As a rule, profit calculated according to tax accounting data differs from profit calculated according to accounting data.

This is due to the various regulatory rules applied to the recording of generated income and expenses of business organizations. For tax accounting, these rules are determined by the Tax Code of the Russian Federation, and for accounting – by the Accounting Regulations (PBU).

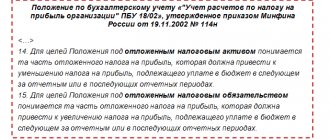

To reflect in accounting and reporting the difference between the tax on accounting profits and the tax shown in the income tax return, PBU 18/02 “Accounting for calculations of corporate income tax” is used (approved by Order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n).

We draw the attention of readers: By Order of the Ministry of Finance of Russia dated November 20, 2018 No. 236n, changes were made to PBU 18/02. The changes are applied by organizations starting with the accounting (financial) statements for 2021. You can start applying the changes earlier by reflecting this fact in the accounting (financial) statements.

PBU 18/02 may not apply only to small business organizations.

What are permanent tax liabilities?

Expenses and income that are generated in any private company require that they be taken into account differently when preparing tax and accounting reports. Some values are included in these reports in different amounts. In the same way, the starting price of assets can be fundamentally different for tax and accounting purposes. This gives rise to permanent tax obligations, better known among professionals under the abbreviation PNO.

To learn how to calculate them correctly, it is important to understand that there are two types of differences when calculating income tax and preparing accounting documents. These include permanent tax assets and liabilities.

The first ones are formed at the moment when part of the expenses can be recorded by law exclusively for tax purposes. Another option is to reflect part of the income exclusively in accounting. As a result, profit, which is calculated on the basis of accounting, turns out to be higher than taxable profit. Thus, assets are equal to the amount of income and expenses, in both accounts, multiplied by 20%.

These obligations arise from the fact that part of the income is officially recognized only when reports are prepared that indicate tax purposes. This leads to a situation in which the profit, according to accounting information, turns out to be significantly lower than that which is taxed. Such an obligation falls under the expense section. To calculate them, the amount is multiplied by 20%.

The point is to clearly see the difference in the amount of profitability for different parameters of the reporting used. It is important to understand this concept in detail in order to conduct accounting competently and efficiently.

Causes of PNA and PNO

The main conditions for the formation of PNA are:

- recognition of certain costs in NU and their non-recognition in accounting. In particular, paragraph 7 of Art. 262 of the Tax Code of the Russian Federation allows you to take into account R&D costs (if the research is reasonably valuable for the state) in NU with a coefficient of 1.5, i.e. each ruble can be taken into account at one and a half times. The amount of costs exceeding the expense according to the accounting system in this case is converted into a positive difference, and, as a consequence, into the PNA;

- decrease in the value of fixed assets after revaluation. In such a situation, the value of assets according to the accounting book will be lower than their tax value, therefore, the share of accrued depreciation will be recognized in the accounting book, but will not be recognized in the accounting book - this amount forms the PNA.

Reverse processes (increase in the value of assets after revaluation, non-recognition or limited recognition of expenses in accounting, with their unlimited recognition in accounting, or increase in the value of fixed assets upon gratuitous transfer) will lead to the occurrence of PNO.

The legislative framework

The essence of the concept and the basis of obligations are enshrined in the order of the Ministry of Finance dedicated to the approval of accounting regulations. The document was adopted in 2002.

It notes that the order is intended to bring domestic legislation to the standards of global financial reporting, and is also necessary to fulfill the parameters of the accounting reform program.

When do PNOs appear?

Such obligations are formed upon the official recognition of expenses only within the framework of accounting. This is also possible when income is recorded exclusively as part of tax reporting. This leads to the fact that when forming the base necessary for calculating income tax, there are several operations that can lead to the emergence of PIT.

Table 1. What leads to the appearance of PNO.

| Cause | Description |

| Property owned by the company is given free of charge to a third party for use | When preparing a report for the tax office, such an operation will not be taken into account in the expense column, and the resulting balance for the price of the object itself or a list of them will also be ignored. In accounting, such a procedure falls into the category of expenses. |

| When preparing a report for the Federal Tax Service, the company identified a certain loss | For example, expenses turned out to be higher than income when calculating the tax base. According to the legislation that was in force two years ago, it was allowed to reduce the tax base by the amount of the loss. This was allowed to be done for ten years from the moment of its formation. After the expiration of this period, the loss could no longer be taken into account when preparing tax reporting. However, it is still taken into account in accounting. |

| Expenses aimed at organizing corporate events also lead to the formation of PNO | To prepare income tax reports, expenses must be supported by official justifications related to specific business processes and documents. Spending on corporate events cannot meet these requirements, so they are not taken into account when preparing tax reporting. |

| Due to changes in the value of the object, fixed assets may be revalued | As a result, their original cost is recalculated. This leads to a recalculation of all depreciation that must be taken into account from the moment the object is used. These nuances are reflected in accounting, but for tax reporting they have no significance. |

These are the most common situations when PNO occurs. In practice, you have to deal with them much more often.

Watch the video on the topic:

Examples of permanent tax differences

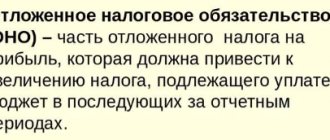

Permanent tax liability (PNO)

A permanent tax liability arises in the following cases:

1) The excess of actual expenses taken into account when forming accounting profit (loss) over expenses that are not accepted for tax purposes (paragraph 4 of clause 4 of PBU 18/02)

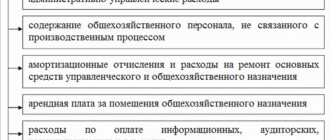

According to PBU No. 10/99 “Expenses of the organization”, all expenses of the organization are taken into account in accounting, regardless of what type of expenses they relate to: the cost of goods, work, services, operating expenses, at the same time, according to Art. 264 Tax Code of the Russian Federation, art. 270 of the Tax Code of the Russian Federation, part of the organization’s expenses cannot be accepted in full; there are either restrictions or norms for these types of expenses.

This category of expenses, in particular, includes the following types of expenses:

- Standardized advertising costs, which are taken into account in the amount of 1% of sales revenue, determined in accordance with Art. 249 of the Tax Code of the Russian Federation (clause 4 of Article 264 of the Tax Code of the Russian Federation);

- Entertainment expenses, taken into account in the amount of 4% of the taxpayer’s expenses for wages (clause 2 of Article 264 of the Tax Code of the Russian Federation);

- business travel expenses (daily allowances within the limits approved by the Government of the Russian Federation);

- insurance costs;

- expenses for compensation for the use of personal cars and motorcycles for business trips;

- expenses referred to in Art. 270 Tax Code of the Russian Federation.

In addition, when accepted for income tax accounting, expenses must be documented, have an economic justification, and must also be related to the organization’s activities aimed at generating income. If an organization has expenses and they do not meet these requirements, then such expenses are excluded from expenses for tax purposes.

When excluding from the organization's expenses expenses in excess of the standard or those expenses that are recognized in tax accounting taking into account restrictions, in order to form the tax base for income tax, the accounting profit becomes greater than the tax profit (the condition Expenses NU < Expenses according to accounting is met) and the organization has a permanent tax liability (TLO).

Example 1 – advertising costs:

During the tax period, the organization carried out advertising campaigns, during which the share of standardized advertising expenses amounted to 324,000 rubles (including 20% VAT in the amount of 54,000 rubles). The organization's sales revenue for the tax period amounted to 1,900,000 rubles (excluding VAT).

In accounting, advertising expenses will be reflected in the amount of 270,000 (324,000 - 54,000) rubles.

In tax accounting, advertising expenses will be accepted in the amount of 1% of revenue in the amount of 190,000 (1,900,000 * 1%) rubles.

Exceeding the standard creates a permanent tax difference on advertising expenses in the amount of 80,000 (270,000 - 190,000) rubles.

The organization has a permanent tax liability (Expenses under NU < Expenses under accounting) in the amount of 16,000 (80,000 * 20%) rubles.

In the accounting records at the end of the tax period, the accountant must make an entry to reflect the permanent tax liability (PNO):

Accounting entries

Amount, rub. Grounds Dt Kr

99 “Permanent tax liability” 68.04 “Income tax” 16,000 A permanent tax liability is reflected (RUB 80,000 * 20%)

Example 2 – entertainment expenses:

The organization's entertainment expenses for the tax period amounted to 70,000 rubles. Labor costs for this period amounted to 1,200,000 rubles.

In accounting, entertainment expenses will be reflected in the amount of 70,000 rubles.

In tax accounting, entertainment expenses for the tax period will be accepted in the amount of 4% of the organization’s expenses for wages in the amount of 48,000 (1,200,000 * 4%).

Exceeding the standard creates a permanent tax difference for entertainment expenses in the amount of 22,000 (70,000-48,000) rubles.

The organization has a permanent tax liability (Accounting expenses < Accounting expenses) in the amount of 4,400 (22,000* 20%) rubles.

In accounting, the accountant needs to make an entry to reflect the permanent tax liability (PNO):

| Accounting entries | Amount, rub. | Operation description | |

| Dt | Kr | ||

| 99 subaccount “Permanent tax liability” | 68.04 subaccount “Income Tax” | 4 400 | A permanent tax liability is reflected (RUB 22,000 *20%) |

Example 3 – expenses excluded from NU:

The organization (OSNO) decided to hold a corporate event for its employees. The amount of expenses for the corporate event amounted to 400,000 rubles, including 20% VAT in the amount of 66,667 rubles. The organization did not personalize the participants of the corporate event.

The accountant, when providing him with primary documents for expenses incurred during the event, does not recognize expenses in the amount of 400,000 rubles, including the amount of VAT, in tax accounting, which results in a permanent tax difference in the amount of 400,000 rubles.

The organization has a permanent tax liability (Accounting expenses < Accounting expenses) in the amount of 80,000 (400,000* 20%) rubles.

The following entry must be made in accounting to reflect the permanent tax liability:

| Accounting entries | Amount, rub. | Operation description | |

| Dt | Kr | ||

| 99 subaccount “Permanent tax liability” | 68.04 subaccount “Income Tax” | 80 000 | A permanent tax liability is reflected (RUB 400,000 *20%) |

2) Transfer of property (goods, work, services) free of charge, in the amount of the cost of the property (goods, work, services) and expenses associated with this transfer (paragraph 5, clause 4 of PBU 18/02)

One of the cases where a permanent difference arises is, in particular, the non-recognition for tax accounting purposes of expenses associated with the transfer of property free of charge in the amount of the cost of the property and expenses associated with this transfer.

In addition, this rule, in particular, applies to organizations that use any property free of charge. Tax authorities insist that an organization in such a situation must recognize monthly non-operating income in the amount of the market price for the rental of identical property, and accounting legislation does not provide for the reflection of the cost of such work (services) on accounting accounts.

Example 1 – gratuitous transfer of fixed assets:

The organization transfers free of charge an object of fixed assets, the initial cost of which is 189,000 rubles. The useful life is 5 years, the actual life of use is 4 years. Depreciation was calculated using the linear method, the amount of accrued depreciation was 151,200 rubles, the residual value of the transferred object was 37,800 rubles.

When transferring a fixed asset free of charge in accounting, it is necessary to charge value added tax (VAT 20%) on the residual value of fixed assets in the amount of 7,560 (37,800 * 20%) rubles.

A loss in accounting upon gratuitous transfer of fixed assets will form a permanent tax difference, since in tax accounting a loss in the form of the value of gratuitously transferred property and expenses associated with such transfer does not reduce the tax base for income tax (clause 16 of article 270 of the Tax Code of the Russian Federation) in in the amount of 45,360 (189,000-151,200+ 7,560) rubles.

The organization has a permanent tax liability (Accounting expenses < Accounting expenses) in the amount of 9,072 (45,360* 20%) rubles.

The following entry must be made in accounting to reflect the permanent tax liability:

| Accounting entries | Amount, rub. | Operation description | |

| Dt | Kr | ||

| 99 subaccount “Permanent tax liability” | 68.04 subaccount “Income Tax” | 9 072 | A permanent tax liability is reflected (RUB 45,360 *20%) |

Example 2 – free use of property:

The founder of the organization transfers for free use the premises that are used by the organization as an office.

The monthly rent at market value for a similar premises is: 60,000 rubles per month. In tax accounting, the accountant recognizes monthly non-operating income in the amount of 60,000 rubles.

In accounting, income associated with the gratuitous use of premises is not included in the organization’s income, resulting in a permanent tax difference.

Since as a result of this posting, the accounting profit will become less than the tax profit (the condition Income NU>Income according to accounting is met), the organization has a monthly permanent tax liability in the amount of 12,000 rubles (60,000 * 20%).

In accounting, at the time of recognition of non-operating income, the following entry must be made:

| Accounting entries | Amount, rub. | Operation description | |

| Dt | Kr | ||

| 99 subaccount “Permanent tax liability” | 68.04 subaccount “Income Tax” | 12 000 | A permanent tax liability is reflected (RUB 60,000 *20%) |

3) The formation of a loss carried forward, which after a certain time, in accordance with the legislation of the Russian Federation on taxes and fees, can no longer be accepted for tax purposes both in the reporting and subsequent reporting periods (paragraph 6, clause 4 of PBU 18/02)

From January 1, 2021, new rules apply for the transfer of losses from previous years for the period from January 1, 2021 to December 31, 2020 (Article 283 of the Tax Code of the Russian Federation). According to the changes, a loss in an amount not exceeding 50% of the tax base of the current period can be carried forward to the future.

In addition, the previously existing ten-year limitation on the carry forward of losses has been abolished.

According to the old rules, permanent tax differences arose if the organization, after ten years, failed to complete the write-off of losses carried forward to the future (clause 2.1 of Article 283 of the Tax Code of the Russian Federation).

Application of the provisions of Art. 283 of the Tax Code of the Russian Federation in the new edition applies to losses received by the taxpayer for tax periods starting from 01/01/2007.

Thus, for losses incurred by the organization before January 1, 2007 (in 2006), which could not be written off within ten years, the organization would have a permanent tax liability in 2016.

Accordingly, in 2021, organizations do not have conditions under which a permanent tax difference may arise on losses carried forward to the future, leading to the emergence of a permanent tax liability.

Permanent tax asset (PTA)

If accounting profit becomes less than tax profit in cases where tax accounting income becomes less (Income according to NU < Income according to accounting) or tax accounting expenses become greater (Expenses according to NU > Expenses according to accounting) than in accounting, then organization a permanent tax asset (PTA) arises.

The list of income not taken into account for tax purposes is contained in Art. 251 of the Tax Code of the Russian Federation, which may lead to the emergence of a permanent tax asset (PTA).

Example 1 – gratuitous assistance from the founder:

The founder of the organization, whose share in the authorized capital is 70%, transfers funds in the amount of 800,000 rubles.

The accounting records reflect the funds received as part of other income in the amount of 800,000 rubles (Dt 51 “Current account” Kr 91.1 “Other income”).

In accordance with paragraphs. 11 clause 1 art. 251 of the Tax Code of the Russian Federation, the value of property received free of charge from an organization whose share in the authorized capital of the organization is more than 50% is not included in income subject to income tax.

The organization has a permanent tax difference in the amount of 800,000 rubles, leading to the emergence of a permanent tax asset in the amount of 160,000 rubles.

The following entries must be made in accounting:

| Accounting entries | Amount, rub. | Operation description | |

| Dt | Kr | ||

| 68 subaccount “Income tax” | 99 subaccount “Permanent tax asset” | 160 000 | A permanent tax asset is reflected (RUB 800,000 *20%) |

How to calculate PNO

This indicator is directly dependent on several constant differences. They are included in the formula on the basis of which the company is able to calculate these obligations. The formula looks like this:

PNO = constant difference * income tax rate

We emphasize that the base rate is standard 20%. It has remained at this level for a long time, starting in 2009, when the corresponding federal law No. 224 was adopted, regulating the provisions of public-private partnerships.

At the same time, at the legislative level, it was decided that local regional authorities have the right to introduce their own rate. A clear example of how this works can be given in the likeness of Moscow. Here, reduced tax rates of 12.5% have been introduced for companies specializing in the production of automobiles. And other enterprises calculate their reporting based on the requirements of federal legislation.

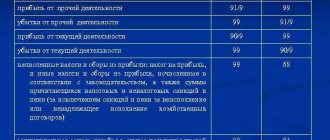

What postings to create in case of a permanent difference?

First of all, it is necessary to determine whether the constant difference is positive or negative. To do this, you need to understand which profit - “tax” or “accounting” - turned out to be greater after this constant difference occurred.

If the “tax” profit is BIGGER than the “accounting” profit, then the constant difference is positive. In this case, a permanent tax liability (PNO) should be reflected in accounting. Its value is equal to the positive constant difference multiplied by the tax rate. In this case, the accountant must make the following entry:

DEBIT 99 CREDIT 68 - permanent tax liability (PNO) is reflected.

If the “tax” profit is LESS than the “accounting” profit, then the permanent difference is negative. In this case, a permanent tax asset (PTA) should be reflected in accounting. Its value is equal to the negative constant difference multiplied by the tax rate. In this case, the accountant must make the following entry:

DEBIT 68 CREDIT 99 - a permanent tax asset (PTA) is reflected.

Examples of PNO accounting

To clearly understand how to calculate permanent tax liabilities, let’s look at a specific example using the formula.

Let’s assume that a particular company’s spending on purchasing gift products for its anniversary amounted to 68,000 rubles. Expenses made must be reflected in accounting. We calculate the required indicator. If an enterprise uses general rules when reporting, then it should use regulation 18/02, which regulates how income tax calculations must be made.

It will take 68,000 rubles multiplied by 20%. We receive 13,600 rubles. This will be the permanent tax liability accrued by us.

Of course, the use of constant taxes in accounting is not limited to this example. Let's look at another common situation. When paying for certain types of advertising services, a limit is introduced on the amount that can be officially recognized for tax purposes. In particular, this value is 1% of the revenue achieved for the reporting period. Let's say that over the past tax period the company spent 100 million on advertising. Of these, 10 million will not be taken into account, since this is the difference that turns out to be above the norm.

Considering that the standard rate used by the enterprise is 20%, the size of the PNO will be equal to 2 million rubles.

The expenses incurred by the enterprise in this case are reflected as follows: 100 million Dt 44 – Kt 60.

To visually display the PNO, you will need to multiply 10 million by 20%: 2 million Dt 99 - Kt 68.

Another option is how such discrepancies between different reporting forms may appear and be taken into account. The company receives 200,000 rubles for development. One of the investors transfers this amount to her account. He is actually the largest owner, since he has over half of the authorized capital in the investment portfolio. According to Article 251 of the Tax Code of the Russian Federation, these funds at the disposal of the company are not taxed.

Reflection of obligations in 1C, watch the video:

When preparing financial statements, the money will have to be officially considered acquired income. A stable difference is formed on which the permanent tax asset is based. It is also calculated based on a base rate of 20%. In this situation, it turns out to be equal to 40,000 rubles.

Who is obliged to take into account the difference when generating profit?

When determining profit for tax calculation in accounting (BU) and tax (TA) accounting, discrepancies often arise between expenses incurred and income received. This is due to the difference in regulatory rules that must be followed: for tax accounting they are determined by the Tax Code of the Russian Federation, and for accounting - various PBUs.

As a result, a situation arises when expenses or income take place in one accounting, but not in the other. Then the accounting profit indicated in the financial results will differ from the tax profit recorded in the income tax return. In order for this discrepancy to be correctly reflected in accounting, accounting regulation 18/02 “Accounting for calculations of corporate income tax” was developed, approved by Order of the Ministry of Finance dated October 19, 2002 No. 114n.

This provision must be used by income tax payers. Enterprises that use a simplified accounting system, including simplified financial statements, are exempt from this obligation. They have the right to decide whether to apply the document or not. This decision must be fixed in the accounting policy.

To whom and to what extent PBU 18/02 applies, you can find out from the article “PBU 18/02 - who should apply and who should not?”

PNO in financial statements

The easiest way to illustrate tax obligations is to use the special Appendix 18/02, which is used by all representatives of this profession without exception. It regulates in detail and describes how the calculation of the income tax of a particular company or enterprise should be carried out according to the law. According to this document, tax liabilities recognized as permanent should be accounted for in debit account 99. It describes the losses and profits of legal entities. Additionally, it is necessary to consider the credit account No. 68, and not the subsidized account. Only together does it become possible to create a complete and objective picture.

Tax liabilities, considered permanent in accounting terminology, as well as the corresponding assets, are officially recorded precisely during the period when the financial transactions were directly carried out. It is recommended to limit them to a certain month so as not to delay reporting. Such requirements are contained in Article 7 of the Regulations. These transactions do not need to be reflected when preparing the balance sheet.

When compiling a report on the financial successes or failures achieved by the company, liabilities, along with assets, are written down in line No. 2421 specially designated for this. The difference in debit turnover compared to credit turnover is entered here.

The impact of PNO on company profits

You can assess how these tax obligations affect the financial condition of the enterprise by again referring to the same Regulations. Having studied it, we come to the conclusion that accounting profit, multiplied by the tax rate, will be considered a conditional expense. This value must be taken into account when determining the amount of income tax.

The product of the amount of profit and the direct rate gives us a value equal to the current income tax.

By dividing the total contingent expenses by the income acquired during the reporting period, they strive to bring it as close as possible to the previously obtained parameters. To do this, you just need to use the concepts and calculations of liabilities and assets. Herein lies the key impact of these obligations on the bottom line.

What is PNO

Financial receipts and expenses resulting from the economic activities of a legal entity are perfectly reflected in accounting and tax records. Individual indicators may be concentrated in accounting in figures other than in tax accounting. There are often inconsistencies in the initial value of assets for different types of accounting.

The ratio of tax, the calculation of which is carried out within the framework of tax accounting and within the framework of accounting, can be expressed through:

- PNA (income is accepted exclusively from a financial position or expenses - from a fiscal one) - in fact, the profit exceeds the amount that is subject to taxation.

- PNO (income is regarded as such only from the point of view of taxation of duties, but at the same time is not recognized as such from the accounting side) - means that profit is taxed in an inflated amount in relation to that which goes on the books. accounting.

How to pay off deferred tax liabilities

Economic reporting standards, accepted throughout the world, contain instructions according to which it is recommended to calculate what the amount of taxes will be for a certain period. A basic standard is provided, containing comprehensive algorithms for how to determine all foreign and domestic existing tax payments, and suggests what to include in the final reports. Attention is paid to income taxes withheld at sources of payments.

According to this standard, there is a need to take into account not only those taxes that are required to be paid, but also the size of the resulting consequences determined by the specific results of the organization’s economic activities and completed transactions. This gives rise to a concept called deferred tax liability. When paying them, you should take into account the existing requirements. Everything together gives a specific final result.

Experts use deferred tax liabilities to determine the amount of taxes paid directly on profits. They must be entered for the corresponding calendar and reporting periods. In practice, they appear due to the introduction of taxation boundaries at the legislative level.

As a rule, such liabilities are recognized using reduced net benefits for the previous calendar year or other time period. An alternative option is to reduce the amount of equity capital after it is reflected in the balance sheet of the corresponding item.

When there is a reduction in the amounts subject to the corresponding taxes, a decrease begins, which is reflected in an increase in tax liabilities. They must be paid now. The result of this activity is a reduction in existing outstanding liabilities.

It is possible to establish their parameters by multiplying the amount of borders subject to taxation by a certain rate. Calculations are made for a specific period of time.

For a detailed calculation, it is recommended to use account No. 77, which describes tax liabilities that are currently deferred.

They are formalized in the accounting papers with a special entry, which provides comprehensive calculation parameters, profit charges, and the obligations themselves, which are still deferred.

Great importance is given to analysts' reports in determining temporarily deferred obligations. This activity is carried out on several different types of assets, creating existing tax differences over time.

Periodically, when these differences are gradually reduced or completely eliminated, tax liabilities are also reduced or eliminated. If a specific asset or one or more types of liabilities are lost, a write-off is issued. It is worth noting that it is for them that specific amounts are officially calculated. It increases tax profits. All time periods are taken into account, not just the current and upcoming ones.

About the deferred type in the video:

When changes are made to relevant bills and decrees regarding current rates, the amounts of assets and liabilities need to be recalculated. These actions will be required, since a gap will form during recalculation. Part of the profit may not be distributed, and uncovered losses will appear.

Given that there are currently several different rates, liabilities are assessed based on a specific type of income, and if necessary, it is reduced as much as possible.

To summarize, we note that permanent tax liabilities are an important tool for financiers and accountants. To fill out documents correctly and up to date, you must correctly use the formulas that are used for PNO.

Top

Write your question in the form below