Payment

Penalties are a penalty that must be paid in monetary terms for each day of delay.

A special tax regime for entrepreneurs appeared in Russia in 2013. Chapter 26.5 Tax Code

Legislative regulation of the issue Legislative regulation of the issue is carried out by such legal acts as: Federal Law of

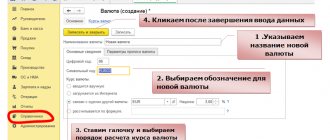

Quite often, when an accountant receives a contract for the purchase of goods, expressed in currency or

Bidding is one of the effective forms of concluding transactions, which guarantees their maximum transparency and

Maternity payments up to 3 years Maternity payments up to 3 years are paid from the Social Insurance Fund. Which

What is a transaction passport? Over the past few years, the currency control procedure has become increasingly strict.

On November 30, 2021, changes were made to the Tax Code that allow taxes to be paid

In organizing the transportation of various goods, the most important process is the registration and preparation of certain documentation. Main

Buying land: what tax breaks are possible In accordance with Art. 220 Tax Code of the Russian Federation buyer