Payment

How the financial result is reflected - postings The loss in accounting (hereinafter referred to as accounting) is determined by

Tax status of the employee A tax resident for tax purposes is a person located in Russia

Labor legislation guarantees full and timely payment of wages to employed citizens. In this case, payment

Home / Taxes / What is VAT and when does it increase to 20 percent?

Home — Articles When your organization opens a separate division (hereinafter referred to as SB) in another

Almost every company has office equipment on its balance sheet. Office equipment has a limited service life. By

According to Article 127 of the Labor Code of the Russian Federation, upon dismissal, an employee is paid monetary compensation for unused vacation.

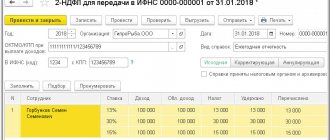

Employer reporting Marina Dmitrieva Leading expert - professional accountant Current as of October 8, 2020

Where to submit and in what time frame First of all, the annual balance must be submitted to the Federal Tax Service.

The filling procedure is prescribed in Order of the Federal Tax Service of the Russian Federation dated October 15, 2020 No. ED-7-11/753. From 1st quarter