Payment

The process of liquidating an LLC is very complex and affects many aspects of the financial condition of the organization. One of

Marketing market research is driven by the emergence of various modernized, new products. Advertising agencies study economic relations,

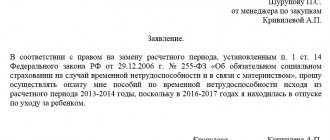

When calculating benefits based on certificates of incapacity for work, the accountant first determines the average income. According to the social insurance law

Reflection of estimated liabilities in accounting is mandatory. Most often, accountants record a payment reserve

The need to maintain separate VAT accounting arises when an organization has export operations

Registration of furniture movement in accounting transactions is regulated by the standards of PBU 6/01 and the Tax Code of the Russian Federation. Furniture

Which depreciation group does it belong to? Thus, the safe is taken into account in current assets, and the cost

Every entrepreneur who is just starting out in the world of big business faces a reasonable question:

An organization can purchase or develop a trademark (service mark) independently. At the same time she has

According to the Tax Code of the Russian Federation, the category of expenses includes losses and expenses that occurred during