information, the accountant prepared and sent to the Pension Fund the SZV-M report with the form type “additional”.

Section 4 of the adjustment report includes only the “forgotten” employee. Information about other employees does not need to be adjusted.

Look at the example of what the SZV-M adjustment looks like if you forgot one employee:

This is what the SZV-M adjustment looks like if you need to add an employee. How can I correct the error if the original SZV-M reflected extra data? We’ll talk about this further, but first let’s focus on another equally important question: will there be a fine for a forgotten employee?

When to submit a supplementary report

The deadline for submitting the supplementary SZV-M depends on who discovered the error - the employer or the Pension Fund:

The PFR notification must contain information about errors and (or) inconsistencies between the submitted individual information and the data available to the PFR (clause 38 of the Instructions, approved by Order of the Ministry of Labor No. 211n, Part 5 of Article 17 of Law No. 27-FZ).

Pension Fund specialists have the right to deliver the notice to the employer personally against signature, send it by registered mail, or send it electronically via TKS.

In order not to be late in submitting the supplementary form (if errors were identified by the Pension Fund) and not to earn a fine, it is important to count the deadline correctly (clause 38 of Instruction No. 211n):

- the notice was sent by registered mail - the date of delivery is considered to be the sixth day counting from the date of sending the registered letter;

- the notification was sent electronically via TKS - the date of receipt is the date indicated in the confirmation of receipt of the employer’s information system.

Instead of notifying that errors have been corrected, the Pension Fund of Russia may send the employer an SZV-M inspection protocol indicating the identified errors and (or) inconsistencies. Both of these documents are legally equivalent (Resolution of the Arbitration Court of the North-Western District of April 23, 2020 No. F07-4647/2020 in case No. A42-9736/2019).

Will there be a fine?

The first question that worries an employer when identifying errors in the original SZV-M: is it possible to add an employee by adjusting the SVZ-M without a penalty?

If you manage to submit to the Pension Fund the corrective SZV-M for the forgotten employee quickly, there will be no fine before the end of the deadline established by law for submitting the original SZV-M. Let us remind you that the SZV-M for the reporting month must be submitted to the Pension Fund no later than the 15th day of the month following the reporting month (clause 2.2 of Article 11 of Law No. 27-FZ dated 01.04.1996).

If the legal reporting deadlines have passed, you will have to fight off the fine in court. In any case, the Pension Fund of Russia will issue it to the company (500 rubles for each forgotten employee) and to its manager (300-500 rubles according to Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation).

The fund's specialists will only record the violation in the protocol, and the court will consider it (clause 4, part 5, article 28.3, part 1, article 23.1 of the Code of Administrative Offenses of the Russian Federation). Moreover, it does not matter to the Pension Fund that the company independently identified and corrected the error (letter from the Pension Fund of March 28, 2018 No. 19-19/5602). The Fund believes that only information that has already been reflected in the original SZV-M can be adjusted without penalty. And a forgotten employee is a set of new data that was missing in the original report.

Deadlines for filing adjustments

The usual deadline for submitting the original SZV-M form is before the 10th day of the month following the reporting month.

In some cases - until the 12th, if there are public holidays at the beginning of the month (May, November, and so on). The schedule changes annually according to the calendar. There are no deadlines for submitting corrective forms. Theoretically, they can be submitted at any time, but in practice, the enterprise is punishable by penalties for late submission or provision of incorrect information about any employee.

That is, to put it simply, you can submit a report for the current month, for example, June, at the end of June, but if any personnel changes occur, you will have very little time left to correct the data. If information is delayed, a fine will be charged. In addition, according to Article 17 No. 27-FZ of April 1, 1996, the very provision of incomplete/inaccurate data is punishable by a fine.

Legally, the very fact of submitting a corrective (cancelling or supplementing) form can lead to a fine, because in fact, the organization admits to submitting false data.

Whether to apply sanctions policy in this case or not, each regional branch of the Pension Fund decides independently. No regulations indicate the situation when an enterprise independently discovers an error in a report and takes measures to correct it; accordingly, this remains for the consideration of officials of the local Pension Fund.

In some departments it is permissible to submit corrective reports before the deadline for submitting the main one, i.e. until the 10th of the next month. In all other cases, a fine automatically follows.

Chances of court cancellation of fines

In court, the chances of canceling the fine issued to the company are quite high. According to the judges, when the company itself found and corrected the error, financial sanctions cannot be imposed on it (decision of the Supreme Court of the Russian Federation dated 02/08/2019 No. 301-KG18-24864).

A fine is also unlikely if the error was found by the Pension Fund of Russia specialists, and the company managed to submit the supplementary SZV-M form within 5 days after receiving the notification from the fund (Determination of the RF Armed Forces dated July 5, 2019 No. 308-ES19-975).

It is difficult to say how the courts will resolve such issues in the future - the Ministry of Labor has prepared a draft according to which the Pension Fund of Russia will legally fine employees if the supplementary SVZ-M was submitted after the deadline reporting date.

It will not be possible to cancel a fine issued to a manager even in court (Resolution of the Supreme Court of the Russian Federation dated July 19, 2019 No. 16-AD19-5).

Find out even more about fines, including for SZV-M, from the materials:

- “What is the penalty for failure to submit the SZV-M report?”;

- “What is the fine for an LLC for operating without a cash register”;

- “Amounts of fines for failure to submit tax reports.”

Complementary SZV-M and coronavirus subsidy

During the coronavirus pandemic, SZV-M acquired a special status. Using data from this report, tax authorities determine whether the employer has the right to receive a subsidy from the federal budget.

What employers need to know about the supplementary SZV-M in order to receive a subsidy, tax officials told in the Federal Tax Service Letter No. BS-4-11 dated October 1, 2020 / [email protected]

A company loses the right to a subsidy if the number of its employees in the month for which the subsidy is paid is at least 90% of the number of employees in March 2021 or reduced by no more than 1 person in March 2021 (Rules for provision in 2020 from the federal budget subsidies, approved by Government Decree No. 576 dated April 24, 2020).

Tax officials recalled that small and medium-sized businesses that reduced staff by more than 10% (based on an analysis of SZV-M reporting) or by more than 1 person in relation to the number of employees in March 2021 cannot qualify for a subsidy. Moreover, the submission of the supplementary SZV-M for March 2021 after the deadline for sending applications to the tax authorities for the subsidy provided for by Resolution No. 576, for the purpose of formally implementing the provisions of the Rules, is not a basis for receiving a subsidy.

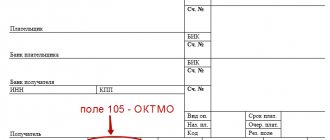

Instruction 2: remove the extra employee from SZV-M

If an extra employee is included in the SZV-M, an adjustment to the original SZV-M will also be required.

A similar situation is solved using the following algorithm:

- Complete and send the SZV-M report to the Pension Fund, indicating the code “o. A report with such a code will mean that the original SZV-M contains unnecessary or erroneous information.

- Take the data for sections 1 and 2 of the corrective form from the original SZV-M.

- In section 4, duplicate only those information that turned out to be redundant/erroneous.

As a result of submitting the cancellation form SZV-M, the previously submitted data will be reset to zero (for those employees you indicate in section 4 of the adjustment SZV-M).

Let's show with an example how to fix SZV-M if an extra employee got into it.

The original SZV-M for March 2021, sent to the Pension Fund on April 15, 2020, mistakenly reflected information on two employees whose employment contracts were not valid in March 2021.

The extra employees in the SZV-M (March report) were discovered only in May - when registering the next SZV-M.

The accountant of SpetsStroyka LLC immediately completed the cancellation form SZV-M and sent it to the Pension Fund.

How to remove employees using the SZV-M adjustment, see the example:

You will find instructions for all occasions on our website:

- “Military registration in an organization - step-by-step instructions 2020”;

- “Step-by-step instructions for changing the general director in an LLC”;

- “Instructions for filling out Form 12-F (nuances)”.

Is a SZV-TD report necessary if there are no personnel changes?

The procedure for filling out the form stipulates that the obligation to submit a SZV-TD arises only if there are personnel events in the reporting period. When submitting a report on an employee for the first time in 2021, it reflects not only information about the event that took place in the reporting month, but also about the last personnel event as of 01/01/2020, if the employee worked for this employer (clause 1.7 of the Procedure ).

In any case, a form with zero PFR indicators is not needed, since there is no actual data to be entered into the information base in such a document. Accordingly, in 2021, policyholders do not submit SZV-TD if there are no personnel events for the employee during the entire year, and they have not submitted an application for a form of maintaining a work record book.

Results

The SZV-M form can be initial, supplementary or canceling. By correctly entering the form type code in section 3 and generating the correct (corrected, supplemented, subject to cancellation) personal information of employees in section 4, you can correct the information in the original report. If the Pension Fund decides to fine the employer for filing a corrective report, you can try to challenge it in court.

Sources:

- Federal Law No. 27-FZ dated 04/01/1996 (as amended on 04/01/2019) “On individual (personalized) accounting in the compulsory pension insurance system”

- Resolution of the Board of the Pension Fund of the Russian Federation dated October 15, 2019 No. 519p “On approval of the Procedure for adjusting individual (personalized) accounting information and making clarifications (additions) to an individual personal account”

- Order of the Ministry of Labor of Russia dated December 21, 2016 No. 766n “On approval of the Instructions on the procedure for maintaining individual (personalized) records of information about insured persons”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

When is the report generated?

The procedure for filling out the form is set out in Resolution of the Board of the Pension Fund of the Russian Federation dated December 25, 2019 No. 730p. It has been established that the SZV-TD report is submitted if (clause 1.6 of the Procedure):

- a personnel event occurred that must be reflected in the ETC;

- An application was received from the employee regarding the option of maintaining work records - continuing to maintain paper work records, or providing information about work activities.

Personnel events include any facts directly related to employment (hiring, dismissal, transfer, advanced training, a ban imposed on occupying a certain position by court decision, renaming the employer, etc.).

Pension Fund error codes

| Error code | What is the problem |

| 20 | The TIN control digits of an individual are a number calculated using the algorithm for generating the TIN control number. |

| The TIN element of the insured person is filled in. | |

| 30 | The SNILS contained in the insurance certificate is indicated. |

| The full name contained in the insurance certificate is indicated. | |

| The status of the ILS in the register of the insured person as of the date of the document being checked should not be equal to the value of the UPRZ. | |

| You must specify at least one of the Last Name or First Name elements. | |

| 50 | The file being checked is sent as a correctly completed XML document. |

| The file being checked does not comply with the XSD schema. | |

| The electronic signature is incorrect. | |

| Element "Registration number". The number under which the policyholder is registered as a payer of insurance premiums is indicated, indicating the codes of the region and district according to the classification adopted by the Pension Fund. | |

| The taxpayer identification number does not match the Pension Fund data. | |

| When providing information about insured persons with the “initial” form type, the presence of previously provided information with the “initial” type for the reporting period for which the information is provided is not allowed. | |

| The period for providing SZV-M is no earlier than April 2021. | |

| For all types of SZV-M forms, the reporting period for which the form is submitted is less than or equal to the month in which the audit is carried out. |

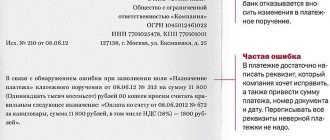

What happens if you send corrections before notifying the Pension Fund

Errors in reporting can be corrected in two ways:

- on its own initiative, that is, when the institution independently identified an inaccuracy and sent corrective information to the Pension Fund;

- or the error was identified by the Pension Fund of Russia, then the inaccuracy is corrected within 5 business days - that’s how many days the company has to correct errors in SZV-M, for which the Pension Fund of Russia sent a notification, without penalties.

IMPORTANT!

The 5 working day rule now applies only to those errors pointed out by regulatory authorities. It will not be possible to correct other defects. There will be penalties for newly identified errors.

Self-identified inaccuracies are corrected only if two conditions are met: the report with the error was submitted in a timely manner and accepted by the Pension Fund, the organization independently sent corrective information to the Pension Fund of the Russian Federation before notification. Here's how to correct errors in SZV-M without a fine if you didn't specify an employee:

- Generate an additional reporting form for a specific employee.

- Send the register to the Pension Fund by the 15th.

If you submit the SZV-M later, a fine cannot be avoided.

Advice: generate and submit reports in the SZV-M form before the due date (15th day of the month following the reporting month). The organization has more time to correct inaccuracies and errors without applying penalties.

If the performer made a mistake in SNILS, code 30 pops up (inaccuracy status - VSZL.B-QUESTIONNAIRE.1.1). Pension Fund specialists will accept the SZV-M form, but not in full, but in part. The correction must be corrected by the 15th. Here's how to submit a new one if the SZV-M was submitted to SNILS with errors and was partially accepted:

- Create a new file. If you provide the same file to the Pension Fund, the system will automatically refuse to accept and process it.

- Indicate the correct SNILS of the employee and check it with the insurance certificate.

- Generate new reports with information about employees for whom an error was made.

- Mark the report type “supplementary” on the title page.

- Submit corrections by the 15th.

How to fix errors now

Errors and inaccuracies are corrected only in the accepted report. That is, after receiving a notification from the Pension Fund. Moreover, in some situations it will not be possible to avoid a fine.

For example, when preparing reports, the institution did not indicate in the SZV-M information about the newly hired employee. In this case, you will have to submit a supplementary form. For such a violation, representatives of the Pension Fund will issue penalties. It is almost impossible to challenge this punishment.

But there are errors in the full name. or the employee’s SNILS number will not be subject to fines. Let’s say that in May the accountant discovered that in the SZV-M for April he did not indicate the middle name of a foreign employee who got a job in April. How to fix the error:

- Submit a cancellation form to the Pension Fund.

- Submit the supplementary form.

Information is prepared only for the employee whose personal information was inaccurate.

The key rules for filling out reports and the unified form remain the same. We talked about them in detail in a special material “Submitting reports: instructions for filling out the SZV-M.”