Astral

November 1, 2021 16328

Taxes

For violation of tax legislation, the taxpayer may bear administrative liability in the form of a monetary penalty - a fine. The tax authority notifies the payer by requiring the payment of a fine. According to paragraph 1 of Art. 45 of the Tax Code of the Russian Federation, either the debtor can pay the fine himself, or a third party can do it for him. For individuals, payment is provided through a Personal Account on the Federal Tax Service website or through a bank branch. In addition, the taxpayer can use online banking services, for example, Sberbank Online. We will tell you more about this method.

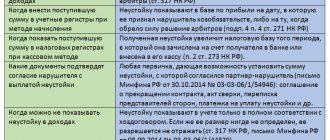

Basis of payment when paying a fine to the tax office according to the decision of the Federal Tax Service

Article 199 of the Criminal Code of the Russian Federation applies to officials - managers and accountants of organizations that prepare financial statements.

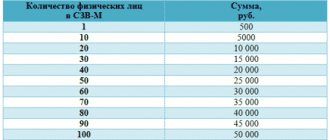

Sometimes employees who participate in fraudulent actions against the Federal Tax Service can be recognized as assistants. Grounds: non-payment of taxes in the amount of over 15,000,000 rubles for three years. Punishment is a fine of up to 500,000 rubles* or imprisonment for up to 6 years. Let's look at how to fill out a payment order to pay an administrative fine using a specific example. In IP "Zvezdin I.L." An audit was carried out, as a result of which the tax inspectorate determined that the company did not pay additional VAT. Based on these violations, the authorities sent demand No. 14-44/34124 dated January 28, 2020 for the payment of arrears, penalties and fines. Document UIN 42214533211348892011. Payer details:

How to avoid paying too much

When processing a claim, it is important to know about the peculiarity of indicating amounts in the “Arrears” field. If the amount is marked with an asterisk, then you do not need to pay it - this information is for reference only.

When you create a payment order in Externa, you will never include an amount with an asterisk in it by mistake. This amount will be in the general list, but you cannot select it to generate a payment order.

Payment of an administrative fine: procedure and available methods

Additional liability does not exempt you from paying the imposed fine. If the case is transferred to the bailiffs, the property of the debtor may be seized. For example, if a vehicle is seized, its owner no longer has the right to sell it or deregister it. Rights are restored only after the debt is eliminated.

In addition, details can be provided by Sberbank employees. All branches have information stands with examples of correctly filling out payment receipts sent to government departments, as well as with detailed information about paying fines.

How to pay an administrative fine through Sberbank online

- go to the Sberbank website online;

- open your personal account;

- find the “Payments and Transactions” section;

- then you need to open the link “Staff Police, taxes, half tires, budget payments”;

- if a traffic police officer issued a fine to you, then follow the appropriate link and fill out all the details, you will find them in the receipt;

- if the fine was issued by another government agency, then you can find it through the search bar using the TIN number;

- then fill out the form and submit payment.

Surely, in the same way, you can use the Internet banking of other financial institutions or payment services. Only here there is an essential condition: you definitely need details to pay a fine for an administrative offense; you can only find them in the receipt. But it happens that there is no receipt, then you have to look for another way.

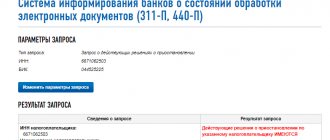

We pay the tax service fine

Fines, unlike taxes, are “secret” from taxpayers. Services such as government services or the Personal Account of the Federal Tax Service will notify you about them only when the fine becomes a debt , having increased by two (!) times the original amount. True, as readers rightly suggest, this does not apply to penalties accrued for late payment of taxes. It is visible in the personal account.

Therefore, make sure you find out about the fine imposed on time.

To do this, indicate your current phone number in your personal tax account. The usual operating procedure of the Federal Tax Service is that they notify exclusively by telephone. The payer's email is not used at all. The written document is sent after the consideration of your administrative offense has already been completed. At this stage, it is more difficult to do something with the size of the fine. So it's in our best interest to be informed from the very beginning.

Find mitigating circumstances.

During a telephone conversation with a tax officer, immediately try to clarify why you are being fined and under what article of the Code of Administrative Offenses (CAO). It makes sense, before considering your case, to clarify the possible amount of the fine and submit documents mitigating your guilt. For example, delays in notifying the Federal Tax Service may be explained by your absence from Russia, serious illness or other reasons. In this case, you will no longer face the upper limit of liability or the violation itself will be canceled. Then, study the protocol that you will receive after the review.

If everything is correct, then...

Is it easy to pay the fine?

Oh, don’t rush to answer!..