In certain documentation of a business entity, a code according to the OKTMO reference book must be written.

Taxpayers indicate this detail when processing various payment orders and preparing financial statements submitted to the relevant state authorities. The OKTMO code clearly informs about the territorial affiliation of the payer (business entity) to a certain region, municipal entity, or populated area.

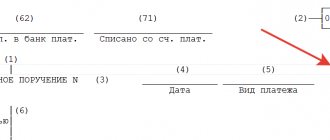

The reflection of the OKTMO code in field 105 when generating a payment order is strictly prescribed by Order number 107n, approved by the Ministry of Finance of the Russian Federation in 2013.

It should be noted that it is this regulatory act that regulates the proper filling of all lines/fields of a bank payment order.

So, if the payment document does not contain any mandatory information, including OKTMO, the servicing bank will not be able to accept the client’s order for execution, and the money, accordingly, will not be transferred to the addressee on time.

Thus, you should understand what OKTMO is, how it is indicated on the payment slip, where you can check this detail.

In addition, it is important to find out what actions the payer should take if the OKTMO code is incorrectly indicated in a document that has already been sent for execution.

Where to find

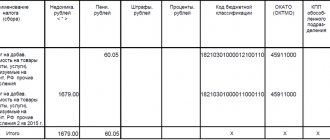

To understand which OKTMO code to indicate in a payment order, you need to know that all the values of the codes in question are listed in the All-Russian Classifier of Municipal Territories - abbreviated OKTMO, which was approved on June 14, 2013 by order of Rosstandart No. 159-st. This reference book was adopted to replace OKATO - the classifier of administrative-territorial divisions. Thus, the question in itself disappears - what to indicate - the OKATO or OKTMO code in the payment order.

Please note that since the beginning of 2014, in tax returns and in payment slips, the value in field 105 has been entered in accordance with the OKTMO classifier. It represents the code of the municipality in which the organization operates or makes payments.

If an organization has separate divisions, which OKTMO should be indicated in payment orders when deducting contributions and taxes? Payments and declarations indicate the OKTMO code of the area where the “isolation” is located.

If the tax is transferred on the basis of a declaration, then the OKTMO code in the payment order is indicated in accordance with such a declaration.

The code in question consists of 8 or 11 digits. In accordance with the Classifier, the last 3 digits - from 9th to 11th - indicate a specific small settlement.

Any payer can find out his or the required OKTMO using a special service on the website of the Federal Tax Service of Russia www.nalog.ru. It allows you to determine the code using a directory through the name of the municipality.

Also see “Electronic services for accountants on the Federal Tax Service website: use wisely.”

There is a feature whose OKTMO is indicated in the payment order in relation to payments at customs. It is necessary to take the code of the territory that accumulates the corresponding payment.

Also see “Field 107 of the payment order: customs authority code”.

Octmo in a payment order (nuances)

OKTMO will need to be reflected in the payment order when transferring tax payments or insurance premiums. Where you can find out this code and what nuances need to be taken into account when indicating it in the payment, we will tell you in our article.

OKTMO: how and where to reflect

Features of reflecting OKTMO in the payment slip

How to find out OKTMO

Find out OKTMO from OKATO

Find out OKTMO at the address

Results

OKTMO: how and where to reflect

OKTMO is a code assigned to the territory of a municipality or a settlement that is part of it. In tax returns and payment orders for the transfer of tax payments and insurance premiums, it is necessary to indicate OKTMO of the territory in which the corresponding taxes, fees or contributions are accumulated.

https://www.youtube.com/watch?v=pXkaUJG-C4Q

Let's analyze the situation.

In 2021, 2 friends each opened their own business in the Eastern District of Moscow: one organized Sadko LLC in Novogireevo, and the other created IP Zakharov M.N. in the village. Akulovo. They had not been involved in business before and became acquainted with all the intricacies of difficult commercial work in the process of their activities.

At the initial stage of work, both of them kept their own accounts, so when it came time to transfer the first tax payments, everyone thought about how to fill out the payment slip correctly - there were too many codes and ciphers in it.

Read more about decoding the fields of a payment order in the material “How to decrypt a payment order?”.

Friends meticulously tried to understand the intricacies of the contents of this payment document.

We took as a basis the main regulatory document that defines the requirements for filling out payment slips when paying taxes - the order of the Ministry of Finance of Russia dated November 12.

2013 No. 107n on the rules for filling out information in payment orders for the transfer of tax payments. And for control, we checked with a ready-made sample taken from the Internet.

Both had to work hard to complete the payment slips: indicate the 20-digit current account numbers without errors, unravel the incomprehensible coded words (KBK, OKTMO, BIC). Finally, this difficult process was completed, and both friends met to reconcile their bills - as a control step before sending them to the bank.

We'll tell you what came out of this later.

Features of reflecting OKTMO in the payment slip

Reconciling the invoices did not take much time - both merchants successfully completed the task of filling them out. But a dispute still broke out over one prop.

The OKTMO code, reflected in everyone’s payment document in field No. 105, for some reason had a different length. For individual entrepreneur M.N. Zakharov it consisted of 11 characters, and the founder of Sadko LLC counted only 8 digits in his code.

Did someone really miss some characters or add extra ones?

IMPORTANT! OKTMO codes can be found using the All-Russian Classifier of Municipal Entities (approved by order of Rosstandart dated June 14, 2013 No. 159-st).

In addition, it turned out that friends used different sources to obtain information about OKTMO.

In fact, both turned out to be correct. The classifier included both 8- and 11-digit OKTMOs. However, it must be taken into account that the OKTMO code in the payment order must match the OKTMO code in the tax return.

How to find out OKTMO

The answer to the question of how to find out OKTMO is easy to find on the Internet. By typing the request “OKTMO how to find out”, you will see quite a lot of sites, by going to which you will receive a link to services that allow you to find out OKTMO by OKATO, address or INN.

Find out OKTMO from OKATO

Finding out OKTMO from OKATO is quite simple. To do this, you need to go to the Federal Tax Service website - section “Electronic services” - “Find out OKTMO”. The service allows you to find out OKTMO by OKATO or the name of the municipality.

To do this, select a subject of the Russian Federation, enter the name of the city or municipality and click the find button.

Find out OKTMO at the address

How to find out OKTMO by address? To do this, you can use the “Fill out a payment order” service on the Federal Tax Service website, in the “Electronic Services” section.

1. Select the taxpayer and payment document by placing dots in the appropriate checkboxes and click the “Next” button.

To find out OKTMO by address, just enter the address in the field provided.

2. Select the Federal Tax Service code from the presented directory.

3. Place a dot in the “Determine by address” checkbox.

4. Enter the address of the business and the system will automatically fill in the “OKTMO Code” field

You can also find out the OKTMO code by address in the Federal Information Address System https://fias.nalog.ru/.

Since 2021, due to the transformation of some municipal districts of the Moscow region into urban districts, OKTMO has changed. You can find out where this happened in the material “Starting from 2021, tax payments will have new OKTMO!”

To learn how to correct an error in the OKTMO code made when preparing the 6-NDFL form, read the article “How to correctly correct OKTMO in the calculation of 6-NDFL?” .

Results

OKTMO must be indicated when filling out payment slips for the transfer of tax payments. Field 105 is provided for this detail in the payment order.

The OKTMO code may contain 8 or 11 digits, depending on the type of territory to which it is assigned.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Source: https://nalog-nalog.ru/uplata_nalogov/rekvizity_dlya_uplaty_nalogov_vznosov/oktmo_v_platezhnom_poruchenii_nyuansy/

What to do if it is specified incorrectly

If the OKTMO code in the payment order is indicated incorrectly, this will not affect the receipt of tax to the budget. When an error is discovered in this detail, in accordance with clause 7 of Art. 45 of the Tax Code of the Russian Federation, an organization should contact the Federal Tax Service with an application to clarify the details. Such a petition is written in free form. In this case, the document must indicate:

- date of payment, transferred amount, purpose of payment;

- details that are specified incorrectly;

- the correct value of this attribute.

Along with the application you must submit:

- A copy of the erroneously completed payment slip.

- Statement of transfer of the amount.

In the event of an error in OKTMO in a payment order, the tax office may invite the organization to reconcile the calculations. The Federal Tax Service must make a decision no later than 10 working days from the date of receipt of the application from the organization, taking into account the execution of a settlement reconciliation report. The tax office is obliged to notify the payer of its decision.

Also see “Request for a reconciliation report with the tax office: changes since 2017.”

If the OKTMO code is entered incorrectly in the payment slip when paying insurance premiums in 2021, clarification of the payment is not required, since the Treasury does not take its value into account when distributing insurance premiums between budgets. This payment does not fall into the unknown, but will be taken into account in a special payment card with the budget, which indicates the OKTMO code at the place of activity of the organization.

Occasionally, OKTMO in a payment slip at the Pension Fund may have a zero value. This issue is regulated by clause 4 of Appendix No. 4 of Order No. 107n of the Ministry of Finance dated November 12, 2013.

Read also

13.07.2017

Sample payment order with octmo code. Octmo in a payment order (nuances)

Payment orders are used for non-cash payments, as well as for paying taxes and insurance premiums.

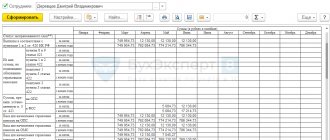

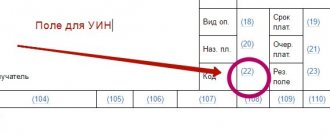

In the payment order form, the fields that are especially worth paying attention to in connection with the changes that came into force on January 1, 2014 are highlighted in red.

New details “UIN” are being introduced

In 2014, a new requisite appeared - “Unique accrual identifier” (UIN). Data about it is provided by the budget revenue administrator. Props “UIN” from January 1 to March 30, 2014

The unique accrual identifier is indicated first in the “Payment purpose” detail and consists of 23 characters: the first three characters take the value “UIN”, characters from 4 to 23 correspond to the value of the unique accrual identifier. To highlight information about a unique accrual identifier, the symbol “///” is used after the unique accrual identifier.

For example: “UIN12345678901234567890///”.

Unique payment identifier

Until March 31, 2014, the value of the attribute is not indicated in field 22 “Code”. From March 31, 2014, the rules for filling out the “Code” field come into force (Instruction of the Bank of Russia dated July 15, 2013 No. 3025-U). In addition to the concept of “UIN”, the concept of “unique payment identifier (UPI)” also appears.

The UIP will be indicated in the “Code” field (22). On paper, it may be possible to indicate a unique payment identifier in two or more lines.

At the same time, paragraph 12 of Appendix 2 and paragraph 7 of Appendix 4 to it is said that the “Code” detail indicates a unique accrual identifier. From the above we can conclude that UIN and UIP are the same indicator.

How to find out the UIN value and fill it out in a payment order 2014

To find out the meaning of the UIN, an organization must contact directly the tax office, the Pension Fund or the territorial branch of the Federal Social Insurance Fund of the Russian Federation.

Rules for filling out a payment order: – January 1 to March 30, 2014. Fill in the “Purpose of payment” field “UIN12345678901234567890/// Insurance premiums...” or “UIN0/// Insurance premiums...” (in the absence of UIN)

– from March 31, 2014. The “Code” field is filled in with 20 characters.

Field 101 “Payer status”

If there are entries in fields 104-110 of the settlement document, field 101 must be filled in.

Field 101 of the payment order indicates the status of the payer. This indicator can take values 01-26.

The number of possible payer status values has increased, but this does not affect . Since the beginning of 2014, when transferring any payments, you must set the status to 08.

Field “101” can have the following statuses: “01” – taxpayer (payer of fees) – legal entity; “02” – tax agent; “03” – the federal postal organization that issued the order for the transfer of funds for each payment by an individual; “04” – tax authority; “05” – territorial bodies of the Federal Bailiff Service; “06” – participant in foreign economic activity – legal entity; “07” – customs authority; “08” – payer – a legal entity (individual entrepreneur) transferring funds to pay insurance premiums and other payments to the budget system of the Russian Federation; “09” – taxpayer (payer of fees) – individual entrepreneur; “10” – taxpayer (payer of fees) – a notary engaged in private practice; “11” – taxpayer (payer of fees) – lawyer who established a law office; “12” – taxpayer (payer of fees) – head of a peasant (farm) enterprise; “13” – taxpayer (payer of fees) – other individual – bank client (account holder); “14” – taxpayer making payments to individuals; “15” – a credit organization (a branch of a credit organization), a paying agent, a federal postal service organization that has drawn up a payment order for the total amount with a register for the transfer of funds accepted from payers - individuals; “16” – participant in foreign economic activity – individual; “17” – participant in foreign economic activity – individual entrepreneur; “18” – a payer of customs duties who is not a declarant, who is obligated by the legislation of the Russian Federation to pay customs duties; “19” - organizations and their branches (hereinafter referred to as organizations) that have drawn up an order for the transfer of funds withheld from the wages (income) of a debtor - an individual to repay arrears of payments to the budget system of the Russian Federation on the basis of an executive document sent to organization in the prescribed manner; “20” – credit organization (branch of a credit organization), payment agent, who drew up an order for the transfer of funds for each payment by an individual; “21” – responsible participant in the consolidated group of taxpayers; “22” – participant of the consolidated group of taxpayers; “23” – bodies monitoring the payment of insurance premiums; “24” – payer – an individual who transfers funds to pay insurance premiums and other payments to the budget system of the Russian Federation; “25” – guarantor banks that have drawn up an order for the transfer of funds to the budget system of the Russian Federation upon the return of value added tax received in excess by the taxpayer (credited to him) in a declarative manner, as well as upon payment of excise taxes calculated on transactions of sale of excisable goods for limits of the territory of the Russian Federation, and excise taxes on alcohol and (or) excisable alcohol-containing products;

“26” - founders (participants) of the debtor, owners of the property of the debtor - a unitary enterprise or third parties who drew up an order for the transfer of funds to repay claims against the debtor for the payment of mandatory payments included in the register of creditors' claims, during the procedures applied in the case of bankruptcy.

Field 104 “Budget classification code”

In field 104 you need to enter a 20-digit number. Order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n approved the budget classification codes for 2014.

The changes affected the payment of contributions to the Pension Fund of the Russian Federation; starting from the transfer for January, it is necessary to generate one payment order for the payment of insurance contributions to the pension fund of the Russian Federation. The rest of the codes remain the same.

Insurance premiums for December 2013 must be transferred in two payments to the KBK that were in force in 2013.

List of BCC for 2014 for main taxes and contributions:

Personal income tax – 182 1 0100 110

Insurance contributions to the Pension Fund for payment of the insurance part of the labor pension 392 1 0200 160

Insurance contributions to the Pension Fund for 392 1 0200 160 employees in accordance with List No. 1

Insurance contributions to the Pension Fund at 392 1 0200 160 additional tariff from payments

employees in accordance with List No. 2

Insurance contributions to the Federal Compulsory Compulsory Medical Insurance Fund 392 1 0211 160

Insurance contributions to the Federal Social Insurance Fund of the Russian Federation 393 1 0200 160

Insurance premiums in case of injury 393 1 0200 160 in the Federal Social Insurance Fund of the Russian Federation

Additional insurance contributions 392 1 0200 160 to the Pension Fund for the funded part of the employees’ labor pension. The employer deducts them from the salary

employee based on an application

Employer contributions to the funded 392 1 0200 160 part of the labor pension.

At the employer's discretion.

Field 105 "OKTMO"

Source: https://www.ambaro.ru/obrazec-platezhnogo-porucheniya-s-kodom-oktmo-oktmo-v-platezhnom/

We fill out payment slips for the transfer of taxes and contributions without errors

For example, “UFK for Moscow (Inspectorate of the Federal Tax Service of Russia No. 19 for Moscow)” UFK for _____ (name of the region in which contributions are paid), and a specific branch of the Pension Fund of the Russian Federation is indicated in brackets.

For example, “UFK for the Tula region (GU - OPFR for the Tula region)” UFK for _____ (name of the region in which contributions are paid), and the FSS branch is indicated in brackets. For example, “UFK for the Bryansk region (GU - Bryansk regional branch of the FSS of the Russian Federation)” Payment order (21) 3 KBK (104) Budget classification code corresponding to the tax/contribution paid When paying a tax/contribution, “1” is indicated in the 14th category. If penalties are paid - “2”, fines - “3” Current BCCs for taxes and contributions paid to the Pension Fund can be found: → Tax reporting → Codes for classification of budget income of the Russian Federation; → Employers → Payment of insurance premiums and reporting → Budget classification codes for payment of insurance

Details for paying a traffic police fine by resolution number

Contents: Car owners who have violated traffic rules and are brought to administrative responsibility will not have any difficulty in obtaining all the necessary details to pay a traffic police fine according to the resolution number.

Administrative penalties are applied to people who violate road safety rules. Offenses entailing such penalties are described in Chapter 12 of the “Code of the Russian Federation on Administrative Offences”. Article 12.1 through Article 12.37 describes actions considered violations of the rules and the penalties applied to persons who violate the described rules.

The main legally established penalties applied to persons violating traffic rules:

- Prohibition of driving a vehicle through deprivation of rights;

- Issuance of a verbal warning;

- Imposition of an administrative fine;

- Seizure of the property of the offender, which is the subject of an administrative offense;

- Isolation of the offender from society for up to 15 days by imposing administrative arrest. Code of the Russian Federation on Administrative Offenses

The most common measure of influence on persons who violate traffic rules is a monetary penalty. Similar penalties are imposed for the following illegal actions:

- Driving a vehicle that is not duly registered and detecting a repeat violation.

- Driving a vehicle that has not passed the mandatory periodic technical inspection procedure.

How to pay the state fee when going to court without a TIN

Recently, Sberbank of the Russian Federation, when paying state fees when going to court, requires indicating the TIN of the payer - an individual. This is not always possible, since the payer may not know or may not have an INN (individual taxpayer number).

Here are instructions on how to pay the state duty without a TIN:

First, we find the details for paying the state duty on the website of the relevant court (from there you will need to know the number of the Federal Tax Service, KBK, OKTMO).

In Moscow, the court’s website can be found either on the Unified Portal of Justices of the Peace in Moscow or on the Portal of Courts of General Jurisdiction. To determine a specific court on these portals there are sections “Territorial Jurisdiction”, to search for details - “State Duty Calculator”.

Next, go to the tax service website using the following link: https://service.nalog.ru/

Next, following the instructions and tips, we generate a receipt.

In the section “Type of payer and type of payment document” we indicate – “Individual”.

Systematization of accounting

416 of the Tax Code of the Russian Federation, then the payment order for the transfer of the fee to the budget should indicate the details of the recipient and the OKTMO code at the location of each of the objects. In this regard, the payer will have to fill out a separate payment order for each property indicating its OKTMO.

Let us note that previously the regulatory authorities proposed, in relation to a real estate property, to indicate the recipient of the payment and the OKTMO code at the place of registration as a payer of the trade tax (letter of the Federal Tax Service of Russia dated June 26, 2015 No. For more details on the procedure for calculating and paying the trade tax, see

in the “Trade Fee” directory.

On January 1, 2014, a new version of the All-Russian Classifier of Municipal Territories - OKTMO - came into effect.