Russian legislation determines that maintaining accounting records is an obligation for all economic entities operating in the Russian Federation. This provision is enshrined in acts at the federal level (in particular, No. 402-FZ), therefore the company’s management must ensure a complete, continuous, and reliable reflection of all transactions in primary documents and consolidated registers.

The regulatory documents define BU objects:

- assets in the form of fixed assets and labor, intellectual property, goods, cash, financial investments, accounts receivable and other property;

- obligations and costs that arise for the entity;

- facts of economic life that arise during activity;

- sources of business financing;

- income from all sources.

How to do accounting?

Companies keep accounting records of property, liabilities and business transactions (facts of economic life) by double entry on interconnected accounting accounts.

Accounting registers are used to systematize and accumulate information contained in primary accounting documents accepted for accounting, for reflection in accounting accounts and in accounting (financial) statements.

The procedure for reflecting individual facts of economic life in accounting is established by federal and industry accounting standards, as well as by company methodological documents.

All transactions carried out in the company are documented by supporting documents drawn up in accordance with the requirements of the legislation of the Russian Federation on accounting. These documents serve as primary accounting documents on the basis of which accounting is maintained and the company's accounting (financial) statements are compiled.

Data contained in primary accounting documents (accounting objects) are subject to timely registration and accumulation in accounting registers.

Omissions or withdrawals are not allowed when registering accounting objects in accounting registers, as well as registration of imaginary and feigned accounting objects in accounting registers. An imaginary accounting object is understood as a non-existent object reflected in accounting only for appearance (including unrealized expenses, non-existent obligations, facts of economic life that did not take place). A sham accounting object is understood as an object reflected in accounting instead of another object in order to cover it up (including sham transactions recognized as such in accordance with clause 2 of Article 170 of the Civil Code of the Russian Federation).

Reserves, estimated liabilities, funds provided for by the legislation of the Russian Federation, and the costs of their creation are not imaginary objects of accounting.

Such requirements for accounting are established in Part 3 of Art. 6, parts 2 and 3 art. 10, part 2 art. 12 of Law No. 402-FZ.

Important! Micro-enterprises and non-profit organizations have the right to conduct accounting using a simple system (that is, without using double entry), having prescribed such a procedure in the accounting policy (clause 6.1 of PBU 1/2008, part 4 of article 6 of Law No. 402-FZ).

Starting from 2013, the forms of primary accounting documents used (with the exception of government organizations) are determined by the head of the economic entity (clause 4 of article 9 of Law No. 402-FZ). These can be unified forms or your own, developed in compliance with the mandatory details of the primary documents. Before this date, when using unified forms, it was impossible to delete the existing details of such documents; it was only possible to supplement the form with new lines or columns.

At the same time, as practice shows, few economic entities have abandoned the use of the usual unified forms for which most accounting software products are designed.

And only for registration of business transactions for which unified forms of primary accounting documents are not provided, companies independently develop the necessary forms of documents, which are approved by separate administrative documents for the company (usually an appendix to the company’s accounting policy).

For example, to account for production costs, a route sheet is used, which is generated in the software product “1C: Enterprise 8.3” and contains the following information:

- Order number;

- division carrying out order fulfillment;

- basis of order (specification number).

Primary accounting documents can be compiled electronically using an electronic signature in the prescribed manner. A primary accounting document drawn up in electronic form can be accepted for accounting only if it is signed with the electronic signature of the responsible persons in compliance with the requirements and conditions of Art. 6 of the Federal Law “On Electronic Signature” dated April 6, 2011 No. 63-FZ.

A primary accounting document signed with a non-qualified electronic signature can be accepted for accounting if the use of such a signature is provided for by agreement of the parties (Letter of the Federal Tax Service of the Russian Federation dated November 24, 2011 No. ED-4-3 / [email protected] ).

Results

The requirements that modern accounting must meet are aimed primarily at increasing the reliability of the information contained in the financial statements. They must be adhered to by all persons responsible for accounting.

For information about who may be interested in accounting data, read the article “Users of accounting information - who are they?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Who is completely exempt from accounting?

Completely exempt from accounting:

- an individual entrepreneur (if he keeps records of income or income and expenses and (or) other objects of taxation or physical indicators in the manner established by Russian tax legislation);

- A branch, representative office or other structural unit of a company located on the territory of Russia, created in accordance with the legislation of a foreign state (if they keep records of income, expenses and (or) other objects of taxation in the manner established by tax legislation).

Such rules are established by clauses 1 and 2 of Article 6 of Law No. 402-FZ.

Disagreements between the chief accountant and the director

Situation: what should the chief accountant do if disagreements arise between him and the head of the organization regarding the reflection of a particular transaction in accounting?

The chief accountant needs to request a written order from the manager to formalize the controversial transaction.

It is with the written order of the head of the organization that one can reflect or not reflect accounting objects and take into account (or not) the data of primary documents in a situation where there is a disagreement on this issue between the director and the one who is responsible for accounting. In this case, the manager is solely responsible for the accuracy of the reflection of the financial position, financial result, cash flow and other information.

This conclusion follows from Part 8 of Article 7 of the Law of December 6, 2011 No. 402-FZ.

Without a written order from the manager, dubious documents should not be accepted for execution.

Situation: how to transfer affairs when changing the chief accountant?

If the chief accountant resigns, he is obliged to transfer to his successor all documents and material assets for which the accounting department is responsible. In practice, they usually draw up an act of acceptance and transfer of documents or a special inventory. At the same time, keep in mind that accounting documents, in particular primary reports, registers, accounting policies, audit reports, etc., must be stored for at least five years (Article 29 of the Law of December 6, 2011 No. 402-FZ). That is, all such documents for such a period must be included in the inventory or in the act.

Who can do accounting in a simplified way?

“Kids” (small businesses) can do accounting in a simplified way.

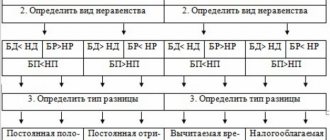

However, the situation changes if the “kids” are subject to mandatory audit. In this case, the company is faced with the need to ensure the maintenance of accounting records in full, including the formation of differences between accounting and tax accounting in the accounting accounts (i.e., apply PBU 18/02, approved by Order of the Ministry of Finance of the Russian Federation dated November 19, 2002. No. 114n), create a reserve for vacation pay (i.e. apply PBU 8/2010, approved by Order of the Ministry of Finance of the Russian Federation dated December 13, 2010 No. 167), etc.

The simplified method can be used by organizations that have received the status of participants in the Skolkovo project and non-profit organizations (clause 4 and clause 5 of Article 6 of Law No. 402-FZ).

Internal control

The organization is obliged to organize and carry out internal control of the facts of economic life (Part 1, Article 19 of the Law of December 6, 2011 No. 402-FZ). How exactly it is necessary to organize such control is not explained in the legislation. In practice, for this purpose, an internal control service of the organization is usually created or a responsible employee is appointed. Specify the functions and tasks in the job descriptions of employees who are responsible for internal control and in the Regulations on Internal Control.

Entrust your accounting to professionals - specialists!

Errors and inattentive attitude of company management to accounting issues can lead to penalties. It is extremely important to either provide the staff with a sufficient number of specialists with the necessary experience, or, which is more reliable, simpler and more profitable for the manager, to transfer the solution of these tasks to a third party.

Important! offers accounting services and solutions to other issues related to the work of accounting, with a guarantee of quality. Choose a modern offer for your business!

Organizational structures of accounting

Accounting, which is an independent structural unit of the enterprise, is headed by the chief accountant.

The structure of the accounting apparatus depends on the structure of enterprise management, production technology, the volume of accounting work and the availability of technical accounting tools. In this regard, in practice, three main types of accounting organizational structure have emerged (Fig. 5).

- Linear

- Functionally

- By structural divisions

Rice.

5. Options for the structure of the accounting department of economic entities In a linear organization, all accounting employees report directly to the chief accountant. This accounting structure is used in small enterprises with a staff of 7-9 people.

When organizing accounting, departments (groups) are created according to the functional basis of the accounting work performed: for calculating wages; for accounting of material assets, etc., headed by senior accountants. In this case, the orders of the chief accountant are transmitted to senior accountants of the relevant departments (groups), who identify specific performers and control the execution of work. This accounting structure is used in most medium-sized and some large enterprises.

An approximate structure of accounting according to the functional characteristics of the accounting work performed is shown in Fig. 6.

- A material group responsible for the acquisition of material assets, their receipt and expenditure. In the same group, as a rule, fixed assets are recorded

- The wage accounting group, which records the labor costs of workers, calculates wages to employees, controls the interpretation of the wage fund, records all settlements with employees of enterprises, the budget, the social insurance fund and other departments related to wages

- Finished products accounting group, where finished products are accounted for in warehouses and sold

- Production and costing group, where production costs are recorded, product costs are calculated, the results of in-plant cost accounting are identified, and production reports are compiled

- General group, whose employees keep records of other transactions and the General Ledger, prepare a balance sheet and other forms of financial reporting

- Other accounting groups, for example, capital construction group, housing and communal services group, etc.

Rice.

6. Composition of the organizational structure of accounting by functional basis At large enterprises, in addition to those listed, there are usually groups (departments) for packaging accounting, fixed asset accounting, a settlement group in which accounts of settlements with debtors and creditors are kept, a summary-analytical group, etc.

When organizing accounting departments in the context of structural divisions of an enterprise, accounting departments are created in each production workshop; in every auxiliary and service production. In this case, senior accountants of such accounting departments are appointed, who independently organize accounting in their departments. This structure of organization of the accounting apparatus is used in particularly large enterprises and production associations.

When establishing the structure of the accounting apparatus and the forms of its communication with individual divisions of the enterprise, it is necessary to resolve the issue of centralization or decentralization of accounting.

With a centralized form of accounting organization, the accounting apparatus of the enterprise is concentrated in the central accounting department, where all synthetic and analytical accounting is carried out on the basis of primary and consolidated documents coming from individual divisions (shops, departments, etc.). In the divisions themselves, only the initial registration of business transactions is carried out.

In a decentralized form of accounting organization, the accounting apparatus is dispersed among individual production divisions of the enterprise, where synthetic and analytical accounting is carried out and balance sheets and reports of factories, workshops or departments are compiled. In this case, the central accounting department checks shop balances and reports, draws up a consolidated balance sheet and reports for the enterprise, and also monitors the organization of accounting in individual divisions of the enterprise.

Practice has shown that centralization of accounting provides more effective leadership and control on the part of the chief accountant, allows for a more expedient distribution of labor among accounting employees, and more efficient use of calculating machines. Therefore, decentralization of accounting is allowed only in very large enterprises. Basically, enterprises use a centralized accounting system. However, some enterprises use partial decentralization of accounting, in which in production departments, in addition to compiling primary documents, they maintain analytical accounting using separate synthetic accounts, record production costs, calculate the actual cost of products, etc. Complete accounting is not maintained in departments and there is no balance sheet. is being compiled.

Relationships between accounting and structural divisions

The work of the accounting apparatus is connected with the activities of all workshops and departments of the enterprise, since they supply all the data necessary for accounting (Table 1).

Table 1

Types of structural divisions of the enterprise with which the accounting department interacts

| Structural subdivision | Composition and name of documents submitted by departments |

| Workshops | Documents on individual business transactions (for production, etc.), production reports on costs, etc., inventory reports, etc. |

| Warehouses | Documents on the movement of inventory (receipts, issues, movements), etc. |

| Planning financial department | Approved development of planned indicators for the types of activities of the enterprise (estimates of expenses and income), etc. |

| Labor and Salary Department | Regulations on wages and bonuses for certain categories of workers, changes in rates, staff salaries, etc. |

| Human Resources Department | Lists of persons (orders) on enrollment (acceptance) for work, dismissal, vacation, movement within the enterprise, etc. |

| Chief Mechanic Department | Documents on the movement of equipment and its repair, on the operation of vehicles, etc. |

Accounting provides systematic information about the work of the enterprise and its individual divisions to managers, chief specialists of the enterprise, managers and other users.