An obligation that an organization will have to repay, but it is unknown in what time frame and in what amount, is recognized as an estimated liability (clause 4 of PBU 8/2010). Therefore, as of the reporting date, the amount of the estimated liability is determined approximately and reflected by creating a reserve in account 96 “Reserves for future expenses.”

According to PBU 8/2010, an organization's estimated liability with an uncertain amount and (or) deadline may also arise from court decisions.

Read also “PBU 8/2010: estimated liabilities”

Thus, if an organization participates in a legal dispute, which may result in the payment of a fine, penalty, or penalty for violation of tax laws, the corresponding amount of the estimated liability is recognized in the accounting records.

The amount of the recognized estimated liability is attributed to the type of expenses to which the amount of the corresponding tax is attributed (clause 8 of PBU 8/2010). For example, if an estimated liability is recognized in connection with a violation of the procedure for paying income tax, it must be debited to account 99 “Profits and losses”. The financiers focused attention on this in their recommendations to audit organizations for conducting an audit of annual reports for 2021 (attachment to letter dated December 28, 2016 No. 07-04-09/78875).

As a matter of fact, with these conclusions the authors of the recommendations exhausted the “evaluative” topic. We will talk about the rules for reflecting “uncertain” obligations in more detail.

What is an estimated liability?

Provisions are an existing obligation of an enterprise that has an uncertain amount or deadline. If available, a reserve must be created.

If the indicator does not appear in the reporting, this will lead to an overstatement of net profit. For this reason, financial statements will not provide objective information about the position of the enterprise. All this can lead to negative consequences: an increase in dividends and a deterioration in the financial condition of the organization.

Are provisions for doubtful debts classified as provisions?

Estimated liabilities differ significantly from other provisions. Let's look at examples:

- The company plans to repair equipment; this will require funds. A reserve of estimated liabilities will not be created for them, since repair work is not the responsibility of the organization. The company may change its mind about carrying out repairs.

- The reserve also does not need to be organized in the presence of ordinary obligations. The company ordered the goods. The products arrived, but the company did not pay for the contractor’s services. In this case, a reserve for estimated liabilities will not be created, since the existing debt is payable. It does not correspond to an important feature of an estimated liability - uncertainty of the amount and timing. In this example, the company knows how much money it owes and when it needs to be repaid.

- Estimated liabilities and estimated provisions differ. The latter represent an adjustment to the balance sheet indicators of assets associated with the receipt of new information. Valuation reserves are created in the presence of doubtful debts, a decrease in the value of inventories, and a decrease in prices for financial deposits. These indicators are not reflected in the balance sheet. The indicators under consideration will be recorded in the liability side of the balance sheet.

- Provisions that are created on the basis of undistributed earnings will also not be classified as provisions.

Difficulties often arise when fixing OO. To prevent errors, it is important to distinguish an estimated liability from other types of provisions.

Are estimated liabilities reflected in tax accounting ?

Principle and terms of creation

The provisions of Regulation No. 8/2010 do not apply to legal relations formed on the basis of contracts and agreements, with the exception of employment contracts. The specified rules cannot be applied to reserve capital, funds, and adjustment entries for the formation of the company’s profit. This standard is applied equally by all commercial and non-profit enterprises, excluding municipal, federal, and credit institutions.

Uncertain obligations indicate the stability of the enterprise, the effectiveness of the application of payment and settlement policies, and the feasibility of implementing the business plan. Such expenses are formed on the basis of the requirements of regulatory legal acts of the state and municipality. Debts are formed as a result of thorough actions of the company’s management, when counterparties are obviously aware of the likelihood of debt formation and the fact of its execution within a specified time frame.

For a detailed understanding of the principle of forming obligations, let's consider two examples. Let's say a contractor is installing building structures. In order for the customer to receive guarantees of high-quality and safe work, the contractor undertakes to respond to claims within a year from the date of delivery of the facility. Since in practice various defects very often arise that require real correction, the debtor will prefer to create a coverage reserve in advance.

As a second example, let’s imagine the business policy of retail outlets. Managers strive to attract the maximum possible flow of customers and increase turnover, therefore they offer dissatisfied consumers compensation and refund payments beyond the legal period. A very frequent promotion is the return of the cost of goods, thirty days from the date of purchase.

If the quality of the product meets legal requirements, then the seller has nothing to fear. But in reality, there are always demanding buyers who want to cancel the deal. It is for such exceptional situations that the accounting service of the retail outlet will reflect the accrual of liabilities.

The reserve is created to compensate for unprofitable transactions

An additional example of the need to open a compensation base is obviously unprofitable contracts. In a difficult economic and market situation, it is not uncommon to conclude transactions that will not bring profit, but, on the contrary, can drive the debtor into a loss. Refusal to fulfill contractual obligations is fraught with a fine, and one-time fulfillment of the creditor’s demands indicates a deterioration in the financial position of the company. The way out of such a vicious circle is commitment.

Formation conditions

Estimated liabilities for uncertain expenses and payment for upcoming employee vacations cannot appear in accounting on their own. Such amounts are calculated artificially, according to a certain order. The enterprise actually has obligations from previous reporting periods that are subject to fulfillment in the following time periods.

For example, a company rented a car from another company and agreed to return the vehicle in a repaired form in the future. The lessee will use the asset for a long time, but now he must create a reserve or reserve to cover obligations. That is, at the time of returning the car, restoration must be carried out, which will require a certain amount of money.

A prerequisite for the formation of obligations is a high risk of unprofitability of the enterprise when fulfilling the principal debt. If the company pays off the potential arrears, then the probability of losses according to calculations should be up to fifty percent. An additional criterion for creating a security base is a clear justification for the planned expenses.

The emergence of estimated liabilities

Estimated liabilities may arise due to the following factors:

- Court decisions or agreements with relevant conditions. For example, a company enters into an agreement with its clients, according to which, if services are provided with insufficient quality, the money will be returned. Customers usually have complaints, so it makes sense to create a reserve. These will be estimated liabilities, since there is a high probability of their occurrence, but the exact amount is unknown.

- Actions that are not recorded in legal documents, but oblige the company to certain obligations. For example, a store posted an announcement that it would return money to customers if the purchased products turned out to be of poor quality. Despite the fact that this obligation is not formalized in any way, the store bears its consequences in connection with a public statement.

- A reserve has been formed for restructuring. It can be created only if the following conditions are met: there is a restructuring plan, interested parties are notified about the procedure.

- A deliberately unfavorable agreement was concluded. The company's managers are confident that they will suffer losses in connection with it. The LLC must be reflected in accounting in the same month in which the agreement is executed.

What are the features of inventory of estimated liabilities ?

Estimated liabilities are indicated in accounting only if the following conditions are met:

- Financial obligations cannot be avoided. For example, a company rents premises that, according to the lease agreement, need to be renovated. While repair work has not yet been carried out, it cannot be avoided.

- The probability of incurring expenses exceeds 50%.

- There is information that allows you to estimate the costs of fulfilling the obligation.

To form a reserve, all of the above conditions must be present. If one of them is not met, a contingent liability is recognized. This indicator does not need to be recorded. It is stated in the notes to the report.

Provision for doubtful debts is now mandatory

(!) Previously, Regulation No. 34n only established the right of organizations to create such a reserve. And formally, each organization decided independently whether to do this or not. Although, by and large, the obligation to create such a reserve follows from the requirement of prudence (Clause 6 of PBU 1/2008 “Accounting Policies of the Organization”). But now this issue has been finally resolved. And if an organization has doubtful accounts receivable, then it is obliged to create a reserve for doubtful debts (Clause 70 of Regulations No. 34n; paragraph 16, paragraph 1 of the Appendix to Order No. 186n). (!) The very concept of doubtful debt has also been changed. Now such receivables are recognized as any receivables that have not been repaid or with a high degree of probability (these four words did not exist before) will not be repaid within the terms established by the agreement and are not secured by appropriate guarantees. As you can see, now debt can also be considered doubtful, the repayment period of which has not yet arrived, but there is reason to believe that it will still not be repaid on time. For example, if your debtor has disappeared or you find out that he does not pay his other creditors, then you have grounds to create a reserve for his even non-overdue debts. But the opposite rule also applies. If you are confident that the overdue debt will be repaid, then there is no need to create a reserve for it. (!) Now there is no mention that reserves are created only for payments for “products, goods, work and inventories”

Accounting Recommendations

Simplified accounting

Bringing to administrative liability for violation of accounting and reporting requirements

Accounting for estimated liabilities

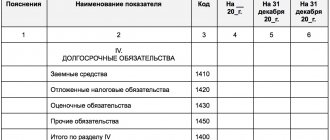

Estimated liabilities are recorded on account 96 “Reserves for future expenses”. The amount may be reflected both in the list of specific expenses (for example, expenses for repairs under warranty) and in the list of other expenses.

OO accrual transactions will look like this:

- DT 20 (23, 25, 26, 44) CT 96 “Reserves for future expenses”

Repayment of obligations will be reflected as follows:

- DT 96 “Reserves for future expenses” CT 10, 76, 70, 90

The selected accounts are determined by the transaction performed.

Example

The company is involved in litigation. It is expected that he will have to pay 80,000 rubles. This will be reflected as follows:

- DT 76 “Settlements with various debtors and creditors” CT 96 “Reserves for future expenses”

A court decision has been received. The company's calculations did not come true. The organization will need to pay 100,000 rubles. The operation can be reflected as follows:

- Repayment of OO: DT 96 “Reserves for future expenses” CT 76 “Settlements with creditors”, subaccount “Settlements for claims”. The transaction amount is indicated: 20,000 rubles.

- Amount that needs to be paid additionally: DT 91 “Other income and expenses”, subaccount “Other expenses” KT 76, subaccount “Calculations for claims”. The amount that needs to be paid is indicated: 20,000 rubles.

All specified transactions must be confirmed by primary documentation. From the accounting it is possible to clearly understand which transactions were carried out.

Is it necessary to reflect estimated liabilities in tax accounting?

Lack of information about a PA in tax accounting is not an error. You do not have to indicate reserves, as they do not affect the amount of taxes assessed. This information will not be required by the tax authorities. But it will be useful to banking institutions to which the enterprise applies, or to its investors.

Summary

Estimated liabilities require the creation of a reserve. In order for obligations to be recognized as valuation obligations, they must meet a number of conditions. The main signs are the inability to determine the exact amounts of accruals and the timing of their repayment. Commitments must be inevitable. For example, they appear on the basis of agreements with employees. If the obligation does not meet the established requirements, then it is taken into account in a different manner. OO are recorded only in accounting. There is no need to indicate them in the tax return, since the estimated expenses do not affect the amount of taxes. Their appearance in accounting is mandatory.

Reflection in NU

According to the rules for forming the tax base, it is not provided to take into account liabilities in expenses. If the enterprise reflects this information in reference materials, then the regulatory authority can only issue a remark or leave the actions without attention. There are no significant penalties or liability standards for this. In fact, information on planned costs is of little interest to the tax inspectorate. Such indicators may be useful to third-party users: credit institutions, lessors, investors, potential founders and owners.