published: 11/16/2016

Despite the desire of most counterparties to conscientiously fulfill their obligations, it is not always possible to fulfill them in strict accordance with the terms of the contract. This may be expressed in violation of deadlines for fulfilling obligations, the volume and quality of fulfilled obligations. For this reason, most contracts provide for liability for breach of obligations, which is established by law or directly stated in the contract. In this article, only a penalty will be considered as a penalty.

What does a penalty (fine) mean and is it necessary to withhold personal income tax from it?

The definition of this concept is given in Art. 330 Civil Code of the Russian Federation. The article clearly states that a penalty (as well as a fine, penalties) is understood as the amount of money that the debtor must pay to the creditor in the event of failure to fulfill or improper fulfillment of its obligations. The amount of this amount is determined by law and agreement. It should be clearly understood that this is not compensation for damage, i.e. this payment is not compensatory in nature.

It should be noted that both the penalty and the fine can be collected pre-trial and through the court. In the first case, the payment is made by the debtor voluntarily, in the second - forcibly. For example, if the developer did not fulfill the terms of the equity participation agreement and did not deliver the house on time, then he must pay the shareholder a penalty, and in some cases a fine. He can do this voluntarily, at the written request of the second participant of the DDU, i.e., the shareholder. If he does not do this, then the shareholder has the right to file a lawsuit against him to collect a penalty. Then they talk about forced collection of the penalty by court order.

Regardless of how the forfeit (fine) is paid to the creditor, voluntarily or compulsorily, in both the first and second cases it is recognized as his income. And income, as established by the Tax Code of the Russian Federation, is subject to personal income tax. This position is confirmed by the relevant legislative norms (see table below).

| Art. 41 Tax Code of the Russian Federation | Art. 209 Tax Code of the Russian Federation | Art. 217 Tax Code of the Russian Federation | Art. 210 Tax Code of the Russian Federation | Art. 208 Code of Civil Procedure of the Russian Federation |

| What is recognized as income | Object of taxation | Non-taxable income | What is included in the tax base | Indexation of amounts collected by the court |

Thus, penalties (fines) collected through the court are monetary income of an individual, since they are recognized as economic benefits. And all income received by an individual in kind or in cash is included in the tax base. In addition, penalties and fines are not included in the list of income that is exempt from personal income tax.

It follows that penalties and fines collected by the court, as well as their indexed amounts, are always subject to personal income tax. This position is recognized by the Federal Tax Service and the Ministry of Finance of the Russian Federation, is confirmed by legal norms and is not subject to challenge at the moment. In particular, in the letter of the Ministry of Finance of the Russian Federation No. 03-04-05/19869 dated March 29, 2021, it is noted that all sanctions that are provided for by the current Federal Law of the Russian Federation No. 2300-1 dated February 7, 1992 (as amended on March 18, 2021) “On the protection of rights consumers” are exclusively punitive in nature. They are not considered compensation. Since they form a property benefit for consumers, they are included in the taxable income of an individual.

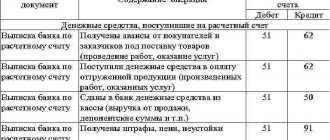

Tax accounting for the recipient of the penalty: income tax

The main points that will help to correctly reflect the penalty are given in the table:

How to correctly draw up an agreement, include sanctions in it, and also about many other things related to consolidating economic relations, the materials in our special section tell you.

Non-personal income tax amounts collected by court decision

So, taking into account the norms of the Tax Code of the Russian Federation, it is determined that penalties and fines paid to an individual by court decision are taxable amounts. At the same time, often the plaintiff, when going to court, demands not only the recovery of these amounts, but also compensation for moral damage (physical, moral suffering), expenses and losses incurred, and lost profits. Accordingly, the question arises whether it is necessary to pay personal income tax on these amounts, i.e. whether they are included in the taxable income of an individual.

As mentioned above, the main list of payments that are exempt from taxation is indicated in Art. 217 Tax Code of the Russian Federation. This implies:

- Compensation for moral, as well as actual, real damage is a compensation payment provided for by law. Therefore, personal income tax is not withheld from her.

- Lost profits are lost income that an individual could have received if his rights had not been violated (in relation to Article 15 of the Civil Code of the Russian Federation). Therefore, personal income tax must be calculated and paid from it.

Important! Legal costs and other related expenses (such as state fees, postage, etc.) that occurred during the consideration of a claim for the collection of a penalty or fine are not subject to personal income tax. Reason: clause 61 of Art. 217 NK.

The following standard situation can be given as an example. A citizen purchased a product that turned out to be defective and of poor quality. He spent his own money to eliminate them. In this situation, he has the right to demand compensation from the seller for damages and moral damages. If he refuses to compensate for the damage, the buyer can go to court.

Thus, through the court it is possible to obtain compensation for real damage (expenses that were spent on eliminating a defect, defect), as well as moral damage. In this case, the guilty person (seller) reimburses all compensation amounts, but the buyer (plaintiff) pays personal income tax on them.

If a company compensates for damage to a citizen

The organization may find itself in the opposite situation. The court may oblige it to pay a penalty to the counterparty or compensate the citizen buyer for the damage caused.