Transition to the linear method

For fixed assets that are depreciated using the non-linear method, from the beginning of the next tax period the organization has the right to switch to the linear method of calculating depreciation. However, this is possible no earlier than five years after the start of using the nonlinear method. This procedure is provided for in paragraph 1 of Article 259 of the Tax Code of the Russian Federation.

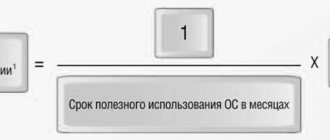

During the transition, you need to establish the residual value of each fixed asset. This indicator should be determined as of January 1 of the year, starting from which the organization will calculate depreciation using the straight-line method. Calculate the depreciation rate based on the remaining useful life of each asset. If, after the end of its useful life, the fixed asset is not fully depreciated, the organization has the right to continue accruing depreciation until its cost is completely written off. Such clarifications are contained in the letter of the Ministry of Finance of Russia dated July 21, 2014 No. 03-03-RZ/35549.

Video: How to calculate depreciation

Candidate of Economic Sciences, N.D. Klikunov, analyzed two methods for calculating depreciation - the compound interest method and the linear method, and showed that the linear method is not perfect.

Depreciation charges are the main way to compensate for the costs of purchasing certain equipment used in production. This amount is calculated in two ways - linear and nonlinear. Depreciation deductions occur throughout the entire service life of the equipment specified in the documents and begin immediately after it is placed on the balance sheet.

Transition to a nonlinear method

When switching from a linear to a non-linear method, include fixed assets in the depreciation group (subgroup) at their residual value. Determine the residual value as of January 1 of the year from the beginning of which the accounting policy for tax purposes established the use of a non-linear depreciation method.

In this case, fixed assets must be included in depreciation groups based on the useful life established for these fixed assets when they were put into operation.

This procedure is provided for in paragraph 3 of Article 322 of the Tax Code of the Russian Federation.

Charges for used equipment

The property received at disposal can be not only new, but also previously used. In this case, it is necessary to find out from the previous owner the actual period of use of the equipment and its useful life. Then you need to find the difference between these two numbers.

For example, the useful life of the machine is 72 months; previously it was used for 20 months. Thus, the difference will be 72 – 20 = 52 months.

The resulting figure will be the useful service life for this equipment. It will form the basis of calculations.

Otherwise, the owner of the enterprise chooses the method of calculating depreciation and applies it according to the formulas described above.

Composition of depreciation groups

The composition of depreciation groups for calculating depreciation using the non-linear method is determined by the useful lives of fixed assets in accordance with the Classification approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1. If the procedure for calculating depreciation for fixed assets included in the same depreciation group, varies, within it one or more depreciation subgroups should be distinguished. For example, this should be done if part of the fixed assets with the same useful life is operated in an aggressive environment and depreciation on them is charged with an increasing factor (subclause 1, clause 1, article 259.3 of the Tax Code of the Russian Federation). Or if the organization uses certain fixed assets (except for buildings and structures) exclusively for R&D (clause 13 of Article 258 of the Tax Code of the Russian Federation).

Legislative standards for depreciation

Legislation for accounting purposes provides for several methods of calculating depreciation. One of 4 methods is used - linear, nonlinear, cumulative or production method. The choice of deduction scheme is made by the enterprise based on economic feasibility. The limit on the amount at which property is recognized as depreciable is 40 thousand rubles.

Taxation provides for a higher limit for classifying tangible assets as depreciable. If the cost of fixed assets or intangible assets is less than 100 thousand rubles, the asset is written off at a time. The maximum limit for classifying property as depreciable applies to objects acquired from 2021. Expenses on property with a value of lesser value are reflected as expenses at a time.

In NU, the value of an asset is written off in one of 2 options - linear or non-linear. One of the distinctive features of NU long-term assets is the possibility of applying a one-time premium in the amount of 10 to 30% of the cost. The tariff size is limited by the group of property.

Important! NU allows a one-time write-off of part of the amount in the form of a depreciation bonus. The rate is calculated based on the balance amount.

Depreciation calculation

To calculate depreciation using the nonlinear method, you need to determine:

1. Total balance of the depreciation group (subgroup). It is defined as the total cost of fixed assets that are included in the same depreciation group (subgroup). When determining the total balance, do not take into account the cost of fixed assets, for which depreciation can only be calculated using the straight-line method.

Initially, determine the size of the total balance on the 1st day of the tax period from which it was decided to apply the non-linear method. Subsequently, the total balance must be determined on the 1st day of each month. It is necessary to take into account that its size will change.

The total balance of the depreciation group (subgroup) may increase:

- when putting into operation new fixed assets included in this depreciation group;

- when the initial cost of fixed assets changes in the event of their completion, additional equipment, reconstruction, modernization, technical re-equipment.

The total balance of the depreciation group (subgroup) may decrease:

- upon disposal of a fixed asset;

- upon partial liquidation of a fixed asset.

In addition, the total balance is reduced monthly by the amount of accrued depreciation for this group of fixed assets for the previous month.

This is stated in paragraphs 2–4, 10 of Article 259.2, paragraph 1 of Article 322 of the Tax Code of the Russian Federation.

Determine the total balance on the 1st day of each month using the formula:

| The total balance of the depreciation group (subgroup) as of the 1st day of the month for which depreciation is calculated | = | Total balance of the depreciation group (subgroup) at the beginning of the previous month | + | Initial cost of fixed assets put into operation in the previous month | + (–) | The amount by which the initial cost of fixed assets increased (decreased) during completion, retrofitting, reconstruction, modernization, technical re-equipment, partial liquidation | – | The amount of accrued depreciation for the previous month (the amount of the residual value of the retired fixed asset) |

This procedure follows from the provisions of paragraphs 3, 4 and 10 of Article 259.2 of the Tax Code of the Russian Federation.

An example of determining the total balance of a depreciation group for calculating depreciation of a fixed asset using the non-linear method in tax accounting

The organization purchased five laptops in January. The cost of one laptop is 110,000 rubles. (without VAT). In accordance with the Classification approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1, the laptop belongs to the second depreciation group (useful life from two to three years).

The accounting policy for tax purposes determines that for fixed assets included in the second depreciation group, depreciation is calculated using a non-linear method.

As of January 1, the organization did not have fixed assets included in the second depreciation group. Therefore, the total balance of this depreciation group on January 1 is zero.

Laptops were put into operation in January. As of February 1, the total balance of the second depreciation group amounted to 550,000 rubles. (RUB 110,000 × 5 pcs.).

The depreciation rate for the second depreciation group is 8.8 percent.

The amount of accrued depreciation for February amounted to 48,400 rubles. (RUB 550,000 × 8.8%).

In February, the organization purchased another laptop worth RUB 102,000. (without VAT) and put it into operation in the same month.

The total balance of the second depreciation group as of March 1 is equal to: 550,000 rubles. + 102,000 rub. – 48,400 rub. = 603,600 rub.

The amount of accrued depreciation for March was: RUB 603,600. × 8.8% = 53,117 rub.

2. Depreciation rate. The depreciation rates that are applied under the non-linear method are defined in paragraph 5 of Article 259.2 of the Tax Code of the Russian Federation. For each depreciation group, fixed depreciation rates are established, which do not depend on the useful life of fixed assets (as with the straight-line method).

Calculate the monthly depreciation amount using the formula:

| Monthly depreciation amount | = | Total balance of the depreciation group as of the 1st day of the month | × | Depreciation rate for the corresponding depreciation group | : | 100% |

An example of calculating depreciation using the non-linear method in tax accounting

In January, the organization purchased a fixed asset - a laptop at a price of 102,000 rubles. (without VAT). The laptop was put into operation that same month. The accountant determined that, in accordance with the Classification approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1, the laptop belongs to the second depreciation group (useful life from two to three years). The useful life of the laptop is 36 months. The organization has no other fixed assets included in this depreciation group.

According to the accounting policy, for tax purposes, depreciation on computer equipment is calculated using a non-linear method.

The monthly depreciation rate for fixed assets included in the second depreciation group is 8.8 percent (clause 5 of Article 259.2 of the Tax Code of the Russian Federation).

Every month, the accountant determined the total balance of the depreciation group and the amount of depreciation for this group:

| Month | Total balance of the depreciation group at the end of the month | Amount of accrued depreciation by depreciation group |

| 2016 | ||

| January | 102,000 rub. | 0 rub. |

| February | RUB 93,024 (RUB 102,000 – RUB 8,976) | 8976 rub. (RUB 102,000 × 8.8%) |

| March | RUB 84,838 (RUB 93,024 – RUB 8,186) | 8186 rub. (RUB 93,024 × 8.8%) |

| April | RUR 77,372 (RUB 84,838 – RUB 7,466) | 7466 rub. (RUB 84,838 × 8.8%) |

| May | RUB 70,563 (RUB 77,372 – RUB 6,809) | 6809 rub. (RUB 77,372 × 8.8%) |

| June | RUB 64,353 (RUB 70,563 – RUB 6,210) | 6210 rub. (RUB 70,563 × 8.8%) |

| July | RUB 58,690 (RUB 64,353 – RUB 5,663) | 5663 rub. (RUB 64,353 × 8.8%) |

| August | RUR 53,525 (RUB 58,690 – RUB 5,165) | 5165 rub. (RUB 58,690 × 8.8%) |

| September | RUB 48,815 (RUB 53,525 – RUB 4,710) | 4710 rub. (RUB 53,525 × 8.8%) |

| October | RUB 44,519 (RUB 48,815 – RUB 4,296) | 4296 rub. (RUB 48,815 × 8.8%) |

| November | RUB 40,601 (RUB 44,519 – RUB 3,918) | 3918 rub. (RUB 44,519 × 8.8%) |

| December | RUB 37,028 (RUB 40,601 – RUB 3,573) | 3573 rub. (RUB 40,601 × 8.8%) |

| 2017 | ||

| January | RUB 33,770 (RUB 37,028 – RUB 3,258) | 3258 rub. (RUB 37,028 × 8.8%) |

| February | RUB 30,798 (RUB 33,770 – RUB 2,972) | 2972 rub. (RUB 33,770 × 8.8%) |

| March | RUB 28,088 (RUB 30,798 – RUB 2,710) | 2710 rub. (RUB 30,798 × 8.8%) |

| April | RUB 25,616 (RUB 28,088 – RUB 2,472) | 2472 rub. (RUB 28,088 × 8.8%) |

| May | RUB 23,362 (RUB 25,616 – RUB 2,254) | 2254 rub. (RUB 25,616 × 8.8%) |

| June | RUB 21,306 (RUB 23,362 – RUB 2,056) | 2056 rub. (RUB 23,362 × 8.8%) |

| July | RUB 19,431 (RUB 21,306 – RUB 1,875) | 1875 rub. (RUB 21,306 × 8.8%) |

After 18 months of using the laptop, the total balance dropped below 20,000 rubles. The organization did not put into operation any other fixed assets belonging to the second depreciation group.

In August 2021, the accountant included in non-operating expenses the entire amount of the residual value for this depreciation group in the amount of 19,431 rubles.

Example of calculation using the reducing balance method

, which is associated with the woodworking industry, purchased a machine for processing logs, the cost of which is 125 thousand rubles, the useful life is set to 13 years, the acceleration coefficient is 2.3.

Let's calculate the rate of decrease in the cost of the machine:

20%. Thus, the amount that will be written off from the residual value at the beginning of the year is equal to:

In the first year: 125 thousand rubles. 20% = 25 thousand rubles, therefore, the residual value is: 125 thousand rubles. – 25 thousand rubles. = 100 thousand rubles;

In the second year: 100 thousand rubles. 20% = 20 thousand rubles, therefore, the residual value is equal to: 100 thousand rubles. – 20 thousand rubles. = 80 thousand rubles, in the third year 64 thousand rubles, in the fourth year 51.2 thousand rubles. and so on. If we continue to count depreciation, then its size will decrease, but will always be greater than zero, therefore, in the last year, as already mentioned in theory, the residual value should be divided by the number of remaining months.

After 13 years, at the beginning of the 13th year, the residual value will be equal to 6.87 thousand rubles. Thus, the monthly depreciation amount will be equal to:

6.87 thousand rubles. 12 months = 0.57 thousand rubles. or 570 thousand rubles.

Thus, the woodworking machine was completely written off through depreciation over 13 years.

Depreciation period

Accrue depreciation from the 1st day of the month following the month in which the property was put into operation (clause 4 of Article 259 of the Tax Code of the Russian Federation). In the same order, calculate depreciation on capital investments in the form of inseparable improvements to fixed assets received under lease agreements or gratuitous use (loans) (clauses 6, 7 of Article 259.2 of the Tax Code of the Russian Federation).

When depreservation, completion of reconstruction (modernization) of a fixed asset, as well as when returning a fixed asset transferred for free use, depreciation is calculated from the 1st day of the month following the month in which these events occurred (clause 9 of Article 259.2 of the Tax Code of the Russian Federation ).

Accrue depreciation for each depreciation group (subgroup) until its total balance is less than 20,000 rubles. In the month following the one in which this value was achieved (provided that in the next month the total balance of the depreciation group did not increase), the organization has the right to liquidate this depreciation group (subgroup) and write off its residual value as non-operating expenses. This procedure is provided for in paragraph 12 of Article 259.2 of the Tax Code of the Russian Federation.

Answers to common questions

Question No. 1. How to achieve compliance between the depreciation values written off in accounting and accounting records?

As a result of the use of one calculation algorithm and the number of years of useful operation, a convergence of the BU and NU is achieved, which reduces the labor costs of accountants. Additionally, in order to match the values, it is necessary to waive the premium and increasing or decreasing factors. In companies with different amounts of deductions, the provisions of PBU 18/02 are used to smooth out the difference.

Question No. 2. How to use the possibility of using increasing coefficients?

Operation of property in difficult conditions determines rapid aging and wear. To compensate for accelerated wear in extended shift modes, toxic, fire hazardous, aggressive external environments and other negative conditions, an increasing coefficient is established when calculating depreciation. The right to preference must be documented.

Results

The concept of depreciation is used in accounting and is important in taxation. The value of the parameter is regulated by regulations. Due to the limit values, the company has the opportunity to reduce its tax liabilities. Management has the right to independently choose the method of calculation, however, in some situations that fall under exceptions, it is determined in accordance with the provisions of legislative acts. A business representative needs to take into account that in homogeneous groups of objects of value one calculation method should be used.

Conclusions on the importance of accounting for depreciation of fixed assets

The above analysis once again proves the importance of taking into account all aspects of the enterprise. Determining the amount of depreciation of fixed assets is the most important component of financial planning of an enterprise. These actions are especially significant at the initial stage of developing the concept of a future enterprise.

In order to correctly calculate the amount of depreciation charges and integrate these parameters into the overall financial model and business plan structure, we recommend downloading a ready-made sample of such a document. You can also turn to specialists in the field of business planning to develop a concept for your enterprise based on the individual characteristics of the business.