Reflection of estimated liabilities in accounting is mandatory. Most often, accountants record a reserve for vacation pay. But this is not the only case where the obligations in question need to be taken into account. They are recorded only in reporting. The reserves will not appear on the tax return.

Question: How are the organization's estimated liabilities reflected in accounting and financial statements in connection with the emergence of employees' right to paid vacations in accordance with the legislation of the Russian Federation? According to the accounting policy of the organization, the formation of an estimated liability for payment of vacations to employees is carried out monthly on the last day of each month based on data on average earnings and the number of vacation days for each employee. Administrative expenses as semi-fixed expenses are recognized in the cost of sales in the period of their acceptance for accounting. In tax accounting, the organization does not create a reserve for upcoming vacation payments. View answer

How to calculate the amount of an estimated liability

There is no reserve algorithm in PBU 8/2010. Therefore, the procedure for its calculation should be approved in the accounting policy.

The following options are possible for determining the specific amount of contributions to the valuation reserve for vacation pay:

- based on the actual size of the monthly wage fund;

- for each employee separately;

- by department or employee category.

For the calculation, you will need data on the number of days of unused vacation for each employee as of the end of the reporting period and the vacation schedule for the coming year.

The amount of vacation pay liability at the end of the reporting period can be calculated as follows: the number of days of unused vacation for each employee is multiplied by his average daily earnings for the 12 months preceding the reporting period.

Average daily earnings are calculated based on all accruals taken into account when calculating vacation pay in accordance with Decree of the Government of the Russian Federation dated December 24, 2007 No. 922.

In this case, the time and amounts accrued during this time are not taken into account in cases where the employee:

- received benefits for temporary disability or maternity benefits;

- did not work due to downtime due to the fault of the employer or for reasons beyond the control of the employer and employee;

- did not participate in the strike, but was not able to do his job;

- used additional paid days off to care for disabled children;

- was on a business trip or vacation or in other cases was released from work with full or partial retention of wages (or without pay).

Social payments and other payments not related to wages are also not taken into account.

The amount of the liability for insurance premiums is determined by multiplying the amount of the liability for vacation pay by the rate of insurance premiums and “injury” premiums.

When calculating insurance premiums, the amount of payments in favor of each individual must not exceed the established limit, beyond which firms paying contributions at the general rate must accrue additional contributions to compulsory pension insurance. Based on the vacation schedule for the current year, it is necessary to assess how, by the time vacation pay is paid to the employee, insurance premiums will be calculated from his income.

You can accrue the estimated liability for vacation pay at a frequency determined at your discretion - for example, quarterly. Then the amount of the reserve must be compared with the amount formed at the end of the previous quarter and increased by actually paid vacation and insurance contributions. Increase the estimated vacation liability by the resulting difference.

You can make similar calculations not for each employee, but, for example, by department, by salary level, etc. In this case, you will have to take into account the average daily earnings for the department (group), calculated from the general wage fund and the average number of employees in 12 months.

The amount of the estimated liability must also include additional vacations.

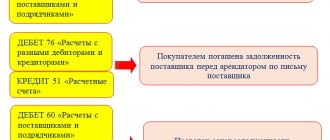

Reflection in accounting

When creating a reserve, vacation expenses can only be written off against this reserve.

The formed reserve is reflected in account 96 “Reserves for future expenses”. The reserve amounts are accrued by debiting expense accounts that record employee salaries:

DEBIT 20 (23, 25, 26, 29, 44...) CREDIT 96

— an estimated reserve for vacation pay has been accrued.

As employees go on vacation, the accountant accrues vacation pay, insurance contributions for health insurance, social insurance, compulsory medical insurance and contributions for “injuries” from the reserve.

Postings are reflected in the debit of account 96 in correspondence with accounts 70 and 69:

DEBIT 96 CREDIT 70

— vacation pay is accrued from the reserve;

DEBIT 96 CREDIT 69

— insurance premiums for OSS, compulsory health insurance, compulsory medical insurance and contributions for “injuries” are calculated at the expense of the reserve.

In tax accounting, a company may or may not create a reserve for vacation pay (Article 324.1 of the Tax Code of the Russian Federation). If a holiday reserve is not created in tax accounting, then differences and associated deferred tax assets will arise. The wiring is completed:

DEBIT 09 CREDIT 68

— a deferred tax asset has been formed (in the amount of the estimated liability × 20%).

When vacation pay is actually accrued, this asset is extinguished:

DEBIT 68 CREDIT 09

— the deferred tax asset is repaid (by the amount of accrued vacation and insurance contributions × 20%).

EXAMPLE 1. ACCRUAL AND USE OF RESERVE FOR PAYMENT OF HOLIDAYS IN ACCOUNTING

In tax accounting, Vesna LLC does not create a reserve for upcoming expenses for payment of vacations.

Let’s assume that as of March 31, the company’s accounting records recognized an estimated liability for the payment of vacation pay in the amount of 50,000 rubles. The following entries were made in the accounting: DEBIT 20 CREDIT 96

- 50,000 rubles.

– the amount of the estimated liability is reflected; DEBIT 09 CREDIT 68

- 10,000 rub.

(50,000 rubles × 20%) – a deferred tax asset is reflected. In the second quarter, employees were accrued vacation pay (together with insurance contributions) in the amount of 50,000 rubles. and additionally, estimated liabilities for vacation pay were recognized in the amount of 100,000 rubles. The following entries were made in accounting: DEBIT 96 CREDIT 70 (69)

- 50,000 rubles.

– vacation and insurance contributions accrued; DEBIT 68 CREDIT 09

- 10,000 rub.

(RUB 50,000 × 20%) – the deferred tax asset is written off; DEBIT 20 CREDIT 96

- 100,000 rub.

– the amount of the estimated liability is reflected; DEBIT 09 CREDIT 68

- 20,000 rub. (RUB 100,000 × 20%) – a deferred tax asset is reflected.

Reserve inventory

As of December 31, take an inventory of the reserve for vacation pay created in accounting and tax accounting. This is the requirement of paragraph 3.50 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated June 13, 1995 No. 49, and paragraph 3 of Article 324.1 of the Tax Code of the Russian Federation.

During the inventory, compare the actual amount of vacation expenses incurred in the current year with the actual amount of contributions to the reserve.

If it turns out that the amount of the accrued reserve is less than the amount of actual expenses for vacation pay, include the difference in the current expenses for vacation pay. This rule is established in paragraph 3 of clause 3 of Article 324.1 of the Tax Code of the Russian Federation.

Make an entry in accounting:

Debit 20 (23, 25, 26, 29, 44) Credit 96 subaccount “Estimated liability for vacation pay”

– an additional reserve has been accrued for the amount of excess of actual expenses for vacation pay over the reserve amount.

An example of additional accrual of reserves to actual expenses for vacation pay

LLC "Torgovaya" created a reserve for vacation pay in accounting and tax accounting.

At the end of the year, the accountant conducted an inventory, as a result of which he revealed the following:

- actual deductions to the reserve were made in the amount of 490,584 rubles;

- the accrued amount of vacation pay, taking into account contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases, amounted to 510,000 rubles.

The amount of the reserve is less than the amount of actual expenses for paying vacation pay (including insurance contributions) by 19,416 rubles. (490,584 rubles – 510,000 rubles).

At the end of the year, the organization’s accountant added the reserve to the actual expenses for vacation pay. He made the following entries in accounting:

Debit 44 Credit 96 subaccount “Estimated obligation to pay for vacations” - 19,416 rubles. – an additional reserve has been accrued for the amount of excess of actual expenses for vacation pay (including insurance premiums) over the reserve amount.

When calculating income tax, the accountant took into account 19,416 rubles in expenses.

If it turns out that the amount of the accrued reserve is greater than the amount of actual expenses for vacation pay, the procedure for accounting for the difference depends on whether the organization will create a reserve for vacation pay next year or not.

The organization may not make changes to the accounting policy and continue to create a reserve for vacation pay (using the same methodology). In this case, part of the reserve that was underused in the current year can be transferred to the next year.

For this:

- determine which employees did not use vacation (part of it) for the current year;

- determine the exact number of vacation days not used by such employees for the current year;

- Calculate the average daily earnings of such employees.

Then, for each employee, calculate how much of the reserve can be carried over to the next year. To do this, determine the estimated amount of vacation pay for vacation not used by the employee in the current year:

| Estimated amount of vacation pay for vacation not used by the employee in the current year | = | The actual number of vacation days not used by the employee in the current year | × | Average daily earnings of an employee | + | The amount of contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases related to calculated vacation pay |

Sum up the results for each employee. You will receive a total reserve amount that can be carried forward to the next year. If a decision is made to transfer the reserve, add it to the reserve for vacation pay for the coming year.

Compare the estimated amount of vacation pay for vacation unused by employees this year with the balance of the reserve. If this amount exceeds the actual reserve balance at the end of the year, include the excess amount in labor costs. If the amount of the calculated reserve for unused vacation is less than the actual balance of the reserve at the end of the year, then include the negative difference in non-operating income.

This procedure is established by paragraph 4 of Article 324.1 of the Tax Code of the Russian Federation.

When forming an accounting policy for the next year, the organization has the right to refuse to create a reserve. In this case, include the entire amount of the underutilized reserve as of December 31 of the current year in non-operating income for the current year. This rule is established by paragraph 5 of Article 324.1 of the Tax Code of the Russian Federation.

And in the case when the organization carries over the balance of the reserve to the next year, and when the reserve is not created in the next year, reflect the amount of the underused reserve for vacation pay in accounting as part of other income:

Debit 96 subaccount “Estimated liability for vacation pay” Credit 91

– the amount of the reserve for vacation pay for the excess difference is reflected in other income.

If the organization carries over the balance of the reserve to the next year, include in other income only the amount of excess of the balance of the reserve over the amount of the reserve in terms of unused vacation. If the organization does not plan to create a reserve for vacation pay next year, then include the balance of the reserve at the end of the year in other income in full.

This accounting procedure follows from the provisions of paragraph 23 of PBU 8/2010.

An example of transferring part of the reserve for vacation pay to the next year

In 2015, Torgovaya LLC created a reserve for vacation pay in accounting and tax accounting. The organization is not changing the reserve formation methodology in 2021.

According to inventory data in 2015:

- actual deductions to the reserve were made in the amount of 540,128 rubles;

- the accrued amount of vacation pay, taking into account mandatory insurance contributions, amounted to 500,000 rubles.

Thus, the amount of the accrued reserve is greater than the amount of actual expenses for vacation pay by 40,128 rubles. (540,128 rubles – 500,000 rubles).

In 2015, only manager A.S. was not granted leave. Kondratiev. The accountant calculated the amount of the reserve relating to unused vacation as follows.

For January–December 2015, Kondratyev received a salary of 276,000 rubles. There were no other payments to the employee during this period. The billing period has been fully worked out.

Kondratiev’s average daily earnings are 784.98 rubles/day. (RUB 276,000: 12 months: 29.3 days/month). Accordingly, the amount of vacation pay as of December 31, 2015 is: 784.98 rubles/day. × 28 days = 21979.44 rub.

Contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases: RUB 21,979.44. × (22% + 2.9% + 5.1% + 0.2%) = RUB 6,637.79

The amount of the reserve for unused vacation is equal to: RUB 21,979.44. + 6637.79 rub. = 28,617.23 rub.

The difference between the amount of the unused reserve for 2015 and the amount of the reserve calculated based on the days of unused vacation is: RUB 40,128. – 28,617.23 rub. = 11,510.77 rub.

When calculating income tax, the accountant included 1,900 rubles. included in non-operating income in 2015. He made an entry in accounting:

Debit 96 subaccount “Estimated obligation to pay for vacations” Credit 91 – 11,510.77 rubles. – the excess difference for 2015 in the amount of the reserve for vacation pay is reflected in other income.

Reserve for vacation pay in the amount of RUB 28,617.23. The accountant postponed it to 2021.

An example of accounting for the difference in the amount of the reserve for vacation pay during capital construction. The created reserve turned out to be greater than actual payments to employees

Alpha LLC is building a new building for its own needs. Expenses directly related to its construction are included in capital investments (account 08). In particular, a reserve for vacation pay was created in accounting and tax accounting - 1,500,000 rubles.

The accountant reflected this operation as follows:

Debit 08 Credit 96 subaccount “Estimated obligation to pay for vacations” - 1,500,000 rubles. – deductions were made to the reserve for vacation pay from the salaries of employees involved in capital construction.

At the time of commissioning of the building, Alpha’s accountant, in accordance with the requirement of paragraph 23 of PBU 8/2010, recalculated all estimated indicators that are associated with this event (including the amount of the reserve for vacation pay). According to the inventory data, it was revealed that the amount of the reserve determined at the time of commissioning of the building is less than the figure calculated earlier and should be 1,200,000 rubles.

Thus, the difference between contributions to the reserve and its size at the time of commissioning of the facility (accounted for in account 96) was:

– 300,000 rub. (RUB 1,500,000 – RUB 1,200,000).

The accountant took the specified amount into account as part of the organization’s other income in accordance with paragraph 22 of PBU 8/2010:

Debit 96 subaccount “Estimated obligation to pay for vacations” Credit 91 – 300,000 rubles. – the excess difference in the amount of the reserve for vacation pay is reflected in other income.

Situation: what to do if the amount of vacation pay actually paid was less than the formed reserve for vacation pay? Deductions to the reserve are made from capital investments in fixed assets. This year the facility was put into operation.

The answer to this question depends on the reason for the difference.

There are two options:

1. The reserve itself was incorrectly formed, or deductions for it were incorrectly made at the expense of capital investments.

2. The reserve was formed correctly, but actual payments actually turned out to be less than expected.

In the first case, adjust the initial cost of the fixed asset and accrued depreciation to the excess amount. At the same time, write off this amount as other expenses.

Let us explain why this should be done. The initial cost of a fixed asset is formed from the actual costs of its acquisition, construction and production. That is, from capital investments (account 08, clause 8 of PBU 6/01). If, at the time of commissioning, capital investments also included the costs of creating a reserve for vacation pay, which were determined to be excessive as a result of the inventory, then the initial cost was overstated.

The identified error must be corrected. After all, it turns out that the organization applied the norm incorrectly. This follows from the provisions of paragraphs 3 and 4 of PBU 22/2010. If the cost of the fixed asset is not adjusted, the organization faces administrative liability.

Errors that are discovered before the end of the year, as in the situation under consideration, should be corrected in the month in which they were discovered. This instruction is contained in paragraph 5 of PBU 22/2010.

Reflect the initial cost correction as follows:

Debit 01 Credit 08

– the initial cost of the fixed asset was reduced by the amount of the identified error.

Accrued depreciation also needs to be adjusted, since it was calculated based on an inflated initial cost:

Debit 20 (23, 25, 44...) Credit 02

– adjustment of accrued depreciation for fixed assets in the amount of the identified error.

At the same time, exclude the excess amount from capital investments. You can do this with the following wiring:

Debit 91 Credit 08

– reflects the write-off of contributions erroneously attributed to capital investments to the reserve for vacation pay.

In the second case, there is no need to adjust the original cost and depreciation.

The fact is that actual payments for vacations, which subsequently turned out to be less than the created reserve, cannot be considered an error. After all, at the time the reserve was formed, its size was determined correctly - based on the time actually worked by employees. There is no need to correct such inaccuracies. This follows from the provisions of paragraph 8 of paragraph 2 of PBU 22/2010.

The difference that arose due to the fact that the created reserve turned out to be more than actual expenses is attributed to other income (clause 22 of PBU 8/2010).

In accounting, write off the excess difference as other income as follows:

Debit 96 subaccount “Estimated liability for vacation pay” Credit 91

– the amount of the reserve for vacation pay for the excess difference is reflected in other income.

An example of reflecting adjustments to the initial cost of a fixed asset in accounting. Deductions for the formation of a reserve for vacation pay were taken into account in it erroneously

Alpha LLC independently builds a building for its own needs. Construction continues from January to September.

Due to capital investments, 5,500,000 rubles were spent on the construction of the building. The accountant reflected them with the corresponding entries:

Debit 08-3 Credit 10 (23, 25, 26, 60, 70, 76...) – RUB 5,500,000. – reflects the costs associated with creating an object and bringing it to a state suitable for use.

The following employees were employed in construction:

- 100 people – from January to July;

- 70 people – from August to September.

Therefore, the accountant made deductions to pay them vacation pay from capital investments - 200,000 rubles each. monthly (based on days actually worked). From January to September, the accountant made the following monthly entries:

Debit 08-3 Credit 96 subaccount “Estimated obligation to pay for vacations” - 200,000 rubles. – deductions were made to the reserve to pay for vacations of employees involved in capital construction.

Also, every month until October, the accountant deducted 100,000 rubles to create a reserve to pay for vacations of employees (50 people) engaged in the main production:

Debit 20 Credit 96 subaccount “Estimated obligation to pay for vacations” - 100,000 rubles. – deductions were made to the reserve to pay for vacations of employees engaged in the main production.

In September, construction was completed and the building was put into operation, all necessary rights to it were registered. The accountant made the following entry:

Debit 01 subaccount “Fixed asset in operation” Credit 08-3 – RUB 7,300,000. (RUB 5,500,000 + RUB 200,000 × 9 months) – a fixed asset created on an economic basis was accepted for accounting and put into operation at its original cost.

The useful life of the building was determined to be 20 years (240 months). Starting in October, the accountant began depreciating the object. According to the accounting policy - linear method. To do this, the accountant first determined the annual depreciation rate for the object: – 5% (1: 20 years × 100).

And then he calculated the amount of monthly depreciation of the building: - 30,416.67 rubles. (5% × RUB 7,300,000: 12 months).

The accountant reflected the calculation of depreciation in accounting as follows: Debit 20 Credit 02 – 30,416.67 rubles. – depreciation has been accrued on fixed assets used in the main production.

Starting from October, when all employees were employed in the main production, the accountant created a reserve for vacation pay entirely from the costs of the main production (300,000 rubles per month based on the days actually worked):

Debit 20 Credit 96 subaccount “Estimated obligation to pay for vacations” - 300,000 rubles. – deductions were made to the reserve to pay for vacations of employees engaged in the main production.

Thus, at the end of the year, the total amount of contributions to the reserve was: - RUB 3,600,000. (RUB 200,000 × 9 months + RUB 100,000 × 9 months + RUB 300,000 × 3 months).

On December 31, the accountant took inventory of the organization’s income and expenses, including the correspondence of the reserve for vacation pay and actual payments to employees. It was revealed:

- that from August to September some of the people previously employed in construction were transferred to the main production. That is, deductions for the formation of a reserve to pay for vacations at the expense of capital investments were overestimated. Instead of 200,000, it was necessary to deduct 140,000 rubles. The remaining 60,000 rubles. had to be attributed to the costs of main production;

- actual payments to employees turned out to be less than the created reserve - RUB 3,400,000.

In order to correct the error associated with inflated deductions due to capital investments, the accountant determined its size:

– 120,000 rub. (RUB 60,000 × 2 months).

The accountant adjusted the initial cost of the fixed asset by this amount by issuing an accounting certificate in December, and reflected this in accounting as follows:

Debit 01 Credit 08-3 – 120,000 rub. – the initial cost of the fixed asset was reduced by the amount of the identified error.

Thus, the initial cost of the building should be:

– 7,180,000 rub. (RUB 7,300,000 – RUB 120,000).

Taking into account the adjustment of the original cost, the accountant also adjusted the depreciation accrued from October to December.

To do this, he first determined how much monthly depreciation should be:

– RUB 29,916.67 (5% × RUB 7,180,000: 12 months).

That is, you need to adjust depreciation by: – 1500 rubles. (3 months × (RUB 30,416.67 – RUB 29,916.67)).

The accountant reflected the adjustment as follows:

Debit 20 Credit 02 – 1500 rub. – the accrued depreciation on the fixed asset was adjusted in the amount of the identified error.

At the same time, the accountant wrote off part of the adjusted initial cost from capital investments to other expenses, taking into account that there was no work in progress at the end of the year:

Debit 91 Credit 08-3 – 120,000 rub. – the excess difference determined during the inventory of the reserve for vacation pay is excluded from the composition of capital investments.

In addition, the accountant reflected the write-off of the excessively formed reserve:

Debit 96 subaccount “Reserve for vacation pay” Credit 91 – 200,000 rubles. (RUB 3,600,000 – RUB 3,400,000) – the amount of the reserve for vacation pay for the excess difference is reflected in other income.

Reserve for vacation pay in tax accounting

If a reserve for upcoming expenses for vacations is not created in tax accounting (Article 324.1 of the Tax Code of the Russian Federation), this may lead to a sharp increase in the company’s expenses in the month of mass vacations. This may result in an income tax loss. Therefore, in order to allocate expenses evenly in tax accounting, it makes sense to create this reserve.

note

If a company forms a reserve for vacation pay in tax accounting, then actually accrued vacation pay and related insurance premiums do not participate in the calculation of the tax base during the entire tax period. That is, expected costs are taken into account, not actual costs.

If a company decides to create this reserve, then in its accounting policy for tax purposes it must approve:

- maximum contribution amount;

- reservation method;

- monthly percentage of deductions.

Mandatory accounting reserves 2020–2021: classification, types, regulations

Accounting reserves can be divided into 3 groups:

- clarifying - intended to adjust the book value of certain assets (reserves for impairment of inventories and (or) financial investments, reserve for doubtful debts);

- contingent - reserves associated with the emergence of conditional facts of economic activity at the company (due to the occurrence of highly probable events in the future: a obviously unsuccessful trial; restructuring of the company, etc.);

- targeted - reserves for upcoming expenses for specific purposes (for example, warranty repairs, upcoming vacation payments, etc.).

The first group of reserves is reflected in accounts specially designated for them:

- 14 “Reserves for reduction in the value of material assets”;

- 59 “Provisions for impairment of financial investments”;

- 63 “Provisions for doubtful debts”.

Get acquainted with the nuances of a doubtful reserve using the material “Reserves for doubtful debts in accounting.”

Each of the specified types of reserves in this group is subject to its own legal requirements:

- If the annual inventory reveals that the market value of inventories has decreased, when creating a reserve, you must be guided by clause 25 of PBU 5/01 “Accounting for inventories” (approved by order of the Ministry of Finance of the Russian Federation dated 06/09/2001 No. 44n) and clause 20 of the guidelines for inventory accounting (approved by order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n);

ATTENTION! From 2021, PBU 5/01, which regulates the procedure for accounting for reserves, will no longer be in force. It will be replaced by FSBU 5/2019 “Inventories” and inventory will need to be taken into account according to new rules.

ConsultantPlus experts explained what will change in inventory accounting when applying FAS 5/2019. Get free demo access to K+ and go to the Ready Solution to find out all the details of the innovations.

- If there are signs of impairment of financial investments, a reserve is created in accordance with paragraphs. 37–39 PBU 19/02 “Accounting for financial investments” (approved by order of the Ministry of Finance of the Russian Federation dated December 10, 2002 No. 126n);

- the appearance of doubtful debts requires the company to create a reserve in accordance with clause 70 of the regulations on accounting and reporting (approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n), clause 11 of PBU 10/99 “Organization expenses” (approved by order of the Ministry of Finance of the Russian Federation dated 05/06/1999 No. 33n).

Reserves from the 2nd and 3rd groups are called estimated liabilities and are formed based on the requirements of PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets” (approved by order of the Ministry of Finance of the Russian Federation dated December 13, 2010 No. 167n).

In the following sections we will dwell on the nuances of forming one of the mandatory accounting reserves - for payment of upcoming vacations.

Limit amount of deductions

The maximum amount of contributions to the reserve is the amount of the reserve that the organization plans to form in the reporting year. It includes:

- the amount of vacation pay calculated in accordance with Decree of the Government of the Russian Federation dated December 24, 2007 No. 922;

- insurance contributions, including contributions for compulsory social insurance in case of temporary disability and in connection with maternity, accrued on vacation pay;

- contributions for compulsory insurance against accidents at work and occupational diseases accrued on vacation pay.

Results

In accounting, reserves are formed for the purpose of reliable assessment of assets and the need to provide users with real reporting data on the company's liabilities. Methods for the formation of reserve amounts for accounting purposes are not regulated by law, so they must be developed independently.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Monthly percentage of deductions

The percentage of contributions to the reserve is calculated using the formula.

Formula for calculating the percentage of contributions to the reserve

The estimated annual amount of labor costs is determined based on all payments provided for by the wage system, participating in the calculation of average earnings, made in favor of workers under employment contracts, and the amount of contributions for all types of compulsory social insurance (excluding vacation pay for the year).

The amount of monthly deductions depends on the amount of actual labor costs incurred during the month. It is calculated using the formula.

Formula for calculating the amount of monthly contributions to the reserve

EXAMPLE 2. RESERVE FOR PAYMENT OF HOLIDAYS IN TAX ACCOUNTING

Blues LLC calculates the reserve for payment of vacations based on planned indicators: - estimated annual amount of expenses for vacations - 100,000 rubles; 30,000 rub. (100,000 rubles × 30%); - the amount of insurance contributions for compulsory social insurance against accidents at work and occupational diseases - 200 rubles. (100,000 rubles × 0.2%); - estimated amount of labor costs - 1,000,000 rubles. Every month, the accountant will create a reserve for vacation pay in tax accounting in the amount of 13.02% of the amount of actual expenses accrued for the month wages ((100,000 rub. + 30,000 rub. + 200 rub.) : 1,000,000 rub. × 100%).