Maintaining accounting and tax reporting of an enterprise requires good knowledge of legal relations both within the framework of Russian legislation and financial reporting in the general structure of IFRS. Even if the required documentation is completed on time and without errors, this does not mean that there will be no discrepancies in the reports. This state of affairs becomes possible because, despite all the similarities between the rules for recording income (or expenses) on the tax base and for accounting, there are some differences. And the result of such actions is deferred tax liabilities on the balance sheet.

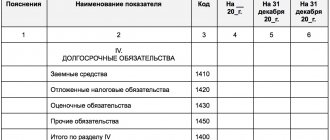

What accounting data will be needed when filling out line 1420

Enterprises, when preparing financial statements, have the legal right to reflect the balanced (i.e., rolled up) amount of deferred assets/liabilities in their balance sheet. In any case, the value of deferred tax liabilities is entered in the line, which is relevant as of the reporting date, as of December 31, the previous and previous periods. To enter information in line 1420 you will need to look at:

- credit balance on account 77,

- debit balance for account 09.

So, depending on which method of reflecting the amount of deferred liabilities the organization’s management chooses, additional actions may be required. A couple of points to consider:

- In any case, the indicators on line 1420 are transferred from the balance sheet for the previous year to December 31 – the previous and previous periods.

- If in the balance sheet for the reporting year, the indicators as of December 31, 2019, and the previous periods preceding the previous one, the amounts of deferred assets/liabilities were indicated in expanded form, and the enterprise customarily reflects the amounts of deferred tax assets/liabilities as of the reporting date in a collapsed form, the indicators as of December 31. - those periods will have to be recalculated before reflecting them in the balance sheet for the reporting period - this will ensure the comparability of the reporting data. The same applies to the reverse situation, when the information was reflected in a collapsed manner, but in the reporting period it was decided to indicate the indicators in an expanded manner.

- It is necessary to compare the balance on account 09 with the balance on account 77 - depending on which value is greater, the indicator on line 1420 can be calculated differently (formulas will be given below in the article).

Basic concepts and emergence process

Accountants whose responsibilities include working with reporting know that even with the correct maintenance of all documentation, there are often cases when the organization’s profit indicators for calculating taxes and for regular accounting have differences.

If we start from the timing of their validity, then these differences can be of two types: those that are permanent and those that should be a temporary phenomenon. If a permanent option arises, income and expenses will be reflected in regular accounting reports, but they will not have any relation to the tax base. Or, on the contrary, they will be taken into account when calculating taxes, but will not be presented in accounting documents.

The second option means that profits, as well as existing costs, which are displayed in reports in one specific period, will be subject to taxation only in the next. The occurrence of such a difference is usually called deferred tax liability (or abbreviated as IT).

That is, this concept means that part of the tax that was postponed for a given period of time with the expectation that in the future this may lead to its increase. This obligation should be recognized and documented only during the time period when the difference was discovered. The phenomenon under consideration may arise for the following reasons:

- At an enterprise, specialists use different methods when calculating depreciation expenses when filling out tax returns and in accounting.

- Expense transactions are also determined using different methods.

- Differences in formulas used to reflect interest payments made by an organization if it uses borrowed funds for its activities.

- There is a need to defer or pay in installments for tax payments.

Deferred tax liabilities may arise for a number of reasons, which differ from case to case.

To determine the amount of IT, use the following formula:

The rate at which deductions are made from profits * time difference = IT.

How to find the amount of deferred tax liabilities (general formula)

The formation of deferred tax liabilities is observed in cases where taxable temporary differences arise. This means that expenses in tax accounting are higher than in accounting. Now it becomes clear why the general formula for calculating deferred tax liabilities is as follows:

Tax losses and tax benefits.

The concept of “deferred tax” combines temporary differences, tax losses and tax credits.

In most countries, if you made a loss last year, you may pay less tax on the current year's profits. Likewise, a tax benefit (the ability to pay less in taxes) may be provided by the government as an incentive, but not as a cash benefit.

Both tax losses and tax benefits are components of tax. They reduce your taxes.

Temporary differences are tax charges. On the contrary, they will have no impact on taxes. They are not a tax. They are tax charges. The fact that they are lumped together with tax losses and tax benefits under the umbrella term “deferred tax” can be misleading.

Reasons for the occurrence of taxable temporary differences

When taxable temporary differences result in taxable profit (loss), this gives rise to deferred income tax, which, in turn, will increase the amount of income tax payable to the budget in the year following the reporting period or in the subsequent year. Let's look at the reasons why taxable temporary differences may arise:

- The use by an enterprise accountant of different procedures for reflecting the interest that the company pays to creditors for the use of borrowed funds for tax and accounting purposes.

- Recognition in the reporting period of income from the sale of manufactured products, goods, services and works in the form of income from ordinary activities.

- Application of various methods of calculating depreciation for calculating income tax and accounting purposes.

- Recognition of interest income of a company for accounting purposes based on the assumption of temporary certainty of facts of economic activity, and for tax purposes - on a cash basis.

- Other similar differences between accounting and tax accounting.

Legal basis

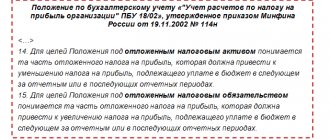

Naturally, working with obligations is impossible without a legislative basis. The civil legal framework on this issue is represented by the following documents:

- Order of the Ministry of Finance of the Russian Federation No. 114-n (dated November 19, 2002). It examines the options for the appearance of a temporary difference, the consequence of which is the emergence of IT.

- Order of the Ministry of Finance of the Russian Federation No. 94-n (dated October 31, 2000). This document provides instructions for drawing up IT transactions if the company carries out any business activities related to financial turnover.

An example of how a deferred tax liability is created

Important! The income tax rate and distribution by shares depend on the field of activity and the region of location of the company. The example will consider randomly selected values.

Let's imagine a hypothetical company, BukhDukh LLC. An accounting employee, by decision of his superiors, calculates depreciation in accounting using the straight-line method . However, tax accounting uses a non-linear method . The company acquired a certain fixed asset, which cost the owners 320 thousand rubles . Since its cost turned out to be more than one hundred thousand rubles, the Tax Code requires the taxpayer to depreciate this fixed asset in tax accounting.

The accountant found the depreciation period for this fixed asset in the All-Russian Classifier of Fixed Assets, and it turned out that it belongs to the tenth group (for fixed assets of this depreciation group, a useful life of 361 months - 30 years at 12 months). Recall that the accountant is instructed to use the straight-line method, and therefore depreciation will be calculated as shown below:

310,000 rub. : 361 months = 858.72 rubles/month.

The economic interpretation of the obtained value is that every month 858 rubles 72 kopecks of depreciation must be written off from the cost of the new OS. The fact that this object belongs to the tenth depreciation group implies a monthly depreciation rate of 0.7%:

310,000 rub. x 0.7% = 2170 rub.

This means that depreciation deductions in the amount of 2,170 rubles .

Let us present the obtained values in tabular form for clarity:

Let's calculate the amount of the temporary taxable difference:

2170 rub. – 858.72 rub. = 1311.28 rubles.

Let's calculate what value of deferred tax liabilities will be transferred to account 77:

RUB 1,311.28 x 20% = 262.25 rubles

(20% is the tax rate for income tax, taking into account the regional and federal shares).

The accountant will make the following entry:

Dt 68.4 “Calculations for income tax” Kt 77 – 262.25 rubles.

IFRS 12: Features of the deferred tax calculation method

E. Chipurenko, Ph.D.

An innovation in Russian accounting is deferred taxes, which represent part of the income tax expenses reflected in the financial statements. Deferred taxes are expressed as the amount of tax that an organization will have to pay (or reimburse) in the future in relation to the current reporting period (the period in which the financial statements are prepared).

According to the rules customary for Russian practice, only current tax obligations payable to the budget at the end of the reporting period were reflected in the balance sheet in the section of short-term liabilities. And only with the introduction of PBU 18/02, new items appeared in the balance sheet: 145 “Deferred tax assets” and 515 “Deferred tax liabilities”. In the income statement, instead of the line “income tax,” the following items appeared: “Current income tax,” “Deferred tax assets,” and “Deferred tax liabilities.” Thus, financial reporting forms have become more complex.