A fixed asset, that is, property that you use as a means of labor in the business activities of an organization, with a useful life of more than 12 months and an initial cost of more than 100,000 rubles, you can include in expenses through depreciation. An exception concerns fixed assets that are not depreciated due to the provisions of the Tax Code of the Russian Federation. If the property meets all the criteria for fixed assets, with the exception of cost (that is, its value is 100,000 rubles or less), then for tax accounting purposes it is not recognized as fixed assets. It can be taken into account as part of material costs. If you have revalued an asset, which led to an increase (decrease) in its value, you cannot take this into account in tax accounting.

Postings, formulas, sample documents

In accounting, fixed assets include assets with a value of 40,000 rubles or more.

At the tax office - from 100,000 rubles. Article navigation

- Accounting for fixed assets

- What does IFRS-16 indicate?

- Accounting entries for fixed assets

- Accounting for depreciation of fixed assets and amortization

- Determination of initial cost

- What determines the service life

- Types of depreciation of fixed assets

- Methods of depreciation of fixed assets in accounting

- Registration of lease of fixed assets

- What postings should the lessor of the fixed asset make?

- OS postings from the tenant's position

- What is the book value of fixed assets

- How to calculate the average annual cost of fixed assets

- Tasks and methods of auditing asset accounting

- What is the difference between tax accounting and accounting?

- Taxation of fixed assets

- Documentation of transactions with fixed assets

- Accounting statements for fixed assets

- Orders relating to fixed assets

- Title documents

- Guidelines for accounting for fixed assets

- Conclusion

According to established practice and due to the requirements of Russian legislation, enterprises must maintain double accounting of fixed assets - tax and accounting. The difference between them exists objectively, and is manifested in many signs. The tasks of accounting and tax accounting are different.

In recent years, the state has done a lot to bring tax and accounting reporting closer together, but it has not yet been possible to merge these forms into one whole. An article about the common features and differences of tax and accounting approaches to accounting for fixed assets.

The concept of bonus depreciation

When accepting fixed assets for tax accounting, a business entity has the opportunity to immediately write off part of the funds that were spent on the purchase of fixed assets. What amount can be written off immediately as an expense depends on the depreciation group in which the asset is included. It varies for different groups, but as a rule it does not exceed 30%. The use of bonus depreciation is on a voluntary basis and is not mandatory for everyone. The depreciation bonus is applied only in tax accounting of fixed assets.

Accounting for fixed assets

The provisions of PAS 6/01 continue to be in effect in 2021. It is on the basis of this document that certain assets should be classified as fixed assets (FPE). The definition of the term is based on the following criteria:

- Use of the accounted object for production or management purposes. Renting, leasing or transferring on the basis of other contractual forms of temporary use by third parties is also possible.

- The useful life of an asset is a period of one year or more.

- The property is capable of generating profit in the future.

- The property was not purchased for resale.

The cost of an asset is determined by the accounting policy adopted by the enterprise, but the lower limit is set by paragraph 5 of PBU 6/01. All assets worth up to 40,000 thousand rubles are reflected in the balance sheet as inventories.

It is theoretically possible to use other listed characteristics of fixed assets to classify objects as them, but this is, as a rule, not practiced in accounting. An enterprise may be interested in artificially increasing the value of fixed assets if there is a need to obtain a loan or attract investors. In other cases, line 1150 in the balance sheet sets the amount of property tax, which increases the fiscal burden experienced by the company.

Thus, the current provision of PBU 6/01 provides a certain freedom in developing the accounting policy of an enterprise in terms of classifying an asset as fixed assets.

What does IFRS-16 indicate?

In addition to PBU 6/01, when drawing up the structure of fixed assets, an accountant can be guided by another official document.

The IFRS-16 standard provides for the classification of fixed assets into the following types of objects:

- land resources;

- buildings and other structures;

- cars and equipment;

- vehicles (cars, ships, airplanes, etc.);

- furniture and other interior items;

- Office equipment.

Explanation of the abbreviation IFRS - International Financial Reporting Standards.

Accounting entries for fixed assets

All actions performed with fixed assets from the moment they are received by the enterprise and ending with liquidation (writing off from the balance sheet) must be documented. The account involved in each specific operation will be discussed below.

The current chart of accounts provides for postings to fixed assets in accounting. For convenience, they are summarized in a table. Movement accounting involves the following actions in the 1C program (you can also do this in a balance sheet on paper).

| Accounts and sub-accounts | Description of action | Confirmation document | |

| Debit | Credit | ||

| Registration (purchase, construction, production of fixed assets) | |||

| 08 | 60 | Acquisition (purchase) | Invoice from supplier |

| 08 | 68 | Payment of state duty and registration fees | Bank statement |

| 08 | 60 (76) | Payment for delivery, installation, intermediary services and other related costs | Agreements, acts |

| 19 | 60 | VAT reflection | Incoming invoices |

| 68.2 | 19 | Submitting VAT for tax deduction | |

| 01 | 08 | Capitalization of fixed assets. VAT deduction upon purchase. | Act in form OS-1 |

| 60 (76) | 51 | OS payment | Payment order |

| Registration (contribution to the authorized capital) | |||

| 08 | 75 | Reflection of income to the authorized capital | Minutes of the founders' meeting (decision), accounting certificate |

| 01 | 08 | Capitalization of fixed assets | Act in form OS-1 |

| 20 (23, 25, 26, 29, 44) | 02 | Depreciation calculation | Accounting certificate |

| Balancing (free receipt) | |||

| 01 | 08 | Fixed assets received free of charge are reflected | Certificate from accounting department, gift agreement |

| 01 | 08 | Capitalization of fixed assets | Act in form OS-1 |

| 20 (23, 25, 26, 29, 44) | 02 | Depreciation calculation | Accounting certificate |

| 98 | 91.1 | Monthly write-off of cost to income (in accordance with depreciation) | Accounting certificate |

| Registration (exchange or offset) | |||

| 08 | 60 | Reflection of debt | Mutual offset protocol, exchange agreement, invoice |

| 19 | 60 | VAT reflection | Incoming invoices |

| 01 | 08 | Receipt of fixed assets and its registration | Act in form OS-1 |

| 62 | 90.1(91.1) | Reflection of supplier debt | Exchange agreement, act (for services), invoice (for goods) |

| 60 | 62 | Reflection of barter | Accounting certificate |

| 68.2 | 19 | Submission of VAT for deduction | |

| Revaluation of fixed assets - revaluation | |||

| 01 | 83 | Increase in the value of a fixed asset | Act of revaluation (revaluation) |

| 83 | 02 | Correction of depreciation amount | Accounting certificate |

| Revaluation of fixed assets - markdown | |||

| 91.2 | 01 | Markdown reflected | Inspection report (markdown) |

| 02 | 91.1 | Correction of depreciation amount | Accounting certificate |

| Liquidation of fixed assets due to wear and tear | |||

| 01 (disposal) | 01 | Write-off of original cost | Act in form OS-4, order of the manager |

| 02 | 01 (disposal) | Write-off of accrued depreciation | |

| 91.2 | 01 (disposal) | Reflection of residual value | |

| Deregistration – sale of fixed assets | |||

| 01 (disposal) | 01 | Write-off (original cost) | Act in form OS-1, purchase and sale agreement |

| 02 | 01 (disposal) | Write-off of accrued depreciation | |

| 91.2 | 01 (disposal) | Write-off (residual value) | |

| 62 | 91.1 | Reflection of revenue | Sales contract, invoice |

| 91.2 | 68.2 | VAT is charged on the sale of fixed assets | Outgoing invoice |

| Selling at a loss | |||

| 99 | 91 | Posting for the amount of negative financial result | |

As a rule, the income brought by the sale of a fixed asset is not included in the proceeds from the sale (it is classified as non-operating).

Forms for accounting for fixed assets in a warehouse purchased but not put into operation are reflected in the subaccount “Fixed assets in a warehouse (in stock)” of account 01 “Fixed assets”.

Accounting for fixed assets with zero tax value

By the tax value of a fixed asset we mean the cost of the object, which can subsequently be taken into account as expenses for profit tax purposes through depreciation, upon sale or other disposal.

The criteria for recognizing property as depreciable are named in Article 256 of the Tax Code of the Russian Federation, and the procedure for determining its value is in Article 257 of the Tax Code of the Russian Federation.

In accordance with paragraph 1 of Article 256 of the Tax Code of the Russian Federation, property that is not used to generate income is not recognized as depreciable. According to the official position of the regulatory authorities, expenses for office decoration (for example, flowers and paintings) cannot be taken into account when calculating income tax, since such expenses are not aimed at generating income and are not related to the organization’s activities (clause 1 of Article 252 of the Tax Code of the Russian Federation , letter of the Ministry of Finance of Russia dated May 25, 2007 No. 03-03-06/1/311). For the same reason, when calculating income tax, it is impossible to take into account the costs of landscaping the territory (clause 49 of Article 270 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated December 10, 2019 No. 03-03-06/1/96105, dated April 1, 2016 No. 03- 03-06/1/18575).

At the same time, there are court decisions according to which the costs of aquariums and other interior items can be included in expenses that reduce the tax base for income tax (Resolution of the Federal Antimonopoly Service of the Moscow District dated June 16, 2009 No. KA-A40/5111-09, dated 05/23/2011 No. KA-A40/4090-11). Read more in the material “Office improvement expenses: justification features, court opinion.”

The costs of landscaping a production facility, as a result of which perennial plantings are created, according to the courts, can be taken into account in income tax expenses through depreciation (resolution of the Moscow District Arbitration Court dated February 24, 2015 No. F05-413/2015 in case No. A40-59510/ 13).

Let’s assume that the organization does not want claims from the tax authorities and does not include the “disputed” fixed asset in the depreciable property as not meeting the criteria of Article 256 of the Tax Code of the Russian Federation. Let's look at an example of how this situation can be reflected in “1C: Accounting 8” (rev. 3.0).

Example 1

The organization TREAGOLNIK LLC applies OSNO, PBU 18/02 (accounting in the program is carried out using the balance sheet method without reflecting PR and BP), and pays VAT. The income tax rate is 20%.

In February 2021, the organization purchased an aquarium worth RUB 144,000.00. (including VAT 20%) and installed it in the director’s reception area.

Revenue from sales of services in February amounted to RUB 240,000.00. (including VAT 20%), there were no other income and expenses in January-February 2020.

Since the organization will never be able to recoup the cost of the aquarium in tax expenses, its tax value will be zero (it is unlikely that the organization plans to sell such an object in the future). To account for fixed assets that are not recognized as depreciable under Article 256 of the Tax Code of the Russian Federation, the following actions can be used in the program:

- reflect the receipt of a non-current asset;

- reflect the acceptance of the fixed asset only in accounting, and write off the tax value of the fixed asset.

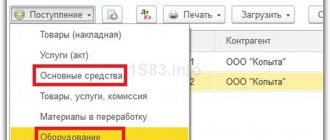

The receipt of equipment is reflected in the standard accounting system document Receipt (act, invoice)

with the type of operation

Equipment (section OS and intangible assets).

When posting the document, accounting entries will be generated:

Debit 08.04.1 Credit 60.01

— for the cost of the aquarium received by the organization (RUB 120,000.00);

Debit 19.01 Credit 60.01

— for the amount of VAT (RUB 24,000.00).

For tax accounting purposes for income tax, the corresponding amounts are also recorded in the resources Amount NU Dt

and

Amount NU Kt

for accounts where tax accounting is maintained (except for account 19 “VAT on acquired values”).

Acceptance for registration and commissioning of the aquarium is registered with the document Acceptance for registration of OS

from the section

OS and intangible assets

.

On the Tax Accounting

in the field

Procedure for including costs in expenses

, select the value

Inclusion in expenses when accepted for accounting

.

In this case, in the Expense Reflection

, you can select one of two values:

- Similar to depreciation

- in this case, the cost of fixed assets in tax accounting will be written off to the account and cost item specified to reflect depreciation expenses in accounting.

The method of reflecting expenses

is selected from the directory of the same name and is indicated in the

Method of reflecting depreciation expenses

on

the Accounting

.

In order for the cost of fixed assets not to be taken into account in tax accounting, in the Method of reflecting expenses

, you must indicate an item of costs (or an item of other income and expenses) not taken into account for profit tax purposes; - Another way

- in this case, in the

Method

, you should indicate a separate

Method for reflecting expenses

, used only in tax accounting (Fig. 1).

In this Method of reflecting expenses

, you should indicate a separate account and analysis of expenses that are not taken into account in tax accounting (for example, account 91.02 “Other expenses”), and an item of other income and expenses with the Accepted

for tax accounting

.

Rice. 1. Acceptance for accounting of fixed assets with zero tax value

When posting a document, accounting register entries are generated:

Debit 01.01 Credit 08.04.1

— for the initial cost of the fixed asset (RUB 120,000.00);

Debit 91.02 Credit 01.01

- with an unfilled amount in accounting.

For tax accounting purposes, the cost of an aquarium accepted for accounting and immediately written off is 120,000.00 rubles. reflected in special fields of the accounting register:

Amount Dt NU: 01.01

and

Amount Kt NU: 08.04.1

;

Amount Kt NU: 01.01

.

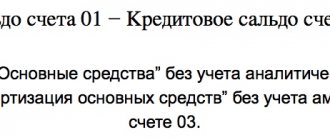

We will generate a report : Turnover balance sheet

on account 01.01 to obtain information about the initial cost of the fixed asset item. Using the report settings panel, we will simultaneously display accounting and tax accounting data (Fig. 2).

Rice. 2. SALT for account 01

As you can see, the difference between the book value and tax value of the aquarium is 120,000.00 rubles, and it is temporary due to the requirements of IAS 12, paragraph 8 of the new edition of PBU 18/02, as well as Recommendation No. R-102/2019- KpR.

In February 2021, when performing a regulatory operation, Calculation of income tax

accounting entries will be generated with simultaneous distribution among budgets:

Debit 99.02.T Credit 68.04.1

— for the amount of current tax RUB 40,000.00. (200,000.00 x 20%).

When performing a regulatory operation Calculation of deferred tax according to PBU 18

for January, included in the

month-end

a deferred tax liability (DTL) is recognized for the asset type

Fixed assets

Debit 99.02.О Credit 77

— in the amount of RUB 24,000.00. (RUB 120,000.00 x 20%).

A detailed calculation of IT is presented in the Deferred Tax Calculation Certificate

for January 2021 (Fig. 3).

Rice. 3. IT calculation

As of 01/01/2020:

- the tax rate is set at 20%;

- no deductible and taxable temporary differences were identified according to accounting data;

- deferred taxes are not recognized.

At the end of February (as of 03/01/2020):

- the book value of assets is 120,000 rubles. (column A), the tax value of assets is zero (column B). This means that in the future the organization will not be able to take into account the cost of the fixed asset;

- the difference between the book value and tax value of the fixed asset is 120,000 rubles. (120,000 rubles - 0 rubles) and is reflected in column 7. This is a taxable temporary difference, since it will lead to the formation of deferred income tax, which should increase the amount of income tax payable to the budget in the next reporting period or subsequent ones reporting periods (clause 11 of PBU 18);

- IT was recognized in the amount of 24,000 rubles. (RUB 120,000 x 20%), which is reflected in column 9.

In February 2021:

- there was an increase in the taxable temporary difference by 120,000 rubles. (120,000 rubles – 0 rubles), which is reflected in column 11;

- IT was recognized in the amount of 24,000 rubles. (column 11a).

Accordingly, the income tax expense for January-February 2020 is RUB 64,000.00. (RUB 24,000.00 + RUB 40,000.00). In this case, the conditional income tax (tax calculated according to accounting data) for the specified period is 40,000 rubles. (RUB 200,000 x 20%).

These indicators are reflected in the reference calculation Income tax expense

, formed in January (Fig. 4).

Rice. 4. Income tax expense for January 2020

At the same time, the calculation certificate reflects a constant tax expense in the amount of 24,000.00 rubles, which, in accordance with paragraph 9 of Recommendation No. R-109/2019-KpR, is defined as a numerical reconciliation between income tax expense and conditional tax expense on profit (RUB 64,000.00 - RUB 40,000.00).

Thus, the difference of 120,000.00 rubles, formed under the conditions of Example 1, represents both a temporary and permanent (“complex”) difference.

In March 2021, the aquarium begins to be depreciated on the books. As the fixed asset is depreciated, IT will be repaid.

How in “1C: Accounting 8” edition 3.0, in accordance with the new edition of PBU 18/02, take into account fixed assets that are not used to generate income (for example, an aquarium or a music center)

Accounting for depreciation of fixed assets and amortization

During operation, most fixed assets become obsolete. The exception is land resources, the service life of which is unlimited.

Monthly contributions to a special fund intended for updating the OS are made at the initial cost and are called depreciation. Wear calculation is performed based on two main parameters:

- initial cost;

- useful life of the object.

Determination of initial cost

The basis for the initial assessment of an asset related to fixed assets is the documented actual amount spent on putting it into operation. In addition to the purchase price, this concept includes direct costs:

- for delivery;

- preparation of the installation area;

- unloading;

- adjustment;

- overheads;

- other possible actions related to achieving serviceability.

If the fixed asset was purchased on credit, then in most cases it should be taken into account only for the principal amount (body), without interest paid. The exception is situations provided for by IFRS 23.

What determines the service life

The standard service life of the OS cannot be less than a year, but for each object it is determined individually, taking into account several factors:

- passport data and recommendations of the manufacturer;

- expected intensity of operation;

- specifics of maintenance;

- expected obsolescence;

- legal and other regulatory restrictions.

Types of depreciation of fixed assets

Complete or partial loss of a fixed asset’s useful operational properties, and, consequently, its depreciation, can occur for two main reasons:

Physical deterioration

Occurs as a result of exposure to harmful factors acting on an object during its use or storage. This concept includes a set of processes of friction, oxidation and other physical and chemical phenomena that accompany all material objects. The intensity of this type of wear is influenced by:

- rate of operation;

- quality indicators of an object that determine its durability;

- quality of fixed assets;

- external working conditions and technological features of the environment;

- personnel qualifications;

- thoroughness and timeliness of prevention and maintenance.

The degree of physical deterioration is determined by two methods:

- Expert, in which the condition of the object is assessed by specialists who compare objective parameters with reference ones.

- Analytical, taking into account the standard service life.

Obsolescence

It is expressed by a critical decrease in the efficiency of using the OS for commercial purposes due to conceptual obsolescence. A clear example would be the best computer produced in the mid-90s. Even if it has been sitting in a warehouse all the time in a packaged form, it does not meet today's requirements for computing technology.

It is customary to divide obsolescence into two types. The first form is associated with the reduction in cost of replacement analogues. In other words, the same object can now be purchased cheaper. The degree of obsolescence of the first form can be determined using the formula:

Where: MI1 – indicator of obsolescence of the first form; OSB – the cost at which an accounting unit is listed on the balance sheet; SALT is the amount that it will cost to restore or update a fixed asset in current market conditions.

The emergence of obsolescence of the second form is due to the advent of more advanced production methods and technologies. It is theoretically possible to work “the old fashioned way,” but the reproduction of a commercial product becomes less profitable, and its sale poses a problem due to competition.

The degree of obsolescence of a fixed asset of the second form is calculated using a formula expressing the relative increase in the efficiency of new means of production:

Where: MI2 – obsolescence of the second form; PNS – productivity of a new means of production in units of measurement accepted at the enterprise (for example, pieces per hour); PSS is the productivity of the old fixed asset in the same units.

Within the second form of obsolescence there is also a division into subcategories. He can be:

- Partial - if not all of its production value is lost. In some cases, an obsolete facility can be used in secondary process areas or operations with acceptable efficiency.

- Complete – when further exploitation entails losses. The outdated OS is awaiting dismantling and disposal.

- Hidden. There are no new, more productive fixed assets yet, but it is known that their development is underway.

- External. This subtype of obsolescence of the second form manifests itself under the influence of factors independent of the internal policy of the enterprise. For example, the production of manufactured products may be limited or prohibited by a decision of the authorities.

Regardless of the form of obsolescence, it is caused by technological progress. Some intangible assets (software, technical documentation, etc.) are also subject to it.

Methods of depreciation of fixed assets in accounting

Accounting uses four main methods for calculating depreciation, depending on the nature of the asset, legal regulations and its own interests.

With the straight-line method, the cost of an asset is written off evenly over its useful life. For example, if a machine is designed to last for five years, then 20% of its original cost will be depreciated each year.

The reducing balance method provides for the calculation of annual depreciation at the same percentage as with the linear method, but for the amount of the residual value rather than the original one. If we take the example of the same machine, then in the first year its cost will also decrease by 20%, but then the process will go slower (in the second year 16% will be written off, that is, a fifth of 80%, etc.). This non-linear method allows you to quickly depreciate fixed assets in the initial period of its operation, and then reduce its share in the cost of the product.

The third method is called “by the sum of numbers” , and is based on the addition of the numbers of the natural series that form the service life of the object. Despite the long name, it is quite simple. If we take the same example with a machine tool, its depreciation will occur at an accelerated rate in the first years of use:

This means that in the first year, depreciation will be one-third of the original cost. In the second year, 40% will be written off:

This method allows for accelerated depreciation.

And finally, the fourth method is that the cost of the fixed asset is transferred into the price of the manufactured product in proportion to the volume of its output. For example, it is known that on the mentioned machine it is possible to produce 10 million products over its useful life (5 years) without compromising quality. If 5 million units have already been made on it, then it should be depreciated by half.

Paragraph 5 of PBU 6/01 and Article 256 of the Tax Code of the Russian Federation clearly indicate that objects costing less than 40,000 rubles are not subject to depreciation.

Depreciation

Starting from the 1st day of the month following the month the OS was put into operation, the accountant should begin to calculate depreciation, that is, regularly write off part of the cost of the object as current expenses. Depreciation is temporarily suspended in the case of transfer of an object for free use, conservation lasting more than 3 months, as well as reconstruction and modernization lasting more than 12 months.

Tax accounting provides two methods for calculating depreciation: linear and non-linear. For objects belonging to the first to seventh depreciation groups, an organization can choose any of the two methods and apply it to all objects without exception, regardless of the date of their acquisition. For objects of the eighth to tenth groups there is no choice; for them the linear method is required.

According to tax accounting rules, a company has the right to change the method from the beginning of the new year. At the same time, you can switch from a linear method to a nonlinear one, as well as from a nonlinear to linear one, no more than once every five years.

The linear method is applied to each object separately, and the non-linear method is applied to the entire depreciation group.

Regardless of the method, taxpayers may apply increasing factors to the depreciation rate if certain conditions are met. In particular, if fixed assets are operated in a hostile environment or with increased shifts, the depreciation rate can be multiplied by a factor not exceeding 2 (see “How to apply increasing factors: litigation on fixed assets in a hostile environment”).

The difference between the original cost and accrued depreciation is called the residual value of the object.

By the way, in accounting there are not two, but four depreciation methods, and increasing coefficients are generally not provided.

Keep records of depreciable property for free according to the new rules

Linear method in tax accounting

To use it, you need to calculate the depreciation rate for the fixed asset. This rate is equal to one divided by the useful life (expressed in months) and multiplied by 100%.

The monthly depreciation amount is equal to the original cost multiplied by the depreciation rate.

Example

Let's say the useful life is 5 years (which corresponds to 60 months), the initial cost is 200,000 rubles. Then the depreciation rate will be 1.67% (1: 60 months x 100%), and monthly depreciation will be 3,340 rubles (200,000 rubles x 1.67%).

Depreciation must be stopped on the 1st day of the month following the month when the cost of the fixed asset was completely written off, or when the fixed asset left the organization.

Nonlinear method in tax accounting

To use it, it is necessary to determine the total balance for each depreciation group. To find it, you need to add up the residual value of all objects included in this group. The total balance must be determined on the 1st day of the month for which depreciation is calculated. If a company has put into operation a new facility, then from the next month its cost will be included in the total balance of the corresponding group. When an object is disposed of, the total balance is reduced by its residual value.

The amount of monthly depreciation for a group is equal to the total balance multiplied by the depreciation rate for this group and divided by 100. Depreciation rates are established by the Tax Code: for the first group 14.3; for the second - 8.8; for the third - 5.6, etc.

Example

Let's say the total balance for the first depreciation group is 1,000,000 rubles. Then depreciation will be 143,000 rubles (1,000,000 rubles x 14.3: 100). If the total balance of a depreciation group reaches zero, such a group is liquidated. If the total balance is less than 20,000 rubles, the company also has the right to liquidate the group and write off the balance value as non-operating expenses.

Registration of lease of fixed assets

In Russia, the legal aspects of leasing are regulated by Chapter 34 of the Civil Code of the Russian Federation. Business entities can transfer various objects, including fixed assets, for temporary use on a commercial basis. In this case, the lessor remains the owner of the property, and the lessee uses the asset for the period specified in the agreement. The exception is leasing, the terms of which provide for a phased purchase.

What postings should the lessor of the fixed asset make?

As with other business transactions, in this case the relationship between the parties is reflected in accounting. Rented objects become income-generating investments, which, in accordance with the current chart of accounts, is indicated by the posting Dt01 - Kt03.

On account 03, according to PBU 6/01, profitable investments are accumulated.

Income generated by the rental of fixed assets is recorded in accounts 90 and 91 (“Sales” and “Other income and expenses”, respectively). Some features should be taken into account:

- If the rental of fixed assets constitutes the main income of the enterprise, then, based on paragraph 5 of PBU 9/99, it is considered revenue and is accounted for in account 90.

- Account 91 (“Other income”) is used if the business structure has another main source of profit (clause 7 of the same PBU).

The postings reflecting the rental of the operating system are as follows:

| Accounts | Description of action | |

| Debit | Credit | |

| If rent is your main income | ||

| 03 | 08 | Putting the facility into operation. The initial cost is carried out. |

| 03 | 03 | Transfer of OS to tenant |

| 62 | 90 (91) | Receipt of rent payments. |

| 90 | 68 | VAT calculation |

| 20 | 02 | Depreciation calculation |

| If rent is “another type of activity” | ||

| 01 | 08 | Putting the facility into operation. The initial cost is carried out |

| 20-26 | 02 | Depreciation during owner use |

| 01 | 01 | Transfer of OS to tenant |

| 76 | 91 | Rental income (“other income”) |

| 91 | 68 | VAT calculation |

| 91 | 02 | Depreciation of leased fixed assets |

Notes Depreciation of leased fixed assets accumulates on account 91, that is, it is attributed to income, through which it will be possible to restore this asset in the future. Profit tax is charged on the amount of receipts.

The leased object is still listed on account 01 as a fixed asset. It is not transferred to account 03, because the lease provides for temporary use. After the contract expires, the asset can again be used for your own needs.

OS postings from the tenant's position

Leased fixed assets are accounted for in off-balance sheet account 001. The cost of the object is indicated in accordance with the lease agreement.

Capitalization of the leased fixed assets is carried out on Dt001. When returning property, the posting ends at Kt001.

Payment of rent is taken into account as expenses, is included in the cost of the product produced by the tenant and affects the calculation of income tax.

Unrealized moments

The concept of tax accounting, which forms the basis for depreciation calculations in the programs “1C: Accounting 8” and “1C: Manufacturing Enterprise Management 8”, allows you to calculate depreciation in all of the above examples. Moreover, all transactions will be generated automatically; the user only needs to describe business transactions in the fixed assets accounting documents.

However, there are features in the calculation of permanent and deferred tax assets and liabilities that lead to interesting results.

Temporary differences

The calculation of IT and ONA in the 1C program is carried out according to the table given in the description of the tax accounting concept.

Let's consider example 4, namely the determination of ONA and ONO in the first month of depreciation. We see that the amount of temporary differences amounted to RUB 125,000. What postings should be made to accounts 09 and 77?

1. In the standard “Enterprise Accounting” configuration, the calculation will be made according to the correspondence table:

Consolidated initial balance = 100,000 rubles (according to the debit of account 01)

Final consolidated balance = -25,000 rubles (100,000 on Dt 01, 125,000 on Kt 02)

Consolidated turnover = -125,000 rub.

According to the table, we see what postings should be made:

Dt 77 Kt 68.04.2 in the amount of 100,000*0.24 = 24,000 rubles

Dt 09 Kt 68.04.2 in the amount of 25,000 * 0.24 = 6,000 rubles

2. Now let's define the entries based on the fact that temporary differences are formed from differences in the original cost and in the method of calculating depreciation.

For VR due to cost differences:

Initial consolidated balance = 100,000 rubles

Final consolidated balance = RUB 75,000

Consolidated turnover = -25,000 rub.

Posting: Dt 77 Kt 68.04.2 in the amount of 25,000*0.24 = 6,000 rubles

For BP due to differences in depreciation:

Initial consolidated balance = 0 rub

Final consolidated balance = -100,000 rub.

Consolidated turnover = -100,000 rub.

Posting: Dt 09 Kt 68.04.2 in the amount of 100,000*0.24 = 24,000 rubles

Note that next month the postings will be as follows:

- Dt 09 Kt 68.04.2 in the amount of 125,000*0.24 = 30,000 rubles

- Dt 77 Kt 68.04.2 in the amount of 25,000 * 0.24 = 6,000 rubles

Dt 09 Kt 68.04.2 in the amount of 100,000*0.24 = 24,000 rubles

That. Although the tax base does not change, the financial statements are distorted. This is due to the fact that temporary differences in fixed assets that arise for various reasons are taken into account for the purposes of PBU 18/02 collectively according to accounting accounts.

Constant differences

A similar problem arises in accounting for permanent differences. To calculate PNO and PNA, turnover on accounts 90 and 91 is used according to the type of PR accounting. So, to calculate PNA, debit turnover on accounts 90 and 91 is used, and to calculate PNA, credit turnover is used. This is incorrect, because. permanent differences are taken together, and, for example, negative amounts may appear in the debit entries of account 91. Such amounts should be treated similarly to credit turnover on 91 accounts.

That is, if we have a posting on the debit of account 91 according to the PR accounting type in the amount of -10,000 rubles, then we should generate not a PNA in the amount of -2,400 rubles, but a PNA in the amount of +2,400 rubles.

Negative amounts in transactions began to appear in 2008 due to changes in PBU 3/2006. For example, if a fixed asset is purchased from a foreign supplier with an advance payment, then the exchange rate differences arising in the accounting system are treated as permanent and are included in the initial cost of the fixed asset. Exchange rate differences can take any sign, so permanent differences can turn out to be negative. When depreciating such fixed assets, these permanent differences will fall into account 90 or 91 with a minus sign.

What is the book value of fixed assets

Fixed assets are reflected in the balance sheet at their value, called residual value. The calculation formula is simple:

Where: O – residual value; F – initial cost; S – the amount of accrued depreciation.

In most cases, during operation the book value decreases. After the tax refund, VAT is also deducted from it.

Changes in the initial book value of fixed assets are possible in the following cases:

- completion or reconstruction of real estate, resulting in an increase in the price of the property;

- improvement of the means of production;

- partial liquidation of OS;

- revaluation.

The revaluation or depreciation of fixed assets at an enterprise can be carried out once a year or less often. These actions are justified by supporting documents or bringing the value into line with market realities (indexation).

Modernization and reconstruction of fixed assets at an enterprise in 2021 differ from repairs according to the criterion of changes in the technical and economic indicators of depreciable property. In cases where they increase, this is modernization. If the goal is to restore previous characteristics and properties lost during operation, then repair takes place.

The Federal Law “On Valuation Activities” establishes the following types of value of fixed assets:

- Market – represents the amount required to purchase an analogue, or the price at which it can be easily sold.

- Restoration – the sum of costs necessary to bring the object to the state in which it was at the time of the last assessment.

- Replacement is the same as restoration, but with the use of modern, cost-saving technological advances and also taking into account actual wear and tear.

- Investment - the amount withdrawn in order to attract shareholders, adjusted for the maximum return on financial investments.

- Liquidation – approximately equal to the market one, but slightly lower. At this price, the asset can be guaranteed and quickly sold.

- Recycling - is made up of the cost of useful materials and liquid components generated during the dismantling of an object, minus the costs of disassembly, sorting, etc.

Initial OS cost

An important characteristic of an asset is its initial cost. It is based on the amount the company costs to purchase this property. This cost is added up by summing up the direct costs of purchasing the OS, as well as the costs of its installation, delivery, registration, registration, etc.

It is formed on the basis of information from primary documentation received when purchasing an object. Sources of receipt of fixed assets influence the process of formation of the initial price of an object.

If the object is received under a purchase and sale agreement, then the main cost for the initial cost comes from the purchase price of the object and services for its delivery.

If a facility is created within an organization (for example, the construction of a building), the initial cost reflects the company's investment in creating the facility. When an operating system is created at the expense of one’s own resources, this is primarily the price of materials and payments for labor. When attracting contractors, a larger amount of the initial cost falls on the price of services under contract agreements.

OS can come to the organization in the form of a contribution from one of the owners of the company. Then the initial cost is assigned by a monetary valuation of the object agreed upon by the founders.

When an asset is received free of charge, its initial price is calculated as the current market value of similar property on the day of receipt.

It is possible that the company pays for fixed assets not in cash, but with some other material assets (for example, an exchange agreement), then the initial price of this type of property is equal to the value of the objects transferred for it.

Attention! The initial price of the fixed asset remains with him until the fact of his disposal.

How to calculate the average annual cost of fixed assets

This indicator is needed for filling out Form 11 and other statistical documents, as well as for internal analysis of the dynamics of enterprise development. There are two main methods to determine the average annual cost of fixed assets: simplified and accurate.

As a rule, solving this problem for individual entrepreneurs using the simplified tax system is not very difficult. An individual entrepreneur has valuable assets in spades and everything is in plain sight. For him, this is the average figure between the values at the beginning and end of the year. The difference between the values is due to depreciation. If the OS is sold in a certain month, then this is easy to take into account, if necessary.

In the case of a large company, LLC or CJSC, everything is not so simple. Complex and expensive equipment can be written off or purchased, and this happens unevenly. The most accurate result will be obtained if you perform calculations using the formula:

Where: GHS – average annual cost of fixed assets; CHi – cost of fixed assets at the beginning of each month; CKi – cost of fixed assets at the end of each month; i – serial number of the month.

The calculation of the average annual cost of the active part is carried out in a similar way, however, in order to isolate it from the total amount of fixed assets, synthetic and analytical accounting is necessary.

Tasks and methods of auditing asset accounting

In order to avoid possible fines for violating the requirements of regulations in force in Russia, enterprises conduct an audit of fixed asset accounting. This event involves monitoring the following facts:

- The fixed assets listed on the balance are available, and their condition corresponds to that indicated.

- Documentary support for operations with fixed assets (receipt, disposal, revaluation, etc.) is carried out correctly.

- Depreciation is carried out properly.

- All taxes have been assessed and paid.

- Objects are classified as OS justifiably.

If a shortage is identified, the auditor reflects it in the reconciliation sheet. The result in the form of an act serves as a guide for eliminating violations. If they are discovered by government audits, penalties will inevitably be imposed, possibly very severely.

What is the difference between tax accounting and accounting?

The differences between tax and accounting are due to the fact that they are regulated by different regulatory documents.

The Tax Code of the Russian Federation defines its criteria for classification as fixed assets. In the Tax Code of the Russian Federation, the minimum cost in 2021 is set at one hundred thousand rubles (according to PBU 6/01 - 40 thousand rubles)

Thus, non-depreciable property is included in material expenses at the time of commissioning, and the taxpayer sets the time for its write-off independently, based on the expected period of use or other considerations.

But it’s not just the 2021 limit that determines the differences. They appear for the purposes of each of the accounting systems:

- Tax accounting determines the tax base.

- Accounting allows us to judge the effectiveness of a commercial organization.

The discrepancies between tax and accounting approaches to accounting are the topic of a separate detailed study. It is unlikely that they will be completely eliminated in the near future, but work towards rapprochement is constantly underway.

Taxation of fixed assets

The article has already talked about how to capitalize a fixed asset and how to sell it, but one more important issue remains - taxation.

We should start with one of the main fiscal obligations of any commercial entity - VAT.

Value added tax is levied on all transactions involving the acquisition, sale, repair and rental of fixed assets without exception. It is accrued if three necessary conditions are simultaneously met:

- OS was acquired for activities subject to VAT.

- The main facility has been put into operation.

- The purchase of the OS is confirmed by a correctly executed invoice.

If a fixed asset is purchased free of charge, then its cost is included in the income portion. Profit tax is charged on this amount, as well as on the sale of products produced through this operating system.

The sale of a fixed asset in accounting is treated as a sale; 20% VAT is deducted from the proceeds if the seller accepted the tax as a deduction at the time of its acquisition. Otherwise, if the cost of the fixed assets “hangs” on account 01 along with incoming VAT, then the tax should be calculated differently:

Where: S – the sum of the residual value with commissioning costs

Property tax is calculated on the basis of accounts 01 (“Fixed Assets”) and 03 (“Income Investments”), based on articles of the Tax Code of the Russian Federation and other regulatory documents.

The tax base is the residual value of the object, equal to the original cost plus the costs of putting it into operation minus depreciation made by the actual owner (not the former).

Since the beginning of 2013, accounting for property taxes involves accrual exclusively on real estate items related to fixed assets.

Comparison of VR and BU data

Organizations often face the problem of reconciling data on temporary differences and postings to accounts 09 and 77. The following questions may be asked regarding the compliance of BP and BU:

- Accountant: how to check whether temporary differences and accounting entries have been calculated correctly?

- Tax inspector: how are the entries for accounts 09 and 77 calculated? give reasons.

- CFO: break down account balances 09 and 77 into short-term (<1 year) and long-term (>1 year).

Within the framework of standard accounting in 1C programs, it is not always possible to fully answer these questions. Let's look at why:

1. The first question can be answered like this.

“If the initial data on the operating system is entered correctly, then the program calculates both temporary differences and transactions for 09 and 77 accounts correctly. To check, you can look at the following correspondence. If we take the consolidated balance of fixed assets accounting accounts by type of accounting BP and multiply by 0.24, then it should coincide with the consolidated balance of accounts 09 and 77 by type of asset “fixed assets”. If an error was made in the initial OS data, it will certainly manifest itself either in a violation of this compliance, or account 68.04.2 (Calculation of income tax) will not be closed at the end of the tax period.”

In the program, in the documents “Month Closing” (“1C: Accounting 8”) and “Calculations for Income Tax” (“1C: Manufacturing Enterprise Management 8”) there is a calculation certificate for generating transactions for 09 and 77 accounts in the context of accounting objects . In it you can see both information about the differences and information about the calculation of SHE and IT.

As described above, in some cases the program incorrectly identifies accounts 09 and 77, although it does the postings according to 68.04.2 correctly. Such cases are almost impossible to detect during a routine check, so we can assume that the answer to the first question has been given.

2. This question is more difficult to answer. Firstly, we can provide a description of the tax accounting methodology distributed in articles on ITS disks. Since 2008, a description of the accounting methodology in accordance with PBU 18/02 can be recorded in the accounting policy of the organization and it makes sense to formulate an accounting policy that corresponds to the 1C methodology.

Secondly, you can consider several typical examples of operating systems with temporary differences, check them manually and compare them with a reference calculation for the differences. The same certificate can be attached as justification for the correctness of the calculation.

3. In the current implementation of OS accounting in 1C programs, such a division cannot be made for a number of reasons. Firstly, accounts 09 and 77 are not broken down into individual fixed assets, and it is possible to determine over what period of time a tax asset (liability) will be written off only using the accounting data of a specific fixed asset. Secondly, even if we know which fixed asset this amount belongs to, say, in account 77, its repayment period depends not just on the remaining depreciation period of the fixed asset, but on the relationship between the fixed asset depreciation parameters in accounting and tax accounting.

Documentation of transactions with fixed assets

Accounting for fixed assets is based on primary documents and acts. They can be carried out on electronic or paper media in any form, in compliance with the required details. Instructions for accounting - Resolution of the State Committee on Statistics of the Russian Federation No. 7 of January 21, 2003.

Approved forms for primary accounting, to which additions can be made, are listed in the table:

| Form designation | Description of the action confirmed by the act |

| OS-1 | Acceptance or transfer of fixed assets, excluding real estate |

| OS-1a | Acceptance or transfer of real estate |

| OS-1b | Reception or transfer of several operating systems, excluding real estate |

| OS-2 | Internal OS relocation |

| OS-3 | Delivery and acceptance of OS after repair, modernization or reconstruction |

| OS-4 | Write-off of fixed assets, except vehicles |

| OS-4a | Vehicle write-off |

| OS-4b | Write-off of several operating systems, except for vehicles |

| 0С-6 | OS inventory card |

| OS-6a | Inventory card for a group of similar operating systems |

| OS-6b | OS inventory book |

| OS-14 | Receipt of equipment |

| OS-15 | Reception and transfer of installed equipment |

| OS-16 | Equipment inspection and defect report |

Accounting statements for fixed assets

During the entire period of use of the OS, all actions performed with it are covered by reporting. The accounting documents in which it is maintained are listed in the table:

| Document form | Purpose |

| Report on fixed assets | The object is characterized by depreciation group, estimated depreciation, initial and residual value, and capitalization date. Allows you to conduct analytical and synthetic analysis of the state of the operating system in the enterprise. |

| OS log book | Report on the movement of fixed assets, from the moment of registration to disposal. |

| OS accounting book | For enterprises operating under a simplified accounting system, it replaces inventory cards OS-6 and OS-6b. Filled out just like them. |

| OS comparison sheet (form INV-18) | Recording differences between inventory results and accounting data. Shortages are indicated by the sign “-”, surpluses by “+”. |

| Certificate of book value of fixed assets | Contains information about the book value of fixed assets at the time of the last report. May be for a third party or an internal sample. The OS balance sheet is requested by banks when considering a loan application. |

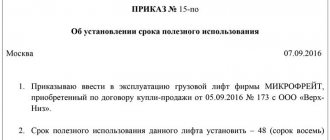

Orders relating to fixed assets

Due to the importance of fixed assets for each enterprise (they form the basis of its financial solvency), all actions with them (write-off, conservation, inventory, modernization, etc.) are formalized by orders of the organization’s top manager. They are completed on standard forms (additions are allowed). It is necessary to indicate the reason for this or that action (justification) and other details provided by the form.

Each of the orders is recorded in the INV-23 journal.

Sample order for fixed assets, in this case their inventory:

Download

Members of the inventory commission can be listed in the text of the document indicating their full names and positions or appointed by a separate order.

A sample order for the creation of a commission for the inventory of OS can be downloaded from the link:

Download

Title documents

Documents for the purchase of fixed assets are, as a rule, stored not in the accounting department, but with the chief lawyer, but they are also related to accounting. This is confirmation of the legal ownership of the OS.

For example, a purchase and sale agreement looks like this:

Download

An enterprise can also own property on the basis of agreements of gratuitous transfer, exchange and other title documents.

How can production switch to a simplified taxation system?

By default, all new individual entrepreneurs and LLCs use the OSNO, unless during registration or within 30 days from the date of submission of documents they have declared their desire to switch to the simplified tax system. Later, it will also be possible to change the taxation system, but the transition will be carried out only from January 1 of the next year.

You can use the simplified tax system if:

- the type of activity allows it. The list of those who do not have the right to switch to the “simplified system” is given in;

- you have no more than 100 employees.

The right to use the simplified tax system will be lost if the annual turnover exceeds 150 million rubles or the number of employees exceeds one hundred ( ).

Conditions for the transition to the simplified tax system for existing individual entrepreneurs and LLCs:

- income for 9 months of the year in which the application was submitted did not exceed 112.5 million rubles ( ). This restriction does not apply to individual entrepreneurs ();

- the residual value of working capital does not exceed 150 million rubles;

- for LLC: no branches and the share of other organizations in the authorized capital does not exceed 25%.

Guidelines for accounting for fixed assets

The procedure for accounting for fixed assets is regulated by the fundamental document - “Methodological guidelines for accounting of fixed assets”, approved by Order No. 91n of the Ministry of Finance of the Russian Federation dated October 13, 2003.

In addition, internal standards of the enterprise are also practiced, established within the limits of legislative restrictions. In particular, the accounting policy is determined by a special order, which once and for all (as long as the organization exists) specifies the rules for accounting, tax and financial reporting.

According to Article 1 of the Accounting Law, accounting policies are the principles, methods and procedures used by an enterprise in the process of preparing financial statements.

The order on accounting policy reflects not only the organization of accounting, but also the rules of accounting assessment.

The internal regulations also include the job description of the accountant for accounting of fixed assets (if such a position is provided for in the staffing table) or the chief accountant.