What does zero reporting include?

The need to submit zero reporting for individual entrepreneurs is due to the fact that it is on the basis of these documents, drawn up by the entrepreneur himself, that the state, represented by the inspections of the Federal Tax Service (FTS), determines whether he has correctly calculated and paid the tax.

The recipient of zero reporting is the tax office

Entrepreneurs often think that if they have no profit and the base on which the tax is determined is zero, then they have nothing to report. However, it is not.

Zero reporting usually means tax reporting . An entrepreneur must report to the Federal Tax Service on taxes and insurance contributions. And it is also necessary to submit calculations to the Pension Fund (PFR), Social Insurance Fund (SIF), and in some cases, statistical authorities. But these forms have their own specifics, as a result of which there is no need to talk about zero reporting in relation to them:

- An entrepreneur is required to make payments for himself to the Pension Fund and submit reports on them, regardless of the financial result, and the amount of payments for businessmen with an income from zero to 300,000 rubles per year is fixed;

- obligations to make contributions to the Pension Fund and the Social Insurance Fund for hired workers and to report on this are determined solely by the availability of personnel, and if there is none, there is nothing to report on.

In turn, the set of documents that includes the tax reporting of an entrepreneur is determined by the taxation system he applies.

Today, the following tax system options are available to individual entrepreneurs:

- general (OSNO);

- simplified (USN);

- unified tax on imputed income (UTII);

- single agricultural tax (USAT);

- patent.

Zero reporting is usually submitted by individual entrepreneurs to OSNO and simplified tax system

A complete set of reports may include:

- declarations on taxes paid in accordance with the chosen taxation system;

- book of income and expenses.

The income and expense accounting book is filled out by all entrepreneurs, except UTII payers. In 2021, KUDiR can be maintained electronically and does not need to be certified by the tax office. But be prepared to present the KUDiR in printed form at the first request of the tax office. It is not necessary to certify the paper version with the IP seal.

In a narrow sense, tax reporting in general and zero reporting in particular means only documents that are subject to submission to the Federal Tax Service inspection within the prescribed period, that is, tax returns. But it is also necessary to keep a book of income and expenses.

In 2021, entrepreneurs using OSNO and simplified tax systems are recommended to maintain KUDiR

Zero reporting forms

There are no separate forms for zero reporting of individual entrepreneurs in 2021. Most often, a standard declaration form is used for the corresponding type of tax, but the columns allocated to indicate income reflect their absence.

To submit zero reporting, a standard tax return form is used.

However, if the entrepreneur:

- is recognized as a taxpayer for one or more taxes;

- does not carry out operations that result in the movement of funds in his bank accounts (at the organization’s cash desk);

- and has no objects of taxation for these taxes...

... then he can submit a single (simplified) tax return for these taxes.

With the book of income and expenses for those who must fill it out, the situation is similar: it also reflects the lack of income.

The Tax Code of the Russian Federation does not contain the concept of zero reporting at all. And in everyday life, this phrase means a declaration with zero income indicators.

Zero reporting on OSNO

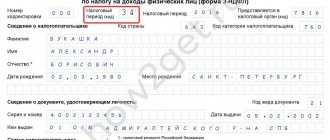

An individual entrepreneur using the general taxation system must submit two documents to the tax office:

- declaration on payment of personal income tax form 3-NDFL;

- value added tax (VAT) declaration.

If the reporting is submitted as zero, only the title page is filled out in both declarations. In section 1, the following are indicated in the appropriate columns OKTMO and KBK: 18210301000011000110 for VAT and 18210102020011000110 for personal income tax. The remaining lines must be filled with dashes.

The VAT return is submitted quarterly by the 25th day of the first month of the new quarter. Form 3-NDFL - once a year until April 30 of the following year.

Zero reporting under simplified tax system

With a simplified taxation system, tax reporting subject to submission to the Federal Tax Service is limited to a single tax declaration in connection with the application of the simplified tax system. It is submitted once a year - until April 30 of the following year.

The procedure for filling out a zero declaration is the same as for individual entrepreneurs on the general system:

- the title page is filled out;

- OKTMO is entered in section 1.1 and the taxpayer attribute and the rate for the object in section 1.2 for those paying 6% of income;

- those paying 15% of the difference between income and expenses indicate OKTMO in section 1.2 and the tax rate in the corresponding paragraphs of section 2.2;

- dashes are placed in all other columns.

Zero reporting for UTII and patent

A feature of these tax regimes is that zero reporting is impossible in principle. After all, the specificity of UTII and patents is that entrepreneurs using these taxation systems transfer UTII or the cost of the patent to the budget, regardless of their financial results.

An individual entrepreneur with a patent does not have to submit any tax returns. His obligations in this regard are limited to timely payment of the cost of the patent and maintaining a ledger of income and expenses. With its help, tax authorities will be able, if necessary, to check whether the income of such an entrepreneur has not exceeded the maximum barrier, after which the right to use the patent is lost.

As for UTII payers, they are required to submit a declaration every quarter before the 20th day of the first month of the next quarter and transfer tax to the budget by the 25th. Including for reporting periods in which they had no profits or did not operate.

Let us emphasize: even if no activity was actually carried out and real income for the period was zero, the single tax is paid based on the potential income received (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). Accordingly, it is impossible to submit a zero declaration and not pay UTII (Letters of the Ministry of Finance dated September 14, 2009 No. 03–11–06/3/233, dated July 2, 2012 No. 03–11–11/196).

Photo gallery: UTII declaration for individual entrepreneurs

Sheet 1 of the UTII declaration is the title page; the full name of the entrepreneur and address are indicated on it

UTII declaration: sheet 2 contains the amount of imputed tax broken down by OKATO codes

UTII declaration: sheet 3 shows the calculation of tax amounts for certain types of activities

UTII declaration: sheet 4 shows the amount of insurance contributions by which the amount of tax payable is reduced

The importance of filing your return on time

The law imposes obligations on entrepreneurs from the moment of registration with the Federal Tax Service. An individual entrepreneur is not a legal entity, it is an individual who is engaged in entrepreneurial activities. After filing documents for registration, you have to wonder at what time and how to file a tax return? Whether you need to do this once a year, once a month or quarterly, this is worth talking about in more detail.

To avoid paying a fine, the declaration must be submitted on time

How and where to submit tax reports

In 2018, the recipient of individual entrepreneurs’ tax returns, including zero ones, remains the Federal Tax Service inspectorate at the entrepreneur’s place of residence.

The place of residence of an individual entrepreneur means the address where he is registered, or, as they say in the old fashioned way, registered. An entrepreneur can actually live and conduct business anywhere, but must send reports to the tax office at his place of registration, even if he has registration at his place of residence somewhere else.

To prepare and submit reports, including zero reports, businessmen often use the services of a specialized organization, which will have to be paid for. Online accounting services (for example, “Elba”, “My Business”, “Deal 24”, etc.) will help you generate declarations, or you can solve this problem entirely on your own.

How to submit zero reporting for individual entrepreneurs yourself

There are three options:

- personally take the documents to the tax office;

- send them there by mail;

- submit via the Internet.

It is necessary to take into account that starting from January 1, 2014, VAT payers (including those who are tax agents) can submit tax returns only electronically via telecommunication channels. The Federal Tax Service has not accepted paper payments for three years now.

When visiting the Federal Tax Service in person, you will need to have a second copy or photocopy of each document submitted. The inspectorate staff will mark them with acceptance.

Instead of an entrepreneur, his authorized representative can submit documents to the Federal Tax Service. To do this, you need to issue a notarized power of attorney for such a person, a copy of which is submitted to the tax office along with the declaration, and reflect the fact of submission of reports by the authorized person in the appropriate section of the title page.

By mail, documents are sent by registered mail with a description of the contents and notification of delivery.

To independently submit documents via the Internet, an entrepreneur will need an electronic digital signature (EDS), which is used to certify each of them, and an individual entrepreneur’s personal account on the government services portal or the website of the Federal Tax Service of Russia.

A “flash drive” with an electronic digital signature relieves entrepreneurs of many problems associated with submitting reports to the Federal Tax Service

Failure to provide 2-NDFL and 6-NDFL certificates

For such oversights, various sanctions are prescribed: the absence of a timely submitted 2-NDFL on the inspector’s desk is fraught with sanctions in the amount of 200 rubles for a document not provided and a fine of 300 to 500 rubles, which must be paid to officials of the organization. If the employer forgot to submit 6-NDFD to the fiscal authorities, the amount of the fine will be 1,000 rubles for each month, including incomplete ones, starting from the date set for its submission.

If an organization acts as a tax agent, penalties are applied, as a rule, to its managers

Don’t know how to fill out forms 2-NDFL and 6-NDFL ? You can familiarize yourself with these topics on our portal. Step-by-step instructions, sample forms, and how to avoid basic mistakes when filling out a declaration.

Reporting to the Federal Tax Service on insurance premiums

Since an individual entrepreneur is obliged to make contributions to the Pension Fund for himself, and if he has employees, for them, regardless of the financial result of his business activity and the very fact of its implementation, reporting on insurance contributions for pension insurance, by definition, cannot be zero.

If the tax reporting of an individual entrepreneur is zero, this does not affect the procedure for submitting reports on payments to the Pension Fund - it remains the same as for an entrepreneur who has something to write in a tax return.

Individual entrepreneurs are obliged to pay contributions to the Pension Fund and report on this, at least for themselves, even with zero income

A businessman’s obligations to the Social Security Fund are affected only by whether he has employees or not. If they are not there, he does not need to report to the FSS. If there is, the procedure, as in the case of the Pension Fund, is the same as for an individual entrepreneur submitting not zero, but regular tax reporting.

Video: tips for successfully submitting zero reporting on insurance premiums

Penalty for failure to provide interim tax reporting

For some types of taxes, taxpayers are required to file interim reports. For example, all organizations using the simplified tax system must submit reports regarding income tax by March 28. If it is not provided, the monetary equivalent of the fine varies depending on the following factors:

Table 1. Amount of fine depending on the situation

| Situation | Amount of fine |

| If payment is transferred to the treasury on time | You should transfer 1000 rubles as a fine |

| If both filing and payment of tax are late, the penalty will be 5% of the total amount for each full and partial month of delay. | The fine will be 5% of the total amount for each full and partial month of delay |

A 30% fine, which is the maximum allowable fine for failure to file a return, must be paid if a company is more than 6 months late in filing its returns.