Type of currency transaction in a payment order

Which business transactions fall under the definition of “currency” are defined in paragraph 9 of Art.

1 of the Federal Law “On Currency Regulation and Currency Control” dated December 10, 2003 No. 173-FZ. Read more about currency transactions in the article “Currency transactions: concept, types, classifications.”

Among foreign exchange transactions there are also those that are associated with the transfer of rubles. It is for them that the transaction type code is provided for filling in the payment order. All types of such operations are described and systematized in Appendix No. 2 to Instruction No. 138-I of the Bank of Russia dated 06/04/2012. Each type is assigned a specific code consisting of numbers.

Why does a non-resident’s current account in Russian banks begin with numbers 40807 and 40820810

Regulations “On the chart of accounts for credit institutions and the procedure for its application”, approved. Bank of Russia dated February 27, 2017 No. 579-P (hereinafter referred to as Regulation No. 579-P), differentiates accounts according to their ownership. You can read the text of this document on the ConsultantPlus website. You can get access to the ConsultantPlus system free of charge for 2 days.

All bank accounts are made up of 20 numbers, divided into several groups, each of which carries certain information about the account owner. In ch. And regulation No. 579-P states that “other accounts” begin with the number 408, and the numbers from 40803 to 40809, from 40812 to 40815, as well as 40818, 40820 indicate various accounts of non-resident individuals or legal entities. Let’s highlight the main points to understand what the numbers 40807 and 40820810 mean in a non-resident’s bank (including current) account :

- 2 digits in combination with register 408 indicate that the account belongs to an individual or legal entity, as well as the type of special account. Accordingly, 40807 denotes the account of a non-resident legal entity, and 40820 - the account of a non-resident individual (the other encodings of non-resident accounts listed above indicate the special nature of the account, for example 40805 - type “I” accounts of legal entities and non-resident entrepreneurs).

- Following them are 2 digits of the so-called 3rd group - an indicator of the currency with which non-cash transactions are made. These numbers are assigned according to the All-Russian Currency Classifier (OKV), where 810 is the ruble designation in force before 01/01/2004. Introduced from the specified date by “Amendment 6/2003 OKW”, this code was canceled. In 2021, the Russian ruble is coded with the numbers 643.

Additional information on this issue can be read in the article What is a personal bank account - concept and structure.

What is a currency transaction type code?

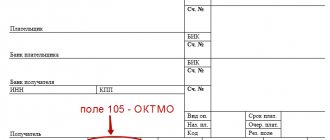

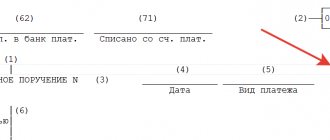

The code for the type of currency transaction in the payment order is indicated before the text part in the “Purpose of payment” detail. There is even a special format for this important prop:

{VO<code of the type of currency transactions>}

It is indicated without indentation or spaces inside curly braces. Its place is before the text part of the payment purpose. The VO designation is large Latin letters that do not change, followed by the digital code itself. In a payment order it always has five characters. Each KVVO is conventionally divided into two parts:

- the first two digits indicate the group into which similar transfers are combined;

- the last three digits indicate a number that specifies the transfer being made in accordance with currency legislation.

What is a currency transaction type code?

KVBO is a five-number value indicating the type of transaction. The code is selected depending on the purpose of the payment and the content of the documents accompanying the transaction. If the payment order and code do not match, the payment is rejected. The list of QVBOs is contained in Central Bank Instruction No. 181-I dated August 16, 2021.

Where should I put the code? If this is an order for a transaction in rubles, you need to put it before the text about the purpose of payment. In other banking documents, KVVO is indicated in a line specially designated for this. The code is both alphabetic and numeric values. There is no need to put spaces or other symbols between letters and numbers.

KVVO consists of two parts. The first indicates the class of the transaction, the second – its essence. Let's look at an example. Operation code – 10100. Its components:

- 10 – indicates the export of products from the territory of Russia.

- 100 – indicates that the buyer made an advance payment.

The very presence of this code means that this is a transaction with a foreign counterparty. Sometimes an accountant encounters problems when choosing a KVBO. There are a lot of codes in the Central Bank instructions. It is not always easy to decide which one is suitable for a particular operation. If an accountant is afraid of making a mistake, he can ask a representative of the servicing bank for advice.

Payment of commission fee

The banking company always charges a fee for cash management services, regardless of the type of account used. In the case of a foreign exchange RS, the fee can be paid in both rubles and foreign currency.

The payment itself is withheld either by a Russian bank (of which you are a client) or a foreign bank (of which a partner is a client).

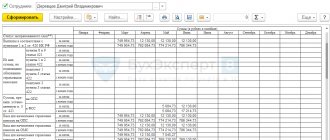

Table 1. Commission deduction by a legal entity’s bank in Russia.

| Debit | Credit | A comment |

| 60 (76) | 51 (52) | Payment of interest for banking services |

| 91 | 60 (76) | Write-off for other types of expenses |

Table 1. Commission deduction by the partner’s bank abroad.

| Debit | Credit | A comment |

| 62 | 90 | Income from the sale of currency |

| 52 | 62 | Transfer of proceeds from the transaction taking into account the commission already withheld (i.e. minus the fee) |

| 76 | 62 | Payment of interest for banking services |

| 91 | 76 | Write-off for other types of expenses |

Thus, we have looked at the accounting for commission payments.

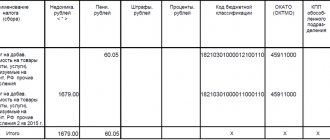

How to decipher KVVO

There is a table that makes it easy to decipher the first two digits of any KVVO.

| 01 | Currency conversion payments made by individuals or Russian companies by bank transfer |

| 02 | Foreign currency conversion non-cash transfers carried out by foreign citizens or companies |

| 10 | Code for settlements between companies from the Russian Federation and foreign companies when conducting foreign trade activities related to the export of goods from the territory of Russia |

| 11 | Currency code when transferring companies from the Russian Federation to foreign companies or individuals when conducting foreign trade activities related to the import of goods into Russia |

| 12 | Transfers of domestic organizations for trade transactions without import of goods to Russia |

| 13 | Payment by foreigners to domestic companies when selling goods directly in Russia |

| 20 | Currency code indicated when paying residents to non-residents when conducting foreign trade activities related to the fulfillment by domestic firms of contractual obligations (work, services, transfer of information, intellectual and exclusive rights) |

| 21 | Payment by organizations from the Russian Federation to foreign companies when carrying out foreign trade activities related to the fulfillment by foreigners of contractual obligations (work, services, transfer of information, intellectual and exclusive rights) |

| 22 | Mutual settlements between residents and non-residents when transferring goods (performing work/services) by domestic firms or individual entrepreneurs |

| 23 | Payment by residents to non-residents when transferring goods (performing work/services) by foreign firms or citizens |

| 30 | Transfers from Russian companies and individual entrepreneurs to foreigners for purchased real estate |

| 32 | Payment by residents to foreigners within the framework of agreements on the assignment of claims (debt transfer) |

| 35 | Code of transfers between residents and non-residents for other foreign trade transactions |

| 40 | Payments for the provision of a cash loan by a Russian company to a foreigner or foreign company |

| 41 | Payment code for the provision of a cash loan by a foreign company from the Russian Federation |

| 42 | Payments when Russian companies fulfill loan obligations |

| 43 | Calculations when foreign companies fulfill loan obligations |

| 50 | Payments upon investment (capital investments) |

| 51 | Transfers when foreigners purchase securities from residents of the Russian Federation |

| 52 | Transfers when Russian companies purchase securities from non-residents |

| 55 | Payments upon fulfillment of obligations under securities |

| 56 | Mutual settlements between Russians and foreigners on derivatives transactions |

| 57 | Payment for transactions related to trust management of assets |

| 58 | Payments for brokerage operations |

| 60 | Payment transactions carried out by foreign companies and citizens on their accounts in Russian rubles in cash |

| 61 | Payments made by Russian companies in foreign currency in cash |

| 70 | Non-trading transactions |

| 80 | Settlements between a bank authorized to carry out foreign exchange transactions and a non-resident in Russian rubles, as well as between a bank and a resident in foreign currency |

| 99 | Settlements for other currency transactions that were not mentioned above |

Let's try to decipher the operation code 10100.

From the table above we immediately see that it is associated with the export of goods. This code usually denotes an advance payment to a resident for goods exported from Russia. The numbers “100” at the end will tell us this. In a similar way, you can decipher any type of currency transaction in a payment order. But to simplify the work, the Central Bank has developed a special table that contains all the necessary values.

Prepaid transactions

The seller, upon receipt of payment for the future delivery of goods (performance of work, provision of services), is obliged to issue an advance invoice within five working days.

An advance invoice is not issued if:

- an advance was received against the future supply of goods with a long production cycle;

- the advance was received against the future supply of goods taxed at a rate of 0%.

The seller must register the advance invoice issued in the sales book. The amount of the advance received by the seller must be reflected in the VAT tax return in column 3 of line 070 of section 3, and the amount of calculated VAT on the advance - in column 5.

After shipment of goods (performance of work, provision of services), the seller has the right to deduct VAT calculated from advance payments. In this case, the seller must issue a shipping invoice. When recording the shipping invoice in the sales ledger, the seller can exercise the right of deduction and record the advance invoice in the purchase ledger. In the “Name of Goods” column when issuing an invoice, you must correctly indicate information about the goods so that the delivery of the goods can be identified.

The advance invoice should indicate that this is an advance payment for the goods. A supply agreement (a contract for the performance of work or the provision of services) must contain conditions on the transfer of an advance payment, its amount and the timing of delivery of goods (performance of work, provision of services).

Amounts of VAT on advances accepted for deduction when shipping goods (performing work, providing services) must be indicated in column 3 of line 170 of section 3 of the declaration. The shipment of goods (performance of work, provision of services) is reflected on line 010 (020) in column 3 of section 3, and the VAT amount is reflected in column 5.

Let's look at this transaction from the perspective of the seller and the buyer.

Salesman

1. The seller issues an invoice for the advance payment with KVO 02, making an entry about it in the sales book. In this case, the following fields are not filled in:

- “Cost of taxable sales according to the invoice, the difference in value according to the adjustment invoice (excluding VAT) in rubles and kopecks, at the rate”;

- “The cost of sales exempt from tax according to the invoice, the difference in value according to the adjustment invoice in rubles and kopecks.”

2. Sales of goods are reflected by an entry in the sales book with KVO 01:

3. The seller returns the advance payment (previously paid to the VAT budget), making an entry in the purchase book with the data of the original (advance) invoice with KVO 22. In the fields “Name of the seller” and “TIN/KPP of the seller” indicates his own details (in information from the purchase book is included only TIN/KPP, the name is not indicated).

Buyer

1. The buyer makes an entry in the purchase book about the received invoice for the advance payment with KVO 02.

2. Receipt of goods from the seller is reflected in the form of an invoice entry for receipt with KVO 01 in the purchase book.

3. The buyer restores the VAT (returns the previously received deduction to the budget) by making an entry in the sales book with the data of the original (advance) invoice with KVO 21. In the fields “Name of the buyer” and “TIN/KPP of the buyer” he indicates his details ( The declaration includes only data on the TIN/KPP, the name is not indicated).

Code groups

The KVVO group is the first 2 digits that reveal the class of the operation. Let's look at these groups and their meaning:

- 01 and 02 – non-cash conversion payments.

- 10 and 11 – payment for export or import of products.

- 12 and 13 – payment for products without import and export.

- 20 and 21 – payment for services, work, rights to intellectual activity.

- 22 and 23 – payment under mixed type agreements.

- 30 – payments for real estate.

- 32 – payment under an agreement for assignment of claims.

- 35 – other payments.

- 40 and 41 – issuance of loans.

- 42 and 43 – payment of loans and interest on them.

- 57 – payment under trust agreements.

- 58 – payment under brokerage service agreements.

- 70 – transactions not related to trade (for example, transfer of salary or pension).

- 90 – other operations.

The next three numbers reveal the contents of the operation. Example: code 70 affects a non-trading transaction. The last numbers indicate which transfer was made. For example, this could be the payment of travel allowances.

Import related operations

Import of goods into the territory of the Russian Federation and other territories under its jurisdiction from the territory of the states of the Eurasian Economic Union

Buyer

- Declares the imported goods, fills out an application for the import of goods, pays fees;

- Makes an entry in the purchase book with KVO 19. In the field "Number and date of the seller's invoice" indicates the details (number and date of the mark) of the application for the import of goods and the date of its registration, the fields "Name of the seller" and "TIN/KPP of the seller" are not fills;

- The details of the application for the import of goods are reflected using the formula NNNNDDDMMGGYGGXXXX (16 characters), where:

- NNNN (1–4 characters) - code of the tax authority that assigned the registration number;

- DDMMYYYY (5–12 characters) — date of registration of the application;

- XXXX (13–16 characters) — serial number of the registration record during the day.

Import of goods into the territory of the Russian Federation and other territories under its jurisdiction in customs procedures of release for domestic consumption, processing for domestic consumption, temporary import and processing outside the customs territory

Buyer

- Declares the imported goods, issues a customs declaration, pays fees;

- Makes an entry with KVO 20 in the purchase book, indicating in the field “Number and date of the seller’s invoice” the details of the goods declaration, but does not fill in the field “TIN/KPP of the seller”;

- Details of the declaration of goods are reflected using the formula: XXXXXXXX/YYYYYY/ZZZZZZZ(/SS) - 8 characters, 6 digits, 7 characters / 2 digits, where:

- XXXXXXXX (1–8 characters) - customs authority code established by the Federal Customs Service of Russia;

- YYYYYY (9–14 characters) — date of filing of the declaration (day, month, last 2 digits of the year);

- ZZZZZZZ (15–21 characters) — serial number of the declaration;

- SS (2 digits) - the serial number of the goods indicated in column 32 of the main or additional sheet of the customs declaration or from the list of goods, if a list of goods was used instead of additional sheets during declaration.

KVBO for operations

Here are the codes that usually accompany operations:

- 10100. Prepayment for the export of a batch of products from the territory of Russia.

- 10200. Deferred payment for a shipment transported out of the country.

- 11100. Advance payment to a foreigner for products imported into the country.

- 11200. Settlements with a resident if he is given a deferred payment for a consignment imported into the country.

- 12060. Payment for goods sold by a non-resident. It is assumed that the products were sold abroad, without import into the Russian Federation.

- 13010. Payment from a foreigner to a resident for goods sold in Russia.

- 20100. Prepayment of services or goods in favor of a resident.

- 20200. Payment between a non-resident and a resident for services or work.

- 20400. Payments under agreements on assignments, guarantees to the resident.

- 20500. Payments under guarantee agreements to a non-resident.

- 21100. Advance payment for services or work in favor of a foreigner.

- 35030. Payment to the resident for other actions.

- 35040. Payment in favor of a foreigner for other actions.

- 41030. Lending to a resident by a non-resident.

- 42015. Payment of the principal debt to a non-resident, if the resident has corresponding obligations.

- 61100. Movement of currency from one account to another.

- 61135. Transfer of currency from a resident’s account to an account in another bank.

- 70060. The resident transfers remuneration to the foreigner for work.

- 99090. Other actions and translations not listed above.

Other operations

KVBO is also needed when working with foreign currency:

- 01010 – sale of currency for rubles.

- 01030 – purchase of currency for rubles.

Features of the currency transaction code “Salary to non-residents”

If a resident pays a salary to an employee who is listed in the bank as a non-resident (has a different citizenship), then when issuing a payment order, the KVVO must be indicated. If this is not done, the bank will not accept the payment order for execution, since it violates currency legislation.

When transferring a salary to such a foreign citizen, you should indicate the code 70060. At the same time, it is important not to forget to simultaneously issue a payment order for the payment of personal income tax and insurance contributions, so as not to violate tax laws.

Currency transaction code 10100

Currency transaction code 10100 is used in settlement transactions of non-residents for prepayment to a resident for goods exported from Russia.

Currency transaction code 10200

The currency transaction type code 10200 denotes payments made by a non-resident to a resident in the event of a deferred payment for products exported from the Russian Federation.

Currency transaction type code 20100

20100 - currency transaction code indicating an advance payment by a non-resident for services/works provided by a resident, etc.

Currency transaction code 20210

The currency transaction type code 20210 in the payment document indicates that the non-resident is paying for work/services performed by the resident, etc.

Currency transaction code 21100: decryption

The currency transaction type code 21100 in the settlement document (certificate) indicates an advance payment by a resident in favor of a non-resident performer of work (services).

Currency transaction code 21200: decryption

The currency transaction type code 21200 represents a payment by a resident for services performed by a non-resident.

Code when paying wages to a non-resident

The company's staff may include non-residents. A non-resident is any person without a Russian passport or citizenship. Within the framework of currency control, it does not matter how long the foreigner lived in Russia. In any case, he is considered a non-resident. When paying remuneration to a foreign person, codes are also used.

Payments in favor of a non-resident are indicated by code 70060. But to use this KVBO, it is not enough to provide only a payment order to the bank. Most likely, you will also need an employment agreement with a foreigner and a copy of his passport.

Remuneration for an employee is not only salary, but also other payments. And each payment is assigned its own code:

- 70200 – payments according to the advance report (for example, travel expenses).

- 70030 – social payments (for example, financial assistance).

- 70120 – payments made by court decision.

Upon payment, accompanying documents are sent to the bank. Their list depends on the type of operation. For example, a non-resident is accrued travel allowances. In this case, a business trip order is sent to the bank.

Sample of filling out a payment order for a non-resident (in Russian rubles)

The payment order is filled out for the transfer of Russian rubles, so its usual filling procedure is maintained in accordance with the documents and details of the counterparty, except for the currency transaction code, which must be indicated in the final field of the payment order. To do this, before the text in the “Purpose of payment” field, write VO in capital Latin letters, and then the five-digit transaction code from the table below. The code must be enclosed in curly braces.

Let’s assume that the Russian organization VESNA LLC needs to pay wages to its employee who works remotely from Kazakhstan and is not a resident of the Russian Federation. In this case, fill out the payment form as usual, and in the appropriate field write:

{VO70060} Salary of Abdurakhmanov Ilyas Karimovich for November 2021.

The given example of filling out a foreign currency payment order shows how to specify the code.

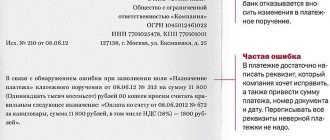

Possible errors when making payments to a counterparty

The value of the list of the most common errors makes it easier to check and identify shortcomings in specific payment orders. These mistakes are very often made:

- Incorrect TIN. If in all other respects the order is completed correctly, then the regulatory authorities do not have the right to demand clarification of the details.

- The basis for payment is incorrectly specified. This is also a minor error. The funds will be sent to the recipient. In this case, it makes sense to contact the recipient. His response clarifying the basis for the payment is attached to the order. This must be done, as otherwise there may be confusion. It can lead to difficulties in the work of accountants and tax representatives.

- Allocation of VAT if the order concerns counterparties under a special tax regime. For example, the counterparty may use the simplified tax system. In this case, he does not need to pay VAT. Accordingly, there is no need to highlight VAT in the payment order. If this is done, you need to send a clarifying letter to your bank. The latter sends a notification to the bank servicing the counterparty. The error must be corrected. Otherwise, the counterparty will have to pay tax at an increased rate.

- Incorrect designation of payment purposes. For example, the funds were actually transferred as an advance for the service. However, the order specifies a loan as the purpose. In this case, you also need to notify the bank about the error. If this is not done, the company will not receive a deduction for the advance payment.

- Incorrect information about the counterparty. The counterparty's details may be changed. However, the company does not always send out notifications about this. That is, the payment is sent using the old details. In this case, the transferred funds will be kept in the banking institution until the information is clarified. On the sixth day, the funds are returned to their sender. When making such an error, the company has two courses of action: submitting updated information to the bank or receiving funds back on the sixth day and then re-issuing the order.

Errors that can be fixed

Let's look at correctable errors and the procedure for eliminating them:

- The purpose of the funds is incorrectly indicated. You need to perform a tax reconciliation with the Federal Tax Service, and then fill out a reconciliation report. It is signed by an accountant, as well as a representative of the Federal Tax Service.

- Inflated payment amount. There are several ways to proceed. First: redirection of funds. The overpaid money will be used to pay the next payments. Second: processing a refund of payment to the company’s bank account.

The listed errors are considered insignificant. They are relatively easy to fix.

Errors that cannot be corrected

Let's consider significant errors that cannot be corrected:

- Indication of the wrong BCC. For example, the code numbers are indicated incorrectly or the old KBK is taken. In this case, the payment is considered unclassified. The tax will be considered unpaid. That is, the payer will have to pay penalties and fines for late payment. To correct the situation, you need to send an application to the Federal Tax Service. It specifies a request to offset the transferred funds. A copy of the incorrect order and a bank statement are attached to the application.

- Underpayment. The tax is also not considered paid. To correct the situation, you need to add the missing amount to the budget.

- Indication of the BCC, which relates to another tax. In this case, you can act in several ways. This is, firstly, a return of funds to the payer’s bank account. Secondly, this is a repeated payment of the payment. What will happen to the old payment? It is credited under another tax, to which the KBK applies. An overpayment is created for this tax, which will be offset against the next payment.

- Invalid recipient account. This is the most difficult mistake. The money will have to be sent again. A penalty will be charged for late payments.

- The name of the banking institution is incorrect. Also an irreversible error.

- Indication of a non-existent BCC. A refund is being issued. The payment is sent again.

There is a big difference between a significant and an insignificant error. In case of correctable errors, the payer only needs to send a clarification. In this case, the payment will be considered paid. Errors that cannot be corrected mean that taxes or payments to counterparties are not considered paid. That is, fines and penalties will be imposed on the payer.

Errors when sending payments to the budget

A payment order for payments to the budget has many fields, which is prone to errors. However, among these fields there are those that control structures pay little attention to. Specifically, these are the following lines:

- Taxable period.

- Tax payer status.

- Order number and date.

- Reason for payment and its type.

If errors are made in these lines, it is not necessary to correct them. The line “priority of payment” is also unimportant. An exception is that orders are sent by companies whose activities involve financial difficulties: restrictions on expense transactions, insufficient funds in a bank account. If these circumstances are present, the “priority” line is checked first.

Adjustment invoice for reduction

The company issues or receives a reduction adjustment invoice if the price has changed, the quantity of the product has changed, or the product has been partially returned.

What to consider when issuing an adjustment invoice:

- The consent of the parties to change the price is required. It can be drawn up in the form of an additional agreement (as a two-sided document), in the form of a notification (a one-sided document) or a primary document (for example, an act on an established discrepancy).

- A correction invoice is issued for a specific original invoice. You can create one adjustment invoice for several original invoices from the same business partner. This document is called a “Unified Adjustment Invoice”.

- An adjustment invoice must be issued within five calendar days from the date of signing the document indicating a change in the value of the invoice, including due to a change in the price or quantity (volume) of goods shipped. If the parties agreed on changes before the seller issued a shipping invoice, then within five days from the date of shipment he issues a regular invoice for the new price/quantity of the goods. In this case, it is not necessary to issue an adjustment invoice.

- Issued in two copies.

The difference between the tax amounts calculated based on the cost of goods shipped before and after such a reduction is taken by the seller as a deduction, and the buyer must restore it.

The buyer selects the recovery period according to the earliest date:

- obtaining primary documents to reduce the cost of goods;

- receiving a corrective invoice.

Let's consider this situation in more detail.

Salesman

1. The seller reflects the sale of goods by making an entry in the sales book about the invoice with KVO 01.

If you need to reduce the amount of a previously registered sales invoice, you should create an adjustment invoice on its basis with KVO 18. An entry about it must be made in the purchase book, indicating:

- in the field “Number and date of the seller’s invoice” - the data of the original invoice;

- in the field “Number and date of the seller’s adjustment invoice” - details of the adjustment invoice;

- in the fields “Name of the seller”, “TIN/KPP of the seller” - your own details (information from the purchase book includes only data on the TIN/KPP, the name is not indicated);

- in the fields “Cost of purchases on the invoice, the difference in the cost on the adjustment invoice (including VAT), in the currency of the invoice”, “VAT amount on the invoice, the difference in the amount of VAT on the adjustment invoice accepted for deduction, in rubles and kopecks” - amounts by which similar amounts of the original invoice were reduced.

Buyer

1. The buyer reflects the purchase of goods by making an entry in the purchase book about the received invoice with KVO 01.

2. Having received an adjustment invoice to reduce the amount of a previously registered invoice, the buyer makes an entry about the adjustment invoice in the sales book with KVO 18, indicating:

- in the field “Number and date of the seller’s invoice” - the data of the original invoice;

- in the field “Number and date of the seller’s adjustment invoice” - details of the adjustment invoice;

- in the fields “Name of the buyer”, “TIN/KPP of the buyer” - your own details (only data on the TIN/KPP is included in the declaration, the name is not indicated);

- in the fields “Cost of sales according to the invoice, difference in value according to the adjustment invoice (including VAT), in the currency of the invoice”, “Cost of taxable sales according to the invoice, difference in value according to the adjustment invoice (without VAT) in rubles and kopecks at the rate”, “VAT amount on the invoice, the difference in the VAT amount on the adjustment invoice, in rubles and kopecks, at the rate” - the corresponding amounts by which similar amounts of the original invoice are reduced.

The code is incorrectly selected and filled in - what to do?

If, when drawing up a payment order, the code for the type of currency transaction was incorrectly specified, the bank will return such a document. And he will be right, since he must control the submitted documents (Chapter 18 of instructions No. 138-I). In this case, the organization has only one option - to redo the payment card.

But there are a number of cases when you don’t have to draw up settlement documents at all. And if they are compiled, then you don’t have to write the code. And this should not be a reason for returning the document from the bank. Such situations are described in paragraph 3.3 and paragraph 3.4 of Chapter. 3 instructions No. 138-I.

Another option when an organization can be sure that the bank will accept its documents is to include clauses in the agreement with the bank stating that the bank will draw up payment orders for foreign exchange transactions on the basis of the documents that the organization provides.

VAT refund for export transactions

Confirmation of export later than 180 days from the date of placing the goods under the customs export procedure.

1. The seller makes an entry in the sales book about the issued sales invoice with KVO 01.

2. If the seller failed to collect the necessary package of documents confirming the 0% rate within 180 days from the date of placing the goods under the customs export procedure, then on the 181st day the seller must charge VAT at a rate of 10% or 18% (reflected in section 6 VAT declaration), about which an entry is made in the additional sheet of the sales book for the tax period in which the goods were shipped. Such a record will also have KVO 01.

3. If, after the expiration of the period of 180 days, the package of documents is nevertheless collected, the seller can return the amount of tax paid by him. To do this, you need to make an entry in the purchase book about the invoice with KVO 24 for the period in which the 0% rate is confirmed, indicating:

- in the field “Number and date of the seller’s invoice” - details of the original (entered in the additional sheet of the sales book) invoice;

- in the fields “Name of the seller” and “TIN/KPP of the seller” - your own details (only data on the TIN/KPP is included in the declaration, the name is not indicated).

Please note: from 07/01/2016 (based on Law dated 05/30/2016 No. 150-FZ), you can apply for deduction of “input” VAT for export operations immediately after accepting goods for registration, without waiting for a package of documents to be collected. This concerns the implementation:

- goods that are exported under the customs procedure of export or placed under the customs procedure of a free customs zone;

- precious metals by taxpayers who mine them or produce them from scrap and waste, and then sell them to Gokhran, the funds of precious metals and precious stones of the constituent entities of the Russian Federation, the Central Bank of the Russian Federation, and banks.

An exception is raw materials exported under the customs export procedure or placed under the customs procedure of a free customs zone. For them, the procedure for deducting input VAT has not changed.

These changes apply to those acquisitions that were registered on July 1, 2016.

Consequences of mistakes made

Payment orders must be drawn up carefully. Even if the error does not lead to the loss of funds, it will still take a lot of time to correct it. Let's look at the consequences of the error:

- Not paid taxes on time. Consequences: accrual of penalties, fines, risk of repaying the full amount of tax.

- The tax is considered unpaid. Consequences: penalties, fines.

- The payment went to another fund. There is no offsetting of amounts between different funds. Therefore, you will have to pay the tax in full again.

The error will have to be corrected. And this entails separation from employees’ activities, the need to draw up additional documents, and legal proceedings.

Features of filling out an application for clarification of tax payment

If the accountant made a minor mistake, the details need to be clarified. To do this, a statement is drawn up containing the information:

- Full name of the head of the Federal Tax Service.

- Company details: name, INN, KPP, OGRN, address.

- Date of.

- Title of the application.

- Request to clarify the payment with reference to regulations (clauses 7-8 of Article 45 of the Tax Code of the Russian Federation).

- Information about the payment (amount, specification of the error committed, corrected version).

- List of attached documents.